See more : DP Cap Acquisition Corp I (DPCS) Income Statement Analysis – Financial Results

Complete financial analysis of U.S. Global Investors, Inc. (GROW) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of U.S. Global Investors, Inc., a leading company in the Asset Management – Global industry within the Financial Services sector.

- Adicet Bio, Inc. (ACET) Income Statement Analysis – Financial Results

- Bartronics India Limited (ASMS.BO) Income Statement Analysis – Financial Results

- 3D Oil Limited (TDO.AX) Income Statement Analysis – Financial Results

- Montrose Environmental Group, Inc. (MEG) Income Statement Analysis – Financial Results

- Nanjing Sciyon Wisdom Technology Group Co., Ltd. (002380.SZ) Income Statement Analysis – Financial Results

U.S. Global Investors, Inc. (GROW)

About U.S. Global Investors, Inc.

U.S. Global Investors, Inc. is a publicly owned investment manager. The firm primarily provides its services to investment companies. It also provides its services to pooled investment vehicles. The firm manages equity and fixed income mutual funds for its clients. It also manages hedge funds. The firm also manages exchange traded funds. It invests in the public equity and fixed income markets across the globe. It invests in G.A.R.P. and value stocks to make its equity investments. The firm employs a fundamental and quantitative analysis with top-down and bottom-up stock picking approach to make its investments. U.S. Global Investors, Inc. was founded in 1968 and is based in San Antonio, Texas.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 10.98M | 15.07M | 24.71M | 21.65M | 4.48M | 4.92M | 6.26M | 6.76M | 5.51M | 9.37M | 11.44M | 18.67M | 23.85M | 41.93M | 35.03M | 23.14M | 56.04M | 58.60M | 44.85M | 16.98M | 12.98M | 7.48M | 7.77M | 8.89M | 10.91M | 9.02M | 10.02M | 14.01M | 20.21M | 15.77M |

| Cost of Revenue | 4.80M | 4.80M | 6.06M | 7.37M | 2.84M | 3.42M | 4.27M | 3.75M | 5.43M | 7.95M | 8.77M | 12.04M | 9.99B | 12.47B | 11.91B | 10.02B | 13.61B | 12.56B | 10.36B | 5.89B | 4.99B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 6.18M | 10.28M | 18.66M | 14.29M | 1.64M | 1.50M | 1.99M | 3.01M | 79.00K | 1.43M | 2.67M | 6.62M | -9.97B | -12.43B | -11.88B | -9.99B | -13.55B | -12.50B | -10.31B | -5.87B | -4.97B | 7.48M | 7.77M | 8.89M | 10.91M | 9.02M | 10.02M | 14.01M | 20.21M | 15.77M |

| Gross Profit Ratio | 56.28% | 68.17% | 75.48% | 65.97% | 36.55% | 30.49% | 31.80% | 44.49% | 1.44% | 15.21% | 23.34% | 35.48% | -41,792.03% | -29,632.62% | -33,907.95% | -43,188.18% | -24,182.27% | -21,332.30% | -22,995.96% | -34,591.98% | -38,298.34% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.25 | 0.17 | 0.95 | -1.04 | -1.23 | 0.13 | -0.08 | -0.62 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 6.06M | 6.12M | 6.91M | 5.70M | 3.66M | 4.04M | 3.87M | 3.49M | 3.73M | 4.28M | 5.20M | 5.93M | 19.89M | 27.70M | 24.91M | 18.71M | 6.81M | 7.48M | 5.46M | 3.82M | 3.96M | 7.61M | 7.85M | 9.32M | 9.99M | 9.32M | 9.30M | 11.64M | 10.52M | 9.41M |

| Selling & Marketing | 404.00K | 382.00K | 405.00K | 220.00K | 174.00K | 198.00K | 172.00K | 135.00K | 212.00K | 411.00K | 615.00K | 862.09K | 1.18M | 1.92M | 1.29M | 406.96K | 488.22K | 508.99K | 513.08K | 369.93K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 6.46M | 6.50M | 7.32M | 5.92M | 3.84M | 4.24M | 4.04M | 3.63M | 3.94M | 4.69M | 5.82M | 6.79M | 21.07M | 29.61M | 26.20M | 19.12M | 7.29M | 7.99M | 5.97M | 4.19M | 3.96M | 7.61M | 7.85M | 9.32M | 9.99M | 9.32M | 9.30M | 11.64M | 10.52M | 9.41M |

| Other Expenses | 199.00K | 242.00K | 226.00K | 196.00K | 202.00K | 224.00K | 241.00K | 253.00K | 316.00K | 327.00K | 256.00K | 274.48K | 281.76K | 291.71K | 321.42K | 7.63M | 32.16M | 29.27M | 23.01M | 10.55M | 6.11M | 492.55K | 164.67K | 226.15K | 395.45K | 492.58K | 457.39K | 481.51K | 1.04M | 5.91M |

| Operating Expenses | 6.66M | 6.75M | 7.54M | 6.12M | 4.04M | 4.46M | 4.28M | 3.88M | 4.26M | 5.01M | 6.07M | 7.06M | 21.35M | 29.90M | 26.52M | 26.75M | 39.46M | 37.26M | 28.99M | 14.74M | 10.07M | 8.11M | 8.02M | 9.54M | 10.38M | 9.82M | 9.76M | 12.12M | 11.57M | 15.32M |

| Cost & Expenses | 11.46M | 11.55M | 13.60M | 13.49M | 6.88M | 7.88M | 8.55M | 7.64M | 9.68M | 12.96M | 14.84M | 19.11M | 21.35M | 29.90M | 26.52M | 26.75M | 39.46M | 37.26M | 28.99M | 14.74M | 10.07M | 8.11M | 8.02M | 9.54M | 10.38M | 9.82M | 9.76M | 12.12M | 11.57M | 15.32M |

| Interest Income | 0.00 | 1.80M | 1.95M | 464.00K | 166.00K | 324.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 3.00K | 4.00K | 4.02M | 0.00 | 0.00 | 2.97M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 196.00K | 14.00M | 25.52M | 3.58M | 8.89M | 8.01M | 8.55M | 7.64M | 9.68M | 327.00K | 259.00K | 274.48K | 281.76K | 291.71K | 321.42K | 270.33K | 284.24K | 244.07K | 152.76K | 109.90K | 108.07K | 121.49K | 164.67K | 226.15K | 395.45K | 492.58K | 457.39K | 481.51K | 425.30K | 536.92K |

| EBITDA | 2.11M | 4.33M | 15.39M | 8.54M | -2.20M | -2.54M | -2.05M | -620.00K | -3.86M | -3.18M | -2.99M | 84.00K | 2.78M | 12.32M | 8.83M | -883.60K | 16.87M | 21.59M | 16.02M | 2.35M | 3.02M | -134.51K | -86.73K | -422.10K | 925.60K | -306.91K | 723.72K | 2.37M | 9.07M | 990.44K |

| EBITDA Ratio | 19.25% | 26.63% | 62.25% | -94.31% | 0.22% | -23.92% | -56.72% | -14.28% | -78.93% | -39.43% | -46.23% | -2.01% | 11.66% | 29.38% | 25.21% | -14.43% | 30.10% | 36.84% | 35.72% | 13.82% | 23.29% | -16.68% | -1.12% | -4.75% | 8.01% | 4.84% | 10.53% | 17.39% | 44.65% | 6.28% |

| Operating Income | -480.00K | 3.53M | 15.80M | 8.17M | -192.00K | -2.96M | -2.29M | -873.00K | -4.18M | -3.59M | -3.40M | -441.56K | 2.50M | 12.03M | 8.51M | -3.61M | 16.58M | 21.35M | 15.87M | 2.24M | 2.92M | -256.00K | -251.40K | -648.25K | 530.15K | -799.49K | 266.34K | 1.89M | 8.65M | 453.52K |

| Operating Income Ratio | -4.37% | 23.38% | 63.95% | 37.71% | -4.29% | -60.28% | -36.54% | -12.91% | -75.86% | -38.29% | -29.74% | -2.37% | 10.48% | 28.69% | 24.29% | -15.60% | 29.59% | 36.42% | 35.38% | 13.17% | 22.46% | -3.42% | -3.24% | -7.29% | 4.86% | -8.87% | 2.66% | 13.50% | 42.79% | 2.88% |

| Total Other Income/Expenses | 2.40M | 558.00K | -6.15M | 29.27M | -2.24M | -1.51M | 3.17M | 346.00K | 485.00K | 353.00K | 2.04M | 262.00K | -177.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -81.00 | -73.15K | 288.11K | -85.38K | -110.25K | -60.91K | -869.99K | -454.53K | -1.28M | -5.65M | -6.35M |

| Income Before Tax | 1.92M | 4.08M | 7.10M | 37.44M | -4.64M | -4.42M | 886.00K | -527.00K | -3.69M | -3.15M | -1.24M | -178.99K | 2.50M | 12.03M | 8.51M | -3.61M | 16.58M | 21.35M | 15.87M | 2.24M | 2.84M | 32.11K | -336.79K | -758.50K | 469.23K | -1.67M | -188.19K | 616.13K | 3.00M | -5.90M |

| Income Before Tax Ratio | 17.43% | 27.09% | 28.71% | 172.89% | -103.64% | -89.81% | 14.15% | -7.79% | -67.05% | -33.66% | -10.81% | -0.96% | 10.48% | 28.69% | 24.29% | -15.60% | 29.59% | 36.42% | 35.38% | 13.17% | 21.89% | 0.43% | -4.34% | -8.53% | 4.30% | -18.51% | -1.88% | 4.40% | 14.84% | -37.38% |

| Income Tax Expense | 582.00K | 934.00K | 1.60M | 5.48M | -175.00K | -977.00K | 197.00K | 17.00K | -6.00K | 822.00K | -517.00K | 15.22K | 968.95K | 4.20M | 3.16M | -1.37M | 5.75M | 7.59M | 5.43M | 789.97K | 675.84K | -10.50K | -95.35K | 36.18K | -26.53K | 183.33K | -39.57K | 331.98K | 1.01M | -2.01M |

| Net Income | 1.33M | 3.15M | 5.50M | 31.96M | -4.46M | -3.44M | 647.00K | -513.00K | -3.68M | -4.03M | -970.00K | -194.21K | 1.53M | 7.83M | 5.35M | -2.24M | 10.84M | 13.76M | 10.44M | 1.45M | 2.17M | 42.61K | -241.43K | -794.68K | 495.76K | -1.85M | -148.62K | 284.15K | 1.99M | -3.85M |

| Net Income Ratio | 12.14% | 20.89% | 22.25% | 147.60% | -99.73% | -69.94% | 10.33% | -7.59% | -66.76% | -43.01% | -8.48% | -1.04% | 6.42% | 18.68% | 15.27% | -9.67% | 19.34% | 23.48% | 23.27% | 8.52% | 16.69% | 0.57% | -3.11% | -8.94% | 4.54% | -20.55% | -1.48% | 2.03% | 9.83% | -24.40% |

| EPS | 0.09 | 0.22 | 0.37 | 2.12 | -0.30 | -0.23 | 0.04 | -0.03 | -0.24 | -0.26 | -0.06 | -0.01 | 0.10 | 0.51 | 0.35 | -0.15 | 0.71 | 0.91 | 0.69 | 0.10 | 0.15 | 0.01 | -0.02 | -0.06 | 0.04 | -0.14 | -0.01 | 0.02 | 0.15 | -0.32 |

| EPS Diluted | 0.09 | 0.22 | 0.37 | 2.12 | -0.30 | -0.23 | 0.04 | -0.03 | -0.24 | -0.26 | -0.06 | -0.01 | 0.10 | 0.51 | 0.35 | -0.15 | 0.71 | 0.90 | 0.69 | 0.10 | 0.15 | 0.00 | -0.02 | -0.06 | 0.04 | -0.14 | -0.01 | 0.02 | 0.15 | -0.32 |

| Weighted Avg Shares Out | 14.18M | 14.64M | 15.01M | 15.07M | 15.11M | 15.14M | 15.16M | 15.21M | 15.24M | 15.40M | 15.46M | 15.48M | 15.44M | 15.38M | 15.34M | 15.28M | 15.25M | 15.16M | 15.03M | 14.96M | 14.44M | 14.92M | 16.10M | 14.45M | 14.16M | 13.23M | 13.23M | 13.33M | 13.20M | 12.03M |

| Weighted Avg Shares Out (Dil) | 14.18M | 14.64M | 15.01M | 15.07M | 15.11M | 15.14M | 15.16M | 15.21M | 15.29M | 15.40M | 15.46M | 15.48M | 15.44M | 15.38M | 15.34M | 15.28M | 15.28M | 15.24M | 15.15M | 15.13M | 14.44M | 14.94M | 16.10M | 14.45M | 14.75M | 13.33M | 13.34M | 13.33M | 13.20M | 12.03M |

U.S. Global Investors, Inc. 2020 Q4 - Results - Earnings Call Presentation

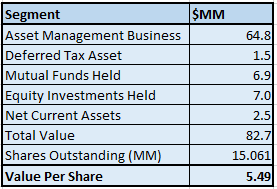

Buy U.S. Global Investors Instead Of The JETS ETF They Manage

The gold rally could forge ahead to $4,000, but analyst says two events could turn its fortunes

San Antonio 122, New Orleans 113

The Contrarian Investment Case For Russian Stocks

Nigel Weiss obituary

Tremont Mortgage Trust Announces Second Quarter 2020 Results

Two Mining Picks Ahead Of Q2 Earnings

Galileo Now Powering MoneyLion's New Demand Deposit Account RoarMoney

Source: https://incomestatements.info

Category: Stock Reports