See more : Authentic Holdings, Inc. (GFTX) Income Statement Analysis – Financial Results

Complete financial analysis of Eaton Corporation plc (ETN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Eaton Corporation plc, a leading company in the Industrial – Machinery industry within the Industrials sector.

- Concord New Energy Group Limited (CWPWF) Income Statement Analysis – Financial Results

- Tenaz Energy Corp. (ATUUF) Income Statement Analysis – Financial Results

- Gores Holdings VIII, Inc. (GIIXW) Income Statement Analysis – Financial Results

- RiskOn International, Inc. (ROI) Income Statement Analysis – Financial Results

- Hugo Boss AG (BOSSY) Income Statement Analysis – Financial Results

Eaton Corporation plc (ETN)

About Eaton Corporation plc

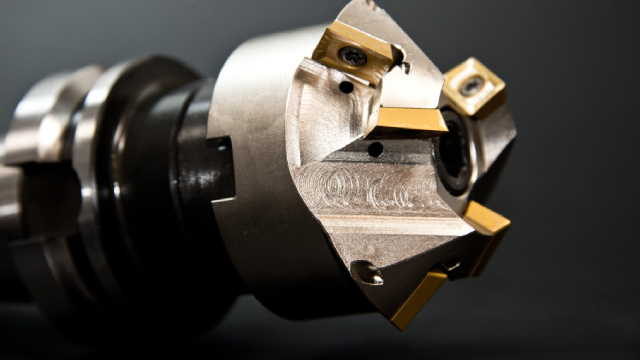

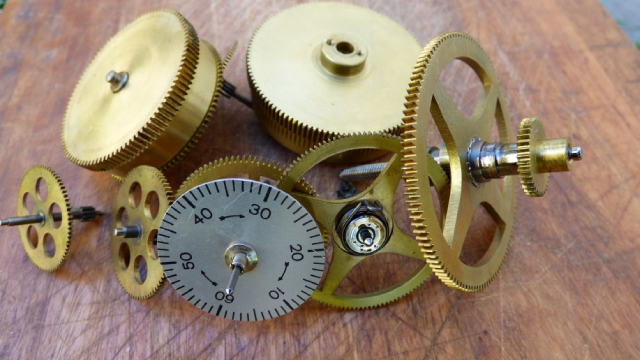

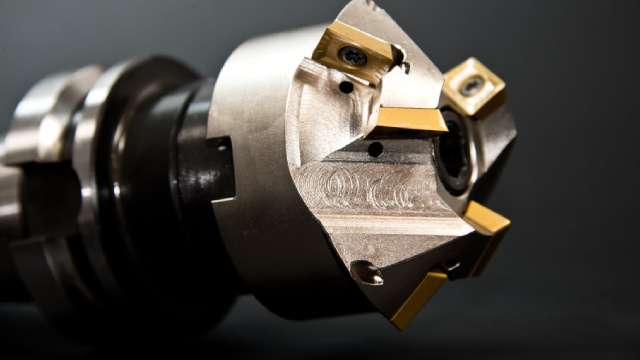

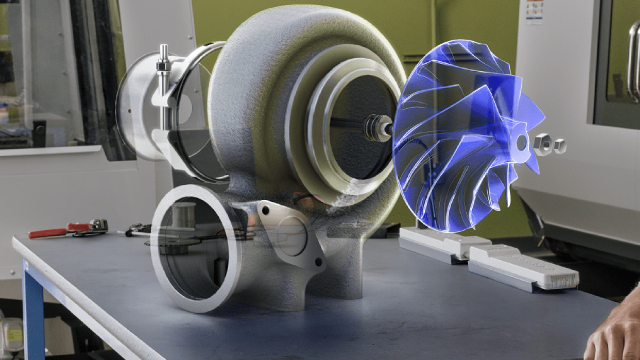

Eaton Corporation plc operates as a power management company worldwide. The company's Electrical Americas and Electrical Global segment provides electrical components, industrial components, power distribution and assemblies, residential products, single and three phase power quality and connectivity products, wiring devices, circuit protection products, utility power distribution products, power reliability equipment, and services, as well as hazardous duty electrical equipment, emergency lighting, fire detection, explosion-proof instrumentation, and structural support systems. Its Aerospace segment offers pumps, motors, hydraulic power units, hoses and fittings, and electro-hydraulic pumps; valves, cylinders, electronic controls, electromechanical actuators, sensors, aircraft flap and slat systems, and nose wheel steering systems; hose, thermoplastic tubing products, fittings, adapters, couplings, and sealing and ducting products; air-to-air refueling systems, fuel pumps, fuel inerting products, sensors, valves, and adapters and regulators; oxygen generation system, payload carriages, and thermal management products; and wiring connectors and cables, as well as hydraulic and bag filters, strainers and cartridges, and golf grips for manufacturers of commercial and military aircraft, and related after-market customers, as well as industrial applications. The company's Vehicle segment offers transmissions, clutches, hybrid power systems, superchargers, engine valves and valve actuation systems, locking and limited slip differentials, transmission controls, and fuel vapor components for the vehicle industry. Its eMobility segment provides voltage inverters, converters, fuses, onboard chargers, circuit protection units, vehicle controls, power distribution systems, fuel tank isolation valves, and commercial vehicle hybrid systems. Eaton Corporation plc was founded in 1911 and is based in Dublin, Ireland.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 23.20B | 20.75B | 19.63B | 17.86B | 21.39B | 21.61B | 20.40B | 19.75B | 20.86B | 22.55B | 22.05B | 16.31B | 16.05B | 13.72B | 11.87B | 15.38B | 13.03B | 12.37B | 11.12B | 9.82B | 8.06B | 7.21B | 7.30B | 8.31B | 8.40B | 6.63B | 7.56B | 6.96B | 6.82B | 6.05B | 4.40B | 3.87B | 3.38B | 3.64B | 3.67B | 3.47B | 3.14B | 3.81B | 3.67B |

| Cost of Revenue | 14.76B | 13.87B | 13.29B | 12.41B | 14.34B | 14.51B | 13.76B | 13.40B | 14.29B | 15.65B | 15.37B | 11.45B | 11.26B | 9.63B | 8.78B | 11.19B | 9.38B | 9.05B | 8.01B | 7.08B | 5.90B | 5.27B | 5.50B | 5.63B | 5.60B | 4.43B | 5.11B | 4.85B | 4.75B | 4.15B | 3.09B | 2.77B | 2.44B | 2.59B | 2.55B | 2.38B | 2.13B | 2.77B | 2.61B |

| Gross Profit | 8.43B | 6.89B | 6.34B | 5.45B | 7.05B | 7.10B | 6.65B | 6.35B | 6.56B | 6.91B | 6.68B | 4.86B | 4.79B | 4.08B | 3.09B | 4.19B | 3.65B | 3.32B | 3.10B | 2.74B | 2.16B | 1.94B | 1.80B | 2.68B | 2.80B | 2.20B | 2.45B | 2.12B | 2.08B | 1.91B | 1.31B | 1.10B | 942.00M | 1.05B | 1.12B | 1.09B | 1.00B | 1.05B | 1.07B |

| Gross Profit Ratio | 36.36% | 33.19% | 32.28% | 30.52% | 32.97% | 32.85% | 32.58% | 32.14% | 31.47% | 30.62% | 30.29% | 29.81% | 29.83% | 29.76% | 26.03% | 27.22% | 28.01% | 26.84% | 27.92% | 27.86% | 26.85% | 26.87% | 24.61% | 32.24% | 33.35% | 33.16% | 32.38% | 30.40% | 30.42% | 31.49% | 29.83% | 28.33% | 27.86% | 28.88% | 30.48% | 31.51% | 32.01% | 27.42% | 29.05% |

| Research & Development | 754.00M | 665.00M | 616.00M | 551.00M | 606.00M | 584.00M | 584.00M | 589.00M | 625.00M | 647.00M | 644.00M | 439.00M | 417.00M | 425.00M | 395.00M | 417.00M | 335.00M | 321.00M | 287.00M | 261.00M | 223.00M | 203.00M | 228.00M | 269.00M | 314.00M | 334.00M | 319.00M | 267.00M | 227.00M | 213.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.55B | 3.57B | 3.51B | 3.60B | 3.81B | 3.89B | 2.89B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 3.80B | 3.23B | 3.26B | 3.08B | 3.58B | 3.55B | 3.57B | 3.51B | 3.60B | 3.81B | 3.89B | 2.89B | 2.74B | 2.49B | 2.25B | 2.51B | 2.14B | 1.95B | 1.76B | 1.59B | 1.35B | 1.22B | 1.22B | 1.30B | 1.32B | 1.05B | 1.09B | 995.00M | 927.00M | 882.00M | 800.00M | 683.00M | 638.00M | 595.00M | 567.60M | 549.10M | 522.40M | 631.70M | 605.80M |

| Other Expenses | 0.00 | 36.00M | -40.00M | -150.00M | -36.00M | 4.00M | 38.00M | 107.00M | 35.00M | 183.00M | 8.00M | -71.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 462.00M | 441.00M | 331.00M | 342.00M | 320.00M | 281.00M | 251.00M | 196.00M | 184.00M | 169.00M | 163.00M | 175.80M | 143.50M | 106.30M | 103.90M | 96.10M |

| Operating Expenses | 4.44B | 3.89B | 3.87B | 3.63B | 4.19B | 4.13B | 4.15B | 4.09B | 4.22B | 4.46B | 4.53B | 3.33B | 3.16B | 2.91B | 2.65B | 2.77B | 2.47B | 2.27B | 2.04B | 1.85B | 1.57B | 1.42B | 1.45B | 2.03B | 2.07B | 1.72B | 1.75B | 1.58B | 1.44B | 1.35B | 996.00M | 867.00M | 807.00M | 758.00M | 743.40M | 692.60M | 628.70M | 735.60M | 701.90M |

| Cost & Expenses | 19.26B | 17.76B | 17.17B | 16.03B | 18.53B | 18.64B | 17.91B | 17.49B | 18.51B | 20.10B | 19.90B | 14.78B | 14.42B | 12.54B | 11.43B | 13.96B | 11.86B | 11.32B | 10.06B | 8.93B | 7.47B | 6.69B | 6.95B | 7.66B | 7.67B | 6.14B | 6.86B | 6.43B | 6.18B | 5.49B | 4.08B | 3.64B | 3.25B | 3.35B | 3.30B | 3.07B | 2.76B | 3.50B | 3.31B |

| Interest Income | 0.00 | 88.00M | 144.00M | 221.00M | 272.00M | 13.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 151.00M | 144.00M | 144.00M | 149.00M | 236.00M | 271.00M | 246.00M | 233.00M | 232.00M | 227.00M | 271.00M | 208.00M | 118.00M | 136.00M | 150.00M | 157.00M | 147.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 926.00M | 954.00M | 922.00M | 811.00M | 884.00M | 903.00M | 914.00M | 929.00M | 925.00M | 983.00M | 997.00M | 598.00M | 556.00M | 551.00M | 573.00M | 592.00M | 469.00M | 434.00M | 409.00M | 400.00M | 394.00M | 376.00M | 449.00M | 462.00M | 441.00M | 331.00M | 342.00M | 320.00M | 281.00M | 251.00M | 196.00M | 184.00M | 169.00M | 163.00M | 175.80M | 143.50M | 106.30M | 103.90M | 96.10M |

| EBITDA | 4.96B | 3.03B | 2.42B | 1.67B | 2.83B | 3.88B | 3.42B | 3.18B | 3.30B | 3.59B | 3.31B | 2.06B | 2.23B | 1.72B | 1.02B | 1.88B | 1.65B | 1.46B | 1.43B | 1.27B | 984.00M | 893.00M | 797.00M | 1.11B | 1.12B | 916.00M | 1.04B | 854.00M | 921.00M | 811.00M | 513.00M | 413.00M | 304.00M | 456.00M | 551.20M | 543.90M | 482.00M | 413.30M | 461.60M |

| EBITDA Ratio | 21.39% | 14.61% | 12.34% | 9.37% | 13.22% | 13.74% | 12.43% | 11.95% | 11.40% | 11.67% | 9.78% | 12.61% | 9.94% | 8.53% | 3.74% | 8.99% | 12.55% | 11.70% | 12.96% | 13.40% | 12.14% | 12.58% | 9.93% | 12.41% | 9.33% | 10.90% | 13.16% | 11.84% | 13.03% | 13.20% | 11.20% | 9.85% | 8.19% | 11.54% | 14.07% | 14.46% | 14.49% | 11.50% | 10.40% |

| Operating Income | 3.89B | 2.08B | 1.50B | 863.00M | 1.94B | 2.97B | 2.50B | 2.25B | 2.34B | 2.45B | 2.15B | 1.53B | 1.63B | 1.17B | 444.00M | 1.26B | 1.18B | 1.05B | 1.06B | 887.00M | 590.00M | 517.00M | 348.00M | 649.00M | 729.00M | 482.00M | 700.00M | 534.00M | 640.00M | 560.00M | 317.00M | 229.00M | 135.00M | 293.00M | 375.40M | 400.40M | 375.70M | 309.40M | 365.50M |

| Operating Income Ratio | 16.75% | 10.01% | 7.65% | 4.83% | 9.08% | 13.73% | 12.25% | 11.41% | 11.23% | 10.86% | 9.74% | 9.38% | 10.18% | 8.54% | 3.74% | 8.16% | 9.03% | 8.51% | 9.53% | 9.04% | 7.32% | 7.17% | 4.77% | 7.81% | 8.68% | 7.28% | 9.26% | 7.67% | 9.38% | 9.25% | 7.20% | 5.92% | 3.99% | 8.05% | 10.23% | 11.54% | 11.97% | 8.12% | 9.95% |

| Total Other Income/Expenses | -58.00M | 834.00M | 1.40B | 883.00M | 648.00M | -542.00M | 830.00M | -182.00M | -197.00M | -688.00M | -263.00M | -279.00M | -80.00M | -135.00M | -141.00M | -115.00M | -136.00M | -40.00M | -23.00M | -87.00M | -82.00M | -118.00M | -70.00M | -97.00M | 214.00M | 134.00M | -32.00M | -49.00M | -48.00M | -72.00M | -55.00M | -51.00M | -53.00M | -43.00M | -39.90M | -33.10M | -47.40M | -89.30M | 21.00M |

| Income Before Tax | 3.83B | 2.91B | 2.90B | 1.75B | 2.59B | 2.42B | 3.37B | 2.13B | 2.15B | 1.76B | 1.88B | 1.25B | 1.55B | 1.04B | 303.00M | 1.13B | 1.04B | 989.00M | 996.00M | 781.00M | 508.00M | 399.00M | 278.00M | 552.00M | 963.00M | 485.00M | 668.00M | 485.00M | 592.00M | 488.00M | 262.00M | 178.00M | 82.00M | 250.00M | 335.50M | 367.30M | 328.30M | 220.10M | 386.50M |

| Income Before Tax Ratio | 16.50% | 14.03% | 14.75% | 9.78% | 12.11% | 11.22% | 16.51% | 10.77% | 10.29% | 7.81% | 8.55% | 7.67% | 9.68% | 7.55% | 2.55% | 7.34% | 7.99% | 8.00% | 8.96% | 7.96% | 6.30% | 5.53% | 3.81% | 6.64% | 11.46% | 7.32% | 8.83% | 6.97% | 8.68% | 8.06% | 5.95% | 4.60% | 2.43% | 6.87% | 9.14% | 10.59% | 10.46% | 5.77% | 10.52% |

| Income Tax Expense | 604.00M | 445.00M | 750.00M | 331.00M | 378.00M | 278.00M | 382.00M | 202.00M | 164.00M | -42.00M | 11.00M | 31.00M | 201.00M | 99.00M | -82.00M | 73.00M | 82.00M | 77.00M | 191.00M | 133.00M | 122.00M | 118.00M | 109.00M | 189.00M | 346.00M | 136.00M | 204.00M | 136.00M | 193.00M | 155.00M | 82.00M | 41.00M | 20.00M | 81.00M | 125.80M | 139.60M | 122.10M | 82.50M | 155.60M |

| Net Income | 3.22B | 2.46B | 2.14B | 1.41B | 2.21B | 2.15B | 2.99B | 1.92B | 1.98B | 1.79B | 1.86B | 1.22B | 1.35B | 929.00M | 383.00M | 1.06B | 994.00M | 950.00M | 805.00M | 648.00M | 386.00M | 281.00M | 169.00M | 453.00M | 617.00M | 349.00M | 410.00M | 349.00M | 399.00M | 333.00M | 187.00M | -128.00M | 74.00M | 179.00M | 224.90M | 230.00M | 201.20M | 137.60M | 230.90M |

| Net Income Ratio | 13.87% | 11.86% | 10.92% | 7.90% | 10.34% | 9.93% | 14.63% | 9.73% | 9.49% | 7.95% | 8.44% | 7.46% | 8.41% | 6.77% | 3.23% | 6.88% | 7.63% | 7.68% | 7.24% | 6.60% | 4.79% | 3.90% | 2.32% | 5.45% | 7.34% | 5.27% | 5.42% | 5.01% | 5.85% | 5.50% | 4.25% | -3.31% | 2.19% | 4.92% | 6.13% | 6.63% | 6.41% | 3.61% | 6.28% |

| EPS | 8.06 | 6.18 | 5.38 | 3.51 | 5.28 | 4.94 | 6.71 | 4.21 | 4.23 | 3.78 | 3.93 | 3.54 | 3.98 | 2.76 | 1.16 | 3.30 | 3.38 | 3.16 | 2.68 | 2.12 | 1.31 | 1.00 | 0.61 | 1.58 | 2.13 | 1.22 | 1.34 | 1.13 | 1.28 | 1.10 | 0.62 | -0.47 | 0.28 | 0.63 | 0.75 | 0.77 | 0.60 | 0.36 | 0.59 |

| EPS Diluted | 8.02 | 6.14 | 5.34 | 3.49 | 5.25 | 4.91 | 6.68 | 4.20 | 4.22 | 3.76 | 3.90 | 3.46 | 3.93 | 2.73 | 1.14 | 3.26 | 3.31 | 3.11 | 2.62 | 2.07 | 1.28 | 0.98 | 0.60 | 1.56 | 2.09 | 1.20 | 1.31 | 1.13 | 1.28 | 1.10 | 0.61 | -0.47 | 0.28 | 0.63 | 0.75 | 0.77 | 0.59 | 0.35 | 0.56 |

| Weighted Avg Shares Out | 399.10M | 398.70M | 398.70M | 402.20M | 419.00M | 434.30M | 444.50M | 455.00M | 465.50M | 474.10M | 473.50M | 347.80M | 338.30M | 335.50M | 332.70M | 320.40M | 294.60M | 300.40M | 300.40M | 306.20M | 295.80M | 286.80M | 277.60M | 287.20M | 294.80M | 285.60M | 307.20M | 309.60M | 311.20M | 302.40M | 302.83M | 275.27M | 269.09M | 283.00M | 298.87M | 297.73M | 336.74M | 384.90M | 394.70M |

| Weighted Avg Shares Out (Dil) | 401.10M | 400.80M | 401.60M | 404.00M | 420.80M | 436.90M | 447.00M | 456.50M | 467.10M | 476.80M | 476.70M | 350.90M | 342.80M | 339.50M | 335.80M | 324.60M | 300.60M | 305.80M | 308.00M | 314.20M | 301.00M | 286.80M | 282.00M | 290.40M | 294.80M | 290.80M | 312.80M | 310.00M | 311.20M | 302.40M | 305.31M | 275.27M | 269.09M | 283.00M | 298.87M | 297.73M | 343.93M | 395.97M | 412.32M |

2 Supercharged Dividend Stocks to Buy if There's a Stock Market Sell-Off

Eaton (ETN) Advances While Market Declines: Some Information for Investors

3 Top Large Cap Stocks for a Stable Approach: ETN, DECK, UNH

Is Eaton Stock's 26.7X PE Still Worth it? Buy, Sell, or Hold?

Why Eaton (ETN) Outpaced the Stock Market Today

Here is What to Know Beyond Why Eaton Corporation, PLC (ETN) is a Trending Stock

POWL vs. ETN: Which Stock Is the Better Value Option?

Eaton Collaborates With Tesla to Provide Efficient Load Management

Is Eaton (ETN) Stock Outpacing Its Industrial Products Peers This Year?

Is It Worth Investing in Eaton (ETN) Based on Wall Street's Bullish Views?

Source: https://incomestatements.info

Category: Stock Reports