See more : Systematix Corporate Services Limited (SYSTMTXC.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Global Ship Lease, Inc. (GSL) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Global Ship Lease, Inc., a leading company in the Marine Shipping industry within the Industrials sector.

- Murphy USA Inc. (MUSA) Income Statement Analysis – Financial Results

- Energy Services of America Corporation (ESOA) Income Statement Analysis – Financial Results

- Security Bancorp, Inc. (SCYT) Income Statement Analysis – Financial Results

- Terminalcare Support Institute Inc. (7362.T) Income Statement Analysis – Financial Results

- Ottakringer Getränke AG (OTS.VI) Income Statement Analysis – Financial Results

Global Ship Lease, Inc. (GSL)

About Global Ship Lease, Inc.

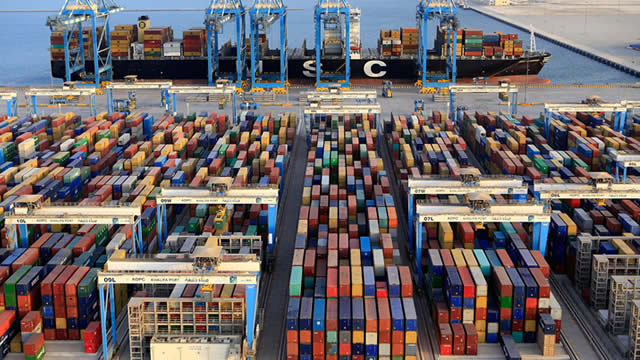

Global Ship Lease, Inc. owns and charters containerships of various sizes under fixed-rate charters to container shipping companies. As of March 10, 2022, it owned 65 mid-sized and smaller containerships with an aggregate capacity of 342,348 twenty-foot equivalent units. The company was founded in 2007 and is based in London, the United Kingdom.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 666.72M | 604.49M | 402.52M | 282.81M | 261.10M | 157.10M | 158.99M | 166.52M | 164.92M | 138.62M | 143.21M | 153.21M | 156.27M | 158.84M | 148.71M | 97.05M | 335.10M | 299.60M |

| Cost of Revenue | 294.53M | 269.90M | 204.97M | 160.96M | 140.72M | 86.30M | 81.44M | 88.50M | 94.96M | 89.83M | 86.43M | 85.93M | 45.52M | 42.07M | 41.37M | 31.92M | 0.00 | 0.00 |

| Gross Profit | 372.19M | 334.59M | 197.56M | 121.85M | 120.38M | 70.80M | 77.55M | 78.02M | 69.96M | 48.79M | 56.78M | 67.27M | 110.75M | 116.77M | 107.34M | 65.13M | 335.10M | 299.60M |

| Gross Profit Ratio | 55.82% | 55.35% | 49.08% | 43.08% | 46.11% | 45.06% | 48.78% | 46.85% | 42.42% | 35.20% | 39.65% | 43.91% | 70.87% | 73.52% | 72.18% | 67.11% | 100.00% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 18.22M | 18.53M | 13.24M | 8.35M | 8.82M | 9.22M | 5.30M | 6.30M | 6.48M | 7.02M | 6.03M | 5.78M | 0.00 | 8.25M | 8.75M | 7.53M | 17.75M | 11.33M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 18.22M | 18.53M | 13.24M | 8.35M | 8.82M | 9.22M | 5.30M | 6.30M | 6.48M | 7.02M | 6.03M | 5.78M | 7.38M | 8.25M | 8.75M | 7.53M | 17.75M | 11.33M |

| Other Expenses | 10.75M | 42.94M | 48.24M | 1.25M | 1.48M | 212.00K | -51.00K | -216.00K | -382.00K | 8.58M | -411.00K | -342.00K | 40.13M | 40.05M | 36.88M | 20.88M | 289.54M | 252.44M |

| Operating Expenses | 28.97M | 18.53M | 13.24M | 8.35M | 8.82M | 9.22M | 5.25M | 6.08M | 6.00M | 6.51M | 5.62M | 5.44M | 47.52M | 47.92M | 45.62M | 28.41M | 307.29M | 263.77M |

| Cost & Expenses | 323.50M | 288.43M | 218.21M | 169.31M | 149.54M | 95.52M | 86.69M | 94.58M | 100.97M | 96.34M | 92.05M | 91.37M | 93.03M | 89.98M | 86.99M | 60.33M | 307.29M | 263.77M |

| Interest Income | 9.78M | 2.51M | 449.00K | 956.00K | 1.79M | 1.43M | 489.00K | 198.00K | 62.00K | 64.00K | 44.00K | 79.00K | 56.00K | 185.00K | 519.00K | 837.00K | 2.55M | 11.91M |

| Interest Expense | 44.82M | 75.29M | 69.23M | 65.35M | 74.99M | 48.69M | 59.39M | 44.77M | 48.15M | 43.87M | 18.85M | 21.18M | 20.56M | 23.83M | 24.22M | 21.44M | 13.56M | 15.06M |

| Depreciation & Amortization | 91.73M | 81.30M | 61.56M | 46.44M | 45.85M | 35.46M | 37.98M | 42.81M | 42.74M | 38.94M | 38.27M | 38.22M | 38.01M | 37.93M | 35.76M | 20.83M | 16.12M | 16.66M |

| EBITDA | 441.50M | 449.47M | 302.34M | 153.40M | 160.68M | 26.83M | 23.17M | 22.52M | 64.17M | 91.12M | 91.85M | 93.58M | 69.84M | 59.96M | 104.35M | -31.30M | 46.48M | 64.41M |

| EBITDA Ratio | 66.22% | 66.45% | 61.89% | 57.33% | 61.54% | 61.98% | 68.54% | 67.76% | 64.73% | 64.82% | 62.47% | 65.36% | 66.18% | 68.68% | 66.94% | 60.23% | 13.87% | 21.50% |

| Operating Income | 343.22M | 354.19M | 237.52M | 104.76M | 111.57M | -10.26M | -15.32M | -20.48M | 19.25M | 42.27M | 51.16M | 61.83M | 49.93M | 51.77M | 61.72M | 36.72M | 30.15M | 47.74M |

| Operating Income Ratio | 51.48% | 58.59% | 59.01% | 37.04% | 42.73% | -6.53% | -9.64% | -12.30% | 11.67% | 30.50% | 35.72% | 40.36% | 31.95% | 32.60% | 41.50% | 37.84% | 9.00% | 15.93% |

| Total Other Income/Expenses | -38.27M | -61.31M | -65.97M | -63.15M | -71.73M | -118.88M | -146.50M | -136.78M | -92.32M | -36.09M | -18.55M | -29.78M | -54.09M | -72.39M | -18.90M | -73.15M | -13.35M | -15.06M |

| Income Before Tax | 304.95M | 292.88M | 171.55M | 41.61M | 39.84M | -57.31M | -74.23M | -65.05M | -28.84M | 6.19M | 32.62M | 32.06M | 9.15M | -3.92M | 42.82M | -36.43M | 16.80M | 32.68M |

| Income Before Tax Ratio | 45.74% | 48.45% | 42.62% | 14.71% | 15.26% | -36.48% | -46.69% | -39.06% | -17.49% | 4.46% | 22.77% | 20.92% | 5.85% | -2.47% | 28.79% | -37.54% | 5.01% | 10.91% |

| Income Tax Expense | 448.00K | -50.00K | 56.00K | 49.00K | 3.00K | 55.00K | 40.00K | 46.00K | 38.00K | 75.00K | 97.00K | 128.00K | 74.00K | 52.00K | 444.00K | 125.00K | 20.00K | 0.00 |

| Net Income | 304.50M | 292.93M | 171.50M | 41.56M | 39.84M | -57.36M | -74.27M | -65.10M | -28.88M | 6.11M | 32.52M | 31.93M | 9.07M | -3.97M | 42.37M | -36.55M | 16.78M | 32.68M |

| Net Income Ratio | 45.67% | 48.46% | 42.60% | 14.70% | 15.26% | -36.52% | -46.71% | -39.09% | -17.51% | 4.41% | 22.71% | 20.84% | 5.80% | -2.50% | 28.49% | -37.66% | 5.01% | 10.91% |

| EPS | 8.33 | 7.74 | 4.65 | 2.32 | 1.45 | -7.71 | -10.73 | -9.42 | -4.19 | 0.80 | 5.44 | 5.36 | 1.52 | -0.58 | 6.32 | -7.10 | 1.34K | 2.62K |

| EPS Diluted | 8.21 | 7.62 | 4.60 | 2.31 | 1.45 | -7.71 | -10.73 | -9.42 | -4.19 | 0.80 | 5.44 | 5.36 | 1.52 | -0.58 | 6.24 | -7.10 | 1.34K | 2.62K |

| Weighted Avg Shares Out | 35.41M | 36.60M | 35.13M | 17.94M | 12.11M | 7.44M | 6.92M | 6.91M | 6.90M | 5.96M | 5.95M | 5.94M | 5.91M | 6.79M | 6.73M | 5.15M | 12.50K | 12.50K |

| Weighted Avg Shares Out (Dil) | 35.93M | 37.20M | 35.51M | 18.00M | 12.16M | 7.44M | 6.92M | 6.91M | 6.90M | 5.98M | 5.97M | 5.95M | 5.93M | 6.79M | 6.77M | 5.15M | 12.50K | 12.50K |

Global Ship Lease: Raised Dividend By 20%, Very Undervalued

Global Ship Lease Provides Update on Refinancing Activity

7 Stocks Set to Explode in August 2024

Global Ship Lease, Inc. (GSL) Q2 2024 Earnings Call Transcript

Global Ship Lease (GSL) Beats Q2 Earnings and Revenue Estimates

Global Ship Lease Reports Results for the Second Quarter of 2024

Global Ship Lease (GSL) Reports Next Week: Wall Street Expects Earnings Growth

Global Ship Lease Announces Second Quarter 2024 Earnings Release, Conference Call and Webcast

Global Ship Lease: I'm Still Staying Away From The Preferred Shares

Global Ship Lease: Most Likely Still Marginally Undervalued, A Moderate Buy

Source: https://incomestatements.info

Category: Stock Reports