Complete financial analysis of Graham Corporation (GHM) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Graham Corporation, a leading company in the Industrial – Machinery industry within the Industrials sector.

- Japan Airlines Co., Ltd. (JAPSY) Income Statement Analysis – Financial Results

- GTN Industries Limited (GTNIND.NS) Income Statement Analysis – Financial Results

- Metals One PLC (MET1.L) Income Statement Analysis – Financial Results

- Carnival Corporation & plc (0EV1.L) Income Statement Analysis – Financial Results

- NewOcean Energy Holdings Limited (0342.HK) Income Statement Analysis – Financial Results

Graham Corporation (GHM)

About Graham Corporation

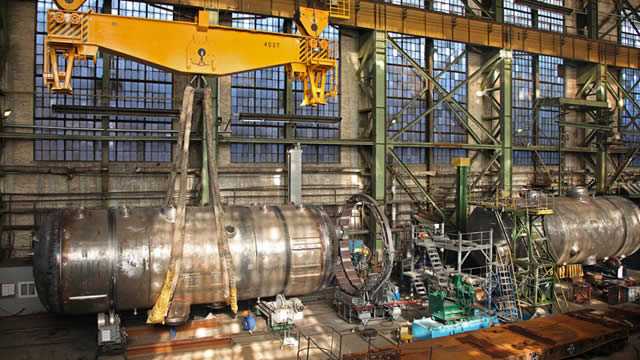

Graham Corporation, together with its subsidiaries, designs and manufactures fluid, power, heat transfer, and vacuum equipment for chemical and petrochemical processing, defense, space, petroleum refining, cryogenic, energy, and other industries. It offers power plant systems comprising ejectors and surface condensers; torpedo ejection and power systems, such as turbines, alternators, regulators, pumps, and blowers; and thermal management systems, including pumps, blowers, and electronics. The company also provides rocket propulsion systems, such as turbopumps and fuel pumps; cooling systems comprising pumps, compressors, fans, and blowers; and life support systems, including fans, pumps, and blowers. In addition, it offers heat transfer and vacuum systems comprising ejectors, process condensers, surface condensers, liquid ring pumps, heat exchangers, and nozzles, as well as turbomachinery products; and power generation systems, including turbines, generators, compressors, and pumps. The company also services and sells spare parts for its equipment. It sells its products directly in the United States, the Middle East, Canada, Asia, South America, and internationally. Graham Corporation was founded in 1936 and is headquartered in Batavia, New York.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 185.53M | 43.03M | 122.81M | 97.49M | 90.60M | 91.83M | 77.53M | 91.77M | 90.04M | 135.17M | 102.22M | 104.97M | 103.19M | 74.24M | 62.19M | 101.11M | 86.43M | 65.82M | 55.21M | 41.33M | 43.32M | 49.38M | 47.40M | 44.43M | 38.73M | 53.00M | 56.20M | 51.40M | 49.50M | 47.40M | 61.30M | 62.70M | 70.70M | 77.90M | 67.80M | 62.40M | 59.40M | 54.20M | 76.90M |

| Cost of Revenue | 144.95M | 35.87M | 113.69M | 77.02M | 72.46M | 69.92M | 60.20M | 69.61M | 66.78M | 93.37M | 70.41M | 73.15M | 70.55M | 52.38M | 39.96M | 59.40M | 52.27M | 49.00M | 39.25M | 33.79M | 35.77M | 40.03M | 37.32M | 34.64M | 27.71M | 37.10M | 37.10M | 35.10M | 35.60M | 34.00M | 45.70M | 49.90M | 50.30M | 58.40M | 49.00M | 44.60M | 45.90M | 41.20M | 62.50M |

| Gross Profit | 40.59M | 7.16M | 9.13M | 20.47M | 18.15M | 21.91M | 17.33M | 22.16M | 23.26M | 41.80M | 31.81M | 31.82M | 32.64M | 21.85M | 22.23M | 41.71M | 34.16M | 16.82M | 15.96M | 7.54M | 7.55M | 9.35M | 10.08M | 9.80M | 11.01M | 15.90M | 19.10M | 16.30M | 13.90M | 13.40M | 15.60M | 12.80M | 20.40M | 19.50M | 18.80M | 17.80M | 13.50M | 13.00M | 14.40M |

| Gross Profit Ratio | 21.87% | 16.63% | 7.43% | 21.00% | 20.03% | 23.86% | 22.35% | 24.15% | 25.83% | 30.93% | 31.12% | 30.31% | 31.63% | 29.43% | 35.75% | 41.25% | 39.53% | 25.55% | 28.91% | 18.24% | 17.43% | 18.94% | 21.26% | 22.05% | 28.44% | 30.00% | 33.99% | 31.71% | 28.08% | 28.27% | 25.45% | 20.41% | 28.85% | 25.03% | 27.73% | 28.53% | 22.73% | 23.99% | 18.73% |

| Research & Development | 3.94M | 4.14M | 3.85M | 3.37M | 3.35M | 3.54M | 3.21M | 3.86M | 3.75M | 3.59M | 3.44M | 3.58M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 23.06M | 20.39M | 17.47M | 16.87M | 17.64M | 15.41M | 14.62M | 16.33M | 18.28M | 16.97M | 16.33M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | -15.83M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 32.22M | 7.24M | 20.39M | 17.47M | 16.87M | 17.64M | 15.41M | 14.62M | 16.33M | 18.28M | 16.97M | 16.33M | 15.54M | 13.01M | 12.09M | 14.83M | 13.07M | 10.34M | 9.82M | 7.69M | 9.78M | 10.20M | 10.44M | 9.49M | 8.94M | 11.80M | 12.40M | 11.10M | 10.00M | 10.10M | 13.00M | 14.20M | 14.50M | 15.10M | 13.10M | 13.00M | 11.80M | 10.50M | 13.10M |

| Other Expenses | 0.00 | 274.00K | 86.00K | 113.00K | 628.00K | 823.00K | 236.00K | 234.00K | 1.79M | 229.00K | 222.00K | 228.00K | 219.00K | 67.00K | 0.00 | 559.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.05M | 1.00M | 1.00M | 900.00K | 900.00K | 1.00M | 1.40M | 1.40M | 1.40M | 1.20M | 1.20M | 1.00M | 1.00M | 700.00K | 1.60M |

| Operating Expenses | 33.66M | 7.51M | 20.47M | 17.47M | 17.50M | 17.88M | 15.65M | 14.86M | 16.57M | 18.51M | 17.20M | 16.56M | 15.54M | 13.08M | 12.19M | 15.38M | 13.07M | 10.34M | 9.82M | 7.69M | 9.78M | 10.20M | 10.44M | 9.49M | 9.99M | 12.80M | 13.40M | 12.00M | 10.90M | 11.10M | 14.40M | 15.60M | 15.90M | 16.30M | 14.30M | 14.00M | 12.80M | 11.20M | 14.70M |

| Cost & Expenses | 178.61M | 43.38M | 134.16M | 94.49M | 89.95M | 87.80M | 75.85M | 84.47M | 83.35M | 111.88M | 87.60M | 89.71M | 86.09M | 65.46M | 52.15M | 74.78M | 65.34M | 59.34M | 49.07M | 41.48M | 45.56M | 50.23M | 47.76M | 44.13M | 37.71M | 49.90M | 50.50M | 47.10M | 46.50M | 45.10M | 60.10M | 65.50M | 66.20M | 74.70M | 63.30M | 58.60M | 58.70M | 52.40M | 77.20M |

| Interest Income | 0.00 | 58.00K | 50.00K | 167.00K | 1.32M | 1.46M | 606.00K | 386.00K | 261.00K | 189.00K | 94.00K | 315.00K | 58.00K | 77.00K | 55.00K | 416.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 248.00K | 300.00K | 450.00K | 11.00K | 12.00K | 12.00K | 12.00K | 10.00K | 10.00K | 11.00K | 1.00K | 264.00K | 476.00K | 92.00K | 36.00K | 5.00K | 0.00 | 10.00K | 17.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 5.43M | 5.99M | 5.60M | 1.95M | 1.97M | 2.21M | 2.22M | 2.33M | 2.44M | 2.31M | 2.20M | 2.08M | 2.02M | 1.65M | 1.80M | 1.11M | 989.00K | 887.00K | 793.00K | 780.00K | 1.04M | 911.00K | 956.00K | 948.00K | 1.05M | 1.00M | 1.00M | 900.00K | 900.00K | 1.00M | 1.40M | 1.40M | 1.40M | 1.20M | 1.20M | 1.00M | 1.00M | 700.00K | 1.60M |

| EBITDA | 11.25M | 7.62M | -5.17M | 5.22M | 4.29M | 2.07M | -10.62M | 9.39M | 11.18M | 24.07M | 16.91M | 16.37M | 19.12M | 10.50M | 11.22M | 27.86M | 22.08M | 7.37M | 7.31M | 629.00K | -1.12M | -62.00K | 594.00K | 1.25M | 2.07M | 4.10M | 6.70M | 5.20M | 3.90M | 3.30M | 2.60M | -1.40M | 5.90M | 4.40M | 5.70M | 4.80M | 1.70M | 2.50M | 1.30M |

| EBITDA Ratio | 6.07% | 13.38% | -4.21% | 5.07% | 4.74% | 9.28% | 5.82% | 10.91% | 12.41% | 19.08% | 16.54% | 16.52% | 18.58% | 14.14% | 19.13% | 27.55% | 25.54% | 11.12% | 13.23% | 0.21% | -3.97% | -2.20% | -7.16% | 2.81% | 10.26% | 7.74% | 11.92% | 10.12% | 8.48% | 10.13% | 3.75% | -11.00% | 8.35% | 5.65% | 7.23% | 7.69% | 2.86% | 2.58% | 4.03% |

| Operating Income | 6.92M | -232.00K | -11.34M | 3.00M | 2.32M | -2.42M | -13.45M | 6.67M | 8.48M | 21.57M | 14.62M | 15.26M | 17.10M | 8.78M | 10.04M | 26.74M | 21.09M | 6.48M | 6.14M | -151.00K | -2.23M | -852.00K | -362.00K | 302.00K | 1.02M | 3.10M | 5.70M | 4.30M | 3.00M | 2.30M | 1.20M | -2.80M | 4.50M | 3.20M | 4.50M | 3.80M | 700.00K | 1.80M | -300.00K |

| Operating Income Ratio | 3.73% | -0.54% | -9.24% | 3.08% | 2.57% | -2.63% | -17.34% | 7.27% | 9.42% | 15.96% | 14.30% | 14.54% | 16.57% | 11.82% | 16.15% | 26.45% | 24.40% | 9.85% | 11.12% | -0.37% | -5.16% | -1.73% | -0.76% | 0.68% | 2.64% | 5.85% | 10.14% | 8.37% | 6.06% | 4.85% | 1.96% | -4.47% | 6.36% | 4.11% | 6.64% | 6.09% | 1.18% | 3.32% | -0.39% |

| Total Other Income/Expenses | -1.35M | -689.00K | 127.00K | 269.00K | 695.00K | -4.41M | -14.06M | -244.00K | 2.04M | -1.54M | 93.00K | 87.00K | -418.00K | -15.00K | -77.00K | -148.00K | 1.02M | 38.00K | -388.00K | 510.00K | 476.00K | 1.10M | 3.84M | -328.00K | -2.13M | -278.00K | -206.00K | -400.00K | -900.00K | -2.10M | -600.00K | 4.70M | -1.10M | -1.20M | -500.00K | -1.50M | -1.40M | -500.00K | -3.70M |

| Income Before Tax | 5.57M | -532.00K | -11.22M | 3.27M | 2.31M | -145.00K | -12.85M | 7.05M | 8.73M | 21.75M | 14.71M | 15.58M | 16.68M | 8.76M | 10.06M | 26.74M | 22.10M | 6.52M | 5.75M | 359.00K | 1.85M | 192.00K | 3.48M | -26.00K | -1.11M | 2.80M | 5.50M | 4.00M | 2.10M | 200.00K | 600.00K | 1.90M | 3.40M | 2.00M | 4.00M | 2.30M | -700.00K | 1.30M | -4.00M |

| Income Before Tax Ratio | 3.00% | -1.24% | -9.13% | 3.35% | 2.55% | -0.16% | -16.58% | 7.68% | 9.70% | 16.09% | 14.39% | 14.84% | 16.16% | 11.80% | 16.18% | 26.45% | 25.58% | 9.90% | 10.42% | 0.87% | 4.26% | 0.39% | 7.34% | -0.06% | -2.87% | 5.28% | 9.79% | 7.78% | 4.24% | 0.42% | 0.98% | 3.03% | 4.81% | 2.57% | 5.90% | 3.69% | -1.18% | 2.40% | -5.20% |

| Income Tax Expense | 1.02M | -51.00K | -2.44M | 893.00K | 440.00K | 163.00K | -3.01M | 2.03M | 2.60M | 7.02M | 4.57M | 4.43M | 6.12M | 2.89M | 3.70M | 9.27M | 7.07M | 758.00K | 2.17M | 63.00K | -777.00K | 59.00K | 1.17M | -221.00K | -280.00K | 400.00K | 1.70M | 900.00K | 800.00K | 200.00K | 200.00K | 600.00K | 900.00K | 700.00K | 300.00K | 500.00K | -100.00K | 200.00K | 200.00K |

| Net Income | 4.56M | -481.00K | -8.77M | 2.37M | 1.87M | -308.00K | -9.84M | 5.02M | 6.13M | 14.74M | 10.15M | 11.15M | 10.55M | 5.87M | 6.36M | 17.47M | 15.03M | 5.76M | 3.59M | -2.91M | -1.07M | 133.00K | 2.31M | 195.00K | -833.00K | 2.40M | 3.80M | 3.10M | 1.10M | -8.40M | 400.00K | 1.50M | 800.00K | 1.30M | 4.20M | 500.00K | -1.10M | -1.20M | -4.20M |

| Net Income Ratio | 2.46% | -1.12% | -7.14% | 2.44% | 2.07% | -0.34% | -12.70% | 5.47% | 6.81% | 10.90% | 9.92% | 10.62% | 10.23% | 7.91% | 10.23% | 17.28% | 17.39% | 8.75% | 6.50% | -7.03% | -2.47% | 0.27% | 4.86% | 0.44% | -2.15% | 4.53% | 6.76% | 6.03% | 2.22% | -17.72% | 0.65% | 2.39% | 1.13% | 1.67% | 6.19% | 0.80% | -1.85% | -2.21% | -5.46% |

| EPS | 0.42 | -0.05 | -0.83 | 0.24 | 0.19 | -0.03 | -1.01 | 0.52 | 0.61 | 1.46 | 1.01 | 1.11 | 1.06 | 0.59 | 0.64 | 1.72 | 1.52 | 0.47 | 0.39 | -0.17 | -0.07 | 0.01 | 0.28 | 0.01 | -0.11 | 0.30 | 0.45 | 0.16 | 0.14 | -0.28 | 0.01 | 0.05 | 0.03 | 0.04 | 0.15 | 0.02 | -0.15 | -0.16 | -0.57 |

| EPS Diluted | 0.42 | -0.05 | -0.83 | 0.24 | 0.19 | -0.03 | -1.01 | 0.52 | 0.61 | 1.45 | 1.00 | 1.11 | 1.06 | 0.59 | 0.64 | 1.71 | 1.49 | 0.47 | 0.38 | -0.17 | -0.07 | 0.01 | 0.28 | 0.01 | -0.11 | 0.29 | 0.44 | 0.15 | 0.14 | -0.28 | 0.01 | 0.05 | 0.03 | 0.04 | 0.15 | 0.02 | -0.15 | -0.16 | -0.57 |

| Weighted Avg Shares Out | 10.74M | 10.61M | 10.54M | 9.96M | 9.88M | 9.82M | 9.75M | 9.72M | 9.98M | 10.12M | 10.07M | 10.03M | 9.96M | 9.92M | 9.90M | 10.13M | 9.91M | 12.17M | 9.13M | 16.82M | 16.47M | 8.36M | 8.23M | 7.80M | 7.57M | 8.11M | 8.37M | 7.93M | 7.90M | 29.51M | 7.84M | 7.84M | 9.87M | 7.70M | 7.35M | 7.34M | 7.34M | 7.34M | 7.34M |

| Weighted Avg Shares Out (Dil) | 10.84M | 10.65M | 10.54M | 9.96M | 9.88M | 9.82M | 9.76M | 9.73M | 9.98M | 10.14M | 10.10M | 10.05M | 10.00M | 9.96M | 9.94M | 10.20M | 10.08M | 12.31M | 9.34M | 17.17M | 16.47M | 16.72M | 8.35M | 16.13M | 7.57M | 8.22M | 8.60M | 7.93M | 7.90M | 29.51M | 7.84M | 7.84M | 9.87M | 7.70M | 7.35M | 7.34M | 7.34M | 7.34M | 7.34M |

Forget Profit, Bet on 4 Stocks With Increasing Cash Flows

Looking for a Growth Stock? 3 Reasons Why Graham (GHM) is a Solid Choice

Are Industrial Products Stocks Lagging Graham (GHM) This Year?

Recent Price Trend in Graham (GHM) is Your Friend, Here's Why

Graham Corporation to Present at the Noble Capital Markets Conference

5 Stocks With Recent Price Strength to Enhance Your Portfolio

Scoop Up Big Gains With 4 Stocks Witnessing Rise in Cash Flow

Graham Corporation to Present at the Southwest IDEAS Conference

Pick These 4 Solid Net Profit Margin Stocks to Boost Portfolio Returns

3 Reasons Why Graham (GHM) Is a Great Growth Stock

Source: https://incomestatements.info

Category: Stock Reports