See more : Total Helium Ltd. (TOH.V) Income Statement Analysis – Financial Results

Complete financial analysis of Ferroglobe PLC (GSM) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Ferroglobe PLC, a leading company in the Industrial Materials industry within the Basic Materials sector.

- Industrial Human Capital, Inc. (AXH) Income Statement Analysis – Financial Results

- European Metals Holdings Limited (EMH.AX) Income Statement Analysis – Financial Results

- Hybrid Financial Services Limited (HYBRIDFIN.NS) Income Statement Analysis – Financial Results

- Predator Oil & Gas Holdings Plc (PRD.L) Income Statement Analysis – Financial Results

- PT Bank Capital Indonesia Tbk (BACA.JK) Income Statement Analysis – Financial Results

Ferroglobe PLC (GSM)

About Ferroglobe PLC

Ferroglobe PLC operates in the silicon and specialty metals industry in the United States, Europe, and internationally. It provides silicone chemicals that are used in a range of applications, including personal care items, construction-related products, health care products, and electronics, as well as silicon metal for primary and secondary aluminum producers; silicomanganese, which is used as deoxidizing agent in the steel manufacturing process; and ferromanganese that is used as a deoxidizing, desulphurizing, and degassing agent in the removal of nitrogen and other harmful elements from steel. The company also offers ferrosilicon products that are used to produce stainless steel, carbon steel, and various other steel alloys, as well as to manufacture electrodes and aluminum; calcium silicon, which is used in the deoxidation and desulfurization of liquid steel, and production of coatings for cast iron pipes, as well as in the welding process of powder metal and in pyrotechnics; and nodularizers and inoculants, which are used in the production of iron. In addition, it provides silica fume, a by-product of the electrometallurgical process of silicon metal and ferrosilicon. Further, the company operates quartz mines in Spain, South Africa, the United States, and Canada; and low-ash metallurgical coal mines in the United States, as well as holds interests in hydroelectric power plant in France. It serves silicone chemical, aluminum, and steel manufacturers; auto companies and their suppliers; ductile iron foundries; manufacturers of photovoltaic solar cells and computer chips; and concrete producers. The company was formerly known as VeloNewco Limited and changed its name to Ferroglobe PLC in December 2015. The company was incorporated in 2015 and is headquartered in London, the United Kingdom. Ferroglobe PLC is a subsidiary of Grupo Villar Mir, S.A.U.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 1.65B | 2.60B | 1.78B | 1.14B | 1.60B | 2.27B | 1.74B | 1.58B | 1.32B | 1.42B | 1.46B | 1.48B |

| Cost of Revenue | 879.29M | 1.36B | 1.28B | 897.03M | 1.32B | 1.56B | 1.15B | 1.18B | 885.79M | 954.73M | 990.00M | 924.04M |

| Gross Profit | 770.75M | 1.24B | 496.68M | 247.41M | 282.76M | 710.11M | 593.18M | 400.36M | 430.80M | 462.35M | 473.88M | 555.57M |

| Gross Profit Ratio | 46.71% | 47.71% | 27.92% | 21.62% | 17.64% | 31.23% | 34.06% | 25.33% | 32.72% | 32.63% | 32.37% | 37.55% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 11.10M | 11.20M | 7.00M | 11.20M |

| General & Administrative | 362.05M | 314.27M | 280.92M | 214.77M | 291.14M | 341.04M | 302.14M | 294.63M | 205.87M | 213.83M | 217.53M | 0.00 |

| Selling & Marketing | -56.19M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 305.86M | 314.27M | 280.92M | 214.77M | 291.14M | 341.04M | 302.14M | 294.63M | 205.87M | 213.83M | 217.53M | 212.43M |

| Other Expenses | 267.95M | 194.62M | 177.27M | 114.95M | 175.53M | 13.41M | -4.47M | 1.54M | -1.26M | -9.53M | 6.48M | 0.00 |

| Operating Expenses | 573.81M | 508.89M | 458.19M | 329.72M | 466.67M | 578.94M | 522.01M | 508.88M | 390.41M | 355.69M | 378.29M | 487.24M |

| Cost & Expenses | 1.45B | 1.87B | 1.74B | 1.23B | 1.79B | 2.14B | 1.67B | 1.69B | 1.28B | 1.31B | 1.37B | 1.41B |

| Interest Income | 0.00 | 2.27M | 253.00K | 16.00K | 68.00K | 72.00K | 3.70M | 1.55M | 425.00K | 3.76M | 1.74M | 32.36M |

| Interest Expense | 30.05M | 61.02M | 56.35M | 45.11M | 51.58M | 57.20M | 62.31M | 30.27M | 23.27M | 21.69M | 39.32M | 0.00 |

| Depreciation & Amortization | 73.53M | 81.56M | 97.33M | 108.19M | 120.13M | 113.84M | 102.49M | 118.34M | 67.05M | 74.75M | 79.10M | 67.13M |

| EBITDA | 268.34M | 734.39M | 128.58M | -47.26M | -228.46M | 224.75M | 147.26M | -256.71M | 81.81M | 175.53M | 165.02M | 36.43M |

| EBITDA Ratio | 16.26% | 33.34% | 7.66% | 2.97% | 6.83% | 9.96% | 10.04% | 1.57% | 7.61% | 11.98% | 11.99% | 10.95% |

| Operating Income | 196.94M | 686.65M | 40.36M | -74.17M | -13.60M | 177.40M | 66.36M | -182.07M | -15.13M | 95.11M | 98.65M | 94.85M |

| Operating Income Ratio | 11.94% | 26.43% | 2.27% | -6.48% | -0.85% | 7.80% | 3.81% | -11.52% | -1.15% | 6.71% | 6.74% | 6.41% |

| Total Other Income/Expenses | -40.92M | -68.74M | -151.32M | -38.07M | -56.23M | -63.51M | -56.20M | -32.23M | 6.60M | -16.02M | -52.04M | -111.92M |

| Income Before Tax | 156.02M | 620.88M | -104.89M | -171.58M | -419.59M | 111.15M | 9.11M | -214.29M | -8.53M | 79.09M | 46.61M | 35.96M |

| Income Before Tax Ratio | 9.46% | 23.90% | -5.90% | -14.99% | -26.17% | 4.89% | 0.52% | -13.56% | -0.65% | 5.58% | 3.18% | 2.43% |

| Income Tax Expense | 57.54M | 158.47M | -4.56M | 17.09M | -50.13M | 27.67M | -10.92M | -57.56M | 49.94M | 57.65M | 24.56M | 1.28M |

| Net Income | 82.66M | 440.31M | -100.33M | -188.67M | -369.45M | 89.52M | 25.17M | -136.55M | -43.27M | 38.44M | 28.45M | 35.19M |

| Net Income Ratio | 5.01% | 16.95% | -5.64% | -16.49% | -23.05% | 3.94% | 1.45% | -8.64% | -3.29% | 2.71% | 1.94% | 2.38% |

| EPS | 0.44 | 2.34 | -0.57 | -1.11 | -2.18 | 0.52 | 0.00 | -0.79 | -0.43 | 0.39 | 0.29 | 175.94 |

| EPS Diluted | 0.43 | 2.32 | -0.57 | -1.11 | -2.18 | 0.52 | 0.00 | -0.79 | -0.43 | 0.39 | 0.29 | 175.94 |

| Weighted Avg Shares Out | 187.87M | 187.82M | 176.51M | 169.27M | 169.15M | 171.41M | 171.95M | 171.79M | 99.70M | 98.08M | 98.08M | 200.00K |

| Weighted Avg Shares Out (Dil) | 190.29M | 189.63M | 176.51M | 169.27M | 169.15M | 171.53M | 171.95M | 171.84M | 99.70M | 98.08M | 98.08M | 200.00K |

Ferroglobe: Ride The Commodities Price Boom With This Undervalued Stock

Has Ferroglobe (GSM) Outpaced Other Basic Materials Stocks This Year?

Despite Fast-paced Momentum, Globe Specialty Metals (GSM) Is Still a Bargain Stock

Industrial Production & Economic Growth Increasing Metal Ore Mining Demand & Profitability

Ferroglobe (GSM) CEO, Marco Levi on Q2 2022 Results - Earnings Call Transcript

Ferroglobe Schedules Second Quarter 2022 Earnings Call for August 16, 2022

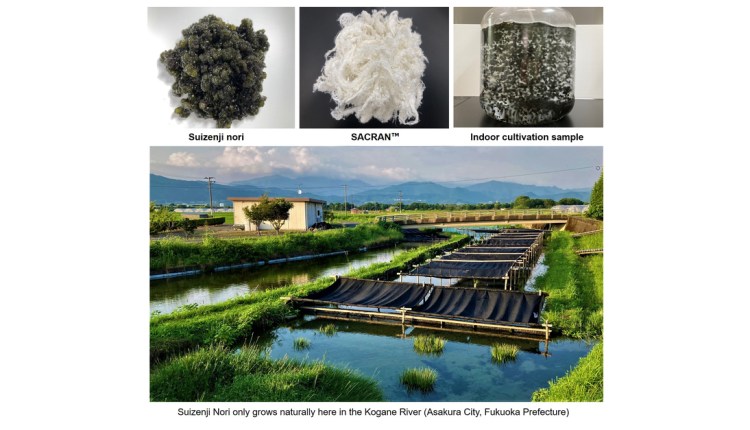

DIC: Suizenji Nori Blue-Green Algae New Key Indoor Cultivation Tech Unlocks Stable, Scalable Algaculture for Delivering SACRANTM Moisture-Retention Effect for More Ethical and More Sustainable Cosmetics and Skincare Products

Ferroglobe PLC (GSM) CEO Marco Levi on Q1 2022 Results - Earnings Call Transcript

Why Ferroglobe Stock Popped on Wednesday

Globe Specialty Metals (GSM) Q1 Earnings Top Estimates

Source: https://incomestatements.info

Category: Stock Reports