See more : ABIVAX Société Anonyme (0RA9.L) Income Statement Analysis – Financial Results

Complete financial analysis of FedNat Holding Company (FNHC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of FedNat Holding Company, a leading company in the Insurance – Property & Casualty industry within the Financial Services sector.

- Aztec Land and Cattle Company, Limited (AZLCZ) Income Statement Analysis – Financial Results

- Ya’acobi Brothers Group (YSB) Ltd (YAAC.TA) Income Statement Analysis – Financial Results

- PT Tera Data Indonusa Tbk (AXIO.JK) Income Statement Analysis – Financial Results

- Royal Mines and Minerals Corp (RYMM) Income Statement Analysis – Financial Results

- REMSleep Holdings, Inc. (RMSL) Income Statement Analysis – Financial Results

FedNat Holding Company (FNHC)

About FedNat Holding Company

FedNat Holding Company, together with its subsidiaries, engages in the insurance underwriting, distribution, and claims processing business in Florida, Louisiana, Texas, Georgia, South Carolina, Alabama, and Mississippi. The company is involved in the homeowners and casualty insurance; and personal automobile insurance businesses, as well as commercial general liability and federal flood businesses. It markets and distributes its own and third-party insurers' products, and other services through a network of independent and general agents. The company was formerly known as Federated National Holding Company and changed its name to FedNat Holding Company in May 2018. FedNat Holding Company was founded in 1991 and is based in Sunrise, Florida. On December 11, 2022, FedNat Holding Company, along with its affiliates, filed a voluntary petition for reorganization under Chapter 11 in the U.S. Bankruptcy Court for the Southern District of Florida.

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 245.55M | 432.23M | 414.96M | 396.09M | 391.66M | 316.38M | 246.82M | 197.90M | 121.74M | 68.65M | 60.16M | 60.60M | 58.85M | 67.36M | 119.13M | 103.92M | 94.67M | 76.57M | 60.12M | 40.58M | 35.48M | 37.55M | 25.38M | 20.70M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 245.55M | 432.23M | 414.96M | 396.09M | 391.66M | 316.38M | 246.82M | 197.90M | 121.74M | 68.65M | 60.16M | 60.60M | 58.85M | 67.36M | 119.13M | 103.92M | 94.67M | 76.57M | 60.12M | 40.58M | 35.48M | 37.55M | 25.38M | 20.70M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 38.25M | 37.21M | 35.32M | 36.46M | 34.48M | 39.57M | 15.03M | 14.97M | 10.19M | 8.44M | 8.00M | 8.61M | 7.93M | 7.43M | 6.73M | 7.01M | 6.38M | 6.13M | 9.15M | 8.00M | 8.48M | 9.38M | 7.47M | 4.00M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 114.87M | 108.78M | 65.32M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 38.25M | 37.21M | 35.32M | 36.46M | 149.35M | 148.35M | 80.35M | 14.97M | 10.19M | 8.44M | 8.00M | 8.61M | 7.93M | 7.43M | 6.73M | 7.01M | 6.38M | 6.13M | 9.15M | 8.00M | 8.48M | 9.38M | 7.47M | 4.00M |

| Other Expenses | -13.90M | -13.79M | 378.68M | 339.54M | 233.65M | 157.65M | 100.65M | 128.03M | 92.81M | 53.56M | 53.00M | 64.39M | 67.07M | 63.57M | 80.27M | 75.99M | 70.62M | -101.08M | -56.37M | -40.71M | -45.58M | -47.91M | -30.61M | -21.90M |

| Operating Expenses | 24.36M | 23.42M | 414.00M | 376.00M | 383.00M | 306.00M | 181.00M | 143.00M | 103.00M | 62.00M | 61.00M | 73.00M | 75.00M | 71.00M | 87.00M | 83.00M | 77.00M | -94.94M | -47.22M | -32.71M | -37.10M | -38.54M | -23.13M | -17.90M |

| Cost & Expenses | 348.33M | 537.88M | 414.25M | 375.89M | 382.74M | 313.65M | 181.62M | 140.59M | 102.52M | 61.90M | 61.16M | 72.56M | 75.06M | 71.16M | 86.63M | 82.62M | 78.90M | 98.78M | 47.83M | 32.71M | 38.29M | 38.54M | 7.47M | 4.00M |

| Interest Income | 0.00 | 11.79M | 15.90M | 12.46M | 10.25M | 9.06M | 7.16M | 5.39M | 3.33M | 3.82M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 8.76M | 7.66M | 10.78M | 4.18M | 348.00K | 348.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 173.00K | 656.00K | 1.40M | 1.09M | 606.91K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 5.56M | 1.90M | 1.48M | 1.39M | 1.17M | 869.00K | 624.00K | 149.00K | 263.00K | 195.00K | 1.42M | 221.00K | 188.00K | 290.00K | -43.00K | 45.00K | 222.94K | 299.27K | 728.34K | 460.88K | 885.32K | 919.80K | 731.75K | 300.00K |

| EBITDA | -403.69M | 0.00 | 12.97M | 25.99M | 10.44M | 3.95M | 0.00 | 0.00 | 0.00 | 0.00 | 417.00K | 0.00 | -10.29M | -2.48M | 21.28M | 13.90M | 4.79M | -18.07M | 13.62M | 8.33M | -737.32K | -65.47K | 2.98M | 3.10M |

| EBITDA Ratio | -164.40% | -22.23% | 3.12% | 6.56% | 3.34% | 1.17% | 26.85% | 29.03% | 16.00% | 10.11% | 0.69% | -19.36% | -27.22% | -5.21% | 27.39% | 21.16% | 19.46% | -23.60% | 22.66% | 20.54% | -2.08% | -0.17% | 11.74% | 14.98% |

| Operating Income | -94.03M | -97.99M | 11.49M | 24.60M | 11.92M | 2.84M | 65.64M | 57.31M | 19.22M | 6.75M | -1.00M | -11.96M | -10.29M | -2.48B | 21.28M | 13.90M | -3.37M | -18.37M | 12.89M | 7.87M | -1.62M | -985.27K | 2.25M | 2.80M |

| Operating Income Ratio | -38.29% | -22.67% | 2.77% | 6.21% | 3.04% | 0.90% | 26.59% | 28.96% | 15.79% | 9.83% | -1.66% | -19.73% | -17.48% | -3,678.90% | 17.86% | 13.37% | -3.56% | -23.99% | 21.45% | 19.40% | -4.57% | -2.62% | 8.85% | 13.53% |

| Total Other Income/Expenses | -8.76M | -514.46M | -10.78M | -4.40M | -3.00M | -102.00K | -623.00K | 2.41M | 481.00K | 101.00K | 0.00 | 0.00 | -5.92M | -1.32M | 11.23M | 7.40M | 19.14M | -3.83M | -606.91K | 0.00 | -1.19M | 0.00 | 11.92M | 6.70M |

| Income Before Tax | -102.78M | -105.65M | 713.00K | 20.21M | 8.93M | 2.73M | 65.19M | 57.31M | 19.22M | 6.75M | -1.00M | -11.96M | -16.21M | -3.80M | 32.51M | 21.29M | 15.77M | -22.21M | 12.29M | 7.87M | -2.81M | -985.27K | 14.17M | 9.50M |

| Income Before Tax Ratio | -41.86% | -24.44% | 0.17% | 5.10% | 2.28% | 0.86% | 26.41% | 28.96% | 15.79% | 9.83% | -1.66% | -19.73% | -27.54% | -5.64% | 27.28% | 20.49% | 16.66% | -29.00% | 20.44% | 19.40% | -7.92% | -2.62% | 55.83% | 45.89% |

| Income Tax Expense | 316.00K | -32.62M | -298.00K | 5.50M | 3.59M | 2.68M | 24.75M | 20.11M | 6.49M | 2.44M | -570.00K | -3.96M | -5.92M | -1.32M | 11.23M | 7.40M | 4.69M | -8.60M | 3.92M | 3.30M | -630.55K | -462.40K | 680.06K | 1.00M |

| Net Income | -103.10M | -73.03M | 1.01M | 14.93M | 7.99M | -196.00K | 40.89M | 37.20M | 12.73M | 4.31M | -430.00K | -8.00M | -10.29M | -2.48M | 21.28M | 13.90M | 12.12M | -10.86M | 8.36M | 4.57M | -992.09K | -522.87K | 1.57M | 1.80M |

| Net Income Ratio | -41.99% | -16.90% | 0.24% | 3.77% | 2.04% | -0.06% | 16.56% | 18.80% | 10.45% | 6.28% | -0.71% | -13.19% | -17.48% | -3.68% | 17.86% | 13.37% | 12.80% | -14.18% | 13.91% | 11.26% | -2.80% | -1.39% | 6.17% | 8.70% |

| EPS | -7.45 | -5.27 | 0.08 | 1.16 | 0.61 | -0.01 | 2.98 | 3.08 | 1.50 | 0.54 | -0.05 | -1.01 | -1.29 | -0.31 | 2.69 | 1.84 | 1.95 | -1.86 | 1.76 | 1.01 | -0.21 | -0.10 | 0.21 | 0.35 |

| EPS Diluted | -7.45 | -5.27 | 0.08 | 1.16 | 0.60 | -0.01 | 2.92 | 2.99 | 1.45 | 0.54 | -0.05 | -1.01 | -1.29 | -0.31 | 2.65 | 1.72 | 1.83 | -1.86 | 1.67 | 1.01 | -0.21 | -0.10 | 0.21 | 0.35 |

| Weighted Avg Shares Out | 13.85M | 13.85M | 13.02M | 12.87M | 13.17M | 13.76M | 13.72M | 12.08M | 8.51M | 7.95M | 7.95M | 7.95M | 8.00M | 7.98M | 7.92M | 7.54M | 6.23M | 5.85M | 4.76M | 4.51M | 4.80M | 5.23M | 7.57M | 5.19M |

| Weighted Avg Shares Out (Dil) | 13.85M | 13.85M | 13.02M | 12.87M | 13.25M | 13.76M | 14.00M | 12.44M | 8.77M | 8.02M | 7.95M | 7.95M | 8.00M | 7.98M | 8.03M | 8.09M | 6.63M | 5.85M | 5.02M | 4.53M | 4.80M | 5.23M | 7.57M | 5.19M |

FedNat Holding Company's (FNHC) CEO Michael Braun on Q3 2020 Results - Earnings Call Transcript

FedNat Announces Regular Quarterly Dividend

FedNat Holding Company Announces Formation of Strategic Review Committee

FedNat Holding Company Reports Third Quarter 2020 Results

Morgan Stanley Sells 24,140 Shares of FedNat Holding Company (NASDAQ:FNHC)

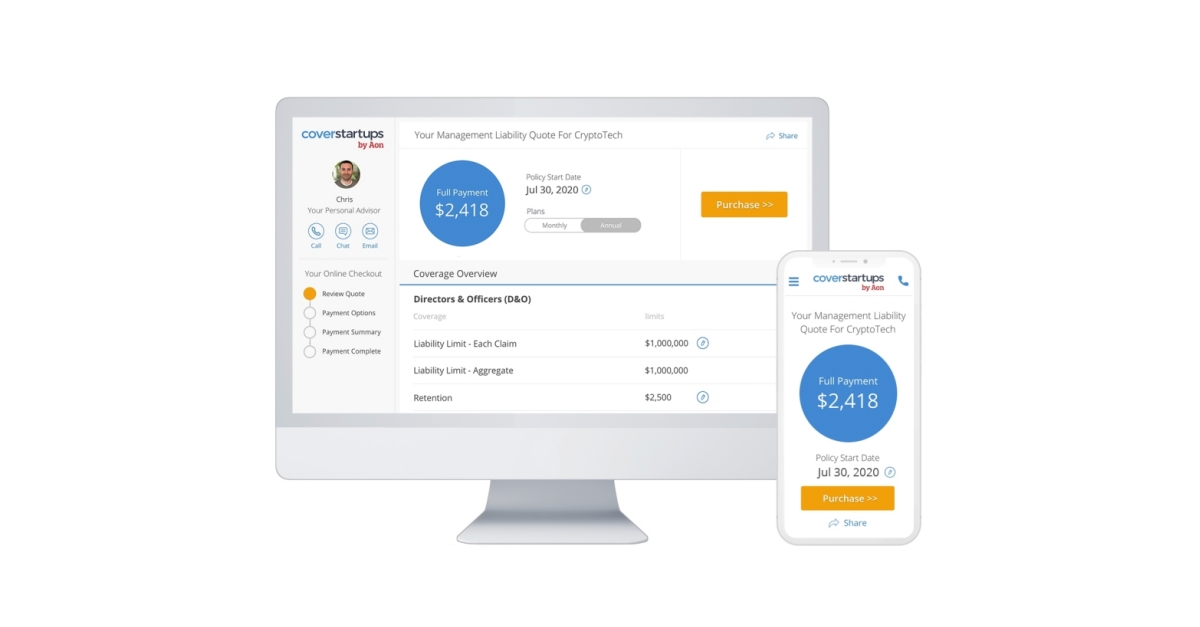

CoverWallet Announces New Digital Insurance Package for Venture-Backed Startups

FedNat bolsters reinsurance, adds Swiss Re quota share on Florida business - Artemis.bm

FedNat reports $48.3m Q2 cat losses after reinsurance recoveries - Artemis.bm

1347 PIH names Swets interim CEO to lead reinsurance & investment focus - Artemis.bm

JPMorgan Chase & Co. Has $2.17 Million Stake in FedNat Holding Company (NASDAQ:FNHC)

Source: https://incomestatements.info

Category: Stock Reports