See more : Danske Bank A/S (DNSKF) Income Statement Analysis – Financial Results

Complete financial analysis of Flotek Industries, Inc. (FTK) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Flotek Industries, Inc., a leading company in the Oil & Gas Equipment & Services industry within the Energy sector.

- Zoomd Technologies Ltd. (ZOMD.V) Income Statement Analysis – Financial Results

- The New India Assurance Company Limited (NIACL.NS) Income Statement Analysis – Financial Results

- AD1 Holdings Limited (AD1.AX) Income Statement Analysis – Financial Results

- Vivos Therapeutics, Inc. (VVOS) Income Statement Analysis – Financial Results

- Hulic Co., Ltd. (HULCF) Income Statement Analysis – Financial Results

Flotek Industries, Inc. (FTK)

About Flotek Industries, Inc.

Flotek Industries, Inc. operates as a technology-driven chemistry and data company that serves customers across industrial, commercial, and consumer markets in the United States, the United Arab Emirates, and internationally. It operates in two segments, Chemistry Technologies (CT) and Data Analytics (DA). The CT segment designs, develops, manufactures, packages, distributes, delivers, and markets green specialty chemicals that enhance the profitability of hydrocarbon producers and cleans surfaces in commercial and personal settings to help reduce the spread of bacteria, viruses, and germs. This segment primarily serves integrated oil and gas, oilfield services, independent oil and gas, national and state-owned oil, geothermal energy, solar energy, and alternative energy companies. The DA segment designs, develops, produces, sells, and supports equipment and services that create and provide valuable information on the composition and properties of energy customers' hydrocarbon fluids. This segment's data platforms combine the energy industry's field-deployable, inline optical analyzer with proprietary cloud visualization and analytics. It sells its products directly through a mix of in-house sales professionals, as well as contractual agency agreements. The company was incorporated in 1985 and is headquartered in Houston, Texas.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 188.06M | 136.09M | 43.27M | 53.14M | 119.35M | 177.77M | 317.10M | 262.83M | 334.36M | 449.16M | 371.07M | 312.83M | 258.79M | 146.98M | 112.55M | 226.06M | 158.01M | 100.64M | 52.87M | 21.88M | 14.84M | 13.26M | 12.56M | 1.56M | 1.79M | 3.18M |

| Cost of Revenue | 163.80M | 142.79M | 40.01M | 3.41M | 8.47M | 9.22M | 227.29M | 172.15M | 219.25M | 266.20M | 223.54M | 181.21M | 152.97M | 94.01M | 83.17M | 135.31M | 90.30M | 59.46M | 30.95M | 12.53M | 9.26M | 8.71M | 9.08M | 1.16M | 1.15M | 2.44M |

| Gross Profit | 24.26M | -6.70M | 3.26M | 49.73M | 110.89M | 168.56M | 89.81M | 90.68M | 115.11M | 182.96M | 147.53M | 131.62M | 105.82M | 52.97M | 29.38M | 90.76M | 67.71M | 41.18M | 21.92M | 9.35M | 5.58M | 4.55M | 3.48M | 396.87K | 644.37K | 742.95K |

| Gross Profit Ratio | 12.90% | -4.92% | 7.53% | 93.58% | 92.91% | 94.82% | 28.32% | 34.50% | 34.43% | 40.73% | 39.76% | 42.07% | 40.89% | 36.04% | 26.11% | 40.15% | 42.85% | 40.92% | 41.47% | 42.74% | 37.59% | 34.31% | 27.73% | 25.41% | 35.92% | 23.35% |

| Research & Development | 2.49M | 4.44M | 5.54M | 7.21M | 8.86M | 10.36M | 13.65M | 9.32M | 7.46M | 4.98M | 3.75M | 3.18M | 2.34M | 1.44M | 2.12M | 1.93M | 849.00K | 656.00K | 555.26K | 300.07K | 46.65K | 139.37K | 34.94K | 21.08K | 0.00 | 4.16K |

| General & Administrative | 0.00 | 0.00 | 0.00 | 16.31M | 27.98M | 31.47M | 78.73M | 80.15M | 95.48M | 87.15M | 78.20M | 66.42M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 712.98K | 735.07K | 1.39M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 37.24M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 877.78K | 1.02M | 1.53M |

| SG&A | 27.87M | 27.12M | 20.17M | 16.31M | 27.98M | 31.47M | 78.73M | 80.15M | 95.48M | 87.15M | 78.20M | 66.42M | 50.61M | 41.86M | 36.94M | 46.31M | 30.64M | 18.92M | 9.49M | 5.35M | 4.79M | 7.48M | 3.77M | 1.59M | 1.75M | 2.92M |

| Other Expenses | -29.32M | 734.00K | 1.01M | 88.27M | 149.23M | -5.04M | 812.00K | -303.00K | -181.00K | -394.00K | 316.00K | -452.00K | 3.98M | 6.65M | 4.93M | 5.57M | 6.54M | 2.75M | 1.77M | 689.90K | 713.53K | 1.30M | 744.31K | 122.81K | 62.25K | 93.10K |

| Operating Expenses | 30.36M | 32.30M | 26.71M | 111.79M | 186.06M | 201.63M | 92.37M | 98.00M | 113.94M | 101.86M | 89.22M | 74.01M | 56.93M | 49.95M | 43.99M | 53.81M | 38.03M | 22.33M | 11.81M | 6.34M | 5.55M | 8.92M | 4.55M | 1.71M | 1.81M | 3.02M |

| Cost & Expenses | 164.84M | 175.09M | 66.73M | 115.20M | 194.53M | 210.85M | 319.66M | 270.15M | 333.19M | 368.06M | 312.76M | 255.22M | 209.90M | 143.96M | 127.15M | 189.12M | 128.32M | 81.79M | 42.76M | 18.87M | 14.81M | 17.63M | 13.63M | 2.88M | 2.96M | 5.46M |

| Interest Income | 0.00 | 7.05M | 78.00K | 60.00K | 2.02M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.22K | 43.82K | 0.00 | 0.00 | 0.00 |

| Interest Expense | 2.86M | 7.05M | 78.00K | 60.00K | 2.02M | 2.87M | 2.17M | 1.98M | 1.76M | 1.61M | 2.09M | 8.10M | 15.96M | 20.22M | 15.43M | 10.23M | 3.50M | 1.01M | 827.09K | 691.57K | 618.44K | 639.92K | 415.43K | 173.78K | 173.78K | 30.45K |

| Depreciation & Amortization | 8.78M | 4.33M | 1.29M | 3.77M | 9.21M | 9.22M | 9.77M | 10.43M | 18.02M | 9.74M | 15.11M | 11.58M | 10.11M | 13.77M | 14.19M | 13.87M | 6.54M | 2.75M | 1.77M | 689.90K | 713.53K | 704.73K | 744.31K | 122.81K | 62.25K | 93.10K |

| EBITDA | 36.50M | -34.54M | -29.63M | -138.80M | -64.59M | -68.58M | 544.00K | 15.55M | 21.00M | 66.31M | 74.81M | 65.14M | 65.34M | -15.03M | -19.07M | -18.00M | 36.22M | 21.52M | 11.80M | 3.75M | 744.94K | -2.09M | -319.43K | 132.39K | -1.19M | -1.11M |

| EBITDA Ratio | 19.41% | -27.95% | -51.68% | -109.42% | -54.46% | -16.26% | 3.28% | 1.07% | 5.69% | 20.14% | 19.87% | 21.97% | 22.80% | 11.42% | -0.37% | 82.41% | 22.92% | 21.38% | 22.31% | 16.71% | 73.83% | -27.65% | -2.76% | -76.72% | -66.64% | -67.74% |

| Operating Income | 23.22M | -35.42M | -23.46M | -62.06M | -75.18M | -69.81M | -2.86M | -7.30M | -19.17M | 80.89M | 58.73M | 58.62M | 48.89M | -6.27M | -33.10M | -30.75M | 29.69M | 18.85M | 10.11M | 3.01M | -5.09M | -4.37M | -1.06M | -1.32M | -1.17M | -2.28M |

| Operating Income Ratio | 12.35% | -26.03% | -54.22% | -116.79% | -62.99% | -39.27% | -0.90% | -2.78% | -5.73% | 18.01% | 15.83% | 18.74% | 18.89% | -4.26% | -29.41% | -13.60% | 18.79% | 18.73% | 19.13% | 13.77% | -34.28% | -32.97% | -8.47% | -84.31% | -65.12% | -71.62% |

| Total Other Income/Expenses | 1.64M | -6.91M | 890.00K | 1.02M | -636.00K | -10.85M | -1.07M | 10.45M | -1.64M | 20.27M | -1.78M | -13.16M | -9.62M | -42.74M | -15.59M | -13.91M | -2.55M | -920.00K | -741.07K | -645.09K | -591.45K | -566.00 | 27.42K | 4.29K | 238.11K | -1.14M |

| Income Before Tax | 24.86M | -42.33M | -30.57M | -142.63M | -76.94M | -80.66M | -4.21M | 3.14M | -21.12M | 78.88M | 56.95M | 45.46M | 39.27M | -49.01M | -48.69M | -41.08M | 27.14M | 17.93M | 9.37M | 2.37M | 31.41K | -4.37M | -1.04M | -1.31M | -1.08M | -2.31M |

| Income Before Tax Ratio | 13.22% | -31.10% | -70.64% | -268.40% | -64.46% | -45.37% | -1.33% | 1.20% | -6.32% | 17.56% | 15.35% | 14.53% | 15.17% | -33.34% | -43.26% | -18.17% | 17.18% | 17.82% | 17.73% | 10.82% | 0.21% | -32.97% | -8.25% | -84.03% | -60.13% | -72.58% |

| Income Tax Expense | 149.00K | -22.00K | -40.00K | -6.18M | -201.00K | -7.22M | 8.84M | 1.24M | -7.65M | 25.28M | 20.77M | -4.33M | 7.86M | -5.55M | 2.02M | -9.14M | 10.41M | 6.58M | 1.65M | 213.10K | 17.01M | 451.66K | -98.65K | -8.59K | -44.24K | 184.47K |

| Net Income | 24.71M | -42.31M | -30.53M | -136.45M | -76.74M | -70.34M | -27.40M | -49.13M | -13.46M | 53.60M | 36.18M | 49.79M | 31.41M | -43.47M | -50.71M | -31.94M | 16.73M | 11.35M | 7.72M | 2.15M | -7.38M | -5.46M | -1.41M | -1.49M | -1.21M | -2.43M |

| Net Income Ratio | 13.14% | -31.09% | -70.55% | -256.77% | -64.29% | -39.57% | -8.64% | -18.69% | -4.03% | 11.93% | 9.75% | 15.92% | 12.14% | -29.57% | -45.05% | -14.13% | 10.59% | 11.28% | 14.60% | 9.84% | -49.74% | -41.20% | -11.21% | -95.16% | -67.65% | -76.46% |

| EPS | -0.12 | -3.41 | -2.50 | -11.98 | -7.84 | -7.28 | -2.85 | -5.30 | -1.47 | 4.36 | 4.23 | 6.20 | 0.60 | -1.69 | -2.59 | -1.67 | 0.91 | 0.66 | 0.53 | 0.16 | -0.62 | -0.55 | -0.22 | -0.01 | -1.50 | -4.29 |

| EPS Diluted | -0.10 | -3.41 | -2.50 | -11.98 | -7.84 | -7.28 | -2.85 | -5.26 | -1.47 | 4.26 | 4.02 | 5.80 | 0.56 | -1.69 | -2.59 | -1.67 | 0.88 | 0.61 | 0.47 | 0.16 | -0.62 | -0.55 | -0.22 | -0.01 | -1.50 | -4.29 |

| Weighted Avg Shares Out | 24.83M | 12.40M | 12.23M | 11.39M | 9.79M | 9.67M | 9.60M | 9.26M | 9.17M | 9.25M | 8.97M | 8.59M | 44.23M | 25.73M | 19.60M | 19.16M | 18.34M | 17.29M | 14.61M | 13.32M | 11.95M | 9.94M | 6.35M | 104.06M | 808.91K | 567.26K |

| Weighted Avg Shares Out (Dil) | 28.38M | 12.40M | 12.23M | 11.39M | 9.79M | 9.67M | 9.60M | 9.35M | 9.18M | 9.30M | 9.00M | 8.93M | 47.64M | 25.73M | 19.60M | 19.16M | 18.96M | 18.59M | 16.51M | 14.03M | 11.95M | 9.94M | 6.35M | 104.06M | 808.91K | 567.26K |

Colombo Port workers end strike against proposed deal with India

Colombo Port workers end strike against proposed deal with India

DR MAX PEMBERTON: Kanye West and the toll of bipolar on loved ones

Sri Lankan port workers protest against proposed deal with India

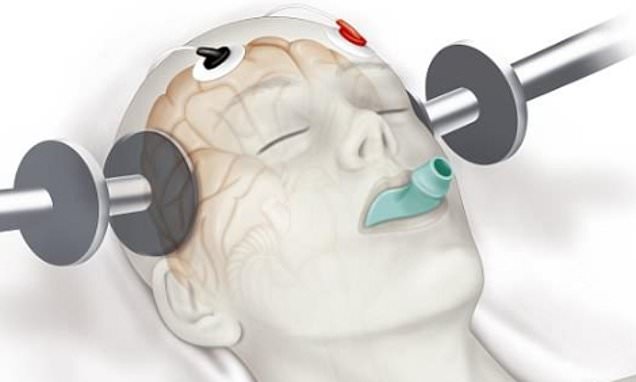

Is it time to BAN electric shock therapy?

Dozens of patients sue the NHS over brain damage claims after therapy

Mental Health Watchdog Renews Call for a Ban on Electroshock Device

An Emerging Section 101 Expansion to Section 112(a) Enablement? The Federal Circuit Should Stop It Now

Ban 'Cuckoo's Nest' electric shock therapy, patients plead

Source: https://incomestatements.info

Category: Stock Reports