See more : AUO Corporation (2409.TW) Income Statement Analysis – Financial Results

Complete financial analysis of Genfit S.A. (GNFT) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Genfit S.A., a leading company in the Biotechnology industry within the Healthcare sector.

- Infinite Group, Inc. (IMCIW) Income Statement Analysis – Financial Results

- Powell Industries, Inc. (POWL) Income Statement Analysis – Financial Results

- TENPOS HOLDINGS Co.,Ltd. (2751.T) Income Statement Analysis – Financial Results

- Mortech Corporation (7419.TWO) Income Statement Analysis – Financial Results

- Shinsei Bank, Limited (SKLKF) Income Statement Analysis – Financial Results

Genfit S.A. (GNFT)

About Genfit S.A.

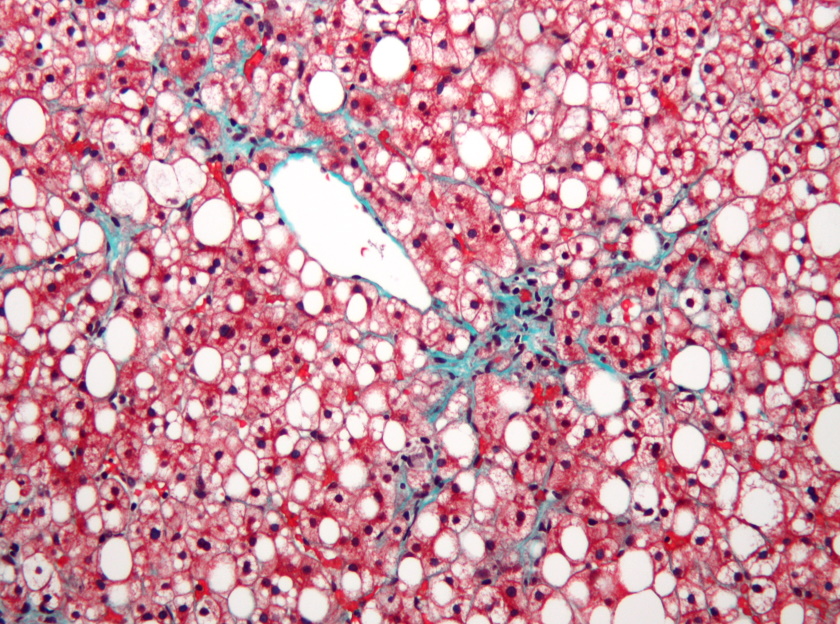

Genfit S.A., a biopharmaceutical company, discovers and develops drug candidates and diagnostic solutions for metabolic and liver-related diseases. The company's products include Elafibranor, which is in Phase 3 clinical trial to treat patients with primary biliary cholangitis. It also engages in the development of NIS4 technology for the diagnosis of nonalcoholic steatohepatitis (NASH) and fibrosis; GNS561, which is in Phase 1b/2 trial to treat patients with cholangiocarcinoma (CCA); and Nitazoxanide, which is in Phase 1 trial to treat acute-on-chronic liver failure. The company has a licensing agreement with Labcorp for the commercialization of NASHnext, a blood-based molecular diagnostic test; and with Genoscience Pharma to develop and commercialize the investigational treatment GNS561 for CCA. Genfit S.A. was incorporated in 1999 and is headquartered in Loos, France.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 28.57M | 20.20M | 80.07M | 765.00K | 30.84M | 69.00K | 118.00K | 284.00K | 527.00K | 1.61M | 1.90M | 1.67M | 2.36M | 3.76M | 5.81M | 8.76M | 9.48M | 10.05M | 12.77M |

| Cost of Revenue | 341.00K | 248.00K | 161.00K | 202.00K | 177.00K | 1.85M | 2.23M | 1.99M | 1.93M | 1.40M | 1.29M | 1.20M | 1.41M | 1.37M | 1.61M | 1.74M | 2.01M | 1.69M | 1.32M |

| Gross Profit | 28.22M | 19.95M | 79.91M | 563.00K | 30.66M | -1.79M | -2.11M | -1.70M | -1.40M | 210.10K | 606.40K | 477.20K | 949.30K | 2.39M | 4.21M | 7.02M | 7.47M | 8.37M | 11.46M |

| Gross Profit Ratio | 98.81% | 98.77% | 99.80% | 73.59% | 99.43% | -2,586.96% | -1,788.98% | -598.94% | -266.41% | 13.01% | 31.93% | 28.54% | 40.21% | 63.57% | 72.37% | 80.10% | 78.84% | 83.23% | 89.68% |

| Research & Development | 46.71M | 35.82M | 35.17M | 59.10M | 66.17M | 47.66M | 35.10M | 19.19M | 5.39M | 9.02M | 5.16M | 4.29M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 8.04M | 16.41M | 16.15M | 14.27M | 17.27M | 13.63M | 13.41M | 11.66M | 9.13M | 9.37M | 7.38M | 6.45M | 6.02M | 6.91M | 0.00 | 0.00 | 6.20M | 4.81M | 4.71M |

| Selling & Marketing | 0.00 | 992.00K | 1.54M | 11.22M | 13.71M | 717.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 8.04M | 17.40M | 17.69M | 25.49M | 30.97M | 13.63M | 13.41M | 11.66M | 9.13M | 9.37M | 7.38M | 6.45M | 6.02M | 6.91M | 0.00 | 0.00 | 6.20M | 4.81M | 4.71M |

| Other Expenses | 53.00K | -5.72M | -4.75M | -6.23M | -8.47M | 6.41M | 6.08M | 1.61M | 1.75M | 100.00 | -1.51M | -100.00 | 2.68M | 3.14M | 10.69M | 12.20M | 7.27M | 4.11M | 5.07M |

| Operating Expenses | 54.80M | 47.50M | 48.11M | 78.35M | 88.67M | 67.70M | 54.58M | 32.46M | 16.27M | 17.48M | 11.02M | 8.19M | 8.70M | 10.04M | 10.69M | 12.20M | 13.47M | 8.92M | 9.78M |

| Cost & Expenses | 55.15M | 47.50M | 48.11M | 78.35M | 88.67M | 69.55M | 56.81M | 34.44M | 18.20M | 18.88M | 12.32M | 9.39M | 10.11M | 11.41M | 12.29M | 13.94M | 15.47M | 10.61M | 11.10M |

| Interest Income | 1.71M | 8.21M | 44.78M | 6.54M | 5.22M | 202.00K | 389.00K | 316.00K | 437.00K | 329.00K | 169.20K | 201.40K | 322.80K | 205.70K | 300.90K | 596.00K | 768.90K | 399.70K | 53.40K |

| Interest Expense | 4.62M | 4.76M | 7.12M | 25.30M | 13.11M | 10.98M | 1.39M | 110.00K | 0.00 | 93.70K | 103.10K | 238.40K | 372.80K | 391.40K | 449.10K | 205.20K | 390.80K | 308.80K | 332.90K |

| Depreciation & Amortization | 1.65M | 1.83M | 2.74M | 4.75M | 5.25M | 1.44M | 1.53M | 799.00K | 327.00K | 292.10K | 465.50K | 556.30K | 788.80K | 919.60K | 1.06M | 1.00M | 943.90K | 537.70K | 874.40K |

| EBITDA | -22.24M | -23.60M | 34.91M | -91.14M | -51.02M | -68.08M | -55.76M | -33.53M | -17.35M | -16.98M | -9.95M | -6.77M | -6.64M | -6.53M | -5.09M | -3.41M | -4.07M | 930.30K | 2.60M |

| EBITDA Ratio | -77.84% | -85.45% | 99.26% | -8,821.70% | -153.07% | -97,182.61% | -46,264.41% | -11,550.70% | -3,146.30% | -1,029.08% | -509.17% | -405.08% | -281.18% | -173.79% | -88.67% | -40.07% | -43.19% | 1.16% | 20.38% |

| Operating Income | -26.58M | -27.55M | 76.74M | -77.79M | -57.83M | -69.48M | -56.70M | -34.16M | -17.68M | -17.26M | -10.51M | -7.72M | -7.75M | -7.66M | -6.47M | -5.17M | -5.99M | -553.30K | 1.68M |

| Operating Income Ratio | -93.05% | -136.41% | 95.84% | -10,168.76% | -187.53% | -100,701.45% | -48,046.61% | -12,027.46% | -3,354.08% | -1,069.04% | -553.56% | -461.39% | -328.32% | -203.82% | -111.40% | -59.06% | -63.21% | -5.50% | 13.12% |

| Total Other Income/Expenses | -1.93M | 3.45M | -7.26M | -18.75M | -7.89M | -10.39M | -2.45M | 526.00K | 541.00K | 234.00K | 179.60K | -13.60K | -50.00K | -185.70K | -177.50K | 559.20K | 611.00K | 223.60K | 33.40K |

| Income Before Tax | -28.51M | -23.84M | 69.47M | -101.65M | -65.72M | -79.88M | -58.22M | -33.63M | -17.14M | -17.03M | -10.33M | -7.73M | -7.80M | -7.84M | -6.65M | -4.71M | -5.38M | -329.70K | 1.71M |

| Income Before Tax Ratio | -99.82% | -118.03% | 86.77% | -13,287.45% | -213.11% | -115,760.87% | -49,338.14% | -11,841.55% | -3,251.42% | -1,054.57% | -544.10% | -462.21% | -330.44% | -208.76% | -114.46% | -53.79% | -56.76% | -3.28% | 13.38% |

| Income Tax Expense | 380.00K | -116.00K | 2.22M | -428.00K | -576.00K | -354.00K | 384.00K | 35.00K | 227.00K | 400.00 | 2.32M | -2.32M | 1.88M | 1.54M | 721.50K | -751.40K | -2.58M | -665.40K | 74.40K |

| Net Income | -28.89M | -23.72M | 67.26M | -101.22M | -65.15M | -79.52M | -58.60M | -33.67M | -17.14M | -17.03M | -12.65M | -5.41M | -9.68M | -9.38M | -7.37M | -3.96M | -2.80M | 327.70K | 1.77M |

| Net Income Ratio | -101.15% | -117.45% | 84.00% | -13,231.50% | -211.24% | -115,247.83% | -49,664.41% | -11,854.58% | -3,251.42% | -1,054.60% | -666.15% | -323.60% | -410.09% | -249.65% | -126.87% | -45.21% | -29.55% | 3.26% | 13.88% |

| EPS | -0.58 | -0.48 | 1.50 | -2.60 | -1.76 | -2.55 | -1.88 | -1.28 | -0.69 | -0.76 | -0.65 | -0.35 | -0.75 | -0.78 | -0.63 | -0.34 | -0.24 | 0.03 | 0.15 |

| EPS Diluted | -0.58 | -0.48 | 1.21 | -2.60 | -1.76 | -2.55 | -1.88 | -1.25 | -0.69 | -0.74 | -0.63 | -0.35 | -0.75 | -0.78 | -0.63 | -0.34 | -0.24 | 0.03 | 0.15 |

| Weighted Avg Shares Out | 49.70M | 49.67M | 44.74M | 38.86M | 36.99M | 31.17M | 31.16M | 26.35M | 24.70M | 22.29M | 19.41M | 15.32M | 12.88M | 11.97M | 11.62M | 11.62M | 11.62M | 11.62M | 11.62M |

| Weighted Avg Shares Out (Dil) | 49.70M | 49.67M | 55.61M | 38.86M | 36.99M | 31.17M | 31.17M | 26.85M | 24.70M | 22.98M | 20.01M | 15.32M | 12.88M | 11.97M | 11.62M | 11.62M | 11.62M | 11.62M | 11.62M |

GENFIT SA (GNFT) CEO Pascal Prigent on Q2 2020 Results - Earnings Call Transcript

Genfit (GNFT) Presents At Digital International Liver Congress 2020

Viking Therapeutics: Another Year In Review

Theratechnologies NASH Data And Other News: The Good, Bad And Ugly Of Biopharma

XBiotech Breakthrough, And Other News: The Good, Bad And Ugly Of Biopharma

Genfit abandons late-stage trial of NASH drug elafibranor -

Intercept Pharmaceuticals: Regulatory Snub Unsettles Liver Therapy Front-Runner

Genfit : L'américain Intercept, rival de Genfit, se prend à son tour les pieds dans le tapis

Source: https://incomestatements.info

Category: Stock Reports