See more : Mister Spex SE (MRX.F) Income Statement Analysis – Financial Results

Complete financial analysis of Fidus Investment Corporation 5.375% Notes Due 2024 (FDUSG) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Fidus Investment Corporation 5.375% Notes Due 2024, a leading company in the industry within the sector.

You may be interested

- Orphazyme A/S (OZYMF) Income Statement Analysis – Financial Results

- Enthusiast Gaming Holdings Inc. (EGLXF) Income Statement Analysis – Financial Results

- Nabriva Therapeutics plc (NBRVF) Income Statement Analysis – Financial Results

- JAFCO Group Co., Ltd. (8595.T) Income Statement Analysis – Financial Results

- Sulliden Mining Capital Inc. (SULMF) Income Statement Analysis – Financial Results

Fidus Investment Corporation 5.375% Notes Due 2024 (FDUSG)

| Metric | 2020 |

|---|---|

| Revenue | 85.12M |

| Cost of Revenue | 0.00 |

| Gross Profit | 85.12M |

| Gross Profit Ratio | 100.00% |

| Research & Development | 0.00 |

| General & Administrative | 0.00 |

| Selling & Marketing | 0.00 |

| SG&A | 0.00 |

| Other Expenses | 6.00K |

| Operating Expenses | 6.00K |

| Cost & Expenses | 6.00K |

| Interest Income | 0.00 |

| Interest Expense | -19.68M |

| Depreciation & Amortization | 6.58M |

| EBITDA | 27.41M |

| EBITDA Ratio | 32.20% |

| Operating Income | 40.51M |

| Operating Income Ratio | 47.59% |

| Total Other Income/Expenses | 0.00 |

| Income Before Tax | 40.51M |

| Income Before Tax Ratio | 47.59% |

| Income Tax Expense | 862.00K |

| Net Income | 39.65M |

| Net Income Ratio | 46.58% |

| EPS | 0.00 |

| EPS Diluted | 0.00 |

| Weighted Avg Shares Out | 0.00 |

| Weighted Avg Shares Out (Dil) | 0.00 |

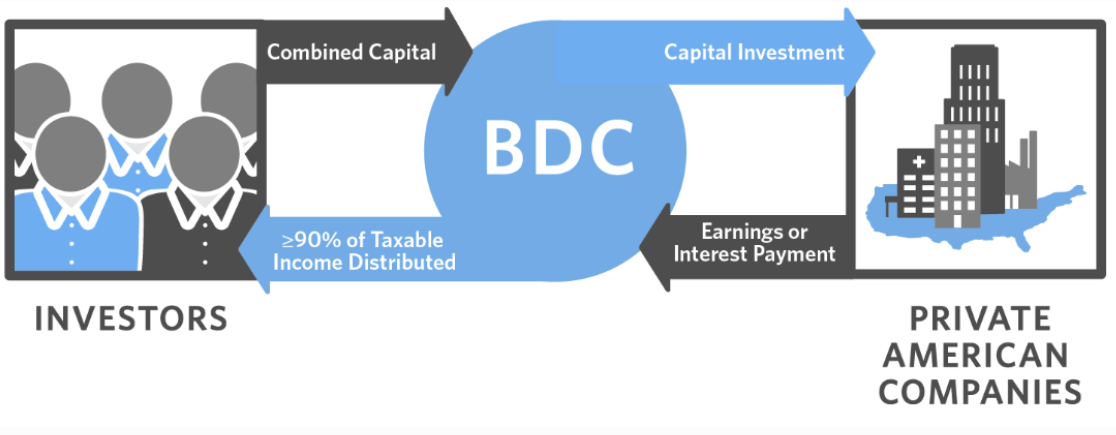

BDC Retirement Income: 12% Yielding New Mountain Finance

This is a series of articles discussing retirement portfolios using BDCs currently yielding around 12% and their safer notes - baby bonds/preferred shares with yield-to-maturities ranging from 6% to 10%.

PennantPark Investment: 55% Discount To Book Driving 14% Yield

This is a series of articles discussing retirement portfolios using BDCs currently around 12% and their safer notes - baby bonds/preferred shares with yield-to-maturities ranging from 6% to 10%.

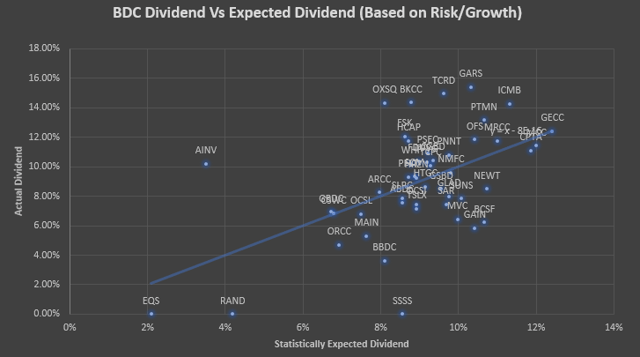

Ranking Business Development Companies From Most Undervalued To Overvalued

As high-yield credit spreads fall, it may be a good time to look to business-development-companies. While high dividend returns and low PB ratios are great, one

Source: https://incomestatements.info

Category: Stock Reports