See more : FaZe Holdings Inc. (FAZEW) Income Statement Analysis – Financial Results

Complete financial analysis of First Seacoast Bancorp (FSEA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of First Seacoast Bancorp, a leading company in the Banks – Regional industry within the Financial Services sector.

- Arteria S.A. (ARR.WA) Income Statement Analysis – Financial Results

- Century Aluminum Company (CENX) Income Statement Analysis – Financial Results

- Cycliq Group Limited (CYQ.AX) Income Statement Analysis – Financial Results

- West Japan Railway Company (9021.T) Income Statement Analysis – Financial Results

- Willow Lane Acquisition Corp. Unit (WLACU) Income Statement Analysis – Financial Results

First Seacoast Bancorp (FSEA)

About First Seacoast Bancorp

First Seacoast Bancorp operates as a holding company for First Seacoast Bank that provides various banking products and services for individuals and businesses. The company offers interest-bearing and non-interest-bearing checking, savings, and money market accounts; and time deposits. It also provides various lending products comprising one- to four-family residential real estate loans; commercial real estate and multi-family loans; acquisition, development, and land loans; commercial and industrial loans; home equity loans and lines of credit; and consumer loans. In addition, the company offers wealth management services, such as retirement planning, portfolio management, investment and insurance strategies, business retirement plans, and college planning services. It operates through its wealth management office located in Dover, New Hampshire; four full-service banking offices in Strafford County, New Hampshire; and one full-service banking office in Rockingham County, New Hampshire. The company was founded in 1890 and is headquartered in Dover, New Hampshire. First Seacoast Bancorp is a subsidiary of First Seacoast Bancorp, MHC.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Revenue | 9.31M | 15.57M | 16.31M | 14.50M | 12.98M | 12.50M | 12.44M |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 9.31M | 15.57M | 16.31M | 14.50M | 12.98M | 12.50M | 12.44M |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 10.26M | 11.15M | 8.22M | 8.46M | 7.66M | 6.91M | 6.53M |

| Selling & Marketing | 530.00K | 598.00K | 361.00K | 364.00K | 1.07M | 547.53K | 477.00K |

| SG&A | 10.79M | 11.75M | 8.58M | 8.82M | 8.73M | 7.45M | 7.01M |

| Other Expenses | 0.00 | -4.35M | -21.67M | -22.27M | -21.97M | -16.80M | -16.02M |

| Operating Expenses | 14.56M | 1.58M | -13.09M | -13.45M | -13.25M | -8.05M | -9.01M |

| Cost & Expenses | 14.56M | 1.58M | -13.09M | -13.45M | -13.25M | -8.05M | -9.01M |

| Interest Income | 20.35M | 16.49M | 15.47M | 15.73M | 15.26M | 14.05M | 12.48M |

| Interest Expense | 9.08M | 1.75M | 1.24M | 3.17M | 3.84M | 3.14M | 1.82M |

| Depreciation & Amortization | 486.00K | 522.00K | 561.00K | 576.00K | 528.00K | 539.54K | 560.00K |

| EBITDA | -6.23M | 0.00 | 3.78M | 1.06M | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | -66.86% | 8.05% | 23.19% | 11.25% | 2.00% | 39.96% | 32.09% |

| Operating Income | -5.25M | 731.00K | 3.22M | 1.06M | -268.00K | 4.46M | 3.43M |

| Operating Income Ratio | -56.37% | 4.70% | 19.75% | 7.27% | -2.06% | 35.64% | 27.59% |

| Total Other Income/Expenses | -1.46M | -1.02M | -1.08M | -1.08M | -4.37M | -1.06M | -1.05M |

| Income Before Tax | -6.71M | -1.02M | 3.22M | 1.06M | -268.00K | 1.31M | 1.61M |

| Income Before Tax Ratio | -72.08% | -6.53% | 19.75% | 7.27% | -2.06% | 10.50% | 12.96% |

| Income Tax Expense | 3.94M | -451.00K | 601.00K | -24.00K | -189.00K | 232.26K | 701.00K |

| Net Income | -10.66M | -565.00K | 2.62M | 1.08M | -79.00K | 1.08M | 912.00K |

| Net Income Ratio | -114.43% | -3.63% | 16.07% | 7.44% | -0.61% | 8.64% | 7.33% |

| EPS | -2.29 | -0.12 | 0.54 | 0.22 | -0.04 | 0.40 | 0.34 |

| EPS Diluted | -2.29 | -0.12 | 0.54 | 0.22 | -0.04 | 0.40 | 0.34 |

| Weighted Avg Shares Out | 4.65M | 4.82M | 4.86M | 4.90M | 2.25M | 2.68M | 2.68M |

| Weighted Avg Shares Out (Dil) | 4.65M | 4.82M | 4.86M | 4.90M | 2.25M | 2.68M | 2.68M |

Can Bernie Sanders Be Stopped? | National Review

Health insurer stocks surge as Bernie Sanders’ primary win seen boosting Trump’s chances

UnitedHealth surges toward record as Bernie Sanders's New Hampshire win is seen as bolstering Trump's re-election chances

Potential S&P 500 (SPX) Top Likely To Send Bitcoin (BTC) Crashing Below $10k Again - BlockBoard

Bernie won, but what now? Our panelists' verdict on the New Hampshire results | Cas Mudde, Jill Filipovic, Art Cullen, Lloyd Green, Jessa Crispin and Derecka Purnell

Biden failed cataclysmically in New Hampshire — and Amy Klobuchar is the comeback kid. This changes everything

Biden tells New Hampshire Democrats that Buttigieg ‘not a Barack Obama’

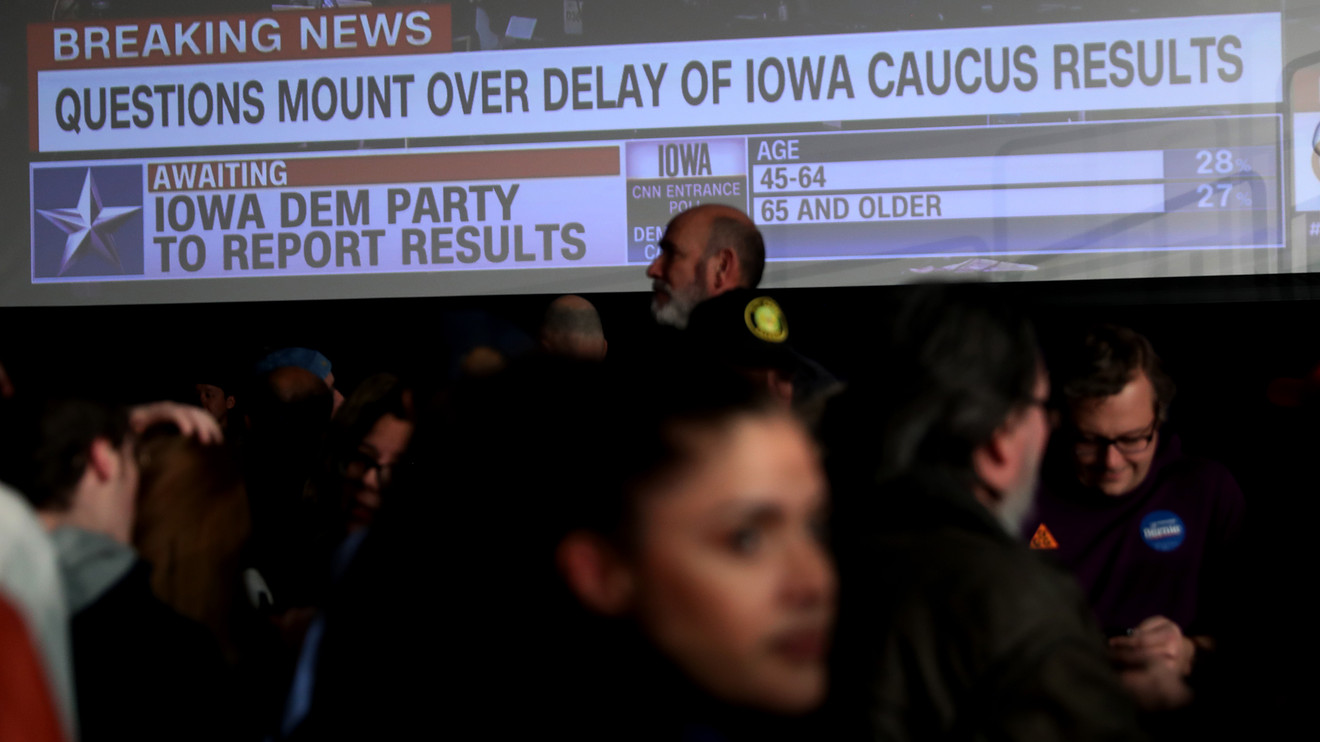

Buttigieg retains narrow lead over Sanders as Iowa results slowly trickle in

'Majority' of Iowa Democratic presidential caucus results expected to be released by 5 p.m. ET Tuesday

Iowa caucus results delayed: ‘People will never believe the figures these Keystone Kops release’

Source: https://incomestatements.info

Category: Stock Reports