See more : Ravileela Granites Limited (RALEGRA.BO) Income Statement Analysis – Financial Results

Complete financial analysis of FARO Technologies, Inc. (FARO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of FARO Technologies, Inc., a leading company in the Hardware, Equipment & Parts industry within the Technology sector.

- Levere Holdings Corp. (LVRAW) Income Statement Analysis – Financial Results

- Alankit Limited (ALANKIT.BO) Income Statement Analysis – Financial Results

- Janover Inc. (JNVR) Income Statement Analysis – Financial Results

- Volt Resources Limited (VRC.AX) Income Statement Analysis – Financial Results

- Phoenix International Limited (PHOENXINTL.BO) Income Statement Analysis – Financial Results

FARO Technologies, Inc. (FARO)

About FARO Technologies, Inc.

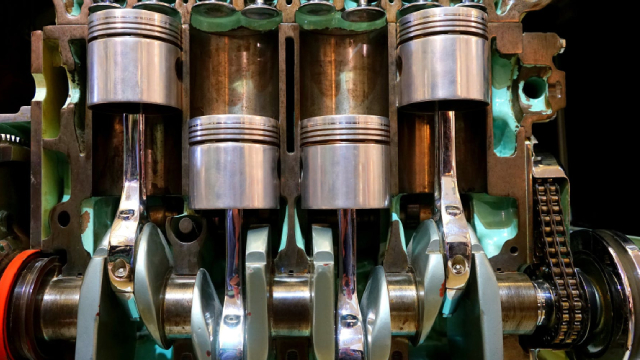

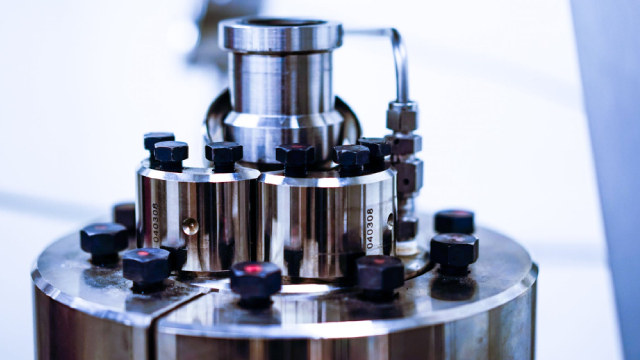

FARO Technologies, Inc. designs, develops, manufactures, markets, and supports software driven three-dimensional measurement, imaging, and realization solutions in North America, South America, Europe, the Middle East, Africa, and the Asia-Pacific. The company offers FaroArm, a combination of a portable articulated measurement arm, a computer, and CAM2 software programs; FARO Laser Tracker, a combination of a portable large-volume laser measurement tool, a computer, and CAM2 software programs; FARO Laser Projector, which provides a virtual template that operators and assemblers can use to quickly and accurate position components; and FARO Laser Scanning Portfolio to measure and collect a cloud of data points. It also provides FARO ScanPlan, a handheld mapper that captures two-dimensional floor plans; and FARO Software, a software solution that integrate with FARO hardware products to merge data and provide collaborative workflows and applications. The company offers its products for metrology, reverse engineering, factory automation, building information modeling, public safety, and other applications. FARO Technologies, Inc. was founded in 1981 and is headquartered in Lake Mary, Florida.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 358.83M | 345.77M | 337.81M | 303.77M | 381.77M | 403.63M | 360.92M | 325.58M | 317.55M | 341.83M | 291.78M | 273.40M | 254.16M | 191.78M | 147.70M | 209.25M | 191.62M | 152.41M | 125.59M | 97.02M | 71.79M | 46.25M | 35.11M | 40.45M | 33.11M | 27.50M | 23.50M | 14.60M |

| Cost of Revenue | 193.83M | 170.00M | 153.89M | 143.92M | 183.63M | 175.28M | 156.28M | 147.62M | 149.87M | 152.91M | 129.89M | 123.78M | 110.48M | 78.38M | 67.00M | 84.02M | 76.57M | 62.95M | 52.66M | 37.02M | 29.52M | 21.11M | 14.30M | 14.75M | 14.16M | 11.10M | 9.60M | 6.50M |

| Gross Profit | 165.00M | 175.76M | 183.93M | 159.85M | 198.13M | 228.35M | 204.64M | 177.96M | 167.68M | 188.91M | 161.89M | 149.62M | 143.69M | 113.40M | 80.71M | 125.23M | 115.04M | 89.46M | 72.93M | 60.00M | 42.27M | 25.14M | 20.81M | 25.70M | 18.94M | 16.40M | 13.90M | 8.10M |

| Gross Profit Ratio | 45.98% | 50.83% | 54.45% | 52.62% | 51.90% | 56.57% | 56.70% | 54.66% | 52.80% | 55.27% | 55.48% | 54.73% | 56.53% | 59.13% | 54.64% | 59.85% | 60.04% | 58.70% | 58.07% | 61.84% | 58.88% | 54.35% | 59.26% | 63.54% | 57.23% | 59.64% | 59.15% | 55.48% |

| Research & Development | 41.81M | 49.42M | 48.76M | 42.90M | 44.18M | 39.71M | 35.38M | 30.13M | 26.56M | 27.51M | 22.41M | 17.58M | 15.20M | 12.69M | 12.61M | 12.63M | 10.26M | 7.23M | 6.44M | 5.44M | 4.53M | 4.03M | 3.37M | 3.55M | 3.83M | 2.60M | 1.10M | 700.00K |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 47.65M | 43.81M | 40.81M | 37.47M | 36.48M | 30.60M | 29.07M | 26.81M | 26.78M | 24.96M | 26.14M | 25.51M | 24.55M | 15.54M | 11.75M | 0.00 | 7.87M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 116.92M | 103.54M | 79.87M | 79.31M | 80.16M | 71.69M | 64.45M | 62.12M | 50.68M | 48.60M | 63.02M | 56.13M | 45.28M | 37.27M | 25.89M | 0.00 | 13.89M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 157.34M | 146.66M | 136.23M | 131.83M | 177.38M | 164.57M | 147.35M | 120.68M | 116.78M | 116.64M | 102.29M | 93.51M | 88.92M | 77.46M | 73.55M | 89.16M | 81.64M | 69.84M | 52.81M | 37.63M | 27.46M | 21.77M | 19.25M | 19.92M | 17.11M | 13.30M | 7.60M | 4.50M |

| Other Expenses | 15.39M | 3.24M | -70.00K | -431.00K | -2.31M | -1.14M | 190.00K | -822.00K | -371.00K | 94.00K | -50.00K | -102.00K | 6.71M | 6.33M | 5.53M | 4.51M | 4.03M | 4.14M | 3.45M | 2.34M | 2.84M | 2.28M | 2.56M | 2.93M | 4.47M | 3.00M | 300.00K | 200.00K |

| Operating Expenses | 199.14M | 196.07M | 185.00M | 174.72M | 221.55M | 222.59M | 199.32M | 164.68M | 154.56M | 151.57M | 131.74M | 118.07M | 110.83M | 96.47M | 91.70M | 106.29M | 95.93M | 81.20M | 62.71M | 45.41M | 34.83M | 28.08M | 25.18M | 26.40M | 25.41M | 18.90M | 9.00M | 5.40M |

| Cost & Expenses | 408.37M | 366.07M | 338.88M | 318.64M | 405.19M | 397.87M | 355.60M | 312.30M | 304.43M | 304.49M | 261.63M | 241.84M | 221.31M | 174.85M | 158.69M | 190.31M | 172.51M | 144.15M | 115.36M | 82.44M | 64.35M | 49.19M | 39.48M | 41.15M | 39.57M | 30.00M | 18.60M | 11.90M |

| Interest Income | 0.00 | 36.00K | 55.00K | 340.00K | 714.00K | 429.00K | 319.00K | 164.00K | 111.00K | 96.00K | 74.00K | 160.00K | 101.00K | 105.00K | 253.00K | 2.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 3.35M | 36.00K | 55.00K | 0.00 | 781.00K | 486.00K | 4.00K | 48.00K | 56.00K | 8.00K | 9.00K | 28.00K | 37.00K | 34.00K | 14.00K | 452.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 15.38M | 14.10M | 13.69M | 14.55M | 18.52M | 18.31M | 16.59M | 13.87M | 11.22M | 7.43M | 7.04M | 6.98M | 6.71M | 6.33M | 5.53M | 4.51M | 5.25M | 4.54M | 3.45M | 2.34M | 2.12M | 2.27M | 2.56M | 2.93M | 4.47M | 3.00M | 300.00K | 200.00K |

| EBITDA | -35.24M | -7.56M | 5.19M | -16.23M | -41.72M | 23.36M | 22.42M | 27.15M | 24.34M | 44.96M | 37.19M | 37.95M | 38.45M | 20.58M | -4.61M | 23.32M | 24.36M | 12.80M | 13.68M | 17.64M | 9.56M | -671.48K | -802.12K | 2.23M | -2.00M | 500.00K | 5.20M | 2.90M |

| EBITDA Ratio | -9.82% | -0.50% | 3.63% | -0.24% | -1.70% | 5.79% | 6.21% | 8.34% | 7.66% | 13.15% | 12.75% | 14.11% | 15.61% | 12.18% | -3.52% | 12.30% | 11.72% | 7.88% | 11.53% | 17.07% | 11.59% | -2.73% | -7.90% | 4.78% | 0.16% | 9.09% | 20.00% | 19.86% |

| Operating Income | -49.54M | -20.31M | -1.14M | -14.88M | -23.42M | 5.75M | 5.32M | 13.28M | 13.12M | 37.34M | 30.15M | 31.55M | 32.86M | 16.93M | -10.99M | 18.94M | 19.11M | 8.26M | 10.23M | 14.58M | 7.44M | -2.94M | -4.37M | -697.10K | -6.46M | -2.50M | 4.90M | 2.70M |

| Operating Income Ratio | -13.80% | -5.87% | -0.34% | -4.90% | -6.13% | 1.43% | 1.47% | 4.08% | 4.13% | 10.92% | 10.33% | 11.54% | 12.93% | 8.83% | -7.44% | 9.05% | 9.97% | 5.42% | 8.14% | 15.03% | 10.36% | -6.36% | -12.44% | -1.72% | -19.52% | -9.09% | 20.85% | 18.49% |

| Total Other Income/Expenses | -4.53M | 3.27M | -125.00K | -91.00K | -2.38M | -1.20M | 505.00K | -658.00K | -316.00K | 182.00K | -1.29M | -612.00K | -1.15M | -2.71M | 831.00K | -577.00K | 3.93M | 1.52M | -328.00K | 705.33K | 2.00M | 1.13M | 855.38K | 1.16M | -2.05M | -1.90M | 400.00K | -300.00K |

| Income Before Tax | -54.06M | -21.65M | -8.56M | -30.77M | -61.01M | 4.56M | 5.83M | 12.63M | 12.81M | 37.52M | 28.86M | 30.94M | 31.71M | 14.22M | -10.16M | 18.36M | 23.04M | 9.78M | 9.90M | 15.29M | 9.44M | -1.80M | -2.51M | 464.20K | -8.52M | -4.40M | 5.30M | 2.50M |

| Income Before Tax Ratio | -15.07% | -6.26% | -2.53% | -10.13% | -15.98% | 1.13% | 1.61% | 3.88% | 4.03% | 10.98% | 9.89% | 11.32% | 12.47% | 7.41% | -6.88% | 8.77% | 12.02% | 6.41% | 7.88% | 15.76% | 13.14% | -3.90% | -7.14% | 1.15% | -25.72% | -16.00% | 22.55% | 17.12% |

| Income Tax Expense | 2.52M | 5.11M | 31.40M | -31.40M | 1.13M | -372.00K | 20.34M | 1.52M | -7.00K | 3.87M | 7.35M | 7.94M | 8.33M | 3.15M | 424.00K | 4.41M | 4.94M | 1.58M | 1.72M | 358.29K | 1.16M | 210.74K | 341.74K | 424.68K | -1.12M | 500.00K | 2.10M | 1.10M |

| Net Income | -56.58M | -26.76M | -39.96M | 629.00K | -62.15M | 4.93M | -14.52M | 11.11M | 12.81M | 33.65M | 21.51M | 23.00M | 23.38M | 11.07M | -10.58M | 13.95M | 18.09M | 8.20M | 8.18M | 14.93M | 8.28M | -2.02M | -2.85M | 39.52K | -7.39M | -4.90M | 3.20M | 1.40M |

| Net Income Ratio | -15.77% | -7.74% | -11.83% | 0.21% | -16.28% | 1.22% | -4.02% | 3.41% | 4.03% | 9.84% | 7.37% | 8.41% | 9.20% | 5.77% | -7.16% | 6.67% | 9.44% | 5.38% | 6.51% | 15.39% | 11.53% | -4.36% | -8.11% | 0.10% | -22.34% | -17.82% | 13.62% | 9.59% |

| EPS | -2.99 | -1.46 | -2.20 | 0.04 | -3.58 | 0.29 | -0.87 | 0.67 | 0.74 | 1.95 | 1.26 | 1.36 | 1.42 | 0.69 | -0.66 | 0.84 | 1.17 | 0.57 | 0.58 | 1.08 | 0.68 | -0.17 | -0.26 | 0.00 | -0.67 | -0.46 | 0.41 | 0.20 |

| EPS Diluted | -2.99 | -1.46 | -2.20 | 0.04 | -3.58 | 0.28 | -0.87 | 0.67 | 0.74 | 1.93 | 1.25 | 1.34 | 1.39 | 0.68 | -0.66 | 0.83 | 1.15 | 0.56 | 0.57 | 1.06 | 0.64 | -0.17 | -0.26 | 0.00 | -0.67 | -0.46 | 0.39 | 0.19 |

| Weighted Avg Shares Out | 18.92M | 18.32M | 18.19M | 17.77M | 17.38M | 17.04M | 16.69M | 16.65M | 17.29M | 17.25M | 17.09M | 16.91M | 16.50M | 16.15M | 16.13M | 16.63M | 15.44M | 14.40M | 14.17M | 13.83M | 12.18M | 11.85M | 11.03M | 9.33M | 11.04M | 10.65M | 7.80M | 7.00M |

| Weighted Avg Shares Out (Dil) | 18.92M | 18.32M | 18.19M | 17.93M | 17.38M | 17.35M | 16.71M | 16.68M | 17.39M | 17.42M | 17.24M | 17.13M | 16.87M | 16.37M | 16.13M | 16.73M | 15.72M | 14.56M | 14.44M | 14.02M | 12.85M | 11.85M | 11.03M | 9.33M | 11.04M | 10.65M | 8.21M | 7.37M |

Faro Technologies (FARO) Q2 Earnings and Revenues Lag Estimates

FARO Announces Second Quarter 2021 Financial Results

FARO Announces Two New Appointments to Board of Directors

FARO to Announce Financial Results for the Second Quarter 2021

FARO Announces Consolidation and Outsourcing of Manufacturing

FARO® Launches All-New Quantum Max FaroArm with Multiple Laser Line Probes

FARO Expands Digital Twin Product Suite - Acquires HoloBuilder, Inc.

FARO to Participate in Upcoming Investor Conferences

Faro Technologies (FARO) Reports Q1 Loss, Misses Revenue Estimates

Faro Technologies: Q1 Earnings Insights

Source: https://incomestatements.info

Category: Stock Reports