See more : Sanyodo Holdings Inc (3058.T) Income Statement Analysis – Financial Results

Complete financial analysis of Fidus Investment Corporation (FDUSZ) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Fidus Investment Corporation, a leading company in the Asset Management industry within the Financial Services sector.

- Fortnox AB (publ) (FNOXF) Income Statement Analysis – Financial Results

- Allied Supreme Corp. (4770.TW) Income Statement Analysis – Financial Results

- Impact Minerals Limited (IPT.AX) Income Statement Analysis – Financial Results

- DaFa Properties Group Limited (6111.HK) Income Statement Analysis – Financial Results

- Alpha Technology Group Limited (ATGL) Income Statement Analysis – Financial Results

Fidus Investment Corporation (FDUSZ)

Industry: Asset Management

Sector: Financial Services

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 154.18M | 52.95M | 127.25M | 39.97M | 53.94M | 55.20M | 50.44M | 46.19M | 30.26M | 24.07M | 31.06M | 22.08M | 23.39M | 17.98M | 14.18M |

| Cost of Revenue | 37.29M | 24.05M | 42.88M | 21.50M | 24.73M | 11.37M | 9.79M | 8.25M | 7.55M | 5.90M | 5.26M | 4.24M | 3.61M | 4.14M | 4.08M |

| Gross Profit | 116.89M | 28.90M | 84.37M | 18.47M | 29.21M | 43.84M | 40.66M | 37.93M | 22.72M | 18.18M | 25.80M | 17.84M | 19.77M | 13.84M | 10.10M |

| Gross Profit Ratio | 75.82% | 54.57% | 66.30% | 46.22% | 54.16% | 79.41% | 80.60% | 82.13% | 75.07% | 75.50% | 83.06% | 80.81% | 84.55% | 76.96% | 71.20% |

| Research & Development | 0.00 | 0.30 | 0.81 | 0.39 | 0.65 | 0.77 | 0.54 | 0.91 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 41.23M | 5.36M | 4.49M | 5.16M | 4.42M | 4.27M | 4.07M | 3.99M | 3.93M | 4.19M | 3.12M | 2.66M | 1.10B | 627.44K | 430.61K |

| Selling & Marketing | -34.94M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -1.10B | 0.00 | 0.00 |

| SG&A | 6.29M | 5.36M | 4.49M | 5.16M | 4.42M | 4.27M | 4.07M | 3.99M | 3.93M | 4.19M | 3.12M | 2.66M | 3.16M | 627.44K | 430.61K |

| Other Expenses | 0.00 | -51.00K | 4.09M | 2.15M | 429.00K | 1.67M | -8.07M | 26.45M | -12.55M | 0.00 | 0.00 | 3.72M | -430.21K | -708.43K | -1.12M |

| Operating Expenses | 41.23M | 5.31M | 8.58M | 7.31M | 4.85M | 4.27M | 4.07M | 3.99M | 3.93M | 4.19M | 3.12M | 2.66M | 2.73M | -80.99K | -684.46K |

| Cost & Expenses | 88.00M | 7.41M | 8.58M | 7.31M | 4.85M | 27.99M | 24.83M | 22.61M | 17.96M | 14.95M | 15.17M | 11.74M | 6.34M | 4.06M | 3.40M |

| Interest Income | 119.45M | 84.54M | 77.38M | 78.16M | 71.39M | 67.61M | 62.29M | 52.88M | 50.65M | 40.32M | 40.11M | 32.91M | 5.49M | 4.96M | 3.69M |

| Interest Expense | 20.60M | 18.67M | 19.16M | 17.41M | 17.07M | 12.96M | 9.89M | 10.59M | 9.43M | 7.51M | 7.08M | 6.42M | 5.49M | 4.96M | 3.69M |

| Depreciation & Amortization | 0.00 | 93.21M | 4.16M | 31.51M | 9.38M | 15.23M | 40.14M | 4.19M | 11.11M | 7.51M | 7.08M | 10.15M | 9.34M | 5.04M | 6.83M |

| EBITDA | 0.00 | -2.67M | 0.00 | -7.12M | 0.00 | 50.93M | 48.25M | 42.20M | 38.00M | 31.17M | 0.00 | 25.84M | 20.87M | 14.00M | 13.92M |

| EBITDA Ratio | 0.00% | 121.25% | 93.26% | 81.72% | 91.01% | 106.24% | 95.65% | 83.00% | 125.57% | 129.48% | 85.69% | 117.04% | 89.25% | 77.84% | 98.15% |

| Operating Income | 102.60M | 66.31M | 118.67M | 32.67M | 49.09M | 48.44M | 33.90M | 27.03M | 26.88M | 23.66M | 19.54M | 15.69M | 11.53M | 8.96M | 7.10M |

| Operating Income Ratio | 66.54% | 125.23% | 93.26% | 81.72% | 91.01% | 87.75% | 67.20% | 58.52% | 88.84% | 98.30% | 62.91% | 71.08% | 49.31% | 49.82% | 50.03% |

| Total Other Income/Expenses | -22.77M | -18.67M | 144.76M | -22.69M | 2.73M | 2.49M | 12.48M | 4.58M | 0.00 | 0.00 | 1.32M | -2.70M | 16.17M | -3.94M | -3.14M |

| Income Before Tax | 79.83M | 47.64M | 118.67M | 32.67M | 49.09M | 50.93M | 46.38M | 42.20M | 26.33M | 19.89M | 27.94M | 19.42M | 11.56B | 5.02M | -1.59M |

| Income Before Tax Ratio | 51.77% | 89.98% | 93.26% | 81.72% | 91.01% | 92.26% | 91.93% | 91.37% | 87.01% | 82.60% | 89.95% | 87.95% | 49,417.39% | 27.93% | -11.23% |

| Income Tax Expense | 2.69M | 11.82M | 2.57M | 1.44M | 621.00K | 1.48M | 2.42M | 630.00K | 351.00K | 400.00K | 739.00K | 4.00K | 24.11M | 0.00 | 0.00 |

| Net Income | 77.13M | 35.82M | 116.10M | 31.23M | 48.47M | 49.45M | 43.95M | 41.57M | 25.98M | 19.49M | 27.20M | 19.41M | 15.39M | 5.02M | -1.59M |

| Net Income Ratio | 50.03% | 67.65% | 91.24% | 78.12% | 89.86% | 89.58% | 87.13% | 90.01% | 85.85% | 80.94% | 87.57% | 87.93% | 65.79% | 27.93% | -11.23% |

| EPS | 2.93 | 1.46 | 4.75 | 1.28 | 1.98 | 2.02 | 1.87 | 2.27 | 1.60 | 1.36 | 2.01 | 1.91 | 1.63 | 0.53 | -0.17 |

| EPS Diluted | 2.93 | 1.46 | 4.75 | 1.28 | 1.98 | 2.02 | 1.87 | 2.27 | 1.60 | 1.36 | 2.01 | 1.91 | 1.63 | 0.53 | -0.17 |

| Weighted Avg Shares Out | 26.37M | 24.47M | 24.44M | 24.44M | 24.46M | 24.47M | 23.53M | 18.28M | 16.20M | 14.35M | 13.52M | 10.19M | 9.43M | 9.43M | 9.43M |

| Weighted Avg Shares Out (Dil) | 26.37M | 24.47M | 24.44M | 24.44M | 24.46M | 24.47M | 23.53M | 18.28M | 16.20M | 14.35M | 13.52M | 10.19M | 9.43M | 9.43M | 9.43M |

Fidus Investment: A Solid Q3 With An Efficient Income Profile

Fidus Investment: Near 9% Yield Should Be Sustainable (Upgrade)

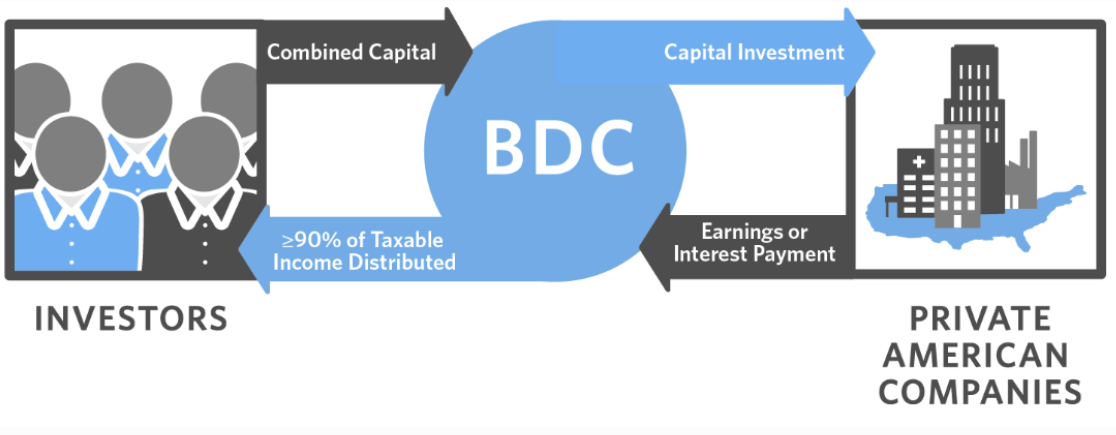

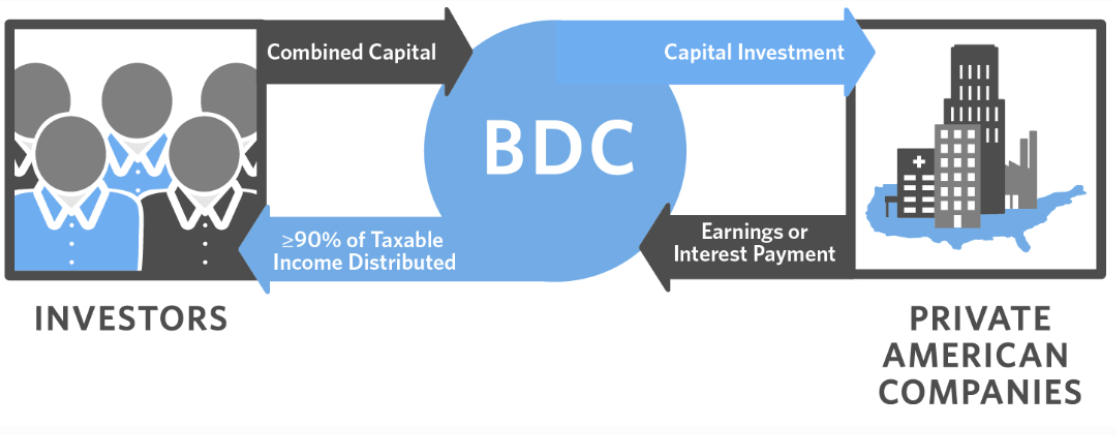

BDC Retirement Income: 12% Yielding New Mountain Finance

PennantPark Investment: 55% Discount To Book Driving 14% Yield

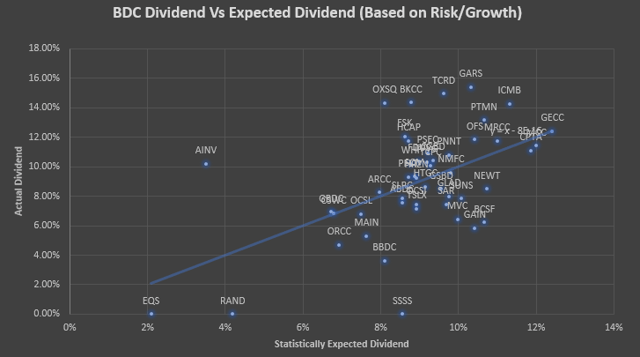

Ranking Business Development Companies From Most Undervalued To Overvalued

Source: https://incomestatements.info

Category: Stock Reports