Complete financial analysis of Great Elm Capital Corp. (GECC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Great Elm Capital Corp., a leading company in the Asset Management industry within the Financial Services sector.

- Equitas Holdings Limited (EQUITAS.NS) Income Statement Analysis – Financial Results

- Sugita Ace Co.,Ltd. (7635.T) Income Statement Analysis – Financial Results

- Transcorp International Limited (TRANSCOR.BO) Income Statement Analysis – Financial Results

- K3I CO LTD (431190.KQ) Income Statement Analysis – Financial Results

- Calbee, Inc. (2229.T) Income Statement Analysis – Financial Results

Great Elm Capital Corp. (GECC)

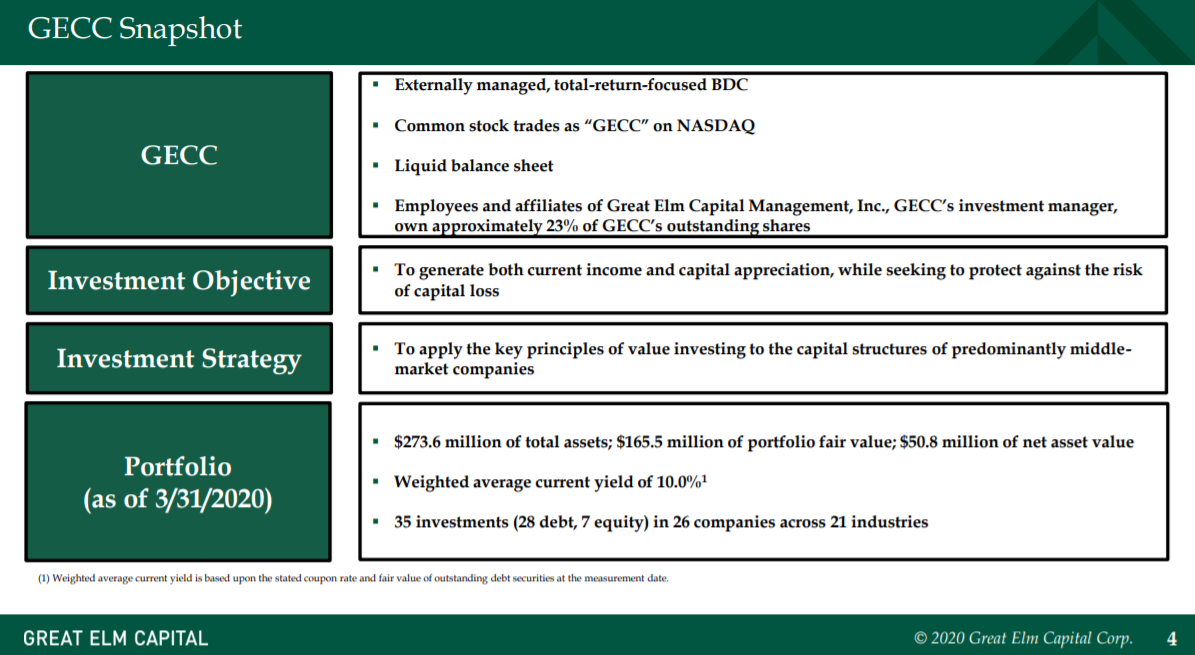

About Great Elm Capital Corp.

Great Elm Capital Corp. is a business development company which specializes in loan and mezzanine, middle market investments. It invests in the debt instruments of middle market companies. The fund prefers to invest in media, commercial services and supplies, healthcare, telecommunication services, communications equipment. It typically makes equity investments between $3 million and $10 million in companies with revenues between $3 million and $75 million.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 35.83M | -16.08M | -6.59M | -28.87M | -4.77M | -5.35M | 668.00K | 1.41M | -6.59M | -4.45M | -5.67M | 5.84M | 4.40M | 3.88M |

| Cost of Revenue | 8.70M | -93.00K | -414.00K | 4.31M | 6.73M | 4.59M | 8.19M | 1.41M | 0.00 | 3.39M | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 27.13M | -15.98M | -6.18M | -33.18M | -11.50M | -9.94M | -7.52M | -2.00K | -6.59M | -7.84M | -5.67M | 5.84M | 4.40M | 3.88M |

| Gross Profit Ratio | 75.73% | 99.42% | 93.72% | 114.94% | 241.13% | 185.87% | -1,125.45% | -0.14% | 100.00% | 176.18% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.15 | -0.65 | -2.68 | -0.26 | -0.29 | -0.08 | -12.64 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 4.58M | 4.11M | 3.63M | 3.07M | 2.57M | 3.48M | 3.23M | 2.77M | 4.08M | 2.17M | 1.96M | 2.03M | 2.03M | 1.54M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 4.58M | 4.11M | 3.63M | 3.07M | 2.57M | 3.48M | 3.23M | -12.70 | 4.08M | 2.17M | 1.96M | 2.03M | 2.03M | 1.54M |

| Other Expenses | 0.00 | 96.88M | -15.83M | -31.65M | -21.31M | -5.65M | -20.33M | -420.00K | -15.99M | -13.81M | -13.65M | -1.58M | 0.00 | 0.00 |

| Operating Expenses | 11.25M | -744.00K | 3.63M | 3.07M | 2.57M | 3.48M | 3.30M | 34.80M | 3.11M | 752.66K | 1.96M | 2.04M | 1.72M | 999.55K |

| Cost & Expenses | 11.25M | -744.00K | 3.63M | 3.07M | 2.57M | 3.48M | 3.30M | 34.80M | 3.11M | 752.66K | 1.96M | 2.04M | 1.72M | 999.55K |

| Interest Income | 28.90M | 18.68M | 19.92M | 19.21M | 24.20M | 27.33M | 28.92M | 630.00K | 14.17M | 16.96M | 11.15M | 10.49M | 8.98M | 7.00M |

| Interest Expense | 11.74M | 10.69M | 10.43M | 9.13M | 7.64M | 5.65M | 2.04M | 0.00 | 3.80M | 4.31M | 2.69M | 1.85M | 889.06K | 525.98K |

| Depreciation & Amortization | 0.00 | -96.98M | 15.41M | 35.96M | 35.68M | 39.00M | 35.99M | 19.19M | 0.00 | -12.96M | -8.78M | -7.26M | 0.00 | 0.00 |

| EBITDA | 0.00 | -15.33M | 17.31M | 17.04M | 22.38M | 24.71M | 26.62M | 1.41M | -9.70M | -5.20M | -7.62M | 0.00 | 2.68M | 2.88M |

| EBITDA Ratio | 0.00% | 95.37% | 155.12% | 110.65% | 153.84% | 164.95% | -393.71% | -2,320.90% | 147.24% | 116.92% | 134.53% | 65.08% | 60.89% | 74.25% |

| Operating Income | 24.57M | -15.33M | -10.23M | -31.94M | -7.34M | -8.83M | -2.63M | 5.98M | -9.70M | -5.20M | -7.62M | 3.80M | 2.68M | 2.88M |

| Operating Income Ratio | 68.59% | 95.37% | 155.12% | 110.65% | 153.84% | 164.95% | -393.71% | 424.73% | 147.24% | 116.92% | 134.53% | 65.08% | 60.89% | 74.25% |

| Total Other Income/Expenses | 1.05M | 0.00 | -10.43M | -27.63M | 6.73M | -3.55M | 8.19M | -8.89M | 0.00 | -18.16M | -13.65M | -3.45M | -4.83M | -961.47K |

| Income Before Tax | 25.62M | -15.33M | -10.23M | -31.94M | -7.34M | -8.83M | -2.63M | -17.37M | -9.70M | -5.20M | -7.62M | 3.80M | 2.68M | 2.88M |

| Income Before Tax Ratio | 71.51% | 95.37% | 155.12% | 110.65% | 153.84% | 164.95% | -393.71% | -1,234.26% | 147.24% | 116.92% | 134.53% | 65.08% | 60.89% | 74.25% |

| Income Tax Expense | 287.00K | 252.00K | 48.00K | 17.00K | 209.00K | 180.00K | 124.00K | -17.37M | 0.00 | 8.61M | -7.62M | 4.37K | 0.00 | 0.00 |

| Net Income | 25.33M | -15.58M | -10.28M | -31.96M | -7.55M | -9.01M | -2.75M | -17.79M | -9.70M | -5.20M | -7.62M | 3.80M | 2.68M | 2.88M |

| Net Income Ratio | 70.71% | 96.94% | 155.85% | 110.71% | 158.22% | 168.32% | -412.28% | -1,264.11% | 147.24% | 116.92% | 134.53% | 65.08% | 60.89% | 74.25% |

| EPS | 3.33 | -2.49 | -2.52 | -14.41 | -4.42 | -5.07 | -1.42 | -6.33 | -2.57 | -2.11 | -5.26 | 3.25 | 2.48 | 3.23 |

| EPS Diluted | 3.33 | -2.49 | -2.52 | -14.41 | -4.42 | -5.07 | -1.42 | -6.08 | -2.57 | -2.11 | -5.26 | 3.25 | 2.48 | 3.23 |

| Weighted Avg Shares Out | 7.60M | 6.25M | 4.07M | 2.22M | 1.71M | 1.78M | 1.94M | 2.81M | 3.78M | 2.47M | 1.45M | 1.17M | 1.08M | 891.79K |

| Weighted Avg Shares Out (Dil) | 7.60M | 6.25M | 4.07M | 2.22M | 1.71M | 1.78M | 1.94M | 2.93M | 3.78M | 2.47M | 1.45M | 1.17M | 1.08M | 891.79K |

The Top Monthly Pay Dividend Stocks And Funds For August

Saudi information security firm Elm to acquire Tabadul

Your Top Monthly Pay Dividend Stocks And Funds In July

Monthly Dividend Stock In Focus: Great Elm Capital - Sure Dividend

Great Elm Capital Corp (NASDAQ:GECC) Short Interest Up 84.7% in June

Great Elm Capital Group (NASDAQ:GEC) versus Magic Software Enterprises (NASDAQ:MGIC) Critical Review

Great Elm Capital (NASDAQ:GECC) Trading 0.5% Higher

Top Monthly-Paying Dividend Stocks And Funds For June

Source: https://incomestatements.info

Category: Stock Reports