See more : Hitachi, Ltd. (HTHIF) Income Statement Analysis – Financial Results

Complete financial analysis of Formula Systems (1985) Ltd. (FORTY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Formula Systems (1985) Ltd., a leading company in the Information Technology Services industry within the Technology sector.

- Zen Technologies Limited (ZENTEC.NS) Income Statement Analysis – Financial Results

- Gladstone Investment Corporation 4.875% Notes due 2028 (GAINZ) Income Statement Analysis – Financial Results

- Tyson Foods, Inc. (TSN) Income Statement Analysis – Financial Results

- Illumina, Inc. Common Stock Ex-distribution When-Issued (ILMNV) Income Statement Analysis – Financial Results

- Avalon Technologies Limited (AVALON.BO) Income Statement Analysis – Financial Results

Formula Systems (1985) Ltd. (FORTY)

About Formula Systems (1985) Ltd.

Formula Systems (1985) Ltd., through its subsidiaries, provides proprietary and non-proprietary software solutions, IT professional services, software product marketing and support, and computer infrastructure and integration solutions worldwide. The company offers computer and telecommunication infrastructure solutions; computer solutions to computer and communications infrastructures; cloud computing solutions; and database and big data services. It also provides customer relations management, computer systems management infrastructures, web world content management, database and data warehouse mining, application integration, database and system, data management, and software development tools; and professional training courses and advanced professional studies. In addition, it markets and sells computers and peripheral equipment to business customers; offers property and casualty insurance platforms, such as Sapiens, Sapiens CoreSuite, Sapiens IDITSuite, Sapiens PolicyPro, Sapiens BillingPro, Sapiens ClaimsPro, e-Tica, and Tia Enterprise; life, pension, and annuities platforms, including Sapiens CoreSuite, Sapiens UnderwritingPro, Sapiens ApplicationPro, Sapiens IllustrationPro, and Sapiens ConsolidationMaster; reinsurance software solutions comprising Sapiens ReinsuranceMaster, Sapiens ReinsurancePro, and Sapiens Reinsurance GO; and Sapiens platform for workers' compensation solutions. Further, the company provides financial and compliance solutions that include Sapiens FinancialPro, Sapiens Financial GO, and Sapiens StatementPro; Sapiens DECISION, a decision management platform; and technology-based solutions. Additionally, it offers application development and business process integration platforms; vertical software solutions; strategic consulting and outsourcing services; and professional services in various areas, as well as develops on-premise payroll software. Formula Systems (1985) Ltd. was incorporated in 1985 and is headquartered in Or Yehuda, Israel.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.62B | 2.57B | 2.41B | 1.93B | 1.70B | 1.49B | 1.36B | 1.11B | 798.80M | 636.42M | 796.67M | 744.73M | 640.62M | 549.69M | 469.39M | 590.81M | 493.35M | 492.74M | 506.37M | 456.61M | 366.83M | 283.31M | 376.92M | 405.74M | 335.49M | 258.80M |

| Cost of Revenue | 1.98B | 1.95B | 1.84B | 1.49B | 1.32B | 1.16B | 1.06B | 849.84M | 630.15M | 530.08M | 603.08M | 564.80M | 492.89M | 412.46M | 352.28M | 452.26M | 369.11M | 340.05M | 333.54M | 284.96M | 230.50M | 186.91M | 253.59M | 244.52M | 178.98M | 155.00M |

| Gross Profit | 643.71M | 622.47M | 563.86M | 447.43M | 386.05M | 333.31M | 296.82M | 258.78M | 168.65M | 106.33M | 193.59M | 179.93M | 147.73M | 137.23M | 117.11M | 138.54M | 124.24M | 152.69M | 172.84M | 171.65M | 136.33M | 96.40M | 123.33M | 161.21M | 156.52M | 103.80M |

| Gross Profit Ratio | 24.56% | 24.20% | 23.44% | 23.14% | 22.69% | 22.33% | 21.90% | 23.34% | 21.11% | 16.71% | 24.30% | 24.16% | 23.06% | 24.96% | 24.95% | 23.45% | 25.18% | 30.99% | 34.13% | 37.59% | 37.16% | 34.03% | 32.72% | 39.73% | 46.65% | 40.11% |

| Research & Development | 77.97M | 72.13M | 65.86M | 52.60M | 46.69M | 41.22M | 39.85M | 22.33M | 10.24M | 787.00K | 14.17M | 12.35M | 5.15M | 5.50M | 4.43M | 6.56M | 6.55M | 16.39M | 22.43M | 25.04M | 17.37M | 15.97M | 21.09M | 18.15M | 12.94M | 8.40M |

| General & Administrative | 309.42M | 225.82M | 211.18M | 0.00 | 0.00 | 182.47M | 184.42M | 94.72M | 39.86M | 110.76M | 117.88M | 110.76M | 93.34M | 84.51M | 77.32M | 0.00 | 0.00 | 0.00 | 0.00 | 128.54M | 107.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 16.96M | 19.41M | 15.60M | 0.00 | 0.00 | 0.00 | -817.00K | 53.23M | 23.06M | -40.24M | 14.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 326.38M | 317.96M | 289.99M | 224.19M | 200.87M | 182.47M | 183.61M | 147.95M | 103.90M | 70.52M | 117.89M | 110.76M | 93.34M | 84.51M | 77.32M | 98.61M | 90.46M | 113.66M | 133.05M | 128.54M | 107.10M | 85.29M | 129.80M | 127.82M | 92.77M | 57.90M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -308.00K | 14.84M | -2.75M | -11.57M | 14.00K | -152.00K | -207.00K | 231.00K | -1.97M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 18.49M | 12.00M |

| Operating Expenses | 404.34M | 390.09M | 355.84M | 276.79M | 247.56M | 223.70M | 223.15M | 170.28M | 114.14M | 71.30M | 132.06M | 122.93M | 98.49M | 90.24M | 81.75M | 105.17M | 97.01M | 130.05M | 155.48M | 153.57M | 124.47M | 101.26M | 150.89M | 145.97M | 124.21M | 78.30M |

| Cost & Expenses | 2.38B | 2.34B | 2.20B | 1.76B | 1.56B | 1.38B | 1.28B | 1.02B | 744.28M | 601.38M | 735.14M | 687.74M | 591.37M | 502.71M | 434.04M | 557.43M | 466.12M | 470.10M | 489.01M | 438.53M | 354.97M | 288.17M | 404.48M | 390.49M | 303.18M | 233.30M |

| Interest Income | 13.80M | 5.82M | 2.65M | 2.56M | 3.04M | 6.73M | 8.61M | 5.14M | 0.00 | 0.00 | 983.00K | 6.93M | 1.03M | 1.06M | 4.16M | 8.97M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 38.37M | 19.93M | 24.01M | 26.89M | 18.65M | 8.26M | 22.86M | 11.59M | 2.37M | 5.77M | 6.24M | 0.00 | 6.62M | 7.56M | 8.57M | 13.50M | 3.81M | 15.33M | 23.12M | 14.04M | 3.68M | 0.00 | 0.00 | 0.00 | 0.00 | 4.90M |

| Depreciation & Amortization | 121.83M | 115.31M | 122.18M | 95.51M | 86.93M | 48.73M | 43.65M | 32.37M | 17.56M | 8.96M | 24.35M | 25.65M | 14.36M | 17.18M | 14.61M | 13.08M | 15.81M | 44.95M | 25.26M | 20.79M | 19.00M | 13.34M | 68.38M | -50.40M | 18.49M | 12.00M |

| EBITDA | 371.23M | 396.96M | 332.65M | 264.97M | 228.15M | 158.35M | 117.80M | 88.50M | 104.62M | 47.79M | 87.06M | 82.20M | 63.93M | 65.62M | 59.97M | 53.03M | 43.04M | 67.58M | 37.44M | 52.37M | 11.86M | 8.48M | -13.18M | -37.62M | 50.80M | 37.50M |

| EBITDA Ratio | 14.16% | 9.03% | 8.65% | 8.82% | 8.14% | 7.34% | 5.44% | 7.98% | 6.82% | 5.51% | 7.72% | 7.65% | 7.65% | 11.87% | 7.18% | 9.34% | 8.46% | 13.62% | 7.86% | 6.40% | 7.69% | 2.73% | 27.33% | -9.27% | -0.26% | 9.00% |

| Operating Income | 239.37M | 276.64M | 85.83M | 75.13M | 51.56M | 109.62M | 73.67M | 88.50M | 54.51M | 35.04M | 61.54M | 57.00M | 49.24M | 46.99M | 35.36M | 33.37M | 27.24M | 19.48M | 15.90M | 18.08M | 11.86M | -6.69M | -38.43M | 12.78M | 32.31M | 25.50M |

| Operating Income Ratio | 9.13% | 10.75% | 3.57% | 3.89% | 3.03% | 7.34% | 5.44% | 7.98% | 6.82% | 5.51% | 7.72% | 7.65% | 7.69% | 8.55% | 7.53% | 5.65% | 5.52% | 3.95% | 3.14% | 3.96% | 3.23% | -2.36% | -10.20% | 3.15% | 9.63% | 9.85% |

| Total Other Income/Expenses | -28.33M | -19.93M | -24.01M | -26.89M | -18.65M | -8.29M | -20.00M | -11.59M | -9.53M | -4.87M | -5.44M | -2.93M | -6.50M | -4.37M | 1.44M | -7.75M | -2.52M | -11.43M | -146.00K | -343.00K | -1.01M | 6.17M | -52.13M | 41.46M | 33.26M | 5.60M |

| Income Before Tax | 211.03M | 256.71M | 184.01M | 143.76M | 119.84M | 101.36M | 50.81M | 76.91M | 46.66M | 30.17M | 55.30M | 50.32M | 42.95M | 42.62M | 36.79M | 26.45M | 24.71M | 14.32M | 9.98M | 17.73M | 10.85M | -513.00K | -52.02M | 54.24M | 65.58M | 31.10M |

| Income Before Tax Ratio | 8.05% | 9.98% | 7.65% | 7.43% | 7.04% | 6.79% | 3.75% | 6.94% | 5.84% | 4.74% | 6.94% | 6.76% | 6.70% | 7.75% | 7.84% | 4.48% | 5.01% | 2.91% | 1.97% | 3.88% | 2.96% | -0.18% | -13.80% | 13.37% | 19.55% | 12.02% |

| Income Tax Expense | 46.08M | 55.24M | 42.61M | 31.27M | 27.20M | 24.34M | 13.37M | 21.16M | 11.87M | 10.07M | 8.93M | 6.58M | 5.69M | 6.54M | 8.31M | 3.54M | 1.93M | 3.50M | 5.20M | 4.63M | 2.54M | 2.01M | 4.06M | 14.22M | 19.39M | 4.50M |

| Net Income | 64.01M | 201.48M | 141.40M | 112.49M | 92.64M | 32.21M | 11.18M | 22.45M | 19.32M | 75.06M | 76.89M | 24.03M | 42.96M | 18.38M | 19.08M | 11.87M | 37.26M | 10.02M | 183.00K | 8.10M | 3.12M | -2.41M | -56.08M | 40.02M | 46.19M | 26.60M |

| Net Income Ratio | 2.44% | 7.83% | 5.88% | 5.82% | 5.45% | 2.16% | 0.83% | 2.02% | 2.42% | 11.79% | 9.65% | 3.23% | 6.71% | 3.34% | 4.06% | 2.01% | 7.55% | 2.03% | 0.04% | 1.77% | 0.85% | -0.85% | -14.88% | 9.86% | 13.77% | 10.28% |

| EPS | 4.17 | 13.17 | 9.25 | 7.36 | 6.10 | 2.13 | 0.78 | 1.58 | 1.38 | 5.38 | 5.57 | 1.78 | 3.17 | 1.37 | 1.44 | 0.88 | 2.82 | 0.80 | 0.01 | 0.73 | 0.29 | -0.24 | -6.01 | 4.27 | 4.93 | 3.12 |

| EPS Diluted | 4.12 | 13.00 | 9.18 | 7.36 | 6.04 | 2.07 | 0.74 | 1.49 | 1.31 | 5.19 | 5.38 | 1.72 | 3.11 | 1.36 | 1.40 | 0.88 | 2.79 | 0.73 | 0.01 | 0.65 | 0.24 | -0.24 | -6.01 | 4.27 | 4.93 | 3.12 |

| Weighted Avg Shares Out | 15.30M | 15.30M | 15.29M | 15.29M | 15.19M | 15.10M | 14.36M | 14.21M | 14.07M | 13.93M | 13.79M | 13.60M | 13.51M | 13.38M | 13.20M | 13.20M | 13.20M | 13.20M | 12.80M | 10.80M | 10.04M | 10.17M | 9.33M | 9.32M | 9.38M | 8.53M |

| Weighted Avg Shares Out (Dil) | 15.50M | 15.50M | 15.40M | 15.29M | 15.34M | 15.57M | 14.72M | 15.53M | 14.74M | 14.41M | 14.19M | 13.79M | 13.67M | 13.52M | 13.56M | 13.20M | 13.20M | 13.30M | 12.80M | 10.80M | 10.29M | 10.17M | 9.33M | 9.32M | 9.38M | 8.53M |

Formula Systems Reports Second Quarter 2021 Financial Results: Record-Breaking Results with Double Digit Growth Across All Key Financial Indices

Formula Systems Reports First Quarter 2021 Financial Results: Record-Breaking Results With Double Digit Growth Across All Key Financial Indices

Formula Systems Reports Fourth Quarter and full year 2020 Financial Results with Annual Net Income of $46.8 million, a 20% growth year over year

Sapiens Reports Q4 and Full Year 2020 Financial Results

Formula Systems Reports Third Quarter 2020 Financial Results

Sapiens Reports Third Quarter 2020 Financial Results

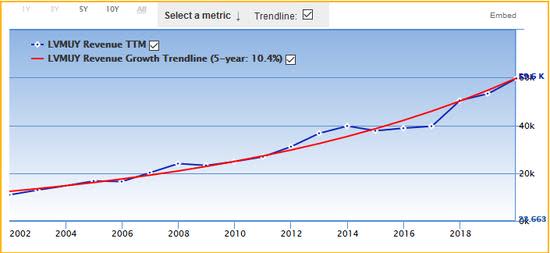

3 Stocks That Have Grown Sales Fast

Source: https://incomestatements.info

Category: Stock Reports