See more : Pediatrix Medical Group, Inc. (MD) Income Statement Analysis – Financial Results

Complete financial analysis of General Mills, Inc. (GIS) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of General Mills, Inc., a leading company in the Packaged Foods industry within the Consumer Defensive sector.

- DCM Shriram Industries Limited (DCMSRMIND.BO) Income Statement Analysis – Financial Results

- Thoughtful Brands Inc. (PEMTF) Income Statement Analysis – Financial Results

- Birla Cable Limited (BIRLACABLE.BO) Income Statement Analysis – Financial Results

- Wolfspeed, Inc. (0I4Q.L) Income Statement Analysis – Financial Results

- Hubei Juneyao Health Drinks Co., Ltd (605388.SS) Income Statement Analysis – Financial Results

General Mills, Inc. (GIS)

About General Mills, Inc.

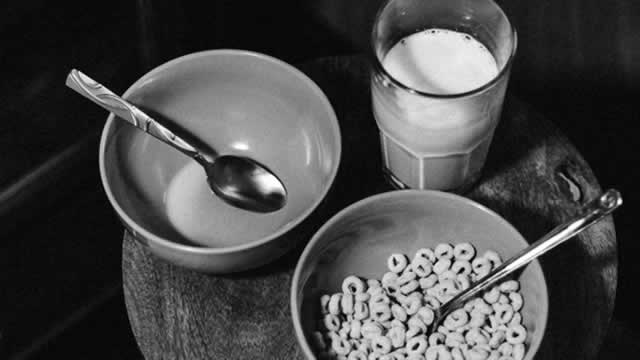

General Mills, Inc. manufactures and markets branded consumer foods worldwide. The company operates in five segments: North America Retail; Convenience Stores & Foodservice; Europe & Australia; Asia & Latin America; and Pet. It offers ready-to-eat cereals, refrigerated yogurt, soup, meal kits, refrigerated and frozen dough products, dessert and baking mixes, bakery flour, frozen pizza and pizza snacks, snack bars, fruit and salty snacks, ice cream, nutrition bars, wellness beverages, and savory and grain snacks, as well as various organic products, including frozen and shelf-stable vegetables. It also supplies branded and unbranded food products to the North American foodservice and commercial baking industries; and manufactures and markets pet food products, including dog and cat food. The company markets its products under the Annie's, Betty Crocker, Bisquick, Blue Buffalo, Blue Basics, Blue Freedom, Bugles, Cascadian Farm, Cheerios, Chex, Cinnamon Toast Crunch, Cocoa Puffs, Cookie Crisp, EPIC, Fiber One, Food Should Taste Good, Fruit by the Foot, Fruit Gushers, Fruit Roll-Ups, Gardetto's, Go-Gurt, Gold Medal, Golden Grahams, Häagen-Dazs, Helpers, Jus-Rol, Kitano, Kix, Lärabar, Latina, Liberté, Lucky Charms, Muir Glen, Nature Valley, Oatmeal Crisp, Old El Paso, Oui, Pillsbury, Progresso, Raisin Nut Bran, Total, Totino's, Trix, Wanchai Ferry, Wheaties, Wilderness, Yoki, and Yoplait trademarks. It sells its products directly, as well as through broker and distribution arrangements to grocery stores, mass merchandisers, membership stores, natural food chains, e-commerce retailers, commercial and noncommercial foodservice distributors and operators, restaurants, convenience stores, and pet specialty stores, as well as drug, dollar, and discount chains. The company operates 466 leased and 392 franchise ice cream parlors. General Mills, Inc. was founded in 1866 and is headquartered in Minneapolis, Minnesota.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 | 1984 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 19.86B | 20.09B | 18.99B | 18.13B | 17.63B | 16.87B | 15.74B | 15.62B | 16.56B | 17.63B | 17.91B | 17.77B | 16.66B | 14.88B | 14.80B | 14.69B | 13.65B | 12.44B | 11.64B | 11.24B | 11.07B | 10.51B | 7.95B | 7.08B | 6.70B | 6.25B | 6.03B | 5.61B | 5.42B | 5.03B | 8.52B | 8.13B | 7.78B | 7.15B | 6.45B | 5.62B | 5.18B | 5.19B | 4.59B | 4.29B | 4.12B |

| Cost of Revenue | 12.91B | 13.55B | 12.59B | 11.68B | 11.50B | 11.11B | 10.31B | 10.06B | 10.73B | 11.68B | 11.54B | 11.35B | 10.61B | 8.93B | 8.92B | 9.46B | 8.78B | 7.96B | 6.97B | 6.83B | 6.58B | 6.11B | 4.77B | 2.84B | 2.49B | 2.40B | 2.39B | 2.33B | 2.24B | 2.02B | 4.46B | 4.30B | 4.12B | 3.72B | 3.49B | 3.11B | 2.85B | 2.83B | 2.56B | 2.48B | 2.43B |

| Gross Profit | 6.95B | 6.55B | 6.40B | 6.45B | 6.13B | 5.76B | 5.43B | 5.56B | 5.83B | 5.95B | 6.37B | 6.42B | 6.04B | 5.95B | 5.87B | 5.23B | 4.87B | 4.49B | 4.67B | 4.41B | 4.49B | 4.40B | 3.18B | 4.24B | 4.21B | 3.85B | 3.64B | 3.28B | 3.18B | 3.00B | 4.06B | 3.84B | 3.65B | 3.43B | 2.96B | 2.51B | 2.33B | 2.36B | 2.02B | 1.81B | 1.69B |

| Gross Profit Ratio | 35.01% | 32.58% | 33.71% | 35.57% | 34.78% | 34.13% | 34.48% | 35.62% | 35.20% | 33.74% | 35.57% | 36.14% | 36.29% | 40.01% | 39.70% | 35.62% | 35.70% | 36.06% | 40.15% | 39.22% | 40.52% | 41.85% | 40.03% | 59.86% | 62.85% | 61.59% | 60.40% | 58.49% | 58.62% | 59.75% | 47.65% | 47.17% | 46.99% | 47.97% | 45.95% | 44.58% | 45.01% | 45.39% | 44.10% | 42.24% | 40.92% |

| Research & Development | 257.80M | 257.60M | 243.10M | 239.30M | 224.40M | 221.90M | 219.10M | 218.20M | 222.10M | 229.40M | 243.60M | 237.90M | 245.40M | 235.00M | 218.30M | 208.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 2.16B | 2.69B | 2.46B | 2.34B | 2.46B | 2.33B | 2.18B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.37B | 1.26B |

| Selling & Marketing | 824.60M | 810.00M | 690.10M | 736.30M | 691.80M | 601.60M | 575.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 3.26B | 3.50B | 3.15B | 3.08B | 3.15B | 2.94B | 2.75B | 2.80B | 3.12B | 3.33B | 3.47B | 3.55B | 3.38B | 3.19B | 3.24B | 2.95B | 2.63B | 2.39B | 2.68B | 2.42B | 2.44B | 2.47B | 1.91B | 3.07B | 2.90B | 2.63B | 2.50B | 2.24B | 2.13B | 2.12B | 2.76B | 2.65B | 2.50B | 2.39B | 2.14B | 1.81B | 1.71B | 1.76B | 1.55B | 1.37B | 1.26B |

| Other Expenses | 0.00 | 88.80M | 113.40M | 132.90M | 112.80M | 87.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 186.00M | 46.00M |

| Operating Expenses | 3.50B | 3.50B | 3.15B | 3.08B | 3.15B | 2.94B | 2.75B | 2.80B | 3.12B | 3.33B | 3.47B | 3.55B | 3.38B | 3.17B | 3.24B | 2.87B | 2.63B | 2.39B | 2.68B | 2.42B | 2.44B | 2.47B | 1.91B | 3.07B | 3.11B | 2.83B | 2.69B | 2.42B | 2.32B | 2.31B | 3.06B | 2.92B | 2.75B | 2.60B | 2.32B | 1.96B | 1.85B | 1.89B | 1.66B | 1.55B | 1.31B |

| Cost & Expenses | 16.43B | 17.05B | 15.74B | 14.76B | 14.65B | 14.04B | 13.07B | 12.86B | 13.85B | 15.01B | 15.01B | 14.90B | 13.99B | 12.10B | 12.16B | 12.33B | 11.40B | 10.35B | 9.64B | 9.25B | 9.03B | 8.58B | 6.68B | 5.91B | 5.60B | 5.23B | 5.08B | 4.75B | 4.56B | 4.34B | 7.52B | 7.22B | 6.88B | 6.33B | 5.80B | 5.08B | 4.70B | 4.72B | 4.22B | 4.03B | 3.74B |

| Interest Income | 18.80M | 14.00M | 3.80M | 7.40M | 6.00M | 5.60M | 11.70M | 7.00M | 8.10M | 13.20M | 16.10M | 12.60M | 9.90M | 7.40M | 6.80M | 7.20M | 27.30M | 31.00M | 26.80M | 30.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 498.00M | 396.10M | 383.40M | 427.70M | 472.50M | 527.40M | 385.40M | 302.10M | 311.90M | 328.60M | 318.50M | 329.50M | 361.80M | 353.70M | 408.40M | 390.00M | 449.00M | 458.00M | 426.40M | 485.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -60.00M | -19.00M |

| Depreciation & Amortization | 552.70M | 546.60M | 570.30M | 601.30M | 594.70M | 620.10M | 618.80M | 603.60M | 608.10M | 588.30M | 585.40M | 588.00M | 541.50M | 472.60M | 457.10M | 453.60M | 459.20M | 418.00M | 424.00M | 443.00M | 399.00M | 365.00M | 296.00M | 223.10M | 208.80M | 194.20M | 194.90M | 182.80M | 186.70M | 191.40M | 303.80M | 274.20M | 247.40M | 218.40M | 180.10M | 152.30M | 140.00M | 131.70M | 113.10M | 109.00M | 99.00M |

| EBITDA | 4.08B | 4.08B | 4.16B | 3.88B | 3.66B | 3.22B | 3.15B | 3.18B | 3.31B | 2.67B | 3.55B | 3.44B | 3.10B | 3.24B | 3.01B | 2.82B | 2.86B | 2.51B | 2.42B | 2.74B | 2.44B | 2.29B | 1.51B | 1.44B | 1.31B | 1.21B | 1.15B | 1.04B | 1.05B | 880.40M | 1.30B | 1.19B | 1.15B | 1.05B | 825.20M | 697.30M | 620.50M | 598.90M | 477.00M | 57.00M | 467.00M |

| EBITDA Ratio | 20.57% | 15.94% | 18.98% | 23.14% | 20.41% | 22.21% | 21.98% | 22.81% | 20.06% | 21.29% | 19.09% | 19.58% | 19.30% | 21.88% | 21.13% | 19.18% | 20.04% | 20.46% | 21.05% | 19.16% | 22.22% | 22.39% | 22.13% | 18.94% | 19.47% | 20.18% | 21.58% | 19.55% | 19.38% | 21.16% | 17.03% | 14.65% | 14.79% | 14.61% | 12.80% | 12.41% | 11.98% | 11.56% | 10.43% | 1.33% | 11.34% |

| Operating Income | 3.43B | 2.66B | 3.48B | 3.14B | 2.95B | 2.52B | 2.51B | 2.57B | 2.71B | 2.08B | 2.96B | 2.85B | 2.56B | 2.77B | 2.61B | 2.32B | 2.23B | 2.06B | 1.97B | 1.91B | 2.02B | 1.86B | 1.27B | 1.17B | 1.10B | 1.02B | 950.20M | 858.90M | 860.00M | 689.00M | 999.40M | 917.60M | 902.70M | 826.70M | 645.10M | 545.00M | 480.50M | 467.20M | 363.90M | 256.00M | 376.00M |

| Operating Income Ratio | 17.28% | 13.22% | 18.30% | 17.35% | 16.76% | 14.92% | 15.94% | 16.43% | 16.35% | 11.78% | 16.51% | 16.04% | 15.38% | 18.65% | 17.61% | 15.81% | 16.32% | 16.54% | 16.89% | 16.97% | 18.22% | 17.73% | 16.01% | 16.52% | 16.40% | 16.29% | 15.75% | 15.31% | 15.88% | 13.71% | 11.73% | 11.28% | 11.61% | 11.56% | 10.00% | 9.70% | 9.28% | 9.00% | 7.93% | 5.97% | 9.13% |

| Total Other Income/Expenses | -403.40M | -6.80M | -266.20M | -287.40M | -353.70M | -838.10M | -564.60M | -295.10M | -303.80M | -315.40M | -302.40M | -313.10M | -570.20M | -346.30M | -453.50M | -415.40M | -399.70M | -402.00M | -369.00M | -156.00M | -508.00M | -486.00M | -573.00M | -189.00M | -149.00M | -179.20M | -286.50M | -155.20M | -104.20M | -284.40M | -246.10M | -73.60M | -58.20M | -61.10M | -32.40M | -27.50M | -37.70M | -34.00M | -40.30M | -60.00M | -19.00M |

| Income Before Tax | 3.03B | 3.14B | 3.21B | 2.86B | 2.60B | 2.08B | 2.14B | 2.27B | 2.40B | 1.76B | 2.66B | 2.53B | 2.21B | 2.43B | 2.20B | 1.93B | 1.81B | 1.63B | 1.57B | 1.82B | 1.51B | 1.38B | 700.00M | 998.30M | 950.30M | 838.50M | 663.70M | 703.70M | 755.80M | 404.60M | 753.30M | 844.00M | 844.50M | 765.60M | 612.70M | 517.50M | 442.80M | 433.20M | 323.60M | 196.00M | 357.00M |

| Income Before Tax Ratio | 15.25% | 15.63% | 16.90% | 15.76% | 14.75% | 12.34% | 13.57% | 14.54% | 14.51% | 9.99% | 14.82% | 14.26% | 13.27% | 16.32% | 14.90% | 13.16% | 13.23% | 13.11% | 13.46% | 16.14% | 13.63% | 13.11% | 8.81% | 14.10% | 14.18% | 13.42% | 11.00% | 12.55% | 13.95% | 8.05% | 8.84% | 10.38% | 10.86% | 10.70% | 9.50% | 9.21% | 8.55% | 8.35% | 7.06% | 4.57% | 8.67% |

| Income Tax Expense | 594.50M | 612.20M | 586.30M | 629.10M | 480.50M | 367.80M | 57.30M | 655.20M | 755.20M | 586.80M | 883.30M | 741.20M | 709.60M | -721.10M | 771.20M | 720.40M | 622.20M | 560.00M | 541.00M | 664.00M | 528.00M | 460.00M | 239.00M | 349.90M | 335.90M | 304.00M | 241.90M | 258.30M | 279.40M | 144.90M | 283.60M | 337.90M | 338.90M | 301.40M | 239.00M | 202.20M | 177.40M | 211.20M | 140.10M | 81.00M | 154.00M |

| Net Income | 2.50B | 2.59B | 2.71B | 2.34B | 2.18B | 1.75B | 2.13B | 1.66B | 1.70B | 1.22B | 1.82B | 1.86B | 1.57B | 1.80B | 1.53B | 1.30B | 1.29B | 1.14B | 1.09B | 1.24B | 1.06B | 917.00M | 458.00M | 665.10M | 614.40M | 534.50M | 421.80M | 445.40M | 476.40M | 367.40M | 469.90M | 506.10M | 495.60M | 472.70M | 381.40M | 484.30M | 283.10M | 222.00M | 183.50M | -73.00M | 233.00M |

| Net Income Ratio | 12.57% | 12.91% | 14.25% | 12.91% | 12.37% | 10.39% | 13.54% | 10.61% | 10.25% | 6.93% | 10.19% | 10.44% | 9.41% | 12.09% | 10.34% | 8.88% | 9.48% | 9.19% | 9.36% | 11.03% | 9.53% | 8.73% | 5.76% | 9.40% | 9.17% | 8.56% | 6.99% | 7.94% | 8.80% | 7.31% | 5.52% | 6.22% | 6.37% | 6.61% | 5.91% | 8.62% | 5.47% | 4.28% | 4.00% | -1.70% | 5.66% |

| EPS | 4.34 | 4.36 | 4.46 | 3.81 | 3.59 | 2.92 | 3.69 | 2.82 | 2.83 | 2.02 | 2.90 | 2.86 | 2.42 | 2.80 | 2.32 | 1.96 | 1.93 | 1.65 | 1.53 | 1.67 | 1.41 | 1.25 | 0.69 | 1.17 | 1.02 | 0.88 | 0.67 | 0.71 | 0.75 | 0.59 | 0.74 | 0.78 | 0.75 | 0.72 | 0.59 | 0.75 | 0.42 | 0.32 | 0.26 | -0.10 | 0.31 |

| EPS Diluted | 4.31 | 4.31 | 4.42 | 3.78 | 3.56 | 2.90 | 3.64 | 2.77 | 2.77 | 1.97 | 2.83 | 2.79 | 2.35 | 2.70 | 2.24 | 1.90 | 1.86 | 1.59 | 1.45 | 1.54 | 1.30 | 1.22 | 0.67 | 1.14 | 1.00 | 0.85 | 0.65 | 0.69 | 0.74 | 0.59 | 0.74 | 0.78 | 0.75 | 0.72 | 0.59 | 0.75 | 0.42 | 0.32 | 0.26 | -0.10 | 0.31 |

| Weighted Avg Shares Out | 575.50M | 594.80M | 607.50M | 614.10M | 608.10M | 600.40M | 576.80M | 587.10M | 598.40M | 599.90M | 628.60M | 648.60M | 648.10M | 642.50M | 659.60M | 663.70M | 666.00M | 693.00M | 715.40M | 742.00M | 750.00M | 738.00M | 662.00M | 568.00M | 598.20M | 613.00M | 632.40M | 631.77M | 635.20M | 628.03M | 635.00M | 653.03M | 660.80M | 656.53M | 651.97M | 650.07M | 674.05M | 704.76M | 705.77M | 715.00M | 750.00M |

| Weighted Avg Shares Out (Dil) | 579.50M | 601.20M | 612.60M | 619.10M | 613.30M | 605.40M | 585.70M | 598.00M | 611.20M | 614.90M | 645.70M | 665.60M | 666.70M | 664.40M | 683.30M | 687.10M | 693.80M | 720.40M | 757.60M | 818.00M | 826.00M | 756.00M | 684.00M | 584.00M | 614.60M | 629.40M | 649.20M | 645.51M | 648.16M | 628.03M | 635.00M | 653.03M | 660.80M | 656.53M | 651.97M | 650.07M | 674.05M | 704.76M | 705.77M | 715.00M | 750.00M |

Top 10 High-Yield Picks For December 2024 With Strategic Allocations: 5 Yield Over 7%

4 Food Stocks Demonstrating Resilience Amid Industry Challenges

NAD Finds Certain Claims for Mott's Fruit Flavored Snacks Supported or Outside NAD's Jurisdiction; Recommends General Mills Discontinue or Modify Other Claims

How Should You Play General Mills Stock at a P/E Multiple of 14.2X?

General Mills Quarterly Dividend Declared

General Mills Bets $1.45B on Pet Food: Growth or Risk?

How is General Mills Strengthening its Hold on the Pet Food Market?

100 November Sustainable Dividend Dogs: 50 'Safer' And 2 Ideal Buys

General Mills: Adding Pet Food Exposure

Donna Kelce and the Pillsbury Doughboy Crown the 52nd Pillsbury Bake-Off™ Contest Winners with Festive Debut of Holiday Recipes

Source: https://incomestatements.info

Category: Stock Reports