See more : Aztec Land and Cattle Company, Limited (AZLCZ) Income Statement Analysis – Financial Results

Complete financial analysis of Glencore plc (GLCNF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Glencore plc, a leading company in the Industrial Materials industry within the Basic Materials sector.

- CBM Bancorp, Inc. (CBMB) Income Statement Analysis – Financial Results

- Sun Frontier Fudousan Co., Ltd. (8934.T) Income Statement Analysis – Financial Results

- Pfizer Inc. (PFE.DE) Income Statement Analysis – Financial Results

- SEIKOH GIKEN Co., Ltd. (6834.T) Income Statement Analysis – Financial Results

- Avacta Group Plc (AVCT.L) Income Statement Analysis – Financial Results

Glencore plc (GLCNF)

About Glencore plc

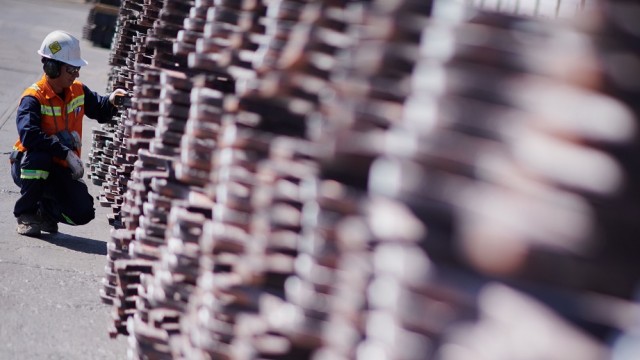

Glencore plc produces, refines, processes, stores, transports, and markets metals and minerals, and energy products in the Americas, Europe, Asia, Africa, and Oceania. It operates through two segments, Marketing Activities and Industrial Activities. The company produces and markets copper, cobalt, nickel, zinc, lead, chrome ore, ferrochrome, vanadium, alumina, aluminum, tin, and iron ore. It also engages in the oil exploration/production, distribution, storage, and bunkering activities; and offers coal, crude oil and oil products, refined products, and natural gas. In addition, the company markets and distributes physical commodities sourced from third party producers and its production to industrial consumers in the battery, electronic, construction, automotive, steel, energy, and oil industries. Further, it provides financing, logistics, and other services to producers and consumers of commodities. The company was formerly known as Glencore Xstrata plc and changed its name to Glencore plc in May 2014. Glencore plc was founded in 1974 and is headquartered in Baar, Switzerland.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 217.83B | 251.04B | 199.82B | 151.73B | 223.38B | 220.52B | 205.48B | 152.95B | 147.35B | 221.07B | 232.69B | 214.44B | 186.15B | 144.98B | 106.36B | 152.24B |

| Cost of Revenue | 207.05B | 227.20B | 188.39B | 147.71B | 218.45B | 211.47B | 197.70B | 149.76B | 144.53B | 214.34B | 227.15B | 210.44B | 181.94B | 140.47B | 103.13B | 147.57B |

| Gross Profit | 10.78B | 23.84B | 11.43B | 4.02B | 4.93B | 9.06B | 7.78B | 3.19B | 2.82B | 6.73B | 5.55B | 4.00B | 4.21B | 4.51B | 3.23B | 4.67B |

| Gross Profit Ratio | 4.95% | 9.50% | 5.72% | 2.65% | 2.21% | 4.11% | 3.79% | 2.08% | 1.91% | 3.04% | 2.38% | 1.87% | 2.26% | 3.11% | 3.04% | 3.07% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | -21.00M | -26.48M | 83.77M | 203.63M | 208.16M | 0.00 | 0.00 | 0.00 | -175.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 2.11B | 2.43B | 2.12B | 1.68B | 1.39B | 1.38B | 1.31B | 1.10B | 1.27B | 1.30B | 1.21B | 997.00M | 857.00M | 1.06B | 839.00M | 850.00M |

| SG&A | 2.08B | 2.40B | 2.20B | 1.88B | 1.60B | 1.38B | 1.31B | 1.10B | 1.10B | 1.30B | 1.21B | 997.00M | 857.00M | 1.06B | 839.00M | 850.00M |

| Other Expenses | 0.00 | 216.00M | -129.00M | -12.00M | -239.87M | -14.00M | -23.00M | -37.00M | -346.33M | 0.00 | 64.00M | -67.00M | 116.00M | 941.00M | 335.00M | -191.00M |

| Operating Expenses | 2.08B | 2.40B | 2.20B | 1.88B | 1.84B | 2.88B | 563.00M | 2.23B | 9.92B | 1.02B | 11.89B | 1.11B | 973.00M | 2.00B | 1.17B | 659.00M |

| Cost & Expenses | 209.13B | 229.61B | 190.59B | 149.60B | 220.29B | 214.35B | 198.26B | 151.99B | 154.45B | 215.37B | 239.03B | 211.54B | 182.91B | 142.47B | 104.31B | 148.22B |

| Interest Income | 615.00M | 427.10M | 204.45M | 127.92M | 235.72M | 1.49B | 1.42B | 1.51B | 1.28B | 1.45B | 1.35B | 401.00M | 339.00M | 281.00M | 267.00M | 298.00M |

| Interest Expense | 2.52B | 1.77B | 1.36B | 1.71B | 2.08B | 1.71B | 1.74B | 1.59B | 1.59B | 1.72B | 1.78B | 1.37B | 1.19B | 1.22B | 854.00M | 1.14B |

| Depreciation & Amortization | 6.62B | 7.22B | 6.40B | 7.20B | 7.52B | 6.05B | 5.67B | 5.10B | 5.63B | 6.04B | 4.19B | 1.47B | 1.07B | 1.03B | 622.00M | 575.00M |

| EBITDA | 15.32B | 32.23B | 12.40B | 2.95B | 8.49B | 14.00B | 11.87B | 7.20B | 7.35B | 10.87B | 8.44B | 5.08B | 6.26B | 5.75B | 3.44B | 5.80B |

| EBITDA Ratio | 7.03% | 11.42% | 7.82% | 6.15% | 4.75% | 6.35% | 5.78% | 4.71% | 4.99% | 4.92% | 3.63% | 2.37% | 3.73% | 3.97% | 3.30% | 3.81% |

| Operating Income | 8.70B | 21.43B | 9.23B | 2.13B | 3.09B | 6.64B | 6.38B | 1.63B | 1.72B | 4.83B | 4.25B | 3.61B | 5.88B | 4.73B | 2.88B | 5.23B |

| Operating Income Ratio | 3.99% | 8.54% | 4.62% | 1.41% | 1.38% | 3.01% | 3.10% | 1.06% | 1.17% | 2.19% | 1.83% | 1.68% | 3.16% | 3.26% | 2.71% | 3.43% |

| Total Other Income/Expenses | -3.28B | -4.63B | -1.86B | -7.13B | -4.17B | -3.00B | 123.75M | -2.63B | -10.10B | -1.17B | -12.03B | -1.82B | -1.88B | 1.83B | -918.00M | -2.68B |

| Income Before Tax | 5.42B | 20.21B | 4.68B | -5.93B | -1.04B | 4.68B | 6.92B | -549.00M | -8.38B | 4.25B | -7.69B | 1.08B | 4.00B | 4.34B | 1.97B | 1.34B |

| Income Before Tax Ratio | 2.49% | 8.05% | 2.34% | -3.91% | -0.47% | 2.12% | 3.37% | -0.36% | -5.69% | 1.92% | -3.30% | 0.50% | 2.15% | 2.99% | 1.85% | 0.88% |

| Income Tax Expense | 2.21B | 6.25B | 2.97B | -1.25B | 641.74M | 2.06B | 1.76B | 638.00M | 9.00M | 1.81B | 254.00M | -76.00M | -264.00M | 234.00M | 238.00M | 268.00M |

| Net Income | 4.28B | 17.32B | 4.97B | -2.03B | -419.52M | 3.41B | 5.78B | -744.00M | -5.22B | 2.31B | -8.05B | 1.00B | 4.05B | 1.29B | 983.00M | 367.00M |

| Net Income Ratio | 1.96% | 6.90% | 2.49% | -1.34% | -0.19% | 1.55% | 2.81% | -0.49% | -3.54% | 1.04% | -3.46% | 0.47% | 2.17% | 0.89% | 0.92% | 0.24% |

| EPS | 0.34 | 1.30 | 0.37 | -0.15 | -0.03 | 0.24 | 0.41 | -0.05 | -0.39 | 0.18 | -0.73 | 0.14 | 0.66 | 0.19 | 0.14 | 0.05 |

| EPS Diluted | 0.34 | 1.29 | 0.37 | -0.15 | -0.03 | 0.24 | 0.40 | -0.05 | -0.39 | 0.18 | -0.73 | 0.14 | 0.66 | 0.19 | 0.14 | 0.05 |

| Weighted Avg Shares Out | 12.43B | 13.04B | 13.20B | 13.22B | 13.68B | 14.15B | 14.26B | 14.22B | 13.32B | 13.10B | 11.02B | 6.99B | 6.09B | 6.92B | 6.92B | 6.92B |

| Weighted Avg Shares Out (Dil) | 12.54B | 13.14B | 13.34B | 13.22B | 13.68B | 14.25B | 14.42B | 14.36B | 13.32B | 13.15B | 11.09B | 6.99B | 6.09B | 6.92B | 6.92B | 6.92B |

Nickel Miners News For The Month Of March 2024

Vanadium Miners News For The Month Of March 2024

Cobalt Miners News For The Month Of March 2024

More investors push Glencore to keep coal post-Teck deal

Glencore share price analysis as the copper surge gains steam

Copper bull market "fast tracked" with higher prices to come soon, Jefferies says

Glencore nabs an upgrade from Deutsche Bank on EVR acquisition

Li-Cycle shares rally as Glencore ups investment

Sigma Lithium expands green lithium shipment to Glencore, secures enhanced prepayment terms

Glencore at "excellent entry point" says US bank

Source: https://incomestatements.info

Category: Stock Reports