See more : Trakcja S.A. (TRK.WA) Income Statement Analysis – Financial Results

Complete financial analysis of FFBW, Inc. (FFBW) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of FFBW, Inc., a leading company in the Banks – Regional industry within the Financial Services sector.

- Omkar Speciality Chemicals Limited (OMKARCHEM.BO) Income Statement Analysis – Financial Results

- Cohen & Company Inc. (COHN) Income Statement Analysis – Financial Results

- Cadre Holdings, Inc. (CDRE) Income Statement Analysis – Financial Results

- Tidewater Midstream and Infrastructure Ltd. (TWMIF) Income Statement Analysis – Financial Results

- C21 Investments Inc. (CXXIF) Income Statement Analysis – Financial Results

FFBW, Inc. (FFBW)

About FFBW, Inc.

FFBW, Inc. operates as the holding company for First Federal Bank of Wisconsin that provides banking products and services in the United States. It offers deposit accounts, including noninterest-bearing and interest-bearing checking accounts, money market accounts, statement savings, and health savings, as well as certificates of deposit. The company also provides various loans, which include one- to four family owner-occupied and investor-owned residential real estate, multifamily residential real estate, commercial real estate, commercial and industrial, and commercial development loans, as well as consumer loans, such as home equity lines of credit, new and used automobile loans, boat loans, recreational vehicle loans, and loans secured by certificates of deposit. It operates through three full-service banking offices in Waukesha County, Wisconsin, and Milwaukee County. FFBW, Inc. was founded in 1922 and is based in Brookfield, Wisconsin.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 |

|---|---|---|---|---|---|---|---|---|---|

| Revenue | 11.86M | 12.53M | 11.61M | 10.65M | 9.49M | 9.20M | 8.33M | 8.10M | 8.44M |

| Cost of Revenue | -166.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 12.02M | 12.53M | 11.61M | 10.65M | 9.49M | 9.20M | 8.33M | 8.10M | 8.44M |

| Gross Profit Ratio | 101.40% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.73M | 5.33M | 6.55M | 5.55M | 5.18M | 4.97M | 4.57M | 4.78M | 4.41M |

| Selling & Marketing | 6.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 8.43M | 5.33M | 6.55M | 5.55M | 5.18M | 4.97M | 4.57M | 4.78M | 4.41M |

| Other Expenses | 0.00 | -13.75M | -15.53M | -13.81M | -12.61M | -10.68M | -11.27M | -11.23M | -10.18M |

| Operating Expenses | 8.43M | -8.42M | -8.98M | -8.25M | -7.43M | -5.72M | -6.70M | -6.45M | -5.77M |

| Cost & Expenses | 8.43M | -8.42M | -8.98M | -8.25M | -7.43M | -5.72M | -6.70M | -6.45M | -5.77M |

| Interest Income | 15.53M | 12.44M | 11.36M | 11.13M | 11.23M | 10.61M | 9.00M | 8.87M | 9.12M |

| Interest Expense | 4.52M | 979.00K | 989.00K | 1.62M | 2.79M | 2.11M | 1.55M | 1.63M | 1.28M |

| Depreciation & Amortization | 511.00K | 444.00K | 401.00K | 314.00K | 362.00K | 358.00K | 476.00K | 489.00K | 329.00K |

| EBITDA | 2.91M | 3.57M | 2.92M | 2.70M | 2.40M | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 24.53% | 35.57% | 25.17% | 25.31% | 25.33% | 41.60% | 25.11% | 26.19% | 35.61% |

| Operating Income | 3.43M | 4.11M | 2.63M | 2.40M | 2.06M | 3.49M | 1.63M | 1.65M | 2.68M |

| Operating Income Ratio | 28.91% | 32.79% | 22.64% | 22.51% | 21.68% | 37.88% | 19.59% | 20.35% | 31.71% |

| Total Other Income/Expenses | -1.03M | -1.02M | 0.00 | 0.00 | -346.00K | 0.00 | 78.00K | 0.00 | 0.00 |

| Income Before Tax | 2.40M | 3.13M | 2.63M | 2.40M | 2.06M | 1.38M | 78.00K | 15.00K | 1.40M |

| Income Before Tax Ratio | 20.22% | 24.97% | 22.64% | 22.51% | 21.68% | 14.96% | 0.94% | 0.19% | 16.52% |

| Income Tax Expense | 889.00K | 787.00K | 646.00K | 566.00K | 502.00K | 318.00K | 264.00K | -156.00K | 417.00K |

| Net Income | 1.51M | 2.34M | 1.98M | 1.83M | 1.56M | 1.06M | -186.00K | 171.00K | 978.00K |

| Net Income Ratio | 12.73% | 18.69% | 17.08% | 17.19% | 16.39% | 11.50% | -2.23% | 2.11% | 11.58% |

| EPS | 0.33 | 0.43 | 0.31 | 0.26 | 0.21 | 0.17 | -0.03 | 0.03 | 0.15 |

| EPS Diluted | 0.32 | 0.43 | 0.31 | 0.26 | 0.20 | 0.17 | -0.03 | 0.03 | 0.15 |

| Weighted Avg Shares Out | 4.64M | 5.44M | 6.45M | 7.02M | 7.49M | 6.22M | 7.45M | 6.36M | 6.36M |

| Weighted Avg Shares Out (Dil) | 4.66M | 5.45M | 6.45M | 7.02M | 7.75M | 6.22M | 7.45M | 6.37M | 6.37M |

Baird Financial Group Inc. Makes New Investment in FFBW Inc (NASDAQ:FFBW)

First Defiance Financial Corp. to Complete Name and Ticker Symbol Change

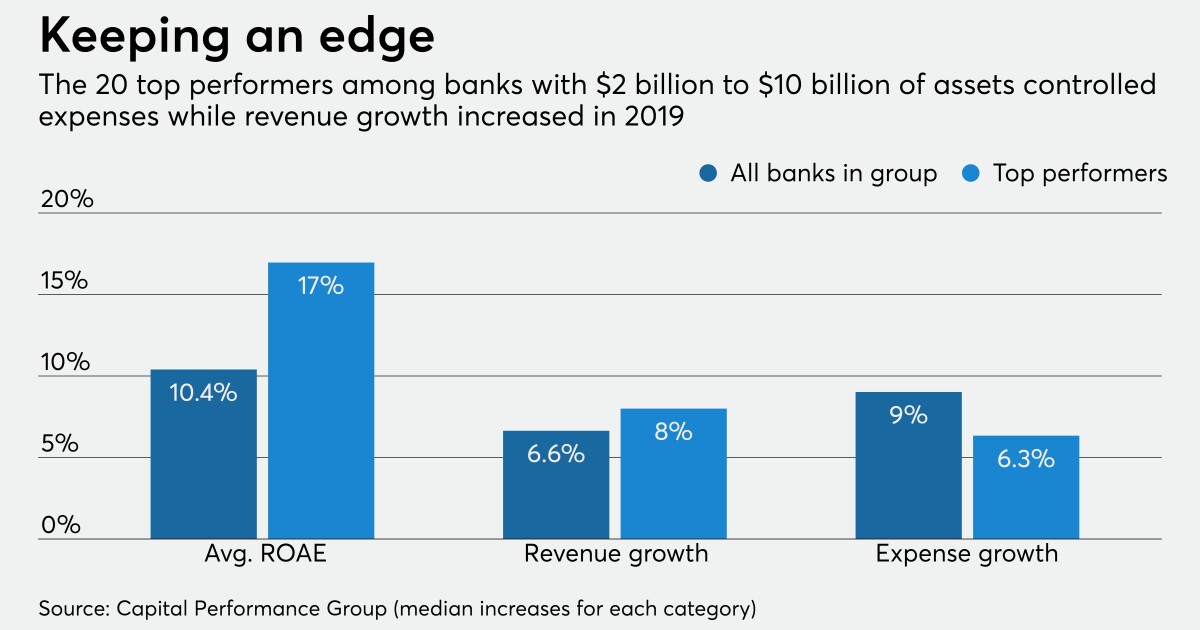

Once-highflying community banks encounter turbulence

NuMark CU Donates $20,000 in Grant Money to Local Charities

Redwood Trust, Inc. (RWT) CEO Chris Abate on Q1 2020 Results - Earnings Call Transcript

Financial Comparison: FFBW (NASDAQ:FFBW) and BBX Capital (NASDAQ:BBXTB)

Stock Analysts' Downgrades for January, 10th (AAVVF, AAWW, ADMA, AIQUY, AMNB, AMRN, AOBC, AOIFF, ATOM, ATRI)

Source: https://incomestatements.info

Category: Stock Reports