See more : Victorian Plumbing Group plc (VIC.L) Income Statement Analysis – Financial Results

Complete financial analysis of EVI Industries, Inc. (EVI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of EVI Industries, Inc., a leading company in the Industrial – Distribution industry within the Industrials sector.

- International Prospect Ventures Ltd. (URANF) Income Statement Analysis – Financial Results

- Fujian Kuncai Material Technology Co., Ltd. (603826.SS) Income Statement Analysis – Financial Results

- Zhejiang Tengy Environmental Technology Co., Ltd (1527.HK) Income Statement Analysis – Financial Results

- Cortelco Systems Puerto Rico, Inc. (CPROF) Income Statement Analysis – Financial Results

- Anhui Sunhere Pharmaceutical Excipients Co.,Ltd. (300452.SZ) Income Statement Analysis – Financial Results

EVI Industries, Inc. (EVI)

About EVI Industries, Inc.

EVI Industries, Inc., through its subsidiaries, distributes, sells, rents, and leases commercial, industrial, and vended laundry and dry cleaning equipment, and steam and hot water boilers in the United States, Canada, the Caribbean, Latin America, and Asia. The company sells and/or leases its customers commercial laundry equipment specializing in washing, drying, finishing, material handling, water heating, power generation, and water reuse applications. It also supplies related replacement parts and accessories; and provides installation, maintenance, and repair services to government, institutional, industrial, commercial, and retail customers. The company was formerly known as EnviroStar, Inc. and changed its name to EVI Industries, Inc. in December 2018. EVI Industries, Inc. was founded in 1959 and is based in Miami, Florida.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 353.56M | 354.17M | 267.32M | 242.01M | 235.80M | 228.32M | 150.01M | 93.98M | 36.02M | 30.75M | 33.83M | 36.23M | 22.46M | 21.33M | 19.63M | 23.16M | 22.71M | 22.75M | 20.41M | 18.39M | 14.67M | 14.32M | 13.33M | 17.95M | 18.45M | 18.00M | 3.84M | 3.88M | 4.23M | 4.20M | 4.10M | 4.60M | 4.40M | 4.60M | 4.90M | 5.40M | 6.30M | 5.80M | 5.50M |

| Cost of Revenue | 248.31M | 250.49M | 193.61M | 182.17M | 180.60M | 175.62M | 113.50M | 73.64M | 27.80M | 22.81M | 26.04M | 27.99M | 16.93M | 16.02M | 14.67M | 17.84M | 17.02M | 16.95M | 14.78M | 13.16M | 10.14M | 9.68M | 9.67M | 13.53M | 13.07M | 13.10M | 2.57M | 2.41M | 2.64M | 2.50M | 2.40M | 2.60M | 2.50M | 3.00M | 3.20M | 3.20M | 3.70M | 3.80M | 3.00M |

| Gross Profit | 105.25M | 103.68M | 73.71M | 59.84M | 55.21M | 52.70M | 36.51M | 20.34M | 8.21M | 7.95M | 7.79M | 8.23M | 5.53M | 5.31M | 4.96M | 5.32M | 5.68M | 5.80M | 5.64M | 5.23M | 4.53M | 4.64M | 3.66M | 4.42M | 5.37M | 4.90M | 1.27M | 1.47M | 1.59M | 1.70M | 1.70M | 2.00M | 1.90M | 1.60M | 1.70M | 2.20M | 2.60M | 2.00M | 2.50M |

| Gross Profit Ratio | 29.77% | 29.27% | 27.57% | 24.73% | 23.41% | 23.08% | 24.34% | 21.64% | 22.80% | 25.84% | 23.04% | 22.72% | 24.62% | 24.90% | 25.25% | 22.97% | 25.02% | 25.48% | 27.61% | 28.45% | 30.91% | 32.41% | 27.48% | 24.61% | 29.13% | 27.22% | 33.04% | 37.84% | 37.61% | 40.48% | 41.46% | 43.48% | 43.18% | 34.78% | 34.69% | 40.74% | 41.27% | 34.48% | 45.45% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.64K | 41.91K | 27.81K | 44.83K | 41.18K | 44.01K | 31.50K | 177.71K | 231.22K | 200.00K | 228.76K | 238.06K | 283.82K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 86.40M | 66.69M | 56.16M | 52.05M | 45.34M | 29.41M | 14.93M | 5.38M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 778.00K | 632.00K | 435.00K | 377.00K | 355.00K | 164.00K | 60.00K | 37.20K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 93.63M | 87.18M | 67.32M | 56.59M | 52.43M | 45.69M | 29.57M | 14.99M | 5.42M | 5.27M | 5.20M | 5.66M | 4.72M | 4.36M | 4.30M | 4.54M | 4.89M | 4.51M | 4.46M | 4.06M | 3.66M | 3.72M | 3.77M | 4.71M | 4.42M | 3.90M | 1.25M | 1.21M | 1.15M | 1.50M | 1.60M | 1.50M | 1.70M | 1.80M | 1.70M | 1.70M | 2.00M | 1.90M | 1.60M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 93.63M | 87.18M | 67.32M | 56.59M | 52.43M | 45.69M | 29.57M | 14.99M | 5.42M | 5.27M | 5.20M | 5.66M | 4.72M | 4.36M | 4.30M | 4.54M | 4.89M | 4.55M | 4.48M | 4.11M | 3.70M | 3.76M | 2.84M | 4.12M | 4.79M | 4.20M | 1.48M | 1.45M | 1.43M | 1.60M | 1.70M | 1.60M | 1.90M | 2.00M | 1.90M | 1.90M | 2.30M | 2.10M | 1.70M |

| Cost & Expenses | 341.94M | 337.67M | 260.93M | 238.76M | 233.02M | 221.31M | 143.07M | 88.63M | 33.22M | 28.08M | 31.23M | 33.66M | 21.65M | 20.37M | 18.97M | 22.38M | 21.91M | 21.50M | 19.26M | 17.27M | 13.84M | 13.44M | 12.51M | 17.65M | 17.87M | 17.30M | 4.05M | 3.86M | 4.07M | 4.10M | 4.10M | 4.20M | 4.40M | 5.00M | 5.10M | 5.10M | 6.00M | 5.90M | 4.70M |

| Interest Income | 0.00 | 2.51M | 679.00K | 0.00 | 1.43M | 1.39M | 0.00 | 0.00 | 2.26K | 4.30K | 6.02K | 15.53K | 19.46K | 21.63K | 13.21K | 74.62K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 2.74M | 2.51M | 679.00K | 635.00K | 1.43M | 1.39M | 552.00K | 160.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 5.98M | 6.02M | 5.35M | 4.65M | 3.71M | 2.70M | 1.58M | 576.00K | 61.40K | 58.81K | 59.87K | 57.87K | 49.92K | 55.87K | 75.05K | 128.22K | 132.37K | 120.48K | 142.45K | 119.24K | 114.95K | 114.94K | 113.10K | 223.19K | 139.03K | 100.00K | 74.01K | 66.56K | 72.16K | -100.00K | -100.00K | -100.00K | -200.00K | -200.00K | 200.00K | 200.00K | 300.00K | 200.00K | 100.00K |

| EBITDA | 17.61M | 22.53M | 6.39M | 15.17M | 6.48M | 7.01M | 8.51M | 5.93M | 2.85M | 2.74M | 2.66M | 2.63M | 858.66K | 1.01M | 729.03K | 906.15K | 923.60K | 1.37M | 1.30M | 1.24M | 944.76K | 991.00K | 931.27K | 801.72K | 719.80K | 800.00K | -400.00K | 85.43K | 229.63K | 200.00K | 100.00K | 200.00K | 200.00K | -500.00K | 0.00 | 500.00K | 400.00K | 100.00K | 900.00K |

| EBITDA Ratio | 4.98% | 6.36% | 4.34% | 0.36% | 2.75% | 3.07% | 5.68% | 6.31% | 7.92% | 8.90% | 100.00% | 7.26% | 3.82% | 4.73% | 3.71% | 3.91% | 4.07% | 6.02% | 6.34% | 6.76% | 6.44% | 0.61% | -0.20% | -1.36% | -1.94% | 1.67% | -3.54% | 2.20% | 5.43% | 4.76% | 0.00% | 4.35% | 2.27% | -10.87% | 0.00% | 9.26% | 6.35% | -1.72% | 16.36% |

| Operating Income | 11.63M | 16.51M | 6.39M | -3.72M | 2.78M | 4.26M | 6.93M | 5.35M | 2.79M | 2.68M | 2.60M | 2.57M | 808.74K | 953.48K | 653.98K | 777.93K | 791.24K | 1.25M | 1.15M | 1.12M | 829.82K | 876.06K | 818.17K | 301.21K | 580.77K | 700.00K | -209.85K | 18.87K | 157.48K | 300.00K | 0.00 | 300.00K | 300.00K | -300.00K | -200.00K | 300.00K | 100.00K | -300.00K | 800.00K |

| Operating Income Ratio | 3.29% | 4.66% | 2.39% | -1.54% | 1.18% | 1.87% | 4.62% | 5.69% | 7.75% | 8.71% | 7.68% | 7.10% | 3.60% | 4.47% | 3.33% | 3.36% | 3.48% | 5.49% | 5.65% | 6.11% | 5.66% | 6.12% | 6.14% | 1.68% | 3.15% | 3.89% | -5.47% | 0.49% | 3.72% | 7.14% | 0.00% | 6.52% | 6.82% | -6.52% | -4.08% | 5.56% | 1.59% | -5.17% | 14.55% |

| Total Other Income/Expenses | -2.74M | -2.51M | -679.00K | 6.64M | -1.43M | -1.39M | -552.00K | -160.00K | 2.26K | 4.30K | 6.02K | 15.53K | 19.46K | 21.63K | 13.21K | 74.62K | 163.36K | 162.79K | 75.44K | 10.69K | 23.81K | 4.16K | -43.11K | 208.70K | 948.68K | 500.00K | -289.82K | 6.25K | 11.00K | -100.00K | 200.00K | 300.00K | 100.00K | 300.00K | 0.00 | 0.00 | -100.00K | -100.00K | -200.00K |

| Income Before Tax | 8.88M | 14.00M | 5.71M | 9.89M | 1.35M | 5.62M | 6.38M | 5.19M | 2.79M | 2.68M | 2.60M | 2.59M | 828.20K | 975.11K | 667.19K | 852.55K | 954.59K | 1.41M | 1.23M | 1.13M | 853.63K | 880.22K | 775.06K | 198.47K | 1.53M | 1.20M | -499.67K | 25.12K | 168.47K | 200.00K | 200.00K | 700.00K | 400.00K | 0.00 | -200.00K | 0.00 | 200.00K | -200.00K | 600.00K |

| Income Before Tax Ratio | 2.51% | 3.95% | 2.14% | 4.09% | 0.57% | 2.46% | 4.25% | 5.52% | 7.76% | 8.72% | 7.70% | 7.14% | 3.69% | 4.57% | 3.40% | 3.68% | 4.20% | 6.20% | 6.02% | 6.17% | 5.82% | 6.15% | 5.81% | 1.11% | 8.29% | 6.67% | -13.02% | 0.65% | 3.98% | 4.76% | 4.88% | 15.22% | 9.09% | 0.00% | -4.08% | 0.00% | 3.17% | -3.45% | 10.91% |

| Income Tax Expense | 3.24M | 4.28M | 1.62M | 1.50M | 573.00K | 1.87M | 2.42M | 2.02M | 1.05M | 1.01M | 984.42K | 979.38K | 316.51K | 371.33K | 253.13K | 325.68K | 352.74K | 529.73K | 424.20K | 428.05K | 317.41K | 334.09K | 295.08K | 76.00K | 564.00K | 400.00K | -150.00K | 13.00K | 44.00K | 100.00K | 100.00K | 300.00K | 500.00K | 100.00K | -100.00K | 200.00K | 100.00K | -100.00K | 300.00K |

| Net Income | 5.65M | 9.72M | 4.10M | 8.38M | 775.00K | 3.74M | 3.97M | 3.17M | 1.74M | 1.67M | 1.62M | 1.61M | 511.69K | 603.77K | 414.07K | 526.86K | 601.85K | 880.99K | 803.98K | 706.26K | 536.22K | 603.79K | -280.01K | 122.47K | 965.45K | 800.00K | -349.67K | 12.12K | 124.47K | 100.00K | 100.00K | 400.00K | -100.00K | -100.00K | -100.00K | 100.00K | 100.00K | -100.00K | 300.00K |

| Net Income Ratio | 1.60% | 2.74% | 1.53% | 3.46% | 0.33% | 1.64% | 2.64% | 3.37% | 4.83% | 5.44% | 4.79% | 4.44% | 2.28% | 2.83% | 2.11% | 2.28% | 2.65% | 3.87% | 3.94% | 3.84% | 3.65% | 4.22% | -2.10% | 0.68% | 5.23% | 4.44% | -9.11% | 0.31% | 2.94% | 2.38% | 2.44% | 8.70% | -2.27% | -2.17% | -2.04% | 1.85% | 1.59% | -1.72% | 5.45% |

| EPS | 0.39 | 0.68 | 0.30 | 0.63 | 0.06 | 0.32 | 0.37 | 0.30 | 0.25 | 0.24 | 0.23 | 0.23 | 0.07 | 0.09 | 0.06 | 0.07 | 0.09 | 0.13 | 0.11 | 0.10 | 0.08 | 0.09 | -0.04 | 0.02 | 0.14 | 0.13 | -0.17 | 0.01 | 0.06 | 0.02 | 0.02 | 0.06 | -0.02 | -0.02 | -0.02 | 0.02 | 0.02 | -0.02 | 0.05 |

| EPS Diluted | 0.37 | 0.67 | 0.29 | 0.61 | 0.06 | 0.31 | 0.35 | 0.30 | 0.25 | 0.24 | 0.23 | 0.23 | 0.07 | 0.09 | 0.06 | 0.07 | 0.09 | 0.13 | 0.11 | 0.10 | 0.08 | 0.09 | -0.04 | 0.02 | 0.13 | 0.12 | -0.17 | 0.01 | 0.06 | 0.02 | 0.02 | 0.06 | -0.02 | -0.02 | -0.02 | 0.02 | 0.02 | -0.02 | 0.05 |

| Weighted Avg Shares Out | 12.68M | 12.55M | 12.37M | 12.14M | 11.84M | 11.53M | 10.84M | 10.47M | 7.03M | 7.03M | 7.03M | 7.03M | 7.03M | 7.03M | 7.03M | 7.03M | 7.03M | 7.03M | 7.03M | 7.02M | 7.01M | 7.00M | 7.00M | 7.00M | 6.95M | 6.17M | 2.05M | 2.05M | 2.00M | 6.67M | 6.67M | 6.67M | 6.67M | 6.67M | 6.67M | 6.67M | 6.67M | 6.67M | 6.67M |

| Weighted Avg Shares Out (Dil) | 13.15M | 12.80M | 12.65M | 12.58M | 12.17M | 12.02M | 11.19M | 10.47M | 7.03M | 7.03M | 7.03M | 7.03M | 7.03M | 7.03M | 7.03M | 7.03M | 7.04M | 7.04M | 7.03M | 7.04M | 7.03M | 7.00M | 7.00M | 7.12M | 7.31M | 6.49M | 2.05M | 2.05M | 2.00M | 6.67M | 6.67M | 6.67M | 6.67M | 6.67M | 6.67M | 6.67M | 6.67M | 6.67M | 6.67M |

EVI Industries Reports Results for Second Quarter of Fiscal 2021; Comments on Business Acquisitions

EVI Industries to Acquire Eastern Laundry Systems

EVI Industries Sets Record Revenue for First Quarter of Fiscal 2021

EVI Industries to Attend Baird Global Industrial Conference

Perjalanan Evi Novida Ginting, dari DKPP hingga menang di PTUN Jakarta

PTUN batalkan pemecatan Komisioner KPU RI Evi Novida Ginting

EVI Industries Inc (NYSEAMERICAN:EVI) Position Reduced by Morgan Stanley

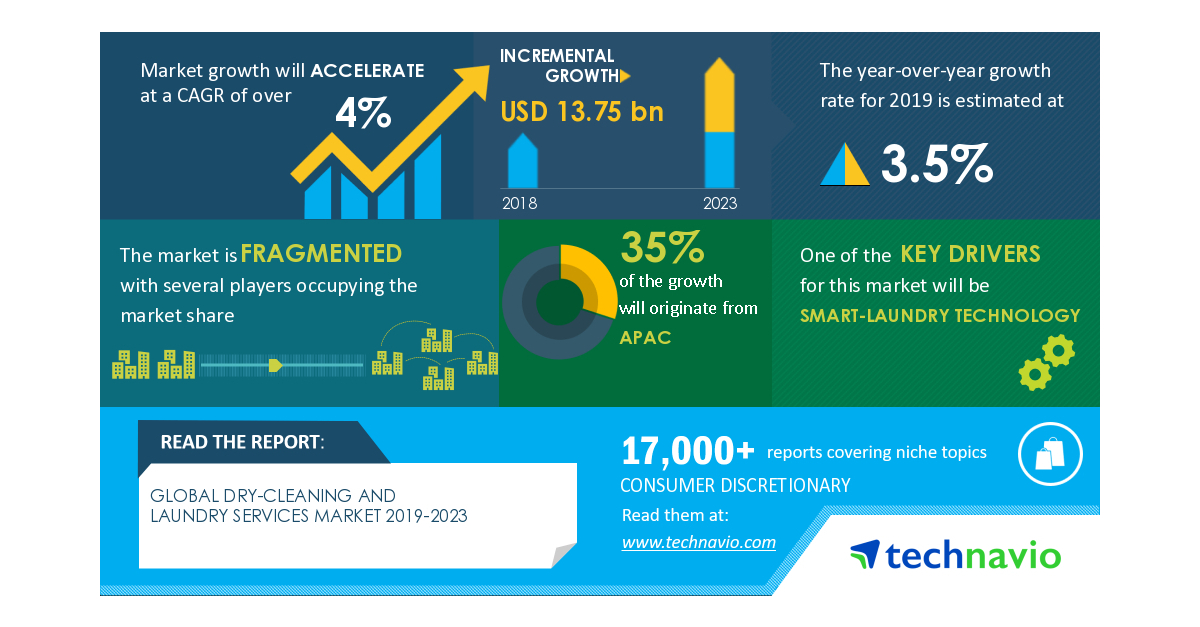

COVID-19 Impact and Recovery Analysis|Dry-cleaning And Laundry Services Market 2019-2023 | Smart-laundry Technology to Boost Growth | Technavio

Electric Vehicles Tread Water Under COVID-19, So What's Next?

EVI Industries (NYSEAMERICAN:EVI) Stock Crosses Above Two Hundred Day Moving Average of $0.00

Source: https://incomestatements.info

Category: Stock Reports