See more : Rex Minerals Limited (RXRLF) Income Statement Analysis – Financial Results

Complete financial analysis of Forest Road Acquisition Corp. II (FRXB) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Forest Road Acquisition Corp. II, a leading company in the Shell Companies industry within the Financial Services sector.

- India Tourism Development Corporation Limited (ITDC.BO) Income Statement Analysis – Financial Results

- PennantPark Floating Rate Capital Ltd. (PFLT.TA) Income Statement Analysis – Financial Results

- Companhia Distribuidora de Gás do Rio de Janeiro – CEG (CEGR3.SA) Income Statement Analysis – Financial Results

- ActiveOps Plc (AOM.L) Income Statement Analysis – Financial Results

- Achieve Life Sciences, Inc. (ACHV) Income Statement Analysis – Financial Results

Forest Road Acquisition Corp. II (FRXB)

About Forest Road Acquisition Corp. II

Forest Road Acquisition Corp II does not have significant operations. The company intends to effect a merger, capital stock exchange, asset acquisition, stock purchase, reorganization, or related business combination with one or more businesses. It intends to identify businesses in the areas of technology, media, and telecommunications industry. The company was formerly known as Forest Road Acquisition Corp. III and changed its name to Forest Road Acquisition Corp II in January 2021. Forest Road Acquisition Corp II was incorporated in 2020 and is based in New York, New York.

| Metric | 2022 | 2021 |

|---|---|---|

| Revenue | 0.00 | 0.00 |

| Cost of Revenue | 3.21M | 948.97K |

| Gross Profit | -3.21M | -948.97K |

| Gross Profit Ratio | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 |

| General & Administrative | 0.00 | 948.97K |

| Selling & Marketing | 0.00 | 0.00 |

| SG&A | 3.21K | 948.97K |

| Other Expenses | 3.21M | -754.69K |

| Operating Expenses | 3.21M | 948.97K |

| Cost & Expenses | 3.21M | 948.97K |

| Interest Income | 4.97M | 28.00K |

| Interest Expense | 0.00 | 0.00 |

| Depreciation & Amortization | -8.58M | -9.51M |

| EBITDA | -11.79M | -10.46M |

| EBITDA Ratio | 0.00% | 0.00% |

| Operating Income | -3.21M | -948.97K |

| Operating Income Ratio | 0.00% | 0.00% |

| Total Other Income/Expenses | 13.55M | 8.78M |

| Income Before Tax | 10.34M | 7.83M |

| Income Before Tax Ratio | 0.00% | 0.00% |

| Income Tax Expense | 813.96K | -28.00K |

| Net Income | 9.52M | 7.83M |

| Net Income Ratio | 0.00% | 0.00% |

| EPS | 0.26 | 0.21 |

| EPS Diluted | 0.26 | 0.21 |

| Weighted Avg Shares Out | 37.04M | 37.04M |

| Weighted Avg Shares Out (Dil) | 37.04M | 37.04M |

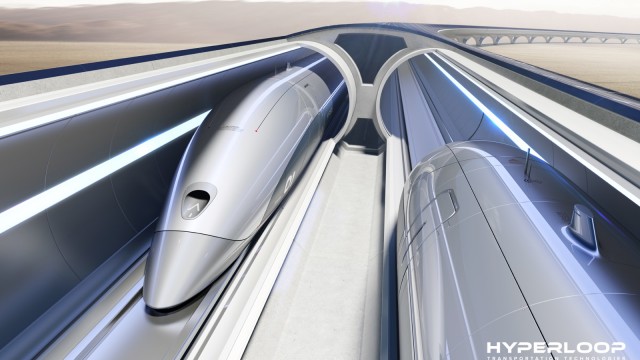

HyperloopTT's SPAC public debut may be going nowhere fast

Source: https://incomestatements.info

Category: Stock Reports