See more : Novint Technologies, Inc. (NVNT) Income Statement Analysis – Financial Results

Complete financial analysis of Five Star Senior Living Inc. (FVE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Five Star Senior Living Inc., a leading company in the Medical – Care Facilities industry within the Healthcare sector.

- Shalimar Paints Limited (SHALPAINTS.NS) Income Statement Analysis – Financial Results

- Ecograf Ltd (FMK.F) Income Statement Analysis – Financial Results

- Dunxin Financial Holdings Limited (DXF) Income Statement Analysis – Financial Results

- SCP & CO Healthcare Acquisition Company (SHACW) Income Statement Analysis – Financial Results

- Yeah Yeah Group Holdings Limited (8082.HK) Income Statement Analysis – Financial Results

Five Star Senior Living Inc. (FVE)

About Five Star Senior Living Inc.

Five Star Senior Living Inc. operates and manages senior living communities in the United States. It operates through Senior Living, and Rehabilitation and Wellness segments. Its senior living communities comprise independent living communities, assisted living communities, continuing care retirement communities (CCRCs), skilled nursing facilities (SNFs), and an active adult community. The company offers nursing and healthcare services; and rehabilitation and wellness services. As of December 31, 2020, it operated 268 senior living communities consisting of 29,271 living units comprising 243 primarily independent and assisted living communities with 28,316 living units, and 9 SNFs with 955 living units located in 31 states. The company was formerly known as Five Star Quality Care, Inc. and changed its name to Five Star Senior Living Inc. in March 2017. Five Star Senior Living Inc. was founded in 2001 and is headquartered in Newton, Massachusetts.

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 934.59M | 1.16B | 1.42B | 1.39B | 1.40B | 1.38B | 1.37B | 1.33B | 1.30B | 1.35B | 1.28B | 1.24B | 1.19B | 1.10B | 972.92M | 827.34M | 757.53M | 628.01M | 576.22M | 522.51M | 229.24M |

| Cost of Revenue | 851.46M | 1.05B | 1.19B | 1.15B | 1.10B | 1.08B | 1.07B | 1.05B | 1.00B | 1.04B | 449.95M | 954.29M | 934.93M | 863.39M | 763.10M | 263.90M | 183.89M | 159.89M | 151.01M | 182.54M | 72.97M |

| Gross Profit | 83.13M | 115.79M | 229.87M | 245.05M | 291.74M | 297.77M | 292.11M | 282.99M | 294.80M | 309.16M | 831.82M | 286.44M | 257.63M | 240.81M | 209.82M | 563.44M | 573.64M | 468.11M | 425.20M | 339.97M | 156.27M |

| Gross Profit Ratio | 8.90% | 9.95% | 16.24% | 17.62% | 20.90% | 21.61% | 21.39% | 21.31% | 22.73% | 22.89% | 64.90% | 23.09% | 21.60% | 21.81% | 21.57% | 68.10% | 75.72% | 74.54% | 73.79% | 65.06% | 68.17% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 85.72M | 92.29M | 229.37M | 287.34M | 281.74M | 275.18M | 269.83M | 269.74M | 257.33M | 263.24M | 789.34M | 243.87M | 231.46M | 207.54M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 85.72M | 92.29M | 229.37M | 287.34M | 281.74M | 275.18M | 269.83M | 269.74M | 257.33M | 263.24M | 789.34M | 243.87M | 231.46M | 207.54M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 4.08M | 7.56M | 16.64M | 35.94M | 38.19M | 38.05M | 33.82M | 31.83M | 27.02M | 25.06M | 21.13M | 16.80M | 16.38M | 8.79M | 186.16M | 677.92M | 650.35M | 464.79M | 431.61M | 347.05M | 155.78M |

| Operating Expenses | 89.80M | 99.85M | 246.01M | 323.28M | 319.94M | 313.24M | 303.65M | 301.58M | 284.35M | 288.30M | 810.47M | 260.67M | 247.84M | 216.33M | 186.16M | 677.92M | 650.35M | 464.79M | 431.61M | 347.05M | 155.78M |

| Cost & Expenses | 941.26M | 1.15B | 1.43B | 1.47B | 1.42B | 1.39B | 1.38B | 1.35B | 1.29B | 1.33B | 1.26B | 1.21B | 1.18B | 1.08B | 949.26M | 941.82M | 834.24M | 624.68M | 582.62M | 529.59M | 228.75M |

| Interest Income | 358.00K | 757.00K | 1.36M | 818.00K | 765.00K | 984.00K | 982.00K | 867.00K | 781.00K | 881.00K | 1.30M | 1.82M | 2.99M | 5.92M | 6.15M | 6.81M | 1.54M | 1.67M | 229.00K | 297.00K | 43.00K |

| Interest Expense | 1.68M | 1.63M | 2.62M | 3.02M | 4.31M | 4.91M | 4.93M | 5.13M | 5.23M | 6.27M | 3.92M | 3.05M | 4.37M | 6.34M | 6.80M | 4.37M | 3.74M | 880.00K | 1.16M | 198.00K | 0.00 |

| Depreciation & Amortization | 11.87M | 11.00M | 16.64M | 35.94M | 38.19M | 38.05M | 33.67M | 33.47M | 28.11M | 25.06M | 21.13M | 16.80M | 16.38M | 14.72M | 13.60M | 9.95M | 7.11M | 3.67M | 3.59M | 1.89M | 1.32M |

| EBITDA | -16.14M | 5.70M | -684.00K | -34.88M | 17.06M | 23.50M | -3.82M | 9.58M | 32.91M | 61.92M | 38.69M | 44.79M | 61.27M | 17.95M | 45.13M | -102.35M | -73.30M | 7.96M | -3.19M | -11.09M | 1.85M |

| EBITDA Ratio | -1.73% | 0.49% | -0.05% | -2.51% | 1.22% | 1.71% | -0.28% | 0.72% | 2.54% | 4.58% | 3.02% | 3.61% | 5.14% | 1.63% | 4.64% | -12.37% | -9.68% | 1.27% | -0.55% | -2.12% | 0.81% |

| Operating Income | -28.01M | 15.94M | -20.27M | -71.56M | -23.05M | -15.97M | -37.02M | -19.18M | 10.26M | 20.86M | 21.35M | 25.77M | 9.80M | 18.55M | 23.66M | -114.48M | -76.71M | 3.32M | -6.40M | -10.03M | 484.00K |

| Operating Income Ratio | -3.00% | 1.37% | -1.43% | -5.15% | -1.65% | -1.16% | -2.71% | -1.44% | 0.79% | 1.54% | 1.67% | 2.08% | 0.82% | 1.68% | 2.43% | -13.84% | -10.13% | 0.53% | -1.11% | -1.92% | 0.21% |

| Total Other Income/Expenses | -1.51M | -22.87M | -240.00K | -2.79M | -2.99M | -3.82M | -3.09M | -3.87M | -5.23M | -1.79M | -3.63M | 441.00K | 31.66M | -16.74M | 3.84M | 2.44M | -4.53M | 786.00K | 0.00 | -348.00K | 43.00K |

| Income Before Tax | -29.51M | -6.93M | -20.51M | -74.35M | -26.05M | -19.79M | -40.12M | -23.05M | 5.03M | 19.07M | 17.72M | 26.21M | 41.45M | 1.82M | 27.51M | -112.04M | -81.25M | 4.11M | 0.00 | -10.38M | 527.00K |

| Income Before Tax Ratio | -3.16% | -0.60% | -1.45% | -5.35% | -1.87% | -1.44% | -2.94% | -1.74% | 0.39% | 1.41% | 1.38% | 2.11% | 3.48% | 0.16% | 2.83% | -13.54% | -10.73% | 0.65% | 0.00% | -1.99% | 0.23% |

| Income Tax Expense | 234.00K | 663.00K | 56.00K | 247.00K | -4.54M | 2.35M | 662.00K | 56.39M | 1.92M | 5.64M | -50.55M | 1.45M | 2.20M | 1.39M | 1.41M | 6.81M | -790.00K | 120.00K | 1.16M | -150.00K | 43.00K |

| Net Income | -29.75M | -7.59M | -20.00M | -74.08M | -20.90M | -21.81M | -43.08M | -85.41M | -2.34M | 24.95M | 64.20M | 23.49M | 38.33M | -4.50M | 23.33M | -116.67M | -84.16M | 3.29M | -7.94M | -13.17M | 527.00K |

| Net Income Ratio | -3.18% | -0.65% | -1.41% | -5.33% | -1.50% | -1.58% | -3.16% | -6.43% | -0.18% | 1.85% | 5.01% | 1.89% | 3.21% | -0.41% | 2.40% | -14.10% | -11.11% | 0.52% | -1.38% | -2.52% | 0.23% |

| EPS | -0.94 | -0.24 | -3.99 | -14.91 | -4.25 | -4.47 | -8.90 | -17.78 | -0.48 | 5.20 | 15.23 | 6.57 | 11.42 | -1.41 | 7.36 | -40.78 | -56.56 | 3.78 | -9.36 | -17.44 | 1.20 |

| EPS Diluted | -0.94 | -0.24 | -3.99 | -14.91 | -4.25 | -4.47 | -8.90 | -17.78 | -0.48 | 5.20 | 14.26 | 5.99 | 9.89 | -1.41 | 5.63 | -40.78 | -56.56 | 3.78 | -9.36 | -17.44 | 1.20 |

| Weighted Avg Shares Out | 31.59M | 31.47M | 5.01M | 4.97M | 4.92M | 4.88M | 4.84M | 4.80M | 4.83M | 4.80M | 4.22M | 3.57M | 3.36M | 3.19M | 3.17M | 2.86M | 1.49M | 871.60K | 848.20K | 755.60K | 437.40K |

| Weighted Avg Shares Out (Dil) | 31.59M | 31.47M | 5.01M | 4.97M | 4.92M | 4.88M | 4.84M | 4.80M | 4.93M | 4.80M | 4.50M | 3.92M | 3.88M | 3.19M | 4.14M | 2.86M | 1.49M | 871.60K | 848.20K | 755.60K | 437.40K |

Five Star Senior Living Inc. Announces Third Quarter 2020 Results

Five Star Senior Living Inc. Third Quarter 2020 Conference Call Scheduled for Thursday, November 5th

The RMR Group Inc. Announces Third Quarter Fiscal 2020 Results

Five Star Senior Living Inc. Announces Second Quarter 2020 Results

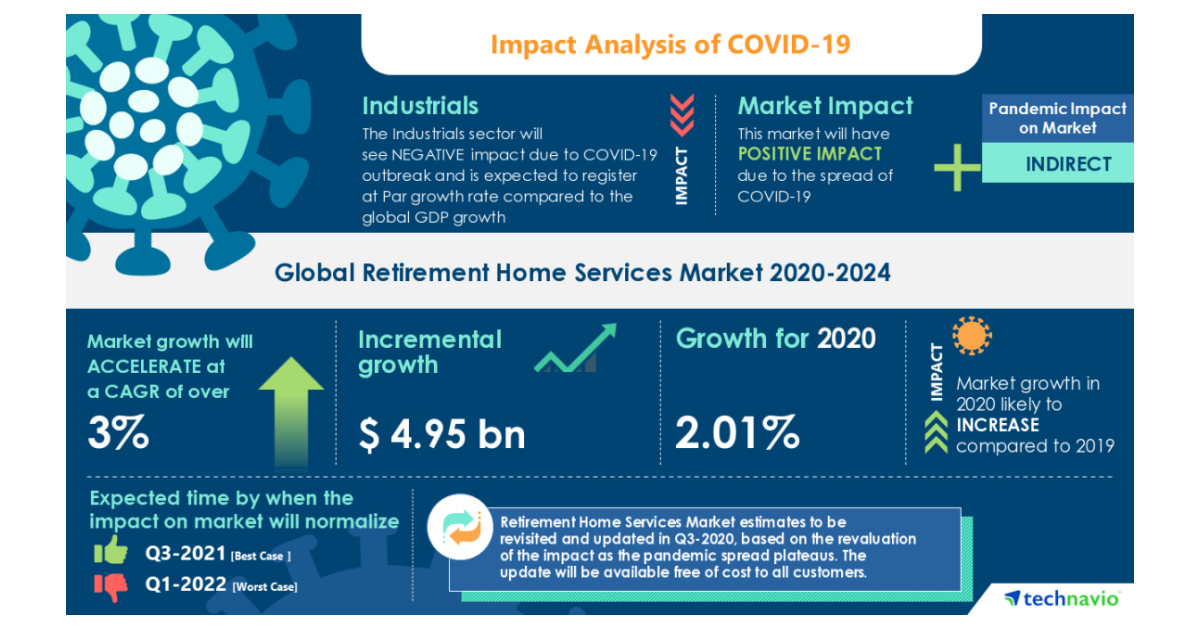

Global Retirement Home Services Market Analysis Highlights the Impact of COVID-19 2020-2024 | Benefits Offered by Retirement Homes to boost Market Growth | Technavio

Five Star Senior Living Inc. Second Quarter 2020 Conference Call Scheduled for Thursday, August 6th

Tower Research Capital LLC TRC Purchases New Position in Five Star Senior Living Inc (NASDAQ:FVE)

Diversified Healthcare Trust Amends Credit and Term Loan Agreements and Provides COVID Related Business Updates

EU on brink: Calls to 'follow Brexit's lead' in THREE member states exposed

National Health Investors, Inc. (NHI) CEO Eric Mendelsohn on Q1 2020 Results - Earnings Call Transcript

Source: https://incomestatements.info

Category: Stock Reports