See more : Impala Platinum Holdings Limited (IMPUY) Income Statement Analysis – Financial Results

Complete financial analysis of First National Corporation (FXNC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of First National Corporation, a leading company in the Banks – Regional industry within the Financial Services sector.

- Sunset Island Group, Inc. (SIGO) Income Statement Analysis – Financial Results

- Nirvana Daii Public Company Limited (NVD.BK) Income Statement Analysis – Financial Results

- Ocado Group plc (OCDDY) Income Statement Analysis – Financial Results

- Tianneng Battery Group Co., Ltd. (688819.SS) Income Statement Analysis – Financial Results

- 2cureX AB (publ) (2CUREX.ST) Income Statement Analysis – Financial Results

First National Corporation (FXNC)

About First National Corporation

First National Corporation operates as the bank holding company for First Bank that provides various commercial banking services to small and medium-sized businesses, individuals, estates, local governmental entities, and non-profit organizations in Virginia. The company's deposit products include checking, savings, money market, and individual retirement accounts, as well as certificates of deposit and treasury management solutions. Its loan products comprise construction loans, including residential, land acquisition, and development loans; 1-4 family residential real estate loans; and commercial real estate loans that are secured by commercial real estate, including multi-family residential buildings, office and retail buildings, hotels, industrial buildings, and religious facilities. The company's loan products also include commercial and industrial loans that are secured by business assets, such as accounts receivable, equipment, and inventory; home equity loans; and secured and unsecured consumer loans, such as lines of credit, automobile loans, deposit account loans, and installment and demand loans. In addition, it provides wealth management services, including estate planning, investment management of assets, trustee under an agreement, trustee under a will, and estate settlement. Further, the company offers title insurance and investment services; and holds other real estate owned and office sites, as well as provides internet and mobile banking, remote deposit capture, and other traditional banking services. It serves customers through 20 bank branch offices, a loan production office, and a customer service center, as well as through a network of ATMs. The company was founded in 1907 and is headquartered in Strasburg, Virginia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 49.05M | 56.86M | 45.01M | 37.69M | 36.56M | 35.97M | 32.75M | 30.88M | 28.29M | 25.40M | 24.71M | 26.07M | 26.00M | 26.46M | 23.91M | 24.07M | 24.17M | 22.73M | 20.60M | 17.73M | 14.59M | 11.95M | 10.22M | 9.02M | 8.65M | 1.49M | 1.10M | 767.90K | 803.24K |

| Cost of Revenue | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 201.00K | 0.00 | 263.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 49.05M | 56.86M | 45.01M | 37.69M | 36.56M | 35.97M | 32.75M | 30.88M | 28.08M | 25.40M | 24.45M | 26.07M | 26.00M | 26.46M | 23.91M | 24.07M | 24.17M | 22.73M | 20.60M | 17.73M | 14.59M | 11.95M | 10.22M | 9.02M | 8.65M | 1.49M | 1.10M | 767.90K | 803.24K |

| Gross Profit Ratio | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 99.29% | 100.00% | 98.94% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 21.67M | 21.17M | 18.14M | 13.57M | 13.61M | 14.07M | 13.87M | 14.06M | 15.01M | 11.67M | 11.60M | 10.57M | 11.82M | 11.01M | 10.91M | 8.49M | 8.37M | 7.45M | 6.38M | 5.22M | 4.54M | 3.51M | 3.09M | 2.95M | 2.69M | 2.61M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 910.00K | 813.00K | 666.00K | 355.00K | 651.00K | 548.00K | 576.00K | 562.00K | 530.00K | 426.00K | 345.00K | 430.00K | 425.00K | 503.00K | 532.00K | 510.00K | 541.00K | 598.00K | 290.00K | 380.04K | 340.10K | 332.57K | 246.33K | 184.81K | 189.63K | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 22.58M | 21.99M | 18.81M | 13.92M | 14.26M | 14.62M | 14.44M | 14.63M | 15.54M | 12.10M | 11.94M | 11.00M | 12.24M | 11.52M | 11.44M | 9.00M | 8.91M | 8.05M | 6.67M | 5.60M | 4.88M | 3.84M | 3.34M | 3.14M | 2.88M | 2.61M | 0.00 | 0.00 | 0.00 |

| Other Expenses | 0.00 | 1.72M | -50.87M | -40.71M | -39.03M | -35.67M | -33.25M | -33.91M | -37.34M | -24.60M | -28.63M | -29.14M | -39.92M | -36.97M | -23.36M | -14.21M | -7.19M | -6.82M | -9.55M | -9.98M | -7.90M | -3.81M | -1.15M | 213.12K | -966.85K | 5.71M | 6.89M | 6.31M | 5.73M |

| Operating Expenses | 29.75M | 3.95M | -32.07M | -26.79M | -24.77M | -20.04M | -18.81M | -19.28M | -21.80M | -12.50M | -16.69M | -18.13M | -27.67M | -25.46M | -11.92M | -5.22M | 1.72M | 1.23M | -2.89M | -4.37M | -3.02M | 29.12K | 2.19M | 3.35M | 1.92M | 8.31M | 6.89M | 6.31M | 5.73M |

| Cost & Expenses | 29.75M | 3.95M | -32.07M | -26.79M | -24.77M | -20.04M | -18.81M | -19.28M | 201.00K | -12.50M | 263.00K | -18.13M | -27.67M | -25.46M | -11.92M | -5.22M | 1.72M | 1.23M | -2.89M | -4.37M | -3.02M | 29.12K | 2.19M | 3.35M | 1.92M | 8.31M | 6.89M | 6.31M | 5.73M |

| Interest Income | 57.61M | 49.30M | 37.06M | 32.75M | 32.79M | 31.05M | 27.57M | 25.16M | 22.08M | 20.32M | 21.08M | 23.36M | 25.58M | 27.15M | 27.37M | 30.91M | 35.50M | 32.95M | 26.01M | 20.52M | 17.74M | 17.06M | 17.36M | 16.95M | 15.22M | 14.08M | 11.97M | 10.83M | 9.94M |

| Interest Expense | 14.31M | 3.82M | 2.30M | 3.38M | 4.89M | 3.51M | 2.39M | 1.98M | 1.44M | 1.78M | 2.71M | 4.17M | 5.45M | 6.81M | 9.08M | 12.79M | 17.40M | 15.39M | 9.79M | 7.22M | 6.77M | 7.65M | 8.67M | 9.33M | 7.68M | 7.11M | 5.74M | 5.10M | 4.73M |

| Depreciation & Amortization | 0.00 | 1.52M | 1.43M | 1.47M | 1.64M | 1.81M | 2.01M | 2.17M | 642.00K | 967.00K | 1.01M | 1.11M | 1.18M | 1.60M | 1.58M | 1.28M | 1.22M | 1.17M | 1.03M | 1.06M | 1.16M | 849.35K | 540.36K | 494.38K | 618.56K | 428.11K | 419.75K | 443.27K | 424.14K |

| EBITDA | 0.00 | 22.26M | 14.35M | 12.37M | 13.43M | 14.23M | 12.43M | 10.40M | 5.48M | 12.12M | 6.67M | 4.87M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 11.50M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA Ratio | 0.00% | 43.25% | 28.82% | 29.34% | 33.08% | 49.31% | 44.48% | 40.05% | 24.48% | 54.62% | 35.51% | 34.69% | -1.89% | 9.82% | 56.74% | 83.65% | 112.13% | 110.54% | 91.00% | 81.32% | 87.25% | 107.35% | 126.72% | 142.64% | 129.30% | 685.41% | 765.20% | 979.96% | 865.55% |

| Operating Income | 11.76M | 23.08M | 12.95M | 10.91M | 11.79M | 15.93M | 13.95M | 11.60M | 6.28M | 12.91M | 7.76M | 7.93M | -1.68M | 1.01M | 11.99M | 18.86M | 25.89M | 23.96M | 17.71M | 13.36M | 11.57M | 11.98M | 12.41M | 12.37M | 10.57M | 9.81M | 7.99M | 7.08M | 6.53M |

| Operating Income Ratio | 23.97% | 40.59% | 28.76% | 28.94% | 32.26% | 44.29% | 42.58% | 37.56% | 22.21% | 50.81% | 31.42% | 30.43% | -6.45% | 3.80% | 50.14% | 78.33% | 107.10% | 105.42% | 85.99% | 75.34% | 79.30% | 100.24% | 121.44% | 137.16% | 122.16% | 656.74% | 726.99% | 922.23% | 812.74% |

| Total Other Income/Expenses | 47.00K | -6.63M | -5.31M | -4.46M | -4.66M | -4.09M | -3.86M | -4.09M | -5.22M | -3.01M | -4.32M | -2.06M | -5.45M | -5.81M | 9.00K | -106.00K | 363.00K | 0.00 | -10.00K | 387.23K | -6.77M | -7.65M | -8.67M | -9.33M | -7.68M | -7.11M | -5.74M | -5.10M | -4.73M |

| Income Before Tax | 11.81M | 20.75M | 12.95M | 10.91M | 11.79M | 12.42M | 10.17M | 8.25M | 3.61M | 11.13M | 5.25M | 3.81M | -7.13M | -5.81M | 2.90M | 6.06M | 8.49M | 8.56M | 7.93M | 6.14M | 4.80M | 4.33M | 3.73M | 3.04M | 2.89M | 2.70M | 2.25M | 1.98M | 1.80M |

| Income Before Tax Ratio | 24.07% | 36.49% | 28.76% | 28.94% | 32.26% | 34.53% | 31.06% | 26.71% | 12.77% | 43.81% | 21.25% | 14.60% | -27.41% | -21.95% | 12.15% | 25.19% | 35.12% | 37.69% | 38.48% | 34.62% | 32.92% | 36.20% | 36.55% | 33.71% | 33.37% | 180.58% | 204.62% | 258.48% | 223.56% |

| Income Tax Expense | 2.18M | 3.95M | 2.59M | 2.05M | 2.24M | 2.29M | 3.73M | 2.35M | 956.00K | 3.50M | -4.75M | 982.00K | 3.84M | -2.21M | 755.00K | 1.84M | 2.74M | 2.77M | 2.54M | 1.93M | 1.50M | 1.35M | 1.14M | 904.49K | 853.34K | 791.88K | 636.34K | 530.60K | 481.22K |

| Net Income | 9.62M | 16.80M | 10.36M | 8.86M | 9.56M | 10.14M | 6.45M | 5.90M | 2.66M | 7.63M | 10.01M | 2.82M | -10.96M | -3.60M | 2.15M | 4.22M | 5.75M | 5.80M | 5.39M | 4.21M | 3.30M | 2.98M | 2.60M | 2.14M | 2.03M | 1.90M | 1.61M | 1.45M | 1.31M |

| Net Income Ratio | 19.62% | 29.54% | 23.01% | 23.50% | 26.14% | 28.17% | 19.69% | 19.11% | 9.39% | 30.04% | 40.49% | 10.83% | -42.16% | -13.61% | 8.99% | 17.54% | 23.78% | 25.51% | 26.16% | 23.72% | 22.62% | 24.93% | 25.40% | 23.69% | 23.51% | 127.55% | 146.69% | 189.38% | 163.66% |

| EPS | 1.54 | 2.69 | 1.87 | 1.82 | 1.92 | 2.05 | 1.30 | 1.20 | 0.31 | 1.32 | 1.83 | 0.39 | -3.71 | -1.22 | 0.49 | 1.45 | 1.98 | 1.99 | 1.84 | 0.72 | 1.12 | 0.94 | 0.82 | 0.67 | 0.64 | 0.61 | 0.52 | 0.47 | 0.43 |

| EPS Diluted | 1.53 | 2.68 | 1.86 | 1.82 | 1.92 | 2.04 | 1.30 | 1.20 | 0.31 | 1.32 | 1.83 | 0.39 | -3.71 | -1.22 | 0.49 | 1.45 | 1.98 | 1.99 | 1.84 | 0.72 | 1.12 | 0.94 | 0.82 | 0.67 | 0.64 | 0.61 | 0.52 | 0.47 | 0.43 |

| Weighted Avg Shares Out | 6.27M | 6.25M | 5.55M | 4.88M | 4.96M | 4.95M | 4.94M | 4.92M | 4.92M | 4.90M | 4.90M | 4.90M | 2.96M | 2.95M | 2.92M | 2.91M | 2.91M | 2.91M | 2.93M | 2.93M | 2.96M | 3.16M | 3.16M | 3.18M | 3.17M | 3.14M | 3.10M | 3.09M | 3.09M |

| Weighted Avg Shares Out (Dil) | 6.28M | 6.26M | 5.56M | 4.88M | 4.97M | 4.96M | 4.95M | 4.93M | 4.92M | 4.90M | 4.90M | 4.90M | 2.96M | 2.95M | 2.92M | 2.91M | 2.91M | 2.91M | 2.93M | 2.93M | 2.96M | 3.16M | 3.16M | 3.18M | 3.17M | 3.15M | 3.10M | 3.09M | 3.09M |

Will you have to tap into your savings this year to cover your bills? Almost half of workers say yes

Empower Expands Fiduciary Role as SEC Regulation Best Interest Nears

AIG Life & Retirement Expands Distribution Network with Annexus to Bring Consumers an Innovative New Index Annuity Solution

AIG Life & Retirement Expands Distribution Network with Annexus to Bring Consumers an Innovative New Index Annuity Solution

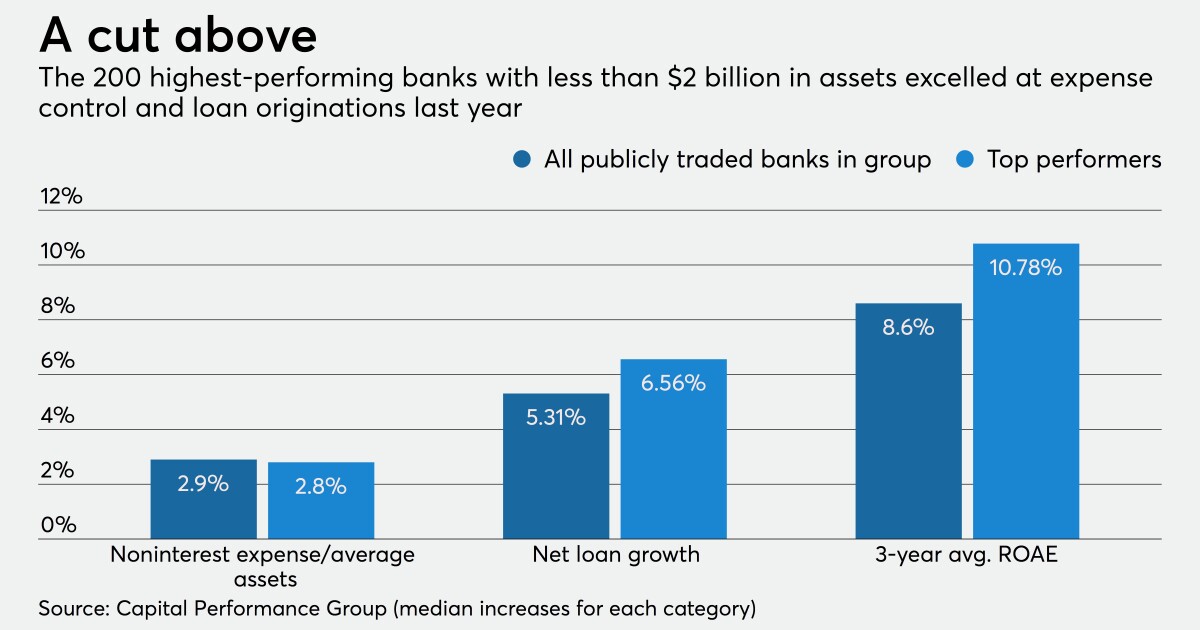

Will pandemic reshuffle the top 200 publicly traded community banks?

JPMorgan Chase & Co. (NYSE:JPM) Shares Acquired by First National Corp MA ADV

First National Corp MA ADV Acquires 665 Shares of Exxon Mobil Co. (NYSE:XOM)

First National Corp MA ADV Acquires 22 Shares of Alphabet Inc (NASDAQ:GOOG)

Amgen, Inc. (NASDAQ:AMGN) Holdings Lifted by First National Corp MA ADV

Source: https://incomestatements.info

Category: Stock Reports