See more : Greens Co.,Ltd. (6547.T) Income Statement Analysis – Financial Results

Complete financial analysis of FRP Holdings, Inc. (FRPH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of FRP Holdings, Inc., a leading company in the Real Estate – Services industry within the Real Estate sector.

- Koninklijke Ahold Delhaize N.V. (AHODF) Income Statement Analysis – Financial Results

- Fujitsu Limited (FJTSY) Income Statement Analysis – Financial Results

- Cyclerion Therapeutics, Inc. (CYCN) Income Statement Analysis – Financial Results

- Hostelworld Group plc (HSWLF) Income Statement Analysis – Financial Results

- Delphi World Money Limited (DELPHIFX.BO) Income Statement Analysis – Financial Results

FRP Holdings, Inc. (FRPH)

About FRP Holdings, Inc.

FRP Holdings, Inc. engages in the real estate businesses in the United States. The company operates through four segments: Asset Management, Mining Royalty Lands, Development, and Stabilized Joint Venture. The Asset Management segment owns, leases, and manages commercial properties. The Mining Royalty Lands segment owns various properties comprising approximately 15,000 acres under lease for mining rents or royalties primarily in Florida, Georgia, and Virginia. This segment also owns an additional 107 acres of investment property in Brooksville, Florida. The Development segment owns and monitors the use of parcels of land that are in various stages of development. The Stabilized Joint Venture segment owns, leases, and manages a 305-unit residential apartment building with approximately 14,430 square feet of first floor retail space; 264-unit residential apartment building with 6,758 square feet of retail space; and 294-unit garden-style apartment community located in Henrico County, Virginia that consists of 19 three-story apartment buildings containing 273,940 rentable square feet. FRP Holdings, Inc. was incorporated in 2014 and is based in Jacksonville, Florida.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 41.51M | 37.48M | 31.22M | 23.58M | 23.76M | 22.02M | 43.19M | 37.46M | 34.65M | 160.14M | 139.77M | 127.51M | 120.11M | 111.34M | 114.55M | 172.05M | 154.28M | 147.37M | 131.04M | 115.79M | 103.30M | 96.95M | 121.26M | 93.86M | 82.02M | 73.97M | 68.84M | 64.40M | 58.30M | 53.90M | 46.60M | 43.00M | 42.80M | 41.60M | 32.40M | 30.90M | 31.10M | 30.20M | 29.50M |

| Cost of Revenue | 21.84M | 4.13M | 3.75M | 2.83M | 2.94M | 2.63M | 5.02M | 4.48M | 4.44M | 140.76M | 118.08M | 113.41M | 105.74M | 96.84M | 85.23M | 142.95M | 123.88M | 118.22M | 106.04M | 93.31M | 85.24M | 76.41M | 99.47M | 77.62M | 62.03M | 57.48M | 53.94M | 49.79M | 43.10M | 34.80M | 30.60M | 27.80M | 28.30M | 27.50M | 22.00M | 22.50M | 21.00M | 19.60M | 20.20M |

| Gross Profit | 19.67M | 33.36M | 27.47M | 20.76M | 20.82M | 19.40M | 38.17M | 32.98M | 30.20M | 19.38M | 21.70M | 14.10M | 14.37M | 14.50M | 29.32M | 29.10M | 30.41M | 29.15M | 24.99M | 22.48M | 18.07M | 20.54M | 21.79M | 16.24M | 19.99M | 16.49M | 14.91M | 14.62M | 15.20M | 19.10M | 16.00M | 15.20M | 14.50M | 14.10M | 10.40M | 8.40M | 10.10M | 10.60M | 9.30M |

| Gross Profit Ratio | 47.39% | 88.99% | 87.99% | 88.02% | 87.62% | 88.08% | 88.37% | 88.05% | 87.18% | 12.10% | 15.52% | 11.06% | 11.96% | 13.03% | 25.60% | 16.91% | 19.71% | 19.78% | 19.07% | 19.42% | 17.49% | 21.19% | 17.97% | 17.30% | 24.38% | 22.30% | 21.65% | 22.69% | 26.07% | 35.44% | 34.33% | 35.35% | 33.88% | 33.89% | 32.10% | 27.18% | 32.48% | 35.10% | 31.53% |

| Research & Development | 0.00 | 0.15 | 1.61 | 0.63 | 0.50 | 0.07 | 3.65 | 0.53 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 7.08M | 6.24M | 6.46M | 5.07M | 5.72M | 5.41M | 4.92M | 6.04M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 0.00 | 7.08M | 6.24M | 6.46M | 5.07M | 5.72M | 5.41M | 4.92M | 6.04M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 13.20M | 15.61M | 12.06M | 12.10M | 9.80M | 9.05M | 8.18M | 8.23M | 12.31M | 9.40M | 7.61M | 6.87M | 5.93M | 5.60M | 5.70M | 5.00M | 4.50M | 4.00M | 3.80M | 3.90M | 3.10M | 0.00 | 2.30M | 2.50M | 2.30M |

| Other Expenses | 7.97M | 18.28M | 18.96M | 9.16M | 9.99M | 11.72M | 19.15M | 11.68M | 11.99M | 1.61M | 1.26M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 43.10M | 13.80M | 6.20M | 5.50M | 4.90M | 4.90M | 3.00M | 2.80M | 2.60M | 2.30M | 1.90M |

| Operating Expenses | 7.97M | 25.36M | 25.20M | 15.62M | 15.06M | 17.44M | 24.56M | 16.60M | 18.02M | 1.61M | 1.26M | 112.37M | 0.00 | 0.00 | 13.20M | 15.61M | 12.06M | 12.10M | 9.80M | 9.05M | 8.18M | 8.23M | 12.31M | 9.40M | 7.61M | 6.87M | 5.93M | 5.60M | 48.80M | 18.80M | 10.70M | 9.50M | 8.70M | 8.80M | 6.10M | 2.80M | 4.90M | 4.80M | 4.20M |

| Cost & Expenses | 29.81M | 29.49M | 28.95M | 18.45M | 18.00M | 20.06M | 29.59M | 21.07M | 22.47M | 142.37M | 119.34M | 113.41M | 105.74M | 96.84M | 98.43M | 158.57M | 135.93M | 130.32M | 115.85M | 102.36M | 93.42M | 84.64M | 111.78M | 87.02M | 69.64M | 64.35M | 59.87M | 55.39M | 91.90M | 53.60M | 41.30M | 37.30M | 37.00M | 36.30M | 28.10M | 25.30M | 25.90M | 24.40M | 24.40M |

| Interest Income | 0.00 | 5.47M | 4.22M | 7.12M | 7.43M | 0.00 | 0.00 | 2.00K | 0.00 | 30.00K | 38.00K | 26.00K | 303.00K | 446.00K | 90.00K | 883.00K | 298.00K | 149.00K | 0.00 | 0.00 | 0.00 | 21.00K | 22.00K | 24.00K | 46.00K | 13.00K | 0.00 | 34.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 4.32M | 3.05M | 2.30M | 1.10M | 1.05M | 3.10M | 4.32M | 1.56M | 2.01M | 1.48M | 2.52M | 2.64M | 3.35M | 3.93M | 3.48M | 4.55M | 3.88M | 3.96M | 3.25M | 0.00 | 3.49M | 3.16M | 3.39M | 3.44M | 2.36M | 2.30M | 1.97M | 2.23M | 1.90M | 1.10M | 900.00K | 1.10M | 1.60M | 1.80M | 800.00K | 700.00K | 800.00K | 600.00K | 500.00K |

| Depreciation & Amortization | 10.82M | 29.49M | 28.95M | 18.45M | 18.00M | 23.16M | 17.30M | 22.64M | 7.53M | 16.14M | 14.07M | 12.99M | 12.21M | 11.51M | 13.43M | 14.74M | 14.16M | 13.51M | 12.48M | 12.23M | 11.96M | 11.09M | 11.47M | 11.14M | 10.07M | 9.15M | 8.36M | 7.67M | -7.30M | -6.90M | -6.20M | -5.50M | -4.90M | -4.90M | -3.00M | 2.80M | 2.60M | 2.30M | 1.90M |

| EBITDA | 22.52M | 20.08M | 9.26M | 5.27M | 9.96M | 12.80M | 26.60M | 23.70M | 19.54M | 32.43M | 32.37M | 24.46M | 26.58M | 22.08M | 29.56M | 168.04M | 14.16M | 30.57M | 27.67M | 25.66M | 21.39M | -64.01M | -90.93M | 17.98M | 22.45M | 18.77M | 17.33M | 16.68M | -33.60M | 7.20M | 11.50M | 11.20M | 10.70M | 10.20M | 7.30M | 8.30M | 7.70M | 7.70M | 7.00M |

| EBITDA Ratio | 54.26% | 36.00% | 29.65% | 22.36% | 41.93% | 45.79% | 61.58% | 63.26% | 56.48% | 21.11% | 24.66% | 21.26% | 22.35% | 100.00% | 25.88% | 16.91% | 21.17% | 20.74% | 21.12% | 21.84% | 21.12% | 24.03% | 18.60% | 19.15% | 27.34% | 25.37% | 25.15% | 25.89% | -57.63% | 13.36% | 24.68% | 26.05% | 25.00% | 24.52% | 22.53% | 26.86% | 24.76% | 25.50% | 23.73% |

| Operating Income | 11.70M | 2.03M | -3.69M | -778.00K | 3.80M | 1.96M | 13.61M | 16.38M | 12.18M | 17.77M | 20.43M | 14.10M | 14.37M | 14.50M | 16.13M | 13.48M | 18.35M | 17.06M | 15.19M | 13.43M | 9.92M | 12.41M | 7.88M | 6.84M | 12.38M | 9.63M | 8.98M | 9.02M | -26.30M | 14.10M | 17.70M | 16.70M | 15.60M | 15.10M | 10.30M | 5.50M | 5.10M | 5.40M | 5.10M |

| Operating Income Ratio | 28.19% | 5.42% | -11.82% | -3.30% | 16.00% | 8.91% | 31.50% | 43.74% | 35.16% | 11.10% | 14.62% | 11.06% | 11.96% | 13.03% | 14.08% | 7.84% | 11.90% | 11.57% | 11.59% | 11.60% | 9.60% | 12.80% | 6.50% | 7.29% | 15.09% | 13.01% | 13.04% | 14.00% | -45.11% | 26.16% | 37.98% | 38.84% | 36.45% | 36.30% | 31.79% | 17.80% | 16.40% | 17.88% | 17.29% |

| Total Other Income/Expenses | -5.30M | -2.42M | 48.10M | 9.80M | 6.03M | -479.00K | 55.86M | 3.49M | -2.19M | -9.02M | 4.79M | -1.58M | -3.08M | -3.48M | -3.40M | 959.00K | -3.74M | -3.81M | -3.25M | -3.46M | -3.49M | -3.46M | -2.96M | -3.41M | -2.29M | -2.28M | -1.99M | -2.19M | 41.20M | -7.90M | -900.00K | -1.10M | -1.50M | -1.70M | -900.00K | -700.00K | -700.00K | -300.00K | -100.00K |

| Income Before Tax | 6.40M | 5.58M | 50.38M | 14.93M | 11.78M | 1.48M | 67.88M | 19.88M | 9.99M | 16.67M | 25.22M | 12.52M | 11.29M | 11.02M | 12.73M | 12.90M | 14.62M | 13.25M | 11.95M | 9.98M | 6.42M | 9.27M | 4.51M | 3.44M | 10.09M | 7.34M | 6.98M | 6.83M | 7.60M | 6.20M | 4.40M | 4.60M | 4.30M | 3.60M | 3.40M | 4.90M | 4.50M | 5.50M | 5.00M |

| Income Before Tax Ratio | 15.41% | 14.88% | 161.35% | 63.30% | 49.60% | 6.73% | 157.16% | 53.06% | 28.83% | 10.41% | 18.04% | 9.82% | 9.40% | 9.90% | 11.11% | 7.50% | 9.47% | 8.99% | 9.12% | 8.61% | 6.22% | 9.56% | 3.72% | 3.66% | 12.31% | 9.93% | 10.14% | 10.60% | 13.04% | 11.50% | 9.44% | 10.70% | 10.05% | 8.65% | 10.49% | 15.86% | 14.47% | 18.21% | 16.95% |

| Income Tax Expense | 1.52M | 1.53M | 10.28M | 4.31M | 2.96M | 524.00K | 7.33M | 7.85M | 3.90M | 6.65M | 9.84M | 4.81M | 4.30M | 3.96M | 4.82M | 4.93M | 5.11M | 5.17M | 4.34M | 3.88M | 2.09M | 3.62M | 1.80M | 1.39M | 3.94M | 2.86M | 2.72M | 2.66M | 3.00M | 2.40M | 1.70M | 1.80M | 1.70M | 1.40M | 1.30M | 1.90M | 2.10M | 2.80M | 2.40M |

| Net Income | 5.30M | 4.57M | 40.09M | 12.72M | 8.82M | 124.47M | 41.75M | 12.02M | 8.27M | 10.02M | 15.39M | 7.81M | 12.21M | 7.37M | 3.75M | 7.97M | 9.51M | 8.08M | 7.61M | 20.74M | 4.58M | 5.66M | 2.70M | 2.04M | 6.16M | 4.48M | 4.26M | 4.17M | 4.60M | 3.80M | 2.70M | 2.80M | 2.60M | 2.20M | 2.10M | 3.00M | 2.40M | 2.70M | 2.60M |

| Net Income Ratio | 12.77% | 12.18% | 128.42% | 53.92% | 37.14% | 565.22% | 96.66% | 32.10% | 23.88% | 6.26% | 11.01% | 6.12% | 10.17% | 6.62% | 3.28% | 4.63% | 6.16% | 5.48% | 5.81% | 17.91% | 4.43% | 5.83% | 2.23% | 2.18% | 7.51% | 6.06% | 6.19% | 6.47% | 7.89% | 7.05% | 5.79% | 6.51% | 6.07% | 5.29% | 6.48% | 9.71% | 7.72% | 8.94% | 8.81% |

| EPS | 0.28 | 0.24 | 2.13 | 0.66 | 0.44 | 6.20 | 1.54 | 0.61 | 0.31 | 0.27 | 0.45 | 0.82 | 1.32 | 0.80 | 0.41 | 0.88 | 1.05 | 0.90 | 0.86 | 2.36 | 0.51 | 0.62 | 0.30 | 0.20 | 0.60 | 0.43 | 0.40 | 0.38 | 0.40 | 0.32 | 0.22 | 0.22 | 0.20 | 0.16 | 0.16 | 0.22 | 0.18 | 0.20 | 0.19 |

| EPS Diluted | 0.28 | 0.24 | 2.13 | 0.66 | 0.44 | 6.16 | 1.53 | 0.61 | 0.31 | 0.27 | 0.45 | 0.81 | 1.29 | 0.78 | 0.40 | 0.85 | 1.01 | 0.87 | 0.83 | 2.32 | 0.50 | 0.62 | 0.30 | 0.20 | 0.59 | 0.43 | 0.40 | 0.38 | 0.40 | 0.31 | 0.22 | 0.22 | 0.20 | 0.16 | 0.16 | 0.22 | 0.18 | 0.20 | 0.19 |

| Weighted Avg Shares Out | 18.84M | 19.02M | 18.81M | 19.27M | 19.85M | 20.08M | 20.07M | 19.79M | 19.65M | 19.56M | 19.14M | 9.52M | 9.45M | 9.18M | 9.12M | 9.10M | 9.07M | 8.94M | 8.85M | 8.79M | 9.10M | 9.43M | 9.47M | 10.00M | 10.33M | 10.36M | 10.66M | 11.05M | 11.50M | 12.00M | 12.46M | 12.54M | 12.79M | 13.47M | 13.40M | 13.43M | 13.58M | 13.73M | 13.93M |

| Weighted Avg Shares Out (Dil) | 18.92M | 18.87M | 18.79M | 19.22M | 19.85M | 20.21M | 20.08M | 19.82M | 19.65M | 19.42M | 19.21M | 9.47M | 9.45M | 9.42M | 9.35M | 9.38M | 9.39M | 9.26M | 9.12M | 8.93M | 9.20M | 9.50M | 9.47M | 10.04M | 10.40M | 10.49M | 10.72M | 11.14M | 11.50M | 12.13M | 12.46M | 12.54M | 12.79M | 13.47M | 13.40M | 13.43M | 13.58M | 13.73M | 13.93M |

Company near Bristol collapses into administration

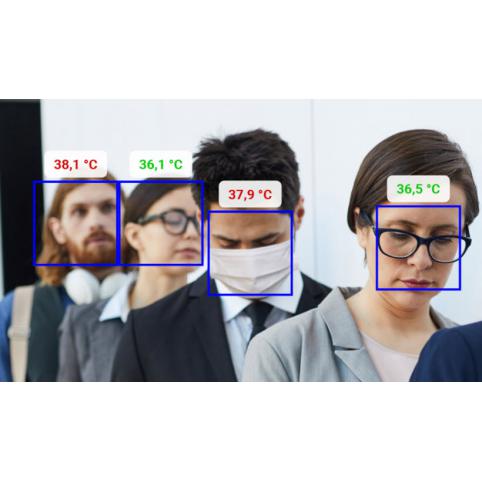

COVID-19 Sandstorm announces a complete and affordable Turnkey Thermal camera Temperature screening solution.

Hanwei Energy Services Reports Year End Fiscal 2020 Financial and Operational Results

List of food chains including Eat and Frankie and Benny's that won't be opening all restaurants in July after lockdown

Restaurants that won't be reopening in July - after closing for good in lockdown

Hindalco exporting over 80% of output amid contracting domestic demand

UBS Group AG Has $127,000 Holdings in FRP Holdings Inc (NASDAQ:FRPH)

Maharashtra: Sugar prices rise amid possible MSP rise

Source: https://incomestatements.info

Category: Stock Reports