See more : Water Oasis Group Limited (WOSSF) Income Statement Analysis – Financial Results

Complete financial analysis of Barrick Gold Corporation (GOLD) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Barrick Gold Corporation, a leading company in the Gold industry within the Basic Materials sector.

- PHINIA Inc. (PHIN) Income Statement Analysis – Financial Results

- Golden Eagle Retail Group Limited (GDNEF) Income Statement Analysis – Financial Results

- American Airlines Group Inc. (AAL) Income Statement Analysis – Financial Results

- New Talisman Gold Mines Limited (NTL.NZ) Income Statement Analysis – Financial Results

- Crescent NV (OPTI.BR) Income Statement Analysis – Financial Results

Barrick Gold Corporation (GOLD)

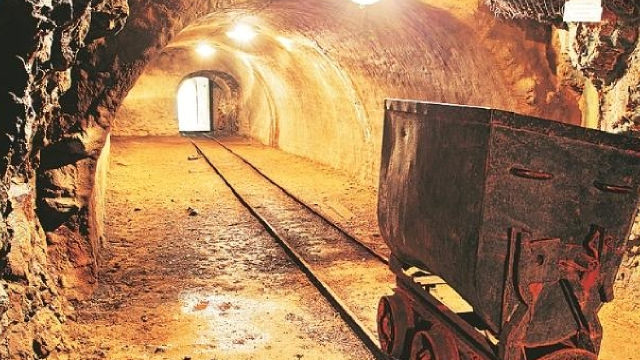

About Barrick Gold Corporation

Barrick Gold Corporation engages in the exploration, mine development, production, and sale of gold and copper properties. It has ownership interests in producing gold mines that are located in Argentina, Canada, Côte d'Ivoire, the Democratic Republic of Congo, Dominican Republic, Mali, Tanzania, and the United States. The company also has ownership interests in producing copper mines located in Chile, Saudi Arabia, and Zambia; and various other projects located throughout the Americas and Africa. Barrick Gold Corporation was founded in 1983 and is headquartered in Toronto, Canada.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 11.40B | 11.01B | 11.99B | 12.60B | 9.72B | 7.24B | 8.37B | 8.56B | 9.03B | 10.24B | 12.51B | 14.55B | 14.31B | 10.92B | 8.14B | 7.91B | 6.33B | 5.64B | 2.35B | 1.93B | 2.03B | 1.95B | 1.28B | 1.33B | 1.42B | 1.29B | 1.28B | 1.30B | 1.28B | -1.31B | -883.70M | 540.40M | 344.70M | 251.60M | 206.10M | 147.50M | 119.70M | 89.80M |

| Cost of Revenue | 7.93B | 7.50B | 7.09B | 7.42B | 6.91B | 5.22B | 5.30B | 5.41B | 6.91B | 6.83B | 7.24B | 7.65B | 6.66B | 4.20B | 3.95B | 4.09B | 3.36B | 2.91B | 1.36B | 1.21B | 1.27B | 1.13B | 660.89M | 590.08M | 560.03M | 631.05M | 719.06M | 756.95M | 684.42M | -670.90M | -416.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 3.47B | 3.52B | 4.90B | 5.18B | 2.81B | 2.02B | 3.07B | 3.15B | 2.12B | 3.41B | 5.27B | 6.89B | 7.65B | 6.72B | 4.19B | 3.82B | 2.97B | 2.73B | 994.93M | 720.06M | 763.86M | 821.63M | 621.31M | 740.10M | 860.99M | 656.05M | 565.02M | 541.99M | 597.95M | -642.20M | -467.70M | 540.40M | 344.70M | 251.60M | 206.10M | 147.50M | 119.70M | 89.80M |

| Gross Profit Ratio | 30.40% | 31.93% | 40.85% | 41.11% | 28.88% | 27.93% | 36.71% | 36.84% | 23.50% | 33.29% | 42.11% | 47.38% | 53.45% | 61.54% | 51.47% | 48.29% | 46.89% | 48.43% | 42.33% | 37.27% | 37.54% | 42.20% | 48.46% | 55.64% | 60.59% | 50.97% | 44.00% | 41.73% | 46.63% | 48.91% | 52.93% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 15.00M | 16.00M | 9.00M | 1.00M | 1.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 153.00M | 85.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 126.00M | 159.00M | 151.00M | 185.00M | 212.00M | 278.00M | 248.00M | 268.00M | 248.00M | 419.00M | 400.00M | 431.00M | 371.00M | 160.00M | 180.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 15.00M | 16.00M | 9.00M | 7.00M | 23.00M | 13.00M | 14.00M | 0.00 | 0.00 | 0.00 | 0.00 | -205.00M | 0.00 | -9.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 126.00M | 159.00M | 151.00M | 185.00M | 212.00M | 278.00M | 248.00M | 268.00M | 248.00M | 419.00M | 400.00M | 431.00M | 166.00M | 160.00M | 171.00M | 691.81M | 550.80M | 385.44M | 71.37M | 70.84M | 83.06M | 64.18M | 45.86M | 34.67M | 34.98M | 50.00M | 36.03M | 32.98M | 31.02M | -32.10M | -21.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 3.33B | 318.00M | 388.00M | 484.00M | 188.00M | -50.00M | -54.00M | 14.00M | -29.00M | 9.00M | -251.00M | -215.00M | 346.00M | 1.38B | 1.21B | 1.03B | 1.00B | 734.83M | 427.38M | 451.70M | 521.66M | 482.94M | 331.07M | 338.71M | 385.01M | 216.03M | 188.04M | 183.00M | 181.30M | -148.80M | -94.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 3.47B | 492.00M | 555.00M | 669.00M | 400.00M | 735.00M | 724.00M | 685.00M | 606.00M | 894.00M | 825.00M | 899.00M | 742.00M | 1.69B | 7.61B | 1.72B | 1.55B | 1.12B | 498.75M | 522.54M | 604.72M | 547.12M | 376.93M | 373.38M | 419.99M | 266.04M | 224.06M | 215.98M | 212.32M | -180.90M | -115.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Cost & Expenses | 8.74B | 7.99B | 7.64B | 8.09B | 7.31B | 5.96B | 6.02B | 6.09B | 7.51B | 7.72B | 8.07B | 8.55B | 7.40B | 5.89B | 11.55B | 5.82B | 4.92B | 4.03B | 1.85B | 1.73B | 1.88B | 1.67B | 1.04B | 963.46M | 980.02M | 897.09M | 943.13M | 972.93M | 896.74M | -851.80M | -531.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Income | 295.32M | 17.00M | 16.00M | 50.00M | 52.00M | 37.00M | 14.00M | 13.00M | 13.00M | 25.00M | 9.00M | 11.00M | 13.00M | 14.00M | 10.00M | 39.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 350.00M | 341.00M | 346.00M | 323.00M | 427.00M | 443.00M | 512.00M | 593.00M | 723.00M | 702.00M | 478.00M | 109.00M | 199.00M | 121.00M | 57.00M | 21.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 2.17B | 2.00B | 2.15B | 2.46B | 2.16B | 1.45B | 1.83B | 1.73B | 1.77B | 1.65B | 1.73B | 1.72B | 1.42B | 1.20B | 1.07B | 1.03B | 1.01B | 734.83M | 429.10M | 455.04M | 513.90M | 482.94M | 481.22M | 338.71M | 385.01M | 216.03M | 188.04M | 183.00M | 181.30M | -148.80M | -94.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EBITDA | 5.16B | 3.70B | 6.65B | 7.73B | 7.11B | 1.63B | 5.16B | 4.09B | -507.48M | -183.08M | -6.96B | 1.38B | 8.43B | 6.43B | -2.50B | 3.79B | 2.42B | 2.25B | 925.27M | 676.72M | 757.65M | 743.47M | 604.98M | 698.76M | 826.02M | 606.05M | 529.00M | 509.01M | 566.41M | -610.10M | -446.30M | 540.40M | 344.70M | 251.60M | 206.10M | 147.50M | 119.70M | 89.80M |

| EBITDA Ratio | 45.27% | 48.66% | 57.78% | 56.46% | 73.12% | 38.04% | 47.83% | 47.35% | 35.03% | 39.90% | 46.70% | 51.08% | 60.63% | 56.96% | -28.69% | 47.93% | 37.70% | 42.02% | 42.22% | 41.98% | 28.20% | 40.54% | 54.48% | 153.03% | 58.13% | 42.97% | 73.99% | 41.19% | 42.20% | 44.50% | 48.56% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Operating Income | 2.47B | 3.36B | 4.82B | 4.90B | 5.07B | 1.29B | 2.35B | 2.47B | 1.52B | 2.52B | 4.44B | 5.99B | 7.28B | 5.03B | 2.84B | 2.10B | 1.41B | 1.61B | 496.17M | 197.52M | 159.14M | 274.51M | 244.38M | 366.72M | 441.00M | 390.01M | 340.96M | 326.01M | 385.63M | -461.30M | -352.30M | 540.40M | 344.70M | 251.60M | 206.10M | 147.50M | 119.70M | 89.80M |

| Operating Income Ratio | 21.66% | 30.53% | 40.24% | 38.93% | 52.21% | 17.78% | 28.06% | 28.84% | 16.79% | 24.56% | 35.51% | 41.20% | 50.86% | 46.08% | 34.86% | 26.50% | 22.34% | 28.56% | 21.11% | 10.22% | 7.82% | 14.10% | 19.06% | 27.57% | 31.03% | 30.30% | 26.55% | 25.10% | 30.07% | 35.13% | 39.87% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Total Other Income/Expenses | 345.00M | -1.34B | -191.00M | 43.00M | 1.28B | -1.53B | 75.00M | -690.00M | -4.20B | -5.09B | -13.38B | -6.45B | -367.00M | -198.00M | -6.47B | -645.69M | 65.45M | 42.06M | -41.28M | -176.68M | 62.88M | -46.39M | 41.46M | -1.31B | 0.00 | 52.97M | -420.92M | -35.97M | 4.62M | -9.90M | -5.70M | -540.40M | -344.70M | -251.60M | -206.10M | -147.50M | -119.70M | -89.80M |

| Income Before Tax | 2.81B | 1.68B | 4.63B | 4.95B | 6.36B | -237.00M | 2.75B | 1.78B | -3.14B | -2.65B | -9.47B | -913.00M | 6.82B | 4.59B | -3.63B | 1.45B | 1.48B | 1.56B | 454.90M | 45.00M | 222.02M | 228.12M | 268.25M | -944.13M | 441.00M | 442.99M | -79.96M | 290.04M | 390.47M | -471.10M | -357.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Income Before Tax Ratio | 24.69% | 15.26% | 38.65% | 39.27% | 65.42% | -3.27% | 32.80% | 20.78% | -34.82% | -25.91% | -75.67% | -6.28% | 47.68% | 41.99% | -44.62% | 18.34% | 23.37% | 27.67% | 19.36% | 2.33% | 10.91% | 11.72% | 20.92% | -70.98% | 31.03% | 34.42% | -6.23% | 22.33% | 30.45% | 35.88% | 40.50% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% | 0.00% |

| Income Tax Expense | 861.00M | 664.00M | 1.34B | 1.33B | 1.78B | 1.20B | 1.23B | 917.00M | -31.00M | 306.00M | 630.00M | -236.00M | 2.29B | 1.37B | 648.00M | 589.69M | 341.36M | 347.67M | 60.19M | -203.35M | 4.66M | -1.27M | 10.05M | -178.02M | 109.97M | 142.00M | 43.02M | 72.02M | 97.98M | -119.70M | -75.40M | -174.90M | -92.40M | -58.20M | -35.80M | -30.50M | -26.70M | -15.10M |

| Net Income | 1.27B | 432.00M | 3.29B | 3.61B | 3.97B | -1.55B | 1.44B | 655.00M | -2.84B | -2.91B | -10.37B | -665.00M | 4.48B | 3.27B | -4.27B | 784.88M | 1.12B | 1.51B | 400.72M | 248.35M | 200.28M | 228.76M | 258.20M | -766.10M | 331.03M | 300.99M | -122.98M | 218.02M | 292.48M | -351.40M | -282.50M | 174.90M | 92.40M | 58.20M | 35.80M | 30.50M | 26.70M | 15.10M |

| Net Income Ratio | 11.16% | 3.92% | 27.43% | 28.69% | 40.85% | -21.33% | 17.17% | 7.65% | -31.43% | -28.39% | -82.86% | -4.57% | 31.33% | 29.97% | -52.53% | 9.92% | 17.67% | 26.71% | 17.05% | 12.86% | 9.84% | 11.75% | 20.14% | -57.59% | 23.30% | 23.39% | -9.58% | 16.78% | 22.81% | 26.76% | 31.97% | 32.36% | 26.81% | 23.13% | 17.37% | 20.68% | 22.31% | 16.82% |

| EPS | 0.72 | 0.23 | 1.85 | 2.03 | 2.31 | -1.32 | 1.23 | 0.56 | -2.44 | -2.50 | -10.15 | -0.66 | 4.49 | 3.32 | -4.73 | 0.90 | 1.29 | 1.79 | 0.75 | 0.47 | 0.37 | 0.36 | 0.18 | -2.21 | 0.85 | 0.80 | -0.33 | 0.60 | 0.83 | -1.14 | -0.99 | 0.61 | 0.34 | 0.23 | 0.14 | 0.12 | 0.13 | 0.10 |

| EPS Diluted | 0.72 | 0.23 | 1.85 | 2.03 | 2.31 | -1.32 | 1.23 | 0.56 | -2.44 | -2.50 | -10.14 | -0.66 | 4.48 | 3.28 | -4.73 | 0.89 | 1.28 | 1.77 | 0.75 | 0.46 | 0.37 | 0.36 | 0.18 | -2.21 | 0.83 | 0.79 | -0.33 | 0.60 | 0.82 | -1.12 | -0.98 | 0.61 | 0.34 | 0.23 | 0.14 | 0.12 | 0.13 | 0.09 |

| Weighted Avg Shares Out | 1.76B | 1.77B | 1.78B | 1.78B | 1.76B | 1.17B | 1.17B | 1.17B | 1.16B | 1.16B | 1.02B | 1.00B | 999.00M | 987.00M | 903.00M | 872.00M | 867.00M | 842.00M | 534.30M | 528.41M | 541.30M | 536.60M | 396.00M | 345.99M | 389.45M | 376.24M | 372.67M | 364.37M | 352.57M | 308.86M | 285.35M | 286.72M | 271.76M | 253.04M | 255.71M | 254.17M | 205.38M | 151.00M |

| Weighted Avg Shares Out (Dil) | 1.76B | 1.77B | 1.78B | 1.78B | 1.76B | 1.17B | 1.17B | 1.17B | 1.17B | 1.17B | 1.02B | 1.00B | 1.00B | 987.00M | 903.00M | 872.00M | 879.00M | 855.00M | 534.30M | 539.90M | 541.30M | 541.00M | 396.00M | 345.99M | 398.83M | 381.00M | 372.67M | 364.37M | 355.71M | 314.38M | 288.27M | 286.72M | 271.76M | 253.04M | 255.71M | 254.17M | 205.38M | 167.78M |

Barrick Gold Starts Development of Lumwana Super Pit Expansion

MONTAGE GOLD SETS SHORT-TERM DISCOVERY TARGET OF MORE THAN 1 MILLION OUNCES OF HIGHER-GRADE M&I RESOURCES

Twiga Partnership Leads Extractive Industry's Contribution to Tanzanian Economy

Barrick Gold Stock Trading Cheaper Than Industry: Buy or Hold?

Why 5 Dividend Gold Stocks May Be the Best October Trade Ever

Ready for Growth? Barrick Gold Stock Could Be the Answer

Barrick Gold (GOLD) Stock Sinks As Market Gains: Here's Why

Lumwana's Super Pit Expansion Officially Launched

Should Value Investors Buy Barrick Gold (GOLD) Stock?

Ready for Growth? Barrick Gold Stock Could Be the Answer

Source: https://incomestatements.info

Category: Stock Reports