See more : Tsinghua Tongfang Co.,Ltd. (600100.SS) Income Statement Analysis – Financial Results

Complete financial analysis of First Mid Bancshares, Inc. (FMBH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of First Mid Bancshares, Inc., a leading company in the Banks – Regional industry within the Financial Services sector.

- United Time Technology Co., Ltd. (UTME) Income Statement Analysis – Financial Results

- Metallica Metals Corp. (MTALF) Income Statement Analysis – Financial Results

- Roots Corporation (RROTF) Income Statement Analysis – Financial Results

- Svitzer Group A/S (SVITZR.CO) Income Statement Analysis – Financial Results

- The Procter & Gamble Company (PRG.DE) Income Statement Analysis – Financial Results

First Mid Bancshares, Inc. (FMBH)

About First Mid Bancshares, Inc.

First Mid Bancshares, Inc., a financial holding company, provides community banking products and services to commercial, retail, and agricultural customers in the United States. It accepts various deposit products, such as demand deposits, savings accounts, money market deposits, and time deposits. The company's loan products include commercial real estate, commercial and industrial, agricultural and agricultural real estate, residential real estate, and consumer loans; and other loans comprising loans to municipalities to support community projects, such as infrastructure improvements or equipment purchases. It also offers wealth management services, which include estate planning, investment, and farm management and brokerage services for individuals; and employee benefit services for business enterprises. In addition, the company provides property and casualty, senior insurance products, and group medical insurance for businesses; and personal lines insurance to individuals. It operates through a network of 52 banking centers in Illinois and 14 offices in Missouri, as well as a loan production office in Indiana. The company was formerly known as First Mid-Illinois Bancshares, Inc. and changed its name to First Mid Bancshares, Inc. in April 2019. First Mid Bancshares, Inc. was founded in 1865 and is headquartered in Mattoon, Illinois.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 274.15M | 254.66M | 237.52M | 186.93M | 181.69M | 147.15M | 123.41M | 98.12M | 76.30M | 69.85M | 69.27M | 67.92M | 64.06M | 55.37M | 50.84M | 50.99M | 46.16M | 44.22M | 41.41M | 40.02M | 39.30M | 37.62M | 32.59M | 28.31M | 7.30M | 6.89M | 6.12M | 4.95M | 4.29M | 3.97M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.97M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 274.15M | 254.66M | 237.52M | 186.93M | 181.69M | 144.18M | 123.41M | 98.12M | 76.30M | 69.85M | 69.27M | 67.92M | 64.06M | 55.37M | 50.84M | 50.99M | 46.16M | 44.22M | 41.41M | 40.02M | 39.30M | 37.62M | 32.59M | 28.31M | 7.30M | 6.89M | 6.12M | 4.95M | 4.29M | 3.97M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 97.98% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 108.30M | 100.40M | 91.26M | 67.76M | 62.80M | 47.86M | 40.66M | 32.35M | 26.34M | 24.77M | 24.96M | 24.31M | 24.00M | 20.77M | 17.39M | 16.88M | 16.41M | 15.42M | 13.31M | 13.63M | 13.23M | 12.73M | 11.12M | 10.10M | 9.62M | 8.65M | 7.92M | 7.94M | 7.48M | 6.96M |

| Selling & Marketing | 3.01M | 3.00M | 3.60M | 1.62M | 2.03M | 1.79M | 1.36M | 1.85M | 1.09M | 1.02M | 1.22M | 1.01M | 1.05M | 940.00K | 963.00K | 847.00K | 911.00K | 945.00K | 728.00K | 771.00K | 662.00K | 738.00K | 789.00K | 769.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 111.31M | 103.40M | 94.87M | 69.38M | 64.83M | 49.66M | 42.02M | 32.35M | 26.34M | 24.77M | 24.96M | 24.31M | 25.05M | 21.71M | 18.36M | 17.72M | 17.32M | 16.36M | 14.04M | 14.40M | 13.89M | 13.47M | 11.91M | 10.87M | 9.62M | 8.65M | 7.92M | 7.94M | 7.48M | 6.96M |

| Other Expenses | 163.62M | -226.38M | -265.60M | -196.57M | -183.25M | -133.47M | -111.24M | -86.37M | -69.85M | -63.34M | -63.14M | -59.01M | 0.00 | 1.42M | 1.81M | 0.00 | 0.00 | 0.00 | -24.83M | -28.48M | -27.53M | -24.39M | -13.35M | -8.91M | 8.97M | 10.59M | 12.44M | 11.35M | 10.71M | 5.87M |

| Operating Expenses | 274.93M | -122.98M | -170.73M | -127.19M | -118.43M | -82.85M | -69.22M | -54.02M | -43.52M | -38.57M | -38.18M | -34.70M | 1.05M | 940.00K | 963.00K | 847.00K | 911.00K | 945.00K | -10.79M | -14.08M | -13.63M | -10.92M | -1.44M | 1.96M | 18.58M | 19.23M | 20.37M | 19.29M | 18.19M | 12.83M |

| Cost & Expenses | 274.93M | -122.98M | -170.73M | -127.19M | -118.43M | -82.85M | -69.22M | -54.02M | -43.52M | -38.57M | -38.18M | -34.70M | 1.05M | 940.00K | 963.00K | 847.00K | 911.00K | 945.00K | -10.79M | -14.08M | -13.63M | -10.92M | -1.44M | 1.96M | 18.58M | 19.23M | 20.37M | 19.29M | 18.19M | 12.83M |

| Interest Income | 300.17M | 215.89M | 183.01M | 144.14M | 149.72M | 124.57M | 99.56M | 75.50M | 59.25M | 54.73M | 53.46M | 55.77M | 56.77M | 50.88M | 51.41M | 57.07M | 59.93M | 55.56M | 44.58M | 40.02M | 38.94M | 41.39M | 45.51M | 44.19M | 39.17M | 37.45M | 37.81M | 35.56M | 33.47M | 26.43M |

| Interest Expense | 106.70M | 31.61M | 15.26M | 16.73M | 24.05M | 12.83M | 6.48M | 4.29M | 3.50M | 3.25M | 3.54M | 6.16M | 8.50M | 10.76M | 15.84M | 21.34M | 28.43M | 24.71M | 15.69M | 11.64M | 11.90M | 14.66M | 21.59M | 22.57M | 18.42M | 18.63M | 19.13M | 17.81M | 16.73M | 11.92M |

| Depreciation & Amortization | 0.00 | 11.19M | 9.79M | 8.86M | 9.45M | 6.23M | 4.81M | 4.40M | 891.00K | 643.00K | 674.00K | 773.00K | 5.40M | 3.94M | 3.07M | 2.23M | 1.85M | 1.67M | 1.49M | 2.45M | 3.10M | 3.17M | 3.20M | 2.89M | 2.47M | 2.07M | 1.86M | 1.25M | 1.23M | 1.50M |

| EBITDA | 0.00 | 106.35M | 81.24M | 68.60M | 74.11M | 56.39M | 49.86M | 41.72M | 34.62M | 27.76M | 26.73M | 25.71M | 21.49M | 15.93M | 18.76M | 22.08M | 21.30M | 20.27M | 18.90M | 18.28M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 0.00% | 54.18% | 30.39% | 34.67% | 38.04% | 47.04% | 45.65% | 46.89% | 44.13% | 45.71% | 45.86% | 50.05% | 49.65% | 50.53% | 61.23% | 77.56% | 98.61% | 93.67% | 77.54% | 70.93% | 73.20% | 79.39% | 105.41% | 117.13% | 388.31% | 409.20% | 463.18% | 515.26% | 552.81% | 460.73% |

| Operating Income | 88.41M | 131.68M | 66.79M | 59.74M | 63.27M | 61.33M | 54.19M | 44.10M | 32.78M | 31.28M | 31.09M | 33.22M | 26.41M | 24.04M | 28.06M | 37.31M | 43.68M | 39.75M | 30.62M | 25.94M | 25.66M | 26.70M | 31.15M | 30.27M | 25.88M | 26.12M | 26.49M | 24.23M | 22.48M | 16.80M |

| Operating Income Ratio | 32.25% | 51.71% | 28.12% | 31.96% | 34.82% | 41.68% | 43.91% | 44.95% | 42.96% | 44.79% | 44.89% | 48.91% | 41.22% | 43.42% | 55.19% | 73.18% | 94.61% | 89.89% | 73.95% | 64.81% | 65.31% | 70.97% | 95.58% | 106.93% | 354.43% | 379.13% | 432.72% | 489.97% | 524.11% | 422.90% |

| Total Other Income/Expenses | 0.00 | 0.00 | 0.00 | -19.80M | 0.00 | 0.00 | 0.00 | 0.00 | -4.44M | -7.40M | -7.26M | -2.04M | -886.00K | -1.42M | -1.81M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -11.90M | -14.66M | -21.59M | -22.57M | -18.42M | -18.63M | -19.13M | -17.81M | -16.73M | -11.92M |

| Income Before Tax | 88.41M | 91.29M | 66.79M | 59.74M | 63.27M | 48.51M | 41.73M | 33.78M | 25.73M | 24.72M | 23.57M | 22.44M | 17.90M | 13.28M | 12.22M | 15.97M | 15.25M | 15.04M | 14.94M | 14.29M | 13.77M | 12.04M | 9.56M | 7.70M | 7.47M | 7.50M | 7.36M | 6.43M | 5.75M | 4.88M |

| Income Before Tax Ratio | 32.25% | 35.85% | 28.12% | 31.96% | 34.82% | 32.96% | 33.81% | 34.43% | 33.72% | 35.38% | 34.03% | 33.03% | 27.95% | 23.99% | 24.04% | 31.32% | 33.03% | 34.01% | 36.07% | 35.71% | 35.03% | 32.00% | 29.32% | 27.18% | 102.27% | 108.80% | 120.18% | 129.98% | 134.16% | 122.93% |

| Income Tax Expense | 19.47M | 18.34M | 15.30M | 14.47M | 15.32M | 11.91M | 15.04M | 11.94M | 9.22M | 9.25M | 8.85M | 8.41M | 6.53M | 4.52M | 4.01M | 5.44M | 5.09M | 5.03M | 5.13M | 4.54M | 4.67M | 4.01M | 3.04M | 2.04M | 2.24M | 2.43M | 2.63M | 2.26M | 1.83M | 1.45M |

| Net Income | 68.94M | 72.95M | 51.49M | 45.27M | 47.94M | 36.60M | 26.68M | 21.84M | 16.51M | 15.46M | 14.72M | 14.03M | 11.37M | 8.76M | 8.21M | 10.52M | 10.16M | 10.01M | 9.81M | 9.75M | 9.09M | 8.03M | 6.52M | 5.66M | 5.23M | 5.06M | 4.73M | 4.17M | 3.92M | 3.43M |

| Net Income Ratio | 25.15% | 28.65% | 21.68% | 24.22% | 26.39% | 24.87% | 21.62% | 22.26% | 21.64% | 22.13% | 21.25% | 20.65% | 17.75% | 15.82% | 16.16% | 20.64% | 22.01% | 22.63% | 23.68% | 24.37% | 23.14% | 21.35% | 20.00% | 20.00% | 71.64% | 73.47% | 77.21% | 84.23% | 91.49% | 86.43% |

| EPS | 3.17 | 3.62 | 2.88 | 2.71 | 2.88 | 2.53 | 2.13 | 2.07 | 1.84 | 1.88 | 1.74 | 1.62 | 1.29 | 1.07 | 1.04 | 1.69 | 1.60 | 1.54 | 1.48 | 1.45 | 1.28 | 1.07 | 0.86 | 0.74 | 0.71 | 0.71 | 0.68 | 0.63 | 1.21 | 1.06 |

| EPS Diluted | 3.15 | 3.60 | 2.87 | 2.70 | 2.87 | 2.52 | 2.13 | 2.05 | 1.81 | 1.85 | 1.73 | 1.62 | 1.29 | 1.07 | 1.04 | 1.67 | 1.57 | 1.51 | 1.44 | 1.42 | 1.25 | 1.05 | 0.85 | 0.74 | 0.68 | 0.66 | 0.64 | 0.59 | 1.15 | 1.02 |

| Weighted Avg Shares Out | 21.78M | 20.17M | 17.89M | 16.72M | 16.68M | 14.49M | 12.53M | 10.55M | 8.97M | 8.22M | 5.88M | 5.97M | 6.04M | 6.09M | 6.13M | 6.23M | 6.35M | 6.50M | 6.63M | 6.74M | 7.10M | 7.53M | 7.58M | 7.63M | 7.36M | 7.15M | 6.93M | 6.66M | 3.23M | 3.23M |

| Weighted Avg Shares Out (Dil) | 21.87M | 20.24M | 17.94M | 16.76M | 16.71M | 14.50M | 12.54M | 10.65M | 9.12M | 8.36M | 5.88M | 5.97M | 6.05M | 6.12M | 6.17M | 6.23M | 6.47M | 6.63M | 6.81M | 6.87M | 7.26M | 7.63M | 7.64M | 7.63M | 7.71M | 7.63M | 7.35M | 7.07M | 3.41M | 3.38M |

First Mid-Illinois Bancshares, Inc. (NASDAQ:FMBH) Expected to Post Quarterly Sales of $46.12 Million

First Trust Advisors LP Sells 1,058 Shares of First Mid-Illinois Bancshares, Inc. (NASDAQ:FMBH)

California Public Employees Retirement System Has $1.04 Million Stock Holdings in First Mid-Illinois Bancshares, Inc. (NASDAQ:FMBH)

First Mid-Illinois Bancshares (NASDAQ:FMBH) Upgraded at BidaskClub

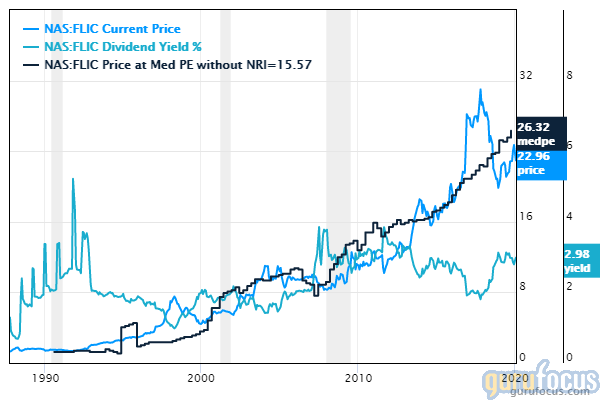

Shareholders Are Loving First Mid Bancshares, Inc.'s (NASDAQ:FMBH) 2.4% Yield

Cetera Advisor Networks LLC Reduces Stake in First Mid-Illinois Bancshares, Inc. (NASDAQ:FMBH)

Zacks: Analysts Anticipate First Mid-Illinois Bancshares, Inc. (NASDAQ:FMBH) to Post $0.72 Earnings Per Share

6 Cheap Stocks With High Dividend Yields

TrustCo Bank Corp NY (NASDAQ:TRST) and First Mid-Illinois Bancshares (NASDAQ:FMBH) Financial Analysis

Source: https://incomestatements.info

Category: Stock Reports