See more : GreenLink International Inc. (WSHE) Income Statement Analysis – Financial Results

Complete financial analysis of Genie Energy Ltd. (GNE) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Genie Energy Ltd., a leading company in the Regulated Electric industry within the Utilities sector.

- SOL Global Investments Corp. (SOL.CN) Income Statement Analysis – Financial Results

- State Bank of India (SBID.L) Income Statement Analysis – Financial Results

- Mie Kotsu Group Holdings, Inc. (3232.T) Income Statement Analysis – Financial Results

- Harris Exploration, Inc. (HXPN) Income Statement Analysis – Financial Results

- Cellular Goods Plc Share (CBX) Income Statement Analysis – Financial Results

Genie Energy Ltd. (GNE)

About Genie Energy Ltd.

Genie Energy Ltd., through its subsidiaries, supplies electricity and natural gas to residential and small business customers in the United States, Finland, Sweden, Japan, and internationally. It operates in three segments: Genie Retail Energy (GRE); GRE International; and Genie Renewables. The company also engages in the provision of energy advisory and brokerage services; solar panel manufacturing and distribution; solar installation design; and project management activities. Genie Energy Ltd. was incorporated in 2011 and is headquartered in Newark, New Jersey.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 428.71M | 315.54M | 363.73M | 379.31M | 315.29M | 280.31M | 264.20M | 212.11M | 210.11M | 275.03M | 279.17M | 229.46M | 203.56M | 201.36M | 264.71M |

| Cost of Revenue | 282.50M | 160.76M | 258.86M | 281.63M | 232.39M | 203.76M | 178.69M | 135.17M | 141.02M | 223.09M | 213.42M | 159.87M | 149.71M | 143.53M | 192.55M |

| Gross Profit | 146.21M | 154.78M | 104.86M | 97.69M | 82.90M | 76.55M | 85.51M | 76.94M | 69.09M | 51.94M | 65.76M | 69.59M | 53.85M | 57.83M | 72.16M |

| Gross Profit Ratio | 34.10% | 49.05% | 28.83% | 25.75% | 26.29% | 27.31% | 32.37% | 36.27% | 32.88% | 18.88% | 23.55% | 30.33% | 26.45% | 28.72% | 27.26% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 207.00K | 39.00K | 0.00 | -269.00K | 1.99M | 12.51M | 11.39M | 9.37M | 7.84M | 5.23M | 6.25M |

| General & Administrative | 84.81M | 67.86M | 64.67M | 70.65M | 68.07M | 61.58M | 80.12M | 61.57M | 66.04M | 61.37M | 49.75M | 54.00M | 17.80M | 0.00 | 0.00 |

| Selling & Marketing | 6.30M | 7.10M | 7.10M | 6.30M | 4.40M | 2.40M | 2.10M | 1.40M | 900.00K | 300.00K | 200.00K | 800.00K | 15.97M | 0.00 | 0.00 |

| SG&A | 91.11M | 74.96M | 71.77M | 76.95M | 72.47M | 61.58M | 80.12M | 61.57M | 66.04M | 61.37M | 49.75M | 54.00M | 33.77M | 21.18M | 26.86M |

| Other Expenses | 45.09M | -520.00K | 707.00K | 639.00K | 1.07M | 156.00K | -367.00K | 207.00K | -193.00K | 389.00K | -444.00K | -143.00K | 24.00K | 86.00K | 118.00K |

| Operating Expenses | 136.20M | 74.96M | 71.77M | 76.95M | 72.67M | 61.83M | 85.00M | 67.45M | 74.61M | 73.88M | 61.14M | 63.37M | 41.64M | 26.49M | 33.23M |

| Cost & Expenses | 415.58M | 235.72M | 330.63M | 358.58M | 305.07M | 265.59M | 263.69M | 202.62M | 215.62M | 296.98M | 274.55M | 223.24M | 191.35M | 170.03M | 225.78M |

| Interest Income | 5.08M | 835.00K | 34.00K | 190.00K | 448.00K | 557.00K | 295.00K | 332.00K | 411.00K | 469.00K | 449.00K | 404.00K | 1.20M | 1.00K | 67.00K |

| Interest Expense | 99.00K | 129.00K | 427.00K | 328.00K | 530.00K | 401.00K | 310.00K | 332.00K | 10.00K | 0.00 | 3.22M | 2.91M | 3.17M | 1.72M | 67.00K |

| Depreciation & Amortization | 463.00K | 385.00K | 436.00K | 2.96M | 3.63M | 2.06M | 2.14M | 581.00K | 428.00K | 132.00K | 110.00K | 124.00K | 24.00K | 86.00K | 118.00K |

| EBITDA | 18.67M | 78.04M | 24.52M | 25.72M | 10.14M | 11.49M | -4.47M | -29.39M | -7.68M | -24.68M | -2.48M | 6.35M | 12.24M | 29.84M | 41.09M |

| EBITDA Ratio | 4.35% | 25.52% | 9.65% | 6.24% | 3.34% | 5.02% | 0.76% | 23.50% | -2.43% | -6.60% | 1.98% | 2.77% | 6.31% | 15.59% | 14.71% |

| Operating Income | 10.01M | 77.75M | 33.09M | 19.34M | 6.91M | 8.55M | -6.54M | -30.51M | -5.88M | -25.61M | 626.00K | 3.05M | 6.97M | 31.33M | 41.52M |

| Operating Income Ratio | 2.33% | 24.64% | 9.10% | 5.10% | 2.19% | 3.05% | -2.48% | -14.39% | -2.80% | -9.31% | 0.22% | 1.33% | 3.43% | 15.56% | 15.69% |

| Total Other Income/Expenses | 8.10M | -231.00K | -430.00K | -1.14M | -3.85M | -2.95M | -7.43M | 539.00K | -179.00K | -2.50M | -3.21M | -2.65M | -2.58M | -3.30M | 1.10M |

| Income Before Tax | 18.11M | 77.52M | 32.66M | 23.87M | 5.98M | 9.02M | -6.92M | -29.97M | -8.11M | -27.31M | -2.59M | 395.00K | 4.39M | 28.03M | 40.98M |

| Income Before Tax Ratio | 4.22% | 24.57% | 8.98% | 6.29% | 1.90% | 3.22% | -2.62% | -14.13% | -3.86% | -9.93% | -0.93% | 0.17% | 2.16% | 13.92% | 15.48% |

| Income Tax Expense | 4.24M | 21.04M | 8.79M | 8.31M | 4.60M | -12.38M | 1.73M | 2.22M | 525.00K | 95.00K | 2.76M | 2.93M | 6.95M | 13.95M | 18.25M |

| Net Income | 19.54M | 56.49M | 29.21M | 13.16M | 1.38M | 22.79M | -6.99M | -24.53M | -7.46M | -26.49M | -5.90M | -3.28M | 1.63M | 14.57M | 22.75M |

| Net Income Ratio | 4.56% | 17.90% | 8.03% | 3.47% | 0.44% | 8.13% | -2.65% | -11.56% | -3.55% | -9.63% | -2.11% | -1.43% | 0.80% | 7.24% | 8.59% |

| EPS | 0.75 | 2.20 | 1.06 | 0.45 | 0.05 | 0.91 | -0.30 | -1.08 | -0.34 | -1.25 | -0.30 | -0.16 | 0.07 | 0.72 | 1.12 |

| EPS Diluted | 0.74 | 2.14 | 1.05 | 0.44 | 0.05 | 0.89 | -0.30 | -1.08 | -0.34 | -1.25 | -0.30 | -0.16 | 0.07 | 0.65 | 1.02 |

| Weighted Avg Shares Out | 25.55M | 25.63M | 25.88M | 26.11M | 26.61M | 25.15M | 23.53M | 22.80M | 22.14M | 21.26M | 19.67M | 20.54M | 22.72M | 20.37M | 20.37M |

| Weighted Avg Shares Out (Dil) | 26.06M | 26.37M | 26.32M | 26.81M | 27.46M | 25.70M | 23.53M | 22.80M | 22.14M | 21.26M | 19.67M | 20.69M | 22.72M | 22.34M | 22.34M |

7 problems for students who want to study abroad as Covid-19 pandemic rages

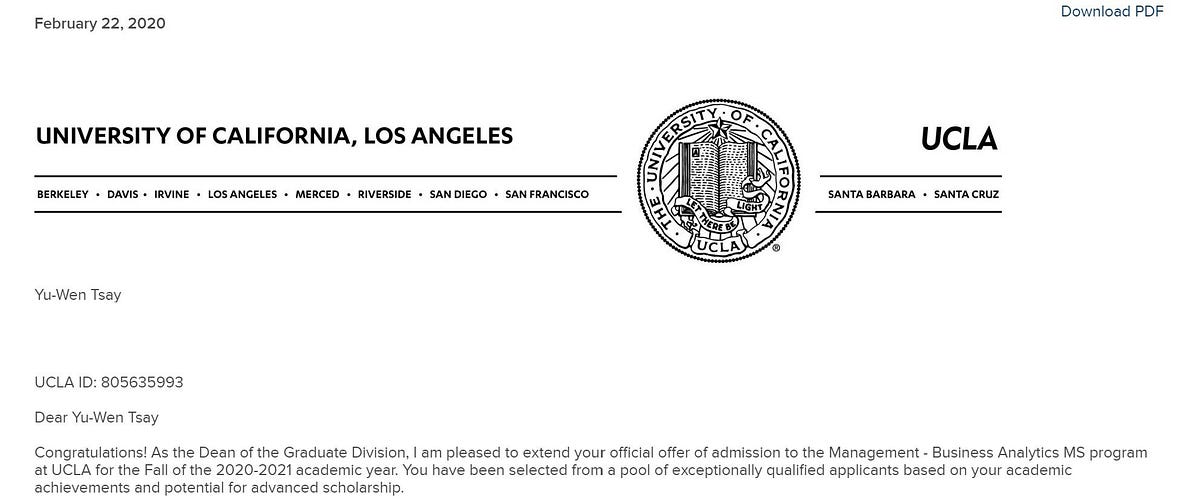

Master in Business Analytics (MSBA) 美國商業分析研究所申請分享

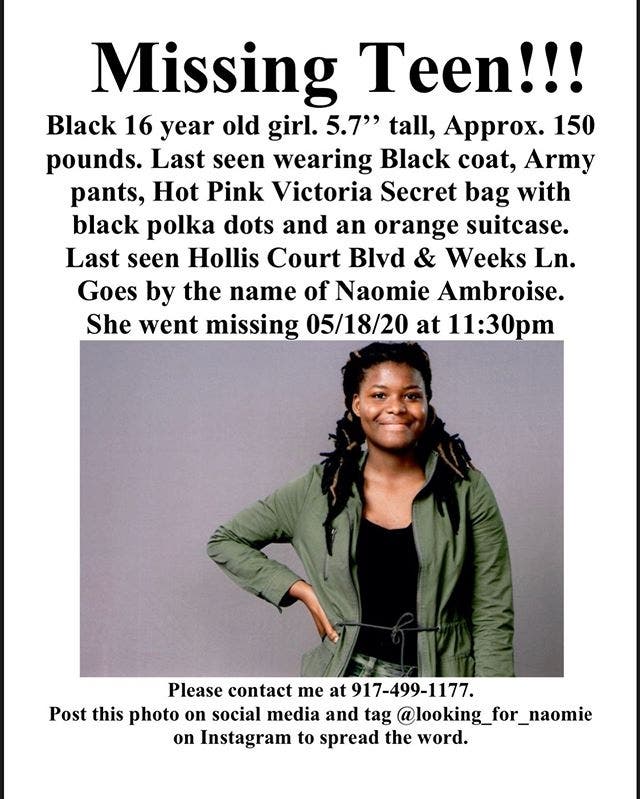

New Post From Your Neighbor

VPN protocols and which is the best to use

Marginal tax rates - Marginal REVOLUTION

Tracking Kahn Brothers Portfolio - Q1 2020 Update

UTSA will automatically admit higher-performing seniors to grad school

Some reflections on GRE scores - Marginal REVOLUTION

Genie Energy Ltd. (GNE) CEO Michael Stein on Q1 2020 Results - Earnings Call Transcript

What should I ask Paul Romer? - Marginal REVOLUTION

Source: https://incomestatements.info

Category: Stock Reports