See more : China Smartpay Group Holdings Limited (8325.HK) Income Statement Analysis – Financial Results

Complete financial analysis of PGIM Global High Yield Fund, Inc (GHY) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of PGIM Global High Yield Fund, Inc, a leading company in the Asset Management – Global industry within the Financial Services sector.

- DMS Imaging SA (0RGO.L) Income Statement Analysis – Financial Results

- PT Palma Serasih Tbk (PSGO.JK) Income Statement Analysis – Financial Results

- GO Acquisition Corp. (GOAC) Income Statement Analysis – Financial Results

- AmTrust Financial Services, Inc. (AFSIM) Income Statement Analysis – Financial Results

- Polygon Real Estate Ltd (POLY.TA) Income Statement Analysis – Financial Results

PGIM Global High Yield Fund, Inc (GHY)

Industry: Asset Management - Global

Sector: Financial Services

About PGIM Global High Yield Fund, Inc

PGIM Global Short Duration High Yield Fund, Inc. is a closed ended fixed income mutual fund launched and managed by PGIM Investments LLC. The fund is co-managed by PGIM Fixed Income. It invests in fixed income markets across the globe. The fund primarily invests in high yield fixed income instruments of varying maturities that are rated Ba1 or lower by Moody's Investors Service, Inc. or BB+ or lower by Standard & Poor's Ratings Services. It seeks to maintain a weighted average maturity of five years or less. PGIM Global Short Duration High Yield Fund, Inc. was formed on December 26, 2012 and is domiciled in the United States.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 68.22M | 35.65M | -96.56M | 101.70M | 5.16M | 64.00M | 26.50M | 49.06M | 32.32M | 58.66M | 62.87M | 32.29M |

| Cost of Revenue | 5.82M | 5.46M | 6.93M | 7.99M | 7.58M | 8.14M | 8.09M | 8.32M | 8.22M | 11.42M | 12.18M | 6.24M |

| Gross Profit | 62.40M | 30.18M | -103.49M | 93.71M | -2.42M | 55.86M | 18.41M | 40.75M | 24.10M | 47.23M | 50.69M | 26.05M |

| Gross Profit Ratio | 91.47% | 84.67% | 107.18% | 92.14% | -46.82% | 87.28% | 69.47% | 83.05% | 74.57% | 80.53% | 80.63% | 80.68% |

| Research & Development | 0.00 | 1.08 | -1.22 | 5.15 | 0.05 | 1.02 | 0.51 | 1.32 | 1.07 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 377.10K | 368.84K | 496.80K | 562.94K | 439.19K | 462.49K | 464.74K | 388.12K | 279.00K | 127.00K | 130.00K | 120.00K |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -279.00K | 0.00 | 0.00 | 0.00 |

| SG&A | 377.10K | 368.84K | 496.80K | 562.94K | 439.19K | 462.49K | 464.74K | 388.12K | 1.07 | 127.00K | 130.00K | 120.00K |

| Other Expenses | 22.50K | 17.59M | 19.49K | 21.58K | 95.18K | 110.65K | 17.25K | 314.00K | 40.92M | 40.07K | 40.00K | 10.00K |

| Operating Expenses | 399.60K | 653.88K | 516.30K | 584.52K | 534.37K | 573.14K | 481.99K | 702.12K | -14.18M | 167.07K | 170.00K | 130.00K |

| Cost & Expenses | 6.22M | 653.88K | 516.30K | 584.52K | 534.37K | 573.14K | 481.99K | 702.12K | 24.10M | 11.59M | 12.35M | 6.37M |

| Interest Income | 49.80M | 45.75M | 46.65M | 54.88M | 57.54M | 54.00M | 49.53M | 52.80M | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 9.11M | 5.77M | 1.96M | 2.21M | 4.76M | 8.43M | 6.05M | 4.33M | 3.04M | -31.85M | 400.00K | -9.96M |

| Depreciation & Amortization | 0.00 | 167.90K | 228.49K | 236.56K | 206.30K | 171.86K | 161.14K | 52.52K | -14.84M | -63.69M | 790.00K | -19.92M |

| EBITDA | 81.62M | 34.99M | -95.11M | 101.11M | -4.90M | 63.43M | 25.52M | 52.70M | 35.25M | -16.63M | 51.32M | 6.00M |

| EBITDA Ratio | 119.64% | 98.17% | 98.50% | 99.43% | 89.64% | 99.10% | 121.00% | 107.40% | -9.06% | -28.35% | 81.63% | 18.58% |

| Operating Income | 81.62M | 34.99M | -95.11M | 101.11M | 4.62M | 63.43M | 32.06M | 52.70M | 38.28M | 47.07M | 50.53M | 25.92M |

| Operating Income Ratio | 119.64% | 98.17% | 98.50% | 99.43% | 89.64% | 99.10% | 121.00% | 107.40% | 118.46% | 80.24% | 80.37% | 80.27% |

| Total Other Income/Expenses | -13.80M | 0.00 | -1.96M | 0.00 | 7.58M | 0.00 | 498.31K | 3.17M | -3.69M | -31.85M | 390.00K | -9.96M |

| Income Before Tax | 67.82M | 34.99M | -97.07M | 101.11M | 4.62M | 63.43M | 26.02M | 48.36M | 34.60M | 15.22M | 50.92M | 15.96M |

| Income Before Tax Ratio | 99.41% | 98.17% | 100.53% | 99.43% | 89.64% | 99.10% | 98.18% | 98.57% | 107.06% | 25.95% | 80.99% | 49.43% |

| Income Tax Expense | 0.00 | 44.51M | -90.85M | 97.45M | 11.54M | 72.16M | -161.14K | -52.52K | 3.73M | 0.00 | 0.00 | 0.00 |

| Net Income | 67.82M | 34.99M | -97.07M | 101.11M | 4.62M | 63.43M | 26.02M | 48.36M | 38.28M | 15.22M | 50.92M | 15.96M |

| Net Income Ratio | 99.41% | 98.17% | 100.53% | 99.43% | 89.64% | 99.10% | 98.18% | 98.57% | 118.46% | 25.95% | 80.99% | 49.43% |

| EPS | 1.66 | 0.86 | -2.37 | 2.47 | 0.11 | 1.55 | 0.64 | 1.18 | 1.11 | 0.37 | 1.24 | 0.39 |

| EPS Diluted | 1.66 | 0.86 | -2.37 | 2.47 | 0.11 | 1.55 | 0.64 | 1.18 | 45.28M | 0.37 | 1.24 | 0.39 |

| Weighted Avg Shares Out | 40.92M | 40.92M | 40.92M | 40.94M | 40.92M | 40.92M | 40.65M | 40.92M | 34.60M | 40.92M | 40.92M | 40.92M |

| Weighted Avg Shares Out (Dil) | 40.86M | 40.92M | 40.92M | 40.94M | 40.92M | 40.92M | 40.65M | 40.99M | 0.85 | 40.92M | 40.92M | 40.92M |

PGIM Investments to Host Closed-End Fund Conference Call

Income Factory Return Of 24.5% Is Great, But The 12.75% Cash Distribution Really Excites Me

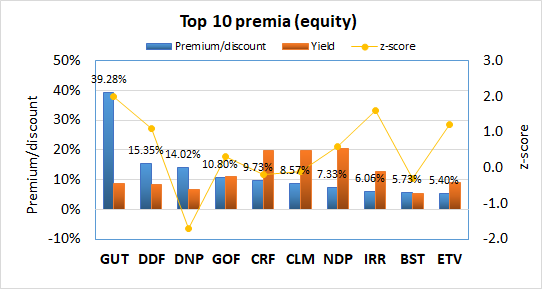

The Chemist's Closed-End Fund Report - April 2019: Treading Water

Keppel REIT Buys PGIM Office Asset for $221M to Break into Seoul Market

Singapore’s Frasers Appoints Former PGIM Exec to Run FCT Retail REIT

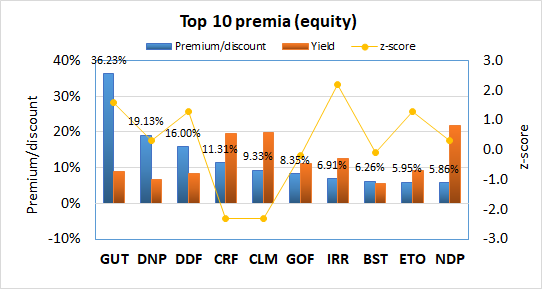

The Chemist's Closed-End Fund Report - March 2019: Fixed Income CEFs Strike Back

Nonfarm payrolls increase by 313,000 in February vs. 200,000 est.

Source: https://incomestatements.info

Category: Stock Reports