See more : Ainsworth Game Technology Limited (AINSF) Income Statement Analysis – Financial Results

Complete financial analysis of First Community Bankshares, Inc. (FCBC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of First Community Bankshares, Inc., a leading company in the Banks – Regional industry within the Financial Services sector.

- Kiland Limited (KIL.AX) Income Statement Analysis – Financial Results

- Just Dial Limited (JUSTDIAL.BO) Income Statement Analysis – Financial Results

- Elate Holdings Limited (0076.HK) Income Statement Analysis – Financial Results

- NBC Bancorp, Inc. (NCXS) Income Statement Analysis – Financial Results

- Aqua Gold International, Inc. (AQUI) Income Statement Analysis – Financial Results

First Community Bankshares, Inc. (FCBC)

About First Community Bankshares, Inc.

First Community Bankshares, Inc. operates as the financial holding company for First Community Bank that provides various banking products and services. It offers demand deposit accounts, savings and money market accounts, certificates of deposit, and individual retirement arrangements; commercial, consumer, and real estate mortgage loans, as well as lines of credit; various credit and debit cards, and automated teller machine card services; and corporate and personal trust services. The company also provides wealth management services, including trust management, estate administration, and investment advisory services; and investment management services. It serves individuals and businesses across various industries, such as education, government, and health services; coal mining and gas extraction; retail trade; construction; manufacturing; tourism; and transportation. As of December 31, 2021, the company operated 49 branches, including 17 branches in West Virginia, 23 branches in Virginia, 7 branches in North Carolina, and 2 branches in Tennessee. First Community Bankshares, Inc. was founded in 1874 and is headquartered in Bluefield, Virginia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 137.17M | 140.58M | 130.45M | 132.74M | 118.68M | 113.43M | 113.47M | 108.26M | 112.58M | 115.06M | 121.73M | 125.80M | 109.85M | 114.55M | 90.05M | 98.13M | 93.15M | 92.97M | 95.93M | 86.51M | 86.37M | 81.25M | 70.70M | 59.07M | 54.97M | 17.43M | 13.62M | 11.34M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 137.17M | 140.58M | 130.45M | 132.74M | 118.68M | 113.43M | 113.47M | 108.26M | 112.58M | 115.06M | 121.73M | 125.80M | 109.85M | 114.55M | 90.05M | 98.13M | 93.15M | 92.97M | 95.93M | 86.51M | 86.37M | 81.25M | 70.70M | 59.07M | 54.97M | 17.43M | 13.62M | 11.34M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 51.40M | 48.31M | 45.07M | 44.43M | 37.47M | 37.60M | 37.23M | 41.30M | 41.14M | 42.39M | 42.95M | 40.20M | 36.11M | 37.38M | 36.38M | 29.88M | 25.85M | 26.87M | 29.48M | 26.65M | 26.76M | 23.27M | 19.83M | 16.05M | 13.13M | 12.24M | 11.34M | 9.58M |

| Selling & Marketing | 3.30M | 2.41M | 2.08M | 1.95M | 2.31M | 2.01M | 2.21M | 1.53M | 1.31M | 1.00M | 1.69M | 1.42M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 54.70M | 50.72M | 47.15M | 46.38M | 39.78M | 39.61M | 37.23M | 41.30M | 41.14M | 42.39M | 42.95M | 40.20M | 36.11M | 37.38M | 36.38M | 29.88M | 25.85M | 26.87M | 29.48M | 26.65M | 26.76M | 23.27M | 19.83M | 16.05M | 13.13M | 12.24M | 11.34M | 9.58M |

| Other Expenses | 101.53M | -24.37M | -111.07M | -133.01M | -2.38M | -2.18M | -3.52M | -5.47M | -6.38M | -3.98M | -5.60M | -158.80M | 2.29M | 185.00K | 74.37M | -125.01M | -114.58M | -114.63M | -119.70M | -54.06M | -49.16M | -34.74M | -20.58M | -11.62M | -11.23M | 27.72M | 29.90M | 26.46M |

| Operating Expenses | 156.23M | 1.30M | -63.92M | -86.63M | 37.40M | 39.80M | 33.71M | 35.82M | 34.76M | 38.41M | 37.36M | -118.60M | 38.40M | 37.57M | 110.75M | -95.14M | -88.74M | -87.77M | -90.22M | -27.41M | -22.40M | -11.47M | -750.00K | 4.43M | 1.90M | 39.96M | 41.24M | 36.04M |

| Cost & Expenses | 156.23M | 1.30M | -63.92M | -86.63M | 37.40M | 39.80M | 33.71M | 35.82M | 34.76M | 38.41M | 37.36M | -118.60M | 38.40M | 37.57M | 110.75M | -95.14M | -88.74M | -87.77M | -90.22M | -27.41M | -22.40M | -11.47M | -750.00K | 4.43M | 1.90M | 39.96M | 41.24M | 36.04M |

| Interest Income | 137.17M | 114.32M | 105.31M | 114.04M | 94.97M | 98.29M | 95.31M | 94.72M | 96.10M | 106.11M | 109.48M | 109.66M | 94.18M | 103.58M | 107.93M | 110.77M | 127.59M | 120.03M | 109.51M | 96.14M | 93.04M | 96.20M | 92.83M | 85.96M | 76.49M | 81.21M | 75.83M | 64.94M |

| Interest Expense | 9.48M | 1.66M | 2.84M | 5.46M | 5.52M | 7.45M | 8.09M | 9.84M | 11.35M | 15.29M | 17.83M | 19.60M | 22.15M | 29.73M | 38.68M | 44.93M | 59.28M | 48.38M | 35.88M | 26.95M | 28.37M | 35.01M | 42.41M | 39.38M | 32.25M | 38.13M | 32.89M | 26.93M |

| Depreciation & Amortization | 5.69M | 5.60M | 5.92M | 5.91M | 4.45M | 3.95M | 4.62M | 4.70M | 1.12M | 787.00K | 729.00K | 804.00K | 1.02M | 1.03M | 1.03M | 4.41M | 4.28M | 4.48M | 4.82M | 5.54M | 5.06M | 3.13M | 4.09M | 3.79M | 3.92M | 3.43M | 1.84M | 1.48M |

| EBITDA | 0.00 | 65.76M | 72.45M | 52.02M | 54.24M | 49.07M | 46.73M | 42.64M | 42.70M | 47.26M | 39.62M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 41.35M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 0.00% | 47.95% | 52.11% | 35.83% | 42.80% | 49.83% | 48.31% | 48.48% | 46.65% | 50.67% | 47.19% | 53.37% | 51.66% | 56.32% | -24.83% | 50.56% | 113.28% | 100.34% | 80.47% | 74.72% | 79.93% | 89.73% | 104.73% | 113.90% | 110.58% | 348.91% | 416.17% | 430.76% |

| Operating Income | 5.65M | 65.97M | 66.53M | 46.11M | 49.80M | 52.57M | 3.50M | 3.21M | 4.13M | 4.36M | 5.24M | 7.20M | 3.89M | 3.66M | 2.62M | 3.00M | 4.41M | 5.20M | 5.72M | 59.10M | 63.98M | 69.78M | 69.95M | 63.50M | 56.87M | 57.39M | 54.86M | 47.38M |

| Operating Income Ratio | 4.12% | 46.92% | 51.00% | 34.74% | 41.96% | 46.35% | 3.09% | 2.96% | 3.67% | 3.79% | 4.30% | 5.72% | 3.54% | 3.20% | 2.91% | 3.05% | 4.74% | 5.60% | 5.96% | 68.32% | 74.07% | 85.88% | 98.94% | 107.49% | 103.46% | 329.24% | 402.67% | 417.70% |

| Total Other Income/Expenses | 56.32M | -13.80M | -14.02M | -16.18M | -8.37M | -17.26M | -13.81M | -15.51M | -23.08M | -29.86M | -24.84M | -7.51M | -3.52M | -1.22M | -68.73M | -31.62M | 37.56M | 35.22M | 10.19M | -5.54M | -28.37M | -35.01M | -42.41M | -39.38M | -32.25M | -38.13M | -32.89M | -26.93M |

| Income Before Tax | 61.97M | 60.16M | 66.53M | 46.11M | 49.80M | 45.12M | 42.11M | 37.95M | 35.92M | 37.81M | 34.22M | 42.71M | 29.60M | 29.67M | -66.10M | 271.00K | 41.97M | 40.43M | 36.64M | 35.81M | 35.60M | 34.77M | 27.54M | 24.12M | 24.62M | 19.27M | 21.97M | 20.45M |

| Income Before Tax Ratio | 45.18% | 42.79% | 51.00% | 34.74% | 41.96% | 39.78% | 37.12% | 35.05% | 31.91% | 32.87% | 28.11% | 33.95% | 26.95% | 25.90% | -73.40% | 0.28% | 45.05% | 43.48% | 38.19% | 41.39% | 41.22% | 42.79% | 38.95% | 40.83% | 44.79% | 110.52% | 161.26% | 180.26% |

| Income Tax Expense | 13.95M | 13.50M | 15.36M | 10.19M | 10.99M | 8.78M | 20.63M | 12.82M | 11.38M | 12.32M | 10.91M | 14.13M | 9.57M | 7.82M | -27.87M | -2.81M | 12.33M | 11.48M | 10.19M | 9.79M | 10.37M | 10.05M | 8.40M | 7.05M | 7.77M | 6.16M | 6.88M | 6.53M |

| Net Income | 48.02M | 46.66M | 51.17M | 35.93M | 38.80M | 36.34M | 21.49M | 25.13M | 24.54M | 25.49M | 23.31M | 28.58M | 20.03M | 21.85M | -38.23M | 3.08M | 29.63M | 28.95M | 26.30M | 22.36M | 25.24M | 24.72M | 19.13M | 17.06M | 16.85M | 13.10M | 15.09M | 13.92M |

| Net Income Ratio | 35.01% | 33.19% | 39.22% | 27.06% | 32.69% | 32.04% | 18.94% | 23.21% | 21.80% | 22.15% | 19.15% | 22.72% | 18.23% | 19.07% | -42.45% | 3.14% | 31.81% | 31.14% | 27.42% | 25.85% | 29.22% | 30.43% | 27.07% | 28.89% | 30.65% | 75.15% | 110.79% | 122.69% |

| EPS | 2.67 | 2.82 | 2.95 | 2.02 | 2.47 | 2.19 | 1.26 | 1.45 | 1.32 | 1.34 | 1.13 | 1.44 | 1.08 | 1.23 | -2.57 | 0.26 | 2.64 | 2.58 | 2.33 | 1.99 | 2.27 | 2.26 | 1.75 | 1.61 | 1.59 | 1.23 | 1.41 | 1.63 |

| EPS Diluted | 2.66 | 2.82 | 2.94 | 2.02 | 2.46 | 2.18 | 1.26 | 1.45 | 1.31 | 1.31 | 1.11 | 1.40 | 1.07 | 1.23 | -2.57 | 0.25 | 2.62 | 2.57 | 2.32 | 1.97 | 2.25 | 2.25 | 1.74 | 1.61 | 1.58 | 1.23 | 1.41 | 1.63 |

| Weighted Avg Shares Out | 18.00M | 16.52M | 17.34M | 17.78M | 15.69M | 16.59M | 17.00M | 17.32M | 18.53M | 18.41M | 19.79M | 19.13M | 17.88M | 17.80M | 14.87M | 11.06M | 11.20M | 11.20M | 11.27M | 11.24M | 12.42M | 10.72M | 10.94M | 10.57M | 10.61M | 10.65M | 10.68M | 8.50M |

| Weighted Avg Shares Out (Dil) | 18.03M | 16.56M | 17.40M | 17.82M | 15.76M | 16.67M | 17.08M | 17.37M | 18.73M | 19.48M | 20.96M | 20.48M | 18.69M | 17.82M | 14.87M | 11.13M | 11.29M | 11.28M | 11.34M | 11.35M | 12.53M | 10.77M | 10.98M | 10.57M | 10.68M | 10.65M | 10.68M | 8.50M |

First Community Bankshares Inc (NASDAQ:FCBC) Shares Bought by Two Sigma Advisers LP

Unity Bancorp (NASDAQ:UNTY) Upgraded to Hold at Zacks Investment Research

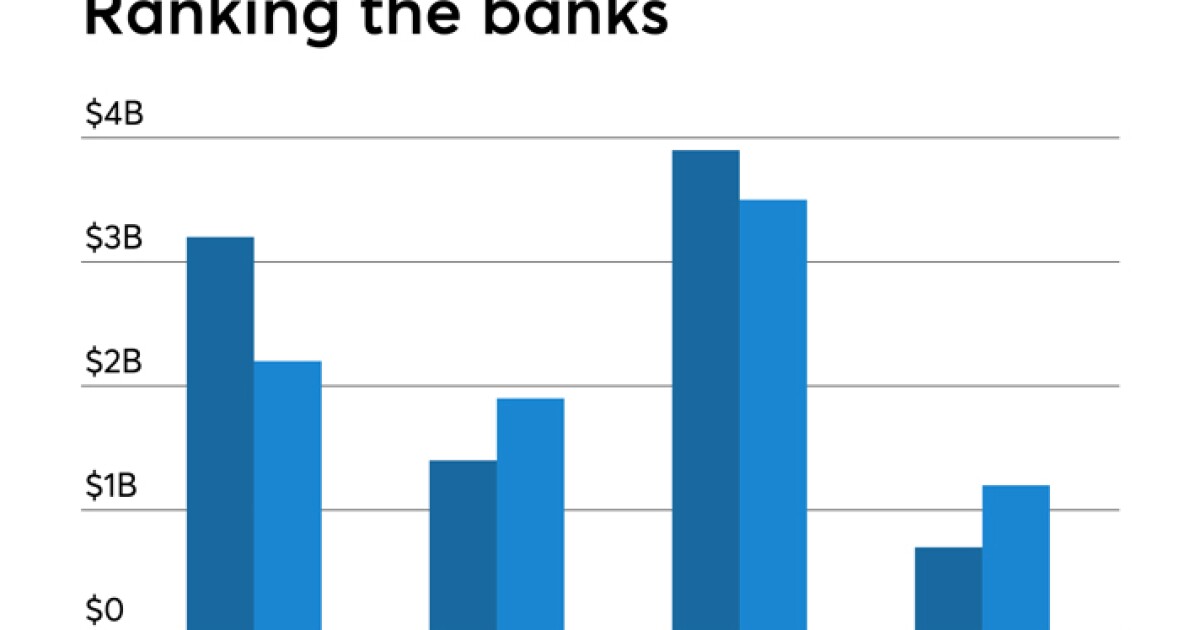

U.S. Bank Holding Companies with the Highest Multiples of Net Income to Salary and Benefits

First Community Bankshares, Inc. Announces First Quarter Results

Dividend Challenger Highlights: Week Of May 3

First Community Bankshares (NASDAQ:FCBC) Raised to "Sell" at BidaskClub

First Community Bankshares, Inc. Announces Quarterly Dividend

First Community Bankshares, Inc. Announces Quarterly Dividend

Contrasting Select Bancorp (NASDAQ:SLCT) and First Community Bankshares (NASDAQ:FCBC)

DA Davidson Comments on First Community Co.'s FY2020 Earnings (NASDAQ:FCCO)

Source: https://incomestatements.info

Category: Stock Reports