See more : Banny Cosmic International Holdings, Inc. (CMHZ) Income Statement Analysis – Financial Results

Complete financial analysis of GigaMedia Limited (GIGM) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of GigaMedia Limited, a leading company in the Electronic Gaming & Multimedia industry within the Technology sector.

- Golden Heaven Group Holdings Ltd. (GDHG) Income Statement Analysis – Financial Results

- KSK Energy Ventures Limited (KSK.NS) Income Statement Analysis – Financial Results

- Misen Energy AB (publ) (MISE.ST) Income Statement Analysis – Financial Results

- Heads UP Ventures Limited (HEADSUP.NS) Income Statement Analysis – Financial Results

- Nerds on Site Inc. (NERD.CN) Income Statement Analysis – Financial Results

GigaMedia Limited (GIGM)

About GigaMedia Limited

GigaMedia Limited, together with its subsidiaries, provides digital entertainment services in Taiwan and Hong Kong. The company operates FunTown, a digital entertainment portal that offers mobile and browser-based casual games through branded platform. It offers MahJong, a traditional Chinese tile-based game; casual card and table games; online card games; and chance-based games, including bingo, lotto, horse racing, Sic-Bo, slots, and various casual games. It also provides role-playing and sports games, such as Tales Runner, a multi-player online obstacle running game; Yume 100, a story-based game that targets female players; Akaseka, a female-oriented game; and Shinobi Master New Link, a male-oriented game. GigaMedia Limited was founded in 1998 and is headquartered in Taipei, Taiwan.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 4.29M | 5.59M | 5.49M | 6.88M | 6.65M | 7.10M | 11.60M | 8.97M | 10.25M | 9.78M | 15.03M | 27.47M | 34.39M | 64.68M | 159.58M | 190.37M | 166.88M | 94.29M | 44.19M | 99.82M | 96.44M | 73.65M | 11.74M | 10.31M |

| Cost of Revenue | 1.85M | 2.33M | 2.58M | 2.96M | 3.06M | 3.59M | 5.10M | 4.14M | 8.89M | 7.84M | 7.58M | 11.39M | 15.31M | 21.11M | 36.89M | 35.17M | 35.54M | 23.33M | 17.38M | 68.21M | 84.31M | 66.89M | 51.21M | 29.73M |

| Gross Profit | 2.45M | 3.25M | 2.91M | 3.92M | 3.58M | 3.52M | 6.50M | 4.83M | 1.36M | 1.94M | 7.45M | 16.08M | 19.09M | 43.57M | 122.69M | 155.20M | 131.33M | 70.96M | 26.80M | 31.61M | 12.13M | 6.76M | -39.47M | -19.42M |

| Gross Profit Ratio | 56.99% | 58.19% | 52.95% | 57.00% | 53.89% | 49.51% | 56.04% | 53.87% | 13.29% | 19.88% | 49.55% | 58.54% | 55.49% | 67.36% | 76.89% | 81.52% | 78.70% | 75.26% | 60.66% | 31.66% | 12.58% | 9.18% | -336.18% | -188.25% |

| Research & Development | 729.00K | 1.11M | 1.45M | 1.33M | 1.19M | 1.09M | 1.07M | 1.05M | 688.00K | 892.00K | 1.70M | 1.47M | 2.00M | 7.30M | 14.20M | 13.46M | 7.91M | 5.74M | 3.56M | 2.51M | 1.23M | 1.86M | 3.04M | 2.41M |

| General & Administrative | 3.24M | 3.51M | 3.70M | 3.12M | 3.18M | 3.68M | 3.53M | 3.49M | 5.76M | 6.38M | 6.32M | 13.38M | 20.39M | 31.78M | 29.69M | 25.04M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 1.62M | 1.64M | 1.73M | 1.62M | 2.00M | 3.30M | 3.99M | 5.51M | 8.66M | 6.71M | 4.82M | 8.38M | 10.69M | 21.59M | 79.42M | 74.17M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 4.87M | 5.16M | 5.43M | 4.74M | 5.18M | 6.98M | 7.52M | 9.00M | 14.42M | 13.09M | 11.14M | 21.76M | 31.08M | 53.37M | 109.11M | 99.21M | 85.33M | 43.26M | 18.88M | 25.83M | 22.92M | 19.35M | 14.32M | 27.22M |

| Other Expenses | 0.00 | 1.51K | 50.00K | 5.26K | -59.00K | 61.00K | -39.00K | 125.53K | -510.00K | 437.00K | 86.17K | 200.80K | 1.82M | 1.64M | 1.09M | 2.91M | 0.00 | 0.00 | 0.00 | 36.85M | 2.32M | 9.33M | 1.18M | 117.32K |

| Operating Expenses | 5.60M | 6.27M | 6.88M | 6.07M | 6.36M | 8.10M | 8.72M | 10.05M | 15.67M | 13.91M | 12.84M | 23.28M | 34.90M | 86.53M | 124.40M | 115.57M | 93.24M | 49.00M | 22.44M | 65.20M | 26.46M | 30.53M | 18.55M | 29.75M |

| Cost & Expenses | 7.45M | 8.61M | 9.46M | 9.03M | 9.43M | 11.68M | 13.82M | 14.19M | 24.55M | 21.74M | 20.42M | 34.67M | 50.21M | 107.65M | 161.29M | 150.74M | 128.79M | 72.33M | 39.82M | 133.41M | 110.77M | 97.42M | 69.76M | 59.48M |

| Interest Income | 1.81M | 718.29K | 252.00K | 613.02K | 1.48M | 1.30M | 602.00K | 302.52K | 333.00K | 682.00K | 237.73K | 282.75K | 766.84K | 956.00K | 432.00K | 1.46M | 1.44M | 722.00K | 411.00K | 170.00K | 424.00K | 1.01M | 928.17K | 5.65M |

| Interest Expense | 0.00 | 37.91K | 0.00 | 0.00 | 0.00 | 1.30M | 34.00K | 81.45K | 182.00K | 243.00K | 48.54K | 246.93K | 426.12K | 370.00K | 390.00K | 976.00K | 655.00K | 582.00K | 0.00 | 7.00K | 37.00K | 40.00K | 31.01K | 124.35K |

| Depreciation & Amortization | 55.00K | 33.00K | 20.00K | 8.00K | 108.00K | 136.00K | 55.00K | 273.00K | 534.00K | 1.51M | 2.32M | 3.43M | 4.39M | 4.87M | 9.58M | 8.37M | 6.40M | 6.04M | 6.41M | 7.22M | 7.55M | 8.47M | 34.83M | 18.09M |

| EBITDA | -3.10M | -2.99M | -3.95M | -2.14M | -2.70M | -3.06M | -472.00K | -6.52M | -1.38M | -2.77M | -32.84M | -9.48M | -41.81M | 34.68M | -45.62M | 46.13M | 44.49M | 28.01M | 10.77M | 9.70M | 377.00K | -15.30M | -23.19M | -31.08M |

| EBITDA Ratio | -72.23% | -39.04% | -76.24% | -34.20% | -18.81% | -43.37% | -14.04% | -72.66% | -136.92% | -105.32% | -30.20% | -23.59% | -182.92% | -89.52% | 5.15% | 24.40% | 25.42% | 18.51% | 19.17% | -25.07% | -1.17% | -11.05% | -239.91% | -369.70% |

| Operating Income | -3.16M | -3.02M | -3.97M | -2.15M | -2.78M | -4.82M | -490.00K | -7.13M | -20.52M | -13.36M | -38.48M | -20.57M | -24.11M | -47.70M | -40.06M | 38.10M | 38.09M | 21.96M | 4.37M | 3.02M | -14.33M | -23.77M | -58.02M | -49.17M |

| Operating Income Ratio | -73.51% | -54.08% | -72.23% | -31.31% | -41.87% | -67.92% | -4.23% | -79.48% | -200.16% | -136.63% | -256.01% | -74.89% | -70.10% | -73.74% | -25.10% | 20.02% | 22.83% | 23.29% | 9.88% | 3.02% | -14.86% | -32.27% | -494.14% | -476.73% |

| Total Other Income/Expenses | -244.00K | 269.00K | 549.00K | 859.00K | 1.15M | 1.39M | 1.64M | -2.00M | 11.70M | 8.41M | -29.25M | -5.56M | -29.65M | 50.17M | -53.88M | -1.32M | 2.48M | 10.69M | 2.71M | -1.14M | -2.58M | 3.13M | 6.26M | 7.05M |

| Income Before Tax | -3.40M | -3.06M | -3.43M | -1.29M | -1.66M | -3.19M | -585.00K | -7.22M | -1.82M | -5.38M | -34.68M | -12.92M | -71.87M | 8.67M | -55.59M | 36.78M | 40.57M | 32.65M | 7.08M | 2.08M | -17.27M | -20.64M | -51.76M | -42.12M |

| Income Before Tax Ratio | -79.19% | -54.75% | -62.36% | -18.81% | -24.97% | -44.97% | -5.04% | -80.43% | -17.79% | -54.97% | -230.73% | -47.05% | -208.97% | 13.40% | -34.83% | 19.32% | 24.31% | 34.63% | 16.01% | 2.09% | -17.91% | -28.02% | -440.86% | -408.34% |

| Income Tax Expense | 0.00 | 263.00 | -492.00K | -819.71K | -59.00K | 2.93M | -1.67M | -1.15M | -414.00K | -73.00K | 61.09K | 671.22K | -245.01K | 7.26M | 517.00K | 1.07M | 403.00K | 1.55M | 436.00K | -79.00K | 143.00K | -126.00K | -11.24K | -12.70M |

| Net Income | -3.40M | -3.06M | -2.93M | -473.70K | -1.60M | -3.19M | 1.09M | -6.07M | -1.37M | -5.47M | -34.78M | -15.29M | -71.21M | 2.65M | -49.09M | 44.39M | 38.89M | 30.78M | 6.34M | 1.68M | -14.26M | -18.39M | -51.75M | -36.47M |

| Net Income Ratio | -79.19% | -54.76% | -53.40% | -6.89% | -24.08% | -44.97% | 9.37% | -67.63% | -13.32% | -55.92% | -231.38% | -55.66% | -207.04% | 4.10% | -30.76% | 23.32% | 23.30% | 32.65% | 14.34% | 1.69% | -14.78% | -24.96% | -440.76% | -353.58% |

| EPS | -0.31 | -0.28 | -0.27 | -0.04 | -0.14 | -0.29 | 0.10 | -0.55 | -0.12 | -0.51 | -3.43 | -1.51 | -6.59 | 0.25 | -4.50 | 4.10 | 3.70 | 3.00 | 0.65 | 0.15 | -1.42 | -1.85 | -5.35 | -3.64 |

| EPS Diluted | -0.31 | -0.28 | -0.27 | -0.04 | -0.14 | -0.29 | 0.10 | -0.55 | -0.12 | -0.51 | -3.43 | -1.51 | -6.59 | 0.20 | -4.50 | 3.70 | 3.25 | 2.55 | 0.60 | 0.15 | -1.42 | -1.85 | -5.35 | -3.64 |

| Weighted Avg Shares Out | 11.05M | 11.05M | 11.05M | 11.05M | 11.05M | 11.01M | 11.05M | 11.05M | 11.05M | 10.74M | 10.14M | 10.14M | 10.81M | 11.17M | 10.90M | 10.82M | 10.58M | 10.18M | 10.06M | 10.03M | 10.07M | 9.94M | 9.67M | 10.03M |

| Weighted Avg Shares Out (Dil) | 11.05M | 11.05M | 11.05M | 11.05M | 11.05M | 11.05M | 11.05M | 11.05M | 11.05M | 10.79M | 10.14M | 10.14M | 10.81M | 11.86M | 10.90M | 12.03M | 12.00M | 12.22M | 11.01M | 10.34M | 10.07M | 9.94M | 9.67M | 10.03M |

Popular Penny Stocks to Buy Right Now? 3 to Watch

Should Trump Sack DWAC And Pursue Paltalk Or GigaMedia?

GigaMedia Announces Fourth-Quarter and Full Year 2020 Financial Results

GIGM Stock Price Increased 29.6%: Why It Happened

GIGM Stock Price Increases Over 45% Pre-Market: What You Should Know About The Company

Agrify Seeks $25 Million IPO For Indoor Agriculture Growth Plan

GigaMedia Announces Third-Quarter 2020 Financial Results

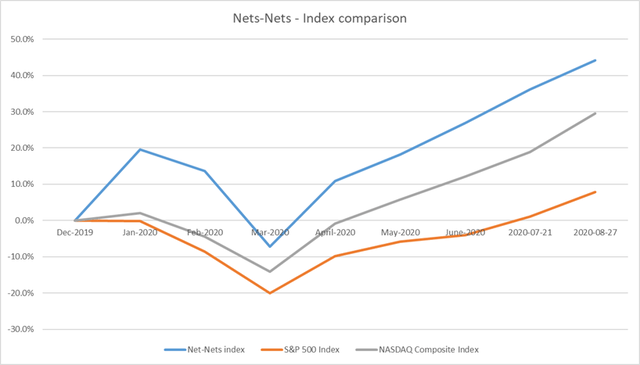

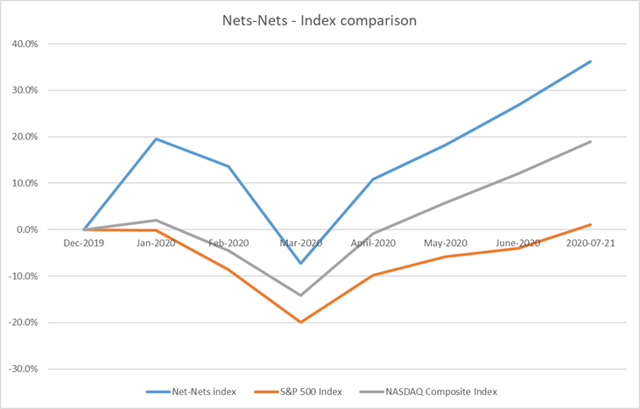

Deep Value Index Outperforms Nasdaq 14.6% Year-To-Date - Model Portfolio Update

Deep Value Index Posts Strong Outperformance Vs. Nasdaq During COVID-19 Pandemic

Contrasting Switch (NYSE:SWCH) and GigaMedia (NYSE:GIGM)

Source: https://incomestatements.info

Category: Stock Reports