See more : Guangdong Yuehai Feeds Group Co.,Ltd. (001313.SZ) Income Statement Analysis – Financial Results

Complete financial analysis of Graphene Manufacturing Group Ltd (GMGMF) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Graphene Manufacturing Group Ltd, a leading company in the Chemicals – Specialty industry within the Basic Materials sector.

- BCTG Acquisition Corp. (BCTG) Income Statement Analysis – Financial Results

- Bajaj Electricals Limited (BAJAJELEC.BO) Income Statement Analysis – Financial Results

- BactiQuant A/S (BACTIQ.CO) Income Statement Analysis – Financial Results

- Medlive Technology Co., Ltd. (2192.HK) Income Statement Analysis – Financial Results

- Great Southern Copper PLC (GSCU.L) Income Statement Analysis – Financial Results

Graphene Manufacturing Group Ltd (GMGMF)

About Graphene Manufacturing Group Ltd

Graphene Manufacturing Group Pty Ltd, together with its subsidiaries, manufactures and supplies graphene. The company engages in the manufacture and sale of energy saving and energy storage solutions. It serves facility management; transport and earth moving; food supply management; retail, shopping centres, and food outlets; utilities education institutions; automotive operations and maintenance; batteries and energy storage; and batter materials. Graphene Manufacturing Group Pty Ltd. was incorporated in 2016 and is based in Richlands, Australia.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 |

|---|---|---|---|---|---|

| Revenue | 294.86K | 170.06K | 54.43K | 246.37K | 110.74K |

| Cost of Revenue | 741.01K | 450.96K | 311.15K | 189.61K | 157.94K |

| Gross Profit | -446.15K | -280.90K | -256.73K | 56.76K | -47.20K |

| Gross Profit Ratio | -151.31% | -165.17% | -471.70% | 23.04% | -42.62% |

| Research & Development | 0.00 | 224.42K | 83.07K | 62.88K | 15.00K |

| General & Administrative | 10.97M | 12.70M | 7.46M | 4.22M | 2.54M |

| Selling & Marketing | 125.93K | 40.81K | 22.07K | 0.00 | 0.00 |

| SG&A | 11.10M | 12.74M | 7.48M | 4.22M | 2.54M |

| Other Expenses | 0.00 | 385.79K | 3.47K | -633.07K | -172.88K |

| Operating Expenses | -446.15K | 12.50M | 6.91M | 3.45M | 1.86M |

| Cost & Expenses | 11.77M | 12.95M | 7.22M | 3.64M | 2.02M |

| Interest Income | 6.40K | 698.00 | 1.85K | 1.79K | 976.00 |

| Interest Expense | 121.74K | 104.08K | 43.72K | 1.99K | 1.70K |

| Depreciation & Amortization | 1.98M | 1.16M | 350.74K | 262.72K | 395.34K |

| EBITDA | -5.30M | -11.24M | -6.81M | -3.77M | -1.67M |

| EBITDA Ratio | -1,798.05% | -6,609.40% | -12,514.54% | -1,528.84% | -1,521.50% |

| Operating Income | -11.47M | -12.40M | -7.16M | -4.03M | -2.08M |

| Operating Income Ratio | -3,890.34% | -7,288.83% | -13,158.98% | -1,635.48% | -1,878.50% |

| Total Other Income/Expenses | 4.07M | 3.46M | -4.60M | -4.71M | 13.16K |

| Income Before Tax | -7.40M | -9.32M | -11.77M | -8.11M | -2.07M |

| Income Before Tax Ratio | -2,509.97% | -5,482.48% | -21,626.18% | -3,291.99% | -1,866.62% |

| Income Tax Expense | 0.00 | 489.88K | 47.18K | -631.09K | -171.18K |

| Net Income | -7.40M | -9.32M | -11.77M | -8.11M | -2.07M |

| Net Income Ratio | -2,509.97% | -5,482.48% | -21,626.18% | -3,291.99% | -1,866.62% |

| EPS | -0.09 | -0.12 | -0.15 | -0.13 | -0.03 |

| EPS Diluted | -0.09 | -0.12 | -0.15 | -0.13 | -0.03 |

| Weighted Avg Shares Out | 85.58M | 80.74M | 76.04M | 60.53M | 69.08M |

| Weighted Avg Shares Out (Dil) | 85.58M | 80.74M | 76.04M | 60.53M | 69.08M |

Graphene Manufacturing Group announces initial factory acceptance testing of semi-automated prototype battery cell assembly equipment

Graphene Manufacturing Group wins regulatory development approval for future battery plant

Graphene Manufacturing Group expects significant ramp-up in sales as it lands key regulatory approval

Graphene Manufacturing Group streamlines internal teams to support and accelerate research and development of graphene production

Graphene Manufacturing Group announces two key appointments

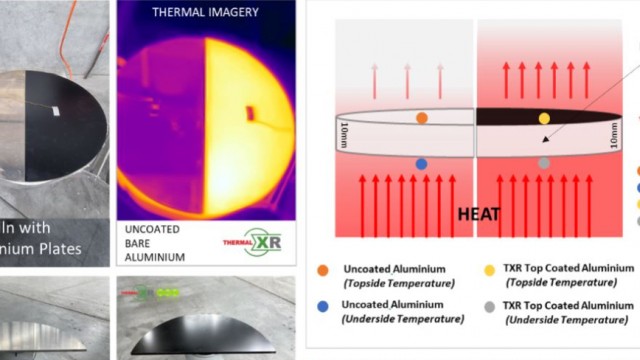

Graphene Manufacturing Group reports improved heat transfer on aluminium with its novel THERMAL-XR coating

Graphene Manufacturing Group is under followed and has meaningful upside, says H.C. Wainwright & Co, which starts coverage

Graphene Manufacturing Group invests A$600,000 to boost battery pouch cell customer testing and development

Graphene Manufacturing Group closes $5.75M offering to fund aluminum-ion battery prototype, other projects

Graphene Manufacturing Group to raise $5M in bought deal unit offering

Source: https://incomestatements.info

Category: Stock Reports