See more : Kinetiko Energy Limited (KKO.AX) Income Statement Analysis – Financial Results

Complete financial analysis of Goodness Growth Holdings, Inc. (GDNSF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Goodness Growth Holdings, Inc., a leading company in the Drug Manufacturers – Specialty & Generic industry within the Healthcare sector.

- Asset Five Group Public Company Limited (A5.BK) Income Statement Analysis – Financial Results

- Casablanca Group Limited (2223.HK) Income Statement Analysis – Financial Results

- Bee Vectoring Technologies International Inc. (BEE.CN) Income Statement Analysis – Financial Results

- Peako Limited (PKO.AX) Income Statement Analysis – Financial Results

- Orzel Bialy S.A. (OBL.WA) Income Statement Analysis – Financial Results

Goodness Growth Holdings, Inc. (GDNSF)

Industry: Drug Manufacturers - Specialty & Generic

Sector: Healthcare

Website: https://www.goodnessgrowth.com

About Goodness Growth Holdings, Inc.

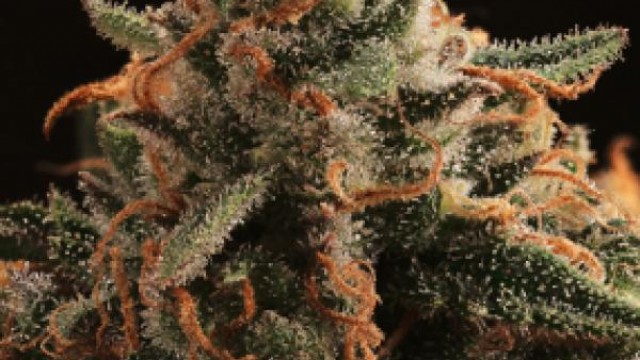

Goodness Growth Holdings, Inc. operates as a physician-led cannabis company in the United States. The company cultivates cannabis in environmentally friendly greenhouses; manufactures pharmaceutical-grade cannabis extracts; and sells its products through its network of Green Goods and other Goodness Growth branded retail dispensaries, as well as third-party dispensaries. As of March 11, 2022, it operated 18 dispensaries, which included 2 in Maryland, 8 in Minnesota, 4 in New Mexico, and 4 in New York; and offered wholesale cannabis products through third-party companies in Arizona, Maryland, Minnesota, and New York. The company was formerly known as Vireo Health International Inc. and changed its name to Goodness Growth Holdings, Inc. in June 2021. Goodness Growth Holdings, Inc. is headquartered in Minneapolis, Minnesota.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 88.13M | 74.63M | 54.45M | 49.21M | 29.96M | 18.46M | 10.87M | 4.26M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost of Revenue | 44.03M | 43.72M | 34.65M | 32.08M | 19.11M | 276.76 | 379.90 | 448.90 | 548.56 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 44.10M | 30.91M | 19.80M | 17.13M | 10.84M | 18.46M | 10.87M | 4.26M | -548.56 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit Ratio | 50.04% | 41.42% | 36.36% | 34.80% | 36.19% | 100.00% | 100.00% | 99.99% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 31.58M | 35.45M | 36.31M | 39.14M | 27.67M | 139.07K | 83.60K | 119.80K | 57.93K | 384.06K | 385.25K | 621.53K | 342.58K | 122.31K | 464.63K | 1.35M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 791.98K | 1.07M | 2.53M | 26.37M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 172.23K | 0.00 | 0.00 | 0.00 |

| SG&A | 32.38M | 36.52M | 38.84M | 39.14M | 27.67M | 139.07K | 83.60K | 119.80K | 57.93K | 384.06K | 385.25K | 621.53K | 342.58K | 122.31K | 464.63K | 1.52M | 2.95M | 51.86K | 58.07K |

| Other Expenses | 7.75M | 1.33M | 1.44M | 1.03M | 2.23M | 277.53 | 378.53 | 447.88 | 549.11 | 491.02 | 0.00 | 0.00 | 0.00 | 3.66K | 45.98K | 9.81K | 268.47K | 51.86K | 58.07K |

| Operating Expenses | 33.52M | 37.85M | 40.28M | 40.17M | 29.91M | 139.34K | 83.97K | 120.25K | 58.47K | 384.55K | 385.25K | 621.53K | 342.58K | 125.97K | 586.91K | 1.70M | 3.21M | 51.86K | 58.07K |

| Cost & Expenses | 77.55M | 81.57M | 74.93M | 72.25M | 49.02M | 139.34K | 83.97K | 120.25K | 58.47K | 384.55K | 385.25K | 621.53K | 342.58K | 125.97K | 586.91K | 1.70M | 3.21M | 51.86K | 58.07K |

| Interest Income | 0.00 | 22.59M | 10.58M | 5.10M | 662.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 315.16 | 628.59 | 0.00 | 8.29K | 3.84K |

| Interest Expense | 31.26M | 22.59M | 10.58M | 5.10M | 5.18M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.32K | 25.28K | 75.29K | 35.08K | 39.05K | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 3.60M | 2.57M | 1.20M | 1.04M | 4.07M | 277.53 | 378.53 | 447.88 | 549.11 | 491.02 | 0.00 | 0.00 | 0.00 | 0.00 | 122.27K | 183.00K | 257.34K | 0.00 | 0.00 |

| EBITDA | 17.04M | -9.96M | -18.87M | -5.96M | -15.47M | -139.07K | -83.60K | -132.24K | -57.24K | -383.53K | -385.25K | -621.53K | -342.58K | -125.97K | -418.34K | -1.51M | -3.77M | -51.86K | -58.07K |

| EBITDA Ratio | 24.88% | -5.85% | -35.42% | -44.72% | -51.64% | -0.75% | -0.77% | -3.10% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Operating Income | 10.58M | -6.94M | -20.48M | -23.04M | -19.53M | -139.34K | -83.97K | -120.25K | -58.47K | -384.55K | -385.25K | -621.53K | -342.58K | -125.97K | -586.91K | -1.70M | -3.21M | -51.86K | -58.07K |

| Operating Income Ratio | 12.00% | -9.30% | -37.62% | -46.82% | -65.21% | -0.75% | -0.77% | -2.82% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Total Other Income/Expenses | -28.40M | -29.63M | -9.09M | 8.89M | -34.94M | 2.26M | -45.12K | 12.47K | -622.85 | -526.33 | -346.34K | 27.13K | 1.02M | -516.09K | -3.29M | -28.61K | 1.00M | 0.00 | 0.00 |

| Income Before Tax | -17.82M | -36.56M | -29.57M | -14.15M | -57.31M | -139.34K | -83.97K | -107.81K | -59.16K | -385.08K | -731.59K | -594.40K | 673.17K | -642.05K | -3.88M | -1.73M | -2.21M | 0.00 | 0.00 |

| Income Before Tax Ratio | -20.22% | -49.00% | -54.31% | -28.76% | -191.31% | -0.75% | -0.77% | -2.53% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 7.72M | 5.89M | 4.12M | 8.79M | -299.00K | 5.20M | 2.39 | -12.44K | 683.87 | 526.33 | 0.00 | 0.00 | 0.00 | 0.00 | 81.06K | 48.86K | -735.65K | 44.75K | 54.76K |

| Net Income | -25.55M | -42.46M | -33.69M | -22.94M | -57.01M | -139.34K | -83.97K | -107.81K | -59.16K | -385.08K | -731.59K | -594.40K | 673.17K | -642.05K | -3.88M | -1.73M | -2.21M | -44.75K | -54.76K |

| Net Income Ratio | -28.99% | -56.89% | -61.88% | -46.62% | -190.31% | -0.75% | -0.77% | -2.53% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| EPS | -0.19 | -0.33 | -0.27 | -0.24 | -0.71 | -0.22 | -0.22 | -0.32 | -0.18 | -1.16 | -2.74 | -3.17 | 23.86 | -32.20 | -230.72 | -116.45 | -243.38 | -8.25 | -81.73 |

| EPS Diluted | -0.19 | -0.33 | -0.27 | -0.24 | -0.71 | -0.22 | -0.22 | -0.32 | -0.18 | -1.16 | -2.74 | -3.17 | 23.86 | -32.20 | -230.72 | -116.45 | -243.38 | -8.25 | -81.73 |

| Weighted Avg Shares Out | 135.24M | 128.13M | 123.81M | 97.55M | 80.82M | 641.97K | 380.18K | 332.73K | 332.73K | 332.73K | 267.43K | 187.59K | 28.22K | 19.94K | 16.81K | 14.86K | 9.07K | 5.43K | 670.00 |

| Weighted Avg Shares Out (Dil) | 135.24M | 128.13M | 123.81M | 97.55M | 80.82M | 641.97K | 380.18K | 332.73K | 332.73K | 332.73K | 267.43K | 187.59K | 28.22K | 19.94K | 16.81K | 14.86K | 9.07K | 5.43K | 670.00 |

Goodness Growth Holdings: Top Pick For Near-Term Investment

Best Marijuana Stocks To Watch Under $2 Right Now

Marijuana Penny Stocks To Watch In The Second Half Of December

Goodness Growth: Waiting On New York

Making The Case For Mid-Tier MSOs (Podcast)

The Best Marijuana Stocks To Buy? 2 To Watch For Better Trading

Best Marijuana Penny Stocks To Watch Today? 2 For Your Watchlist While Pot Stocks Are Down

Goodness Growth Wraps Up $8M Acquisition Of Maryland Dispensary

Marijuana Stocks Vs Federal Cannabis Reform

Goodness Growth Holdings, Inc. (GDNSF) CEO Kyle Kingsley on Q3 2021 Earnings Call Transcript

Source: https://incomestatements.info

Category: Stock Reports