See more : C.Uyemura & Co.,Ltd. (4966.T) Income Statement Analysis – Financial Results

Complete financial analysis of FirstEnergy Corp. (FE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of FirstEnergy Corp., a leading company in the Regulated Electric industry within the Utilities sector.

- Argan SA (0GN6.L) Income Statement Analysis – Financial Results

- Shanghai Wondertek Software Co., Ltd (603189.SS) Income Statement Analysis – Financial Results

- FTAI Aviation Ltd. (FTAIP) Income Statement Analysis – Financial Results

- Procrea Holdings, Inc. (7384.T) Income Statement Analysis – Financial Results

- JEOL Ltd. (6951.T) Income Statement Analysis – Financial Results

FirstEnergy Corp. (FE)

About FirstEnergy Corp.

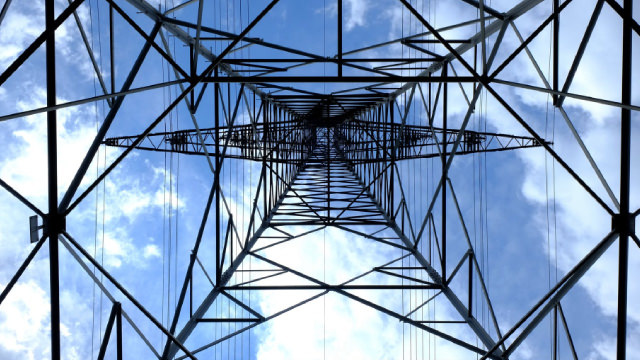

FirstEnergy Corp., through its subsidiaries, generates, transmits, and distributes electricity in the United States. It operates through Regulated Distribution and Regulated Transmission segments. The company owns and operates coal-fired, nuclear, hydroelectric, natural gas, wind, and solar power generating facilities. It operates 24,074 circuit miles of overhead and underground transmission lines; and electric distribution systems, including 273,295 miles of overhead pole line and underground conduit carrying primary, secondary, and street lighting circuits. The company serves approximately 6 million customers in Ohio, Pennsylvania, West Virginia, Maryland, New Jersey, and New York. FirstEnergy Corp. was incorporated in 1996 and is headquartered in Akron, Ohio.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 12.87B | 12.46B | 11.13B | 10.79B | 11.04B | 11.26B | 14.02B | 14.56B | 15.03B | 15.05B | 14.92B | 15.30B | 16.26B | 13.34B | 12.97B | 13.63B | 12.80B | 11.50B | 11.99B | 12.45B | 12.31B | 12.15B | 8.00B | 7.03B | 6.32B | 5.86B | 2.82B |

| Cost of Revenue | 4.65B | 4.59B | 3.45B | 3.07B | 3.42B | 3.65B | 4.58B | 5.48B | 6.17B | 7.00B | 6.46B | 6.71B | 7.30B | 6.06B | 5.88B | 5.63B | 5.01B | 4.25B | 4.01B | 4.47B | 5.16B | 4.27B | 2.24B | 801.29M | 877.00M | 983.70M | 486.30M |

| Gross Profit | 8.22B | 7.87B | 7.69B | 7.72B | 7.61B | 7.61B | 9.44B | 9.08B | 8.85B | 8.05B | 8.46B | 8.60B | 8.96B | 7.28B | 7.08B | 8.00B | 7.79B | 7.25B | 7.98B | 7.98B | 7.15B | 7.89B | 5.76B | 6.23B | 5.44B | 4.88B | 2.34B |

| Gross Profit Ratio | 63.90% | 63.14% | 69.05% | 71.55% | 68.97% | 67.61% | 67.35% | 62.37% | 58.92% | 53.51% | 56.70% | 56.17% | 55.08% | 54.60% | 54.63% | 58.68% | 60.83% | 63.02% | 66.54% | 64.11% | 58.11% | 64.90% | 71.98% | 88.60% | 86.12% | 83.22% | 82.76% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 78.00M | -72.00M | -382.00M | 477.00M | 674.00M | 144.00M | 141.00M | 147.00M | 242.00M | 835.00M | -256.00M | 609.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 78.00M | -72.00M | -382.00M | 477.00M | 674.00M | 144.00M | 141.00M | 147.00M | 242.00M | 835.00M | -256.00M | 609.00M | 3.91B | 2.85B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 5.88B | 5.96B | 5.84B | 5.56B | 5.10B | 205.00M | 6.72B | 6.53B | 6.28B | 6.16B | 6.31B | 6.19B | 2.43B | 2.24B | 5.21B | 5.55B | 5.50B | 5.14B | 5.91B | 5.77B | 5.51B | 5.70B | 4.07B | 4.72B | 3.91B | 3.51B | 1.60B |

| Operating Expenses | 5.96B | 5.88B | 5.46B | 6.04B | 5.78B | 5.26B | 6.86B | 6.68B | 6.52B | 6.99B | 6.06B | 6.79B | 6.34B | 5.09B | 5.34B | 5.55B | 5.50B | 5.14B | 5.91B | 5.77B | 5.51B | 5.70B | 4.07B | 4.72B | 3.91B | 3.51B | 1.60B |

| Cost & Expenses | 10.60B | 10.48B | 8.90B | 9.11B | 9.20B | 8.90B | 11.44B | 12.16B | 12.69B | 13.99B | 12.52B | 13.50B | 13.64B | 11.15B | 11.22B | 11.18B | 10.51B | 9.40B | 9.92B | 10.24B | 10.67B | 9.97B | 6.31B | 5.52B | 4.78B | 4.50B | 2.08B |

| Interest Income | 0.00 | 1.01B | 1.11B | 1.04B | 1.01B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 70.00M | 165.00M | 130.00M | 52.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.03B | 955.00M | 1.07B | 988.00M | 962.00M | 1.05B | 1.10B | 1.05B | 1.02B | 955.00M | 941.00M | 929.00M | 1.01B | 845.00M | 978.00M | 754.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 1.20B | 1.01B | 1.57B | 1.23B | 1.15B | 994.00M | 1.34B | 1.71B | 1.84B | 1.50B | 209.00M | 1.33B | 1.12B | 746.00M | 1.76B | 1.73B | 1.76B | 1.55B | 1.96B | 1.83B | 1.33B | 1.17B | 975.80M | 1.04B | 1.02B | 814.70M | 477.50M |

| EBITDA | 3.73B | 3.45B | 4.24B | 3.39B | 3.27B | 3.61B | 3.72B | -6.44B | 4.17B | 2.56B | 2.61B | 3.14B | 3.62B | 2.78B | 2.78B | 3.48B | 3.41B | 3.00B | 3.62B | 4.04B | 2.97B | 3.35B | 2.66B | 2.54B | 2.55B | 2.18B | 1.36B |

| EBITDA Ratio | 28.97% | 31.62% | 39.05% | 30.73% | 29.87% | 35.05% | 18.39% | 30.22% | 27.75% | 17.02% | 17.50% | 20.49% | 23.43% | 23.24% | 29.03% | 27.89% | 26.60% | 26.12% | 31.76% | 32.47% | 24.13% | 27.58% | 33.26% | 35.76% | 40.42% | 37.17% | 43.14% |

| Operating Income | 2.27B | 2.62B | 2.75B | 2.16B | 2.51B | 2.50B | 172.00M | -8.26B | 2.29B | 1.06B | 1.61B | 2.18B | 1.70B | 1.81B | 1.88B | 2.45B | 2.29B | 2.11B | 2.07B | 2.21B | 1.64B | 2.18B | 1.69B | 1.50B | 1.54B | 1.36B | 739.70M |

| Operating Income Ratio | 17.61% | 21.05% | 24.67% | 20.04% | 22.75% | 22.22% | 1.23% | -56.74% | 15.25% | 7.06% | 10.77% | 14.22% | 10.44% | 13.53% | 14.49% | 17.95% | 17.90% | 18.31% | 17.23% | 17.75% | 13.32% | 17.96% | 21.07% | 21.41% | 24.30% | 23.27% | 26.22% |

| Total Other Income/Expenses | -802.00M | -471.00M | -167.00M | -1.03B | -1.39B | -990.00M | -1.00B | -11.29B | -1.40B | -891.00M | -1.01B | -810.00M | -255.00M | -625.00M | -514.00M | -643.00M | -99.00M | -53.00M | -34.00M | -205.00M | -809.00M | -958.00M | -555.72M | -529.14M | -572.25M | -601.00M | -225.40M |

| Income Before Tax | 1.46B | 1.44B | 1.56B | 1.13B | 1.12B | 1.51B | -829.00M | -9.23B | 893.00M | 171.00M | 570.00M | 1.32B | 1.44B | 1.24B | 1.24B | 2.12B | 2.19B | 2.05B | 1.63B | 1.55B | 828.00M | 1.24B | 1.13B | 975.77M | 963.10M | 763.10M | 489.60M |

| Income Before Tax Ratio | 11.38% | 11.55% | 14.00% | 10.46% | 10.12% | 13.43% | -5.91% | -63.40% | 5.94% | 1.14% | 3.82% | 8.65% | 8.88% | 9.31% | 9.52% | 15.55% | 17.12% | 17.85% | 13.57% | 12.41% | 6.73% | 10.17% | 14.12% | 13.88% | 15.24% | 13.02% | 17.35% |

| Income Tax Expense | 267.00M | 1.00B | 320.00M | 126.00M | 213.00M | 490.00M | 895.00M | -3.06B | 315.00M | -42.00M | 195.00M | 553.00M | 574.00M | 482.00M | 245.00M | 777.00M | 883.00M | 795.00M | 754.00M | 671.00M | 406.00M | 549.48M | 474.46M | 376.80M | 394.80M | 321.70M | 183.80M |

| Net Income | 1.10B | 406.00M | 1.28B | 1.08B | 912.00M | 1.35B | -1.72B | -6.18B | 578.00M | 299.00M | 392.00M | 770.00M | 885.00M | 784.00M | 1.01B | 1.34B | 1.31B | 1.25B | 861.00M | 878.00M | 423.00M | 629.28M | 646.45M | 598.97M | 568.30M | 410.90M | 305.80M |

| Net Income Ratio | 8.56% | 3.26% | 11.53% | 10.00% | 8.26% | 11.97% | -12.30% | -42.42% | 3.85% | 1.99% | 2.63% | 5.03% | 5.44% | 5.88% | 7.76% | 9.85% | 10.22% | 10.90% | 7.18% | 7.05% | 3.44% | 5.18% | 8.08% | 8.52% | 8.99% | 7.01% | 10.84% |

| EPS | 1.92 | 0.71 | 2.27 | 1.85 | 1.59 | 2.74 | -3.88 | -14.50 | 1.37 | 0.71 | 0.94 | 1.85 | 2.22 | 2.44 | 3.31 | 4.41 | 4.27 | 3.84 | 2.62 | 2.68 | 1.39 | 1.89 | 2.82 | 2.69 | 2.50 | 1.82 | 1.94 |

| EPS Diluted | 1.92 | 0.71 | 2.26 | 1.85 | 1.57 | 2.73 | -3.88 | -14.50 | 1.37 | 0.71 | 0.94 | 1.84 | 2.21 | 2.42 | 3.29 | 4.38 | 4.22 | 3.81 | 2.61 | 2.67 | 1.39 | 1.88 | 2.81 | 2.69 | 2.50 | 1.82 | 1.94 |

| Weighted Avg Shares Out | 573.00M | 571.00M | 545.00M | 542.00M | 535.00M | 492.00M | 444.00M | 426.00M | 422.00M | 420.00M | 418.00M | 418.00M | 399.00M | 304.00M | 304.00M | 304.00M | 306.00M | 324.00M | 328.00M | 327.24M | 304.00M | 293.00M | 230.00M | 222.44M | 227.23M | 226.37M | 156.90M |

| Weighted Avg Shares Out (Dil) | 574.00M | 572.00M | 546.00M | 543.00M | 542.00M | 494.00M | 444.00M | 426.00M | 424.00M | 421.00M | 419.00M | 419.00M | 401.00M | 305.00M | 306.00M | 307.00M | 310.00M | 327.00M | 330.00M | 328.46M | 305.00M | 294.00M | 230.00M | 222.73M | 227.36M | 226.37M | 156.90M |

Deck the Halls Safely this Holiday Season

FirstEnergy Awarded $50 Million Smart Grid Grant by U.S. Department of Energy

JCP&L Moving Power Lines Underground in Portions of Somerset County

FirstEnergy Earns Multiple Military Friendly® Company Awards

FirstEnergy Names Karen Sagot Vice President, Investor Relations, and Sean Davies Vice President, Continuous Improvement

JCP&L Expanding Energy Efficiency Offerings

FirstEnergy Corp. (FE) Q3 2024 Earnings Call Transcript

FirstEnergy Misses on Q3 Earnings and Sales, Lowers '24 EPS View

FirstEnergy (FE) Lags Q3 Earnings and Revenue Estimates

FirstEnergy misses quarterly profit estimates, narrows forecast

Source: https://incomestatements.info

Category: Stock Reports