See more : JPMorgan Global Core Real Assets Limited (JARA.L) Income Statement Analysis – Financial Results

Complete financial analysis of Greenwave Technology Solutions, Inc. (GWAV) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Greenwave Technology Solutions, Inc., a leading company in the Waste Management industry within the Industrials sector.

- InterDigital, Inc. (IDCC) Income Statement Analysis – Financial Results

- Sampre Nutritions Limited (SAMPRE.BO) Income Statement Analysis – Financial Results

- Henan Shuanghui Investment & Development Co.,Ltd. (000895.SZ) Income Statement Analysis – Financial Results

- PANJON LTD. (PANJON.BO) Income Statement Analysis – Financial Results

- Sabre Gold Mines Corp. (SGLDD) Income Statement Analysis – Financial Results

Greenwave Technology Solutions, Inc. (GWAV)

About Greenwave Technology Solutions, Inc.

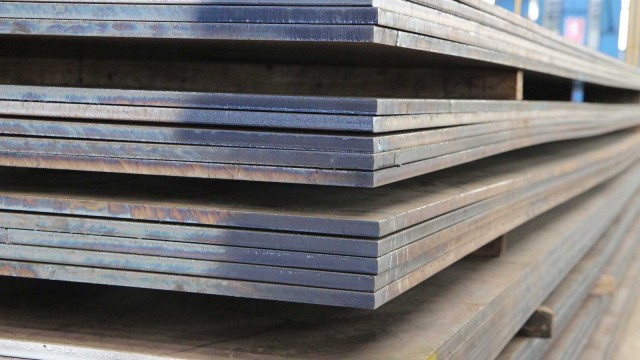

Greenwave Technology Solutions, Inc., through its subsidiary, Empire Services, Inc., operates metal recycling facilities in Virginia and North Carolina. The company, through its 11 metal recycling facilities, collects, classifies, and processes raw scrap ferrous and nonferrous metals for recycling iron, steel, aluminum, copper, lead, stainless steel, and zinc. It is involved in the purchasing and selling processed and unprocessed scrap metals to steel mills and other purchasers. The company was formerly known as MassRoots, Inc and changed its name to Greenwave Technology Solutions, Inc. in October 2021. The company was founded in 2002 and is headquartered in Suffolk, Virginia.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 35.67M | 33.98M | 8.10M | 6.96K | 23.70K | 19.60K | 319.24K | 701.58K | 213.96K | 9.03K | 705.00 |

| Cost of Revenue | 21.18M | 21.54M | 5.24M | 1.28K | 3.53K | 994.00 | 630.00 | 180.43K | 57.61K | 690.00 | 0.00 |

| Gross Profit | 14.48M | 12.44M | 2.86M | 5.68K | 20.17K | 18.60K | 318.61K | 521.15K | 156.35K | 8.34K | 705.00 |

| Gross Profit Ratio | 40.61% | 36.61% | 35.31% | 81.58% | 85.11% | 94.93% | 99.80% | 74.28% | 73.07% | 92.36% | 100.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 14.65M | 13.30M | 4.35M | 1.11M | 2.84M | 11.09M | 30.38M | 13.14M | 5.56M | 1.43M | 1.29M |

| Selling & Marketing | 414.19K | 83.99K | 33.60K | 58.96K | 29.76K | 501.45K | 960.24K | 985.34K | 717.77K | 180.78K | 93.55K |

| SG&A | 15.07M | 13.38M | 4.38M | 1.17M | 2.87M | 11.59M | 31.34M | 14.12M | 6.28M | 1.43M | 1.38M |

| Other Expenses | 18.93M | 9.94M | 1.40M | 162.11M | 38.55K | 1.71M | 1.99M | 9,493.31B | 0.00 | 1.80K | 0.00 |

| Operating Expenses | 31.10M | 23.32M | 5.79M | 1.17M | 2.91M | 13.30M | 33.33M | 14.12M | 6.28M | 1.43M | 1.38M |

| Cost & Expenses | 55.18M | 44.86M | 11.03M | 1.17M | 2.91M | 13.30M | 33.33M | 14.30M | 6.34M | 1.43M | 1.38M |

| Interest Income | 0.00 | 34.08M | 10.56M | 5.14M | 4.94M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 8.90M | 34.08M | 10.56M | 5.14M | 4.94M | 1.97M | 659.77K | 3.85M | 4.38K | 8.32K | 0.00 |

| Depreciation & Amortization | 7.46M | 6.45M | 1.28M | 6.73K | 45.28K | 443.06K | 416.25K | 19.45K | 10.17K | 1.80K | 342.00 |

| EBITDA | -10.58M | 5.49M | 10.21M | -9.57M | -29.29M | -13.60M | -43.31M | -14.16M | -8.35M | -2.36M | -918.90K |

| EBITDA Ratio | -29.67% | -11.43% | 2,229.15% | 2,311,100.00% | -38,106.83% | -65,493.39% | -10,208.78% | -1,936.05% | -2,857.94% | -15,761.09% | -195,509.65% |

| Operating Income | -19.51M | -10.88M | 179.23M | -1.16M | -2.89M | -13.88M | -36.80M | -13.60M | -6.13M | -1.61M | -1.38M |

| Operating Income Ratio | -54.71% | -32.03% | 2,213.29% | -16,660.12% | -12,186.73% | -70,850.21% | -11,528.55% | -1,938.82% | -2,862.69% | -17,798.70% | -195,558.16% |

| Total Other Income/Expenses | -7.42M | -24.16M | 1.30M | -13.55M | -31.38M | -2.13M | -7.59M | -4.43M | -2.35M | -828.92K | 0.00 |

| Income Before Tax | -26.94M | -35.04M | -1.63M | -14.71M | -34.27M | -16.02M | -44.39M | -18.03M | -8.47M | -2.44M | -1.38M |

| Income Before Tax Ratio | -75.52% | -103.13% | -20.16% | -211,235.78% | -144,576.26% | -81,729.05% | -13,904.68% | -2,569.93% | -3,959.98% | -26,978.32% | -195,558.16% |

| Income Tax Expense | 0.00 | 28.82M | 192.72M | 5.14M | -1.25M | 1.20M | 659.77K | 3.85M | 4.38K | 8.32K | 0.00 |

| Net Income | -26.94M | -63.86M | -194.35M | -19.85M | -33.02M | -16.02M | -44.39M | -18.03M | -8.47M | -2.44M | -1.38M |

| Net Income Ratio | -75.52% | -187.94% | -2,400.02% | -285,034.19% | -139,287.26% | -81,729.05% | -13,904.68% | -2,569.93% | -3,959.98% | -26,978.32% | -195,558.16% |

| EPS | -385.81 | -1.46K | -3.78K | -640.03 | -2.58K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| EPS Diluted | -385.81 | -1.46K | -3.56K | -640.03 | -2.58K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Weighted Avg Shares Out | 87.08K | 43.84K | 51.41K | 31.01K | 12.82K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Weighted Avg Shares Out (Dil) | 87.08K | 43.85K | 54.66K | 31.01K | 12.82K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

Greenwave Technology Solutions' Downstream Processing System Generates Record Revenues as Copper Hits All Time High

Greenwave Announces Reverse Stock Split to Regain Nasdaq Compliance

Greenwave Eliminates All Convertible Debt

Why Is Greenwave Technology Solutions (GWAV) Stock Down 60% Today?

Meme Stock Profit-Taking: 3 Companies to Sell While You're Ahead

Trending on Reddit: Meme Stock Greenwave Technology (GWAV) Is Up Another 62% Today

Why Is Greenwave Technology Solutions (GWAV) Stock Up 91% Today?

Greenwave Technology Solutions Expects to Process Record Volumes of Steel and Copper with Revenues Exceeding $40 Million in 2024

Greenwave Technology Solutions' Exchanges All Outstanding Notes Held by its Chief Executive Officer into Equity

Why Is Greenwave Technology Solutions (GWAV) Stock Up 15% Today?

Source: https://incomestatements.info

Category: Stock Reports