See more : Asahi Intecc Co., Ltd. (7747.T) Income Statement Analysis – Financial Results

Complete financial analysis of Harvard Bioscience, Inc. (HBIO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Harvard Bioscience, Inc., a leading company in the Medical – Instruments & Supplies industry within the Healthcare sector.

- oOh!media Limited (OML.AX) Income Statement Analysis – Financial Results

- Tinkerine Studios Ltd. (TKSTF) Income Statement Analysis – Financial Results

- Shanghai Challenge Textile Co.,Ltd. (002486.SZ) Income Statement Analysis – Financial Results

- Handelsinvest – Defensiv 10 (HAID10A.CO) Income Statement Analysis – Financial Results

- COOCON Corporation (294570.KQ) Income Statement Analysis – Financial Results

Harvard Bioscience, Inc. (HBIO)

Industry: Medical - Instruments & Supplies

Sector: Healthcare

Website: https://www.harvardbioscience.com

About Harvard Bioscience, Inc.

Harvard Bioscience, Inc. develops, manufactures, and sells technologies, products, and services that enables fundamental research, discovery, and pre-clinical testing for drug development in the United States and internationally. The company offers cellular and molecular technology instruments, such as syringe and peristaltic pump products, as well as a range of instruments and accessories for tissue and organ-based lab research, including surgical products, infusion systems, and behavior research systems; and spectrophotometers, microplate readers, amino acid analyzers, gel electrophoresis equipment, and electroporation and electrofusion instruments. It also engages in the development and manufacture of precision scientific measuring instrumentation and equipment, which cover data acquisition systems with custom amplifier configurations for cellular analysis, micro electrode array solutions for in vivo recordings, and vitro-systems for extracellular recordings; and offers preclinical products. The company markets its products through sales organizations, websites, catalogs, and distributors to research scientists in pharmaceutical and biotechnology companies, universities, hospitals, and government laboratories, as well as to contract research organizations, academic labs, and government researchers. It primarily sells its products under Harvard Apparatus, DSI, Ponemah, Buxco, Biochrom, BTX, and MCS brand names. The company was founded in 1901 and is headquartered in Holliston, Massachusetts.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 112.25M | 113.34M | 118.90M | 102.10M | 116.18M | 120.77M | 101.88M | 104.52M | 108.66M | 108.66M | 105.17M | 111.17M | 108.86M | 108.18M | 85.77M | 88.05M | 83.41M | 76.18M | 67.43M | 92.60M | 87.14M | 57.38M | 40.87M | 30.57M | 26.18M | 12.15M |

| Cost of Revenue | 46.18M | 52.52M | 51.25M | 44.06M | 51.85M | 57.59M | 54.29M | 56.11M | 59.94M | 59.32M | 57.48M | 58.75M | 58.60M | 56.40M | 44.09M | 45.89M | 43.16M | 38.09M | 34.16M | 46.52M | 43.73M | 28.82M | 20.64M | 15.10M | 12.72M | 5.35M |

| Gross Profit | 66.07M | 60.82M | 67.65M | 58.04M | 64.32M | 63.18M | 47.60M | 48.42M | 48.72M | 49.34M | 47.70M | 52.42M | 50.26M | 51.78M | 41.68M | 42.16M | 40.25M | 38.09M | 33.28M | 46.07M | 43.41M | 28.56M | 20.23M | 15.47M | 13.46M | 6.80M |

| Gross Profit Ratio | 58.86% | 53.66% | 56.90% | 56.85% | 55.37% | 52.31% | 46.72% | 46.32% | 44.84% | 45.41% | 45.35% | 47.15% | 46.17% | 47.86% | 48.60% | 47.88% | 48.25% | 50.00% | 49.35% | 49.76% | 49.82% | 49.77% | 49.50% | 50.61% | 51.40% | 55.97% |

| Research & Development | 11.76M | 12.33M | 10.80M | 8.69M | 10.72M | 10.99M | 5.65M | 5.39M | 6.42M | 4.88M | 4.15M | 7.32M | 5.43M | 4.71M | 4.40M | 4.05M | 3.71M | 3.15M | 2.95M | 7.19M | 6.26M | 4.15M | 3.18M | 1.53M | 1.19M | 325.00K |

| General & Administrative | 22.78M | 24.49M | 24.31M | 23.51M | 22.76M | 21.38M | 18.58M | 20.95M | 19.83M | 16.83M | 19.94M | 19.70M | 18.06M | 17.64M | 15.11M | 26.10M | 25.18M | 24.55M | 20.74M | 31.06M | 26.78M | 18.89M | 14.52M | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 24.11M | 25.04M | 24.64M | 19.92M | 23.26M | 24.44M | 21.04M | 20.49M | 20.58M | 18.23M | 17.33M | 19.17M | 17.47M | 16.35M | 11.76M | 10.97M | 10.35M | 9.50M | 8.11M | 16.82M | 15.38B | 8.44B | 4.84B | 0.00 | 0.00 | 0.00 |

| SG&A | 46.89M | 49.53M | 48.95M | 43.43M | 46.02M | 45.83M | 39.61M | 41.44M | 40.41M | 35.05M | 37.27M | 38.87M | 35.54M | 33.99M | 26.87M | 26.10M | 25.18M | 24.55M | 20.74M | 31.06M | 26.78M | 18.89M | 14.52M | 22.78M | 9.88M | 4.04M |

| Other Expenses | 5.60M | 6.12M | 5.84M | 5.71M | 5.75M | -4.28M | -740.00K | -179.00K | -1.26M | -1.14M | -51.00K | -287.00K | 2.75M | 2.36M | 1.84M | 1.97M | 1.82M | 1.70M | 1.67M | 3.45M | 2.70M | 1.54M | 1.74M | 1.49M | 1.26M | 27.00K |

| Operating Expenses | 64.50M | 67.99M | 65.59M | 57.82M | 62.49M | 62.20M | 47.70M | 49.55M | 49.65M | 42.51M | 44.01M | 48.94M | 43.72M | 41.06M | 33.11M | 32.12M | 30.71M | 29.40M | 25.35M | 41.69M | 35.75M | 24.58M | 19.44M | 25.80M | 12.32M | 4.39M |

| Cost & Expenses | 110.36M | 120.50M | 116.84M | 101.88M | 114.34M | 119.79M | 101.98M | 105.66M | 109.59M | 101.83M | 101.48M | 107.70M | 102.32M | 97.46M | 77.20M | 78.01M | 73.87M | 67.49M | 59.51M | 88.22M | 79.48M | 53.40M | 40.08M | 40.90M | 25.04M | 9.74M |

| Interest Income | 0.00 | 2.55M | 1.54M | 4.83M | 5.41M | 0.00 | 0.00 | 3.00K | 8.00K | 74.00K | 43.00K | 46.00K | 65.00K | 65.00K | 29.00K | 372.00K | 317.00K | 216.00K | 234.00K | 136.00K | 175.99K | 445.67K | 1.36M | 159.85K | 0.00 | 0.00 |

| Interest Expense | 3.59M | 2.25M | 1.54M | 4.83M | 5.41M | 5.37M | 713.00K | 642.00K | 854.00K | 990.00K | 955.00K | 584.00K | 752.00K | 677.00K | 277.00K | 389.00K | 365.00K | 429.00K | 917.00K | 794.00K | 327.23K | 104.18K | 6.87K | 916.21K | 0.00 | 0.00 |

| Depreciation & Amortization | 7.00M | 7.58M | 7.62M | 7.63M | 7.73M | 7.84M | 2.91M | 4.27M | 2.82M | 2.58M | 3.99M | 4.21M | 2.75M | 2.36M | 1.84M | 3.10M | 3.47M | 3.34M | 5.04M | 6.35M | 5.29M | 3.01M | 2.97M | 1.49M | 1.26M | 27.00K |

| EBITDA | 8.03M | 944.00K | 11.31M | 5.49M | 7.50M | 5.36M | -101.00K | 1.80M | 1.73M | 9.29M | 7.67M | 11.68M | 11.95M | 13.80M | 13.14M | 11.14M | 9.53M | 8.69M | 12.96M | 14.73M | 12.95M | 6.99M | 3.76M | -8.84M | 2.39M | 2.44M |

| EBITDA Ratio | 7.16% | -0.92% | 6.09% | 5.02% | 6.21% | 1.73% | 1.57% | 1.35% | 0.59% | 7.69% | 7.29% | 6.69% | 8.59% | 12.15% | 12.18% | 17.61% | 15.50% | 15.89% | 19.37% | 11.39% | 15.17% | 15.61% | 22.79% | 93.51% | 122.81% | 20.07% |

| Operating Income | 1.89M | -7.17M | 1.40M | -585.00K | 1.47M | 984.00K | -101.00K | -3.00M | -1.71M | 6.62M | 1.54M | 3.17M | 6.08M | 10.22M | 8.06M | 8.48M | 9.53M | 8.69M | 7.92M | 4.38M | 7.67M | 1.64M | -4.66M | -10.33M | 1.13M | 2.41M |

| Operating Income Ratio | 1.69% | -6.32% | 1.18% | -0.57% | 1.27% | 0.81% | -0.10% | -2.87% | -1.58% | 6.09% | 1.46% | 2.85% | 5.58% | 9.45% | 9.39% | 9.63% | 11.43% | 11.41% | 11.75% | 4.73% | 8.80% | 2.86% | -11.40% | -33.77% | 4.33% | 19.85% |

| Total Other Income/Expenses | -4.45M | -2.25M | -2.21M | -7.51M | -5.88M | -8.96M | -1.99M | -81.00K | -1.90M | -2.20M | -1.10M | -5.60M | -1.54M | -655.00K | 1.76M | -829.00K | 35.00K | -294.00K | -784.00K | 3.25M | -428.00K | 707.00K | 1.24M | -38.18M | -30.42M | -1.56M |

| Income Before Tax | -2.56M | -9.18M | -140.00K | -7.29M | -5.50M | -8.52M | -2.09M | -3.08M | -3.61M | 4.42M | 435.00K | 2.23M | 4.54M | 9.56M | 9.81M | 7.65M | 9.57M | 8.40M | 7.14M | 3.80M | 7.24M | 2.35M | -3.42M | -48.51M | -29.28M | 854.00K |

| Income Before Tax Ratio | -2.28% | -8.10% | -0.12% | -7.14% | -4.74% | -7.05% | -2.05% | -2.94% | -3.32% | 4.06% | 0.41% | 2.00% | 4.17% | 8.84% | 11.44% | 8.69% | 11.47% | 11.02% | 10.59% | 4.10% | 8.30% | 4.09% | -8.36% | -158.66% | -111.86% | 7.03% |

| Income Tax Expense | 859.00K | 337.00K | 148.00K | 518.00K | -815.00K | -3.68M | -1.22M | 1.23M | 15.43M | 2.06M | -288.00K | 696.00K | 730.00K | -9.45M | 2.67M | 2.24M | 1.97M | 1.78M | 899.00K | 1.47M | 2.98M | 1.61M | 1.79M | 1.36M | 137.48K | 783.00K |

| Net Income | -3.42M | -9.52M | -288.00K | -7.81M | -4.69M | -3.46M | -865.00K | -4.31M | -19.04M | 2.36M | -1.83M | 2.37M | 3.81M | 19.02M | 7.23M | 1.67M | -1.35M | -2.34M | -31.88M | 2.33M | 4.26M | 737.33K | -5.21M | -49.87M | -29.42M | 71.00K |

| Net Income Ratio | -3.04% | -8.40% | -0.24% | -7.65% | -4.03% | -2.87% | -0.85% | -4.12% | -17.52% | 2.17% | -1.74% | 2.13% | 3.50% | 17.58% | 8.43% | 1.90% | -1.62% | -3.07% | -47.27% | 2.52% | 4.89% | 1.28% | -12.74% | -163.11% | -112.38% | 0.58% |

| EPS | -0.08 | -0.23 | -0.01 | -0.20 | -0.12 | -0.10 | -0.03 | -0.13 | -0.57 | 0.07 | -0.06 | 0.09 | 0.13 | 0.66 | 0.24 | 0.05 | -0.04 | -0.08 | -1.05 | 0.08 | 0.14 | 0.03 | -0.20 | -6.23 | -5.25 | -0.01 |

| EPS Diluted | -0.08 | -0.23 | -0.01 | -0.20 | -0.12 | -0.10 | -0.02 | -0.13 | -0.57 | 0.07 | -0.06 | 0.08 | 0.13 | 0.65 | 0.24 | 0.05 | -0.04 | -0.08 | -1.04 | 0.07 | 0.14 | 0.03 | -0.20 | -6.23 | -5.25 | -0.01 |

| Weighted Avg Shares Out | 42.42M | 41.41M | 40.34M | 38.64M | 37.81M | 35.83M | 33.60M | 34.21M | 33.59M | 32.17M | 30.38M | 28.80M | 28.45M | 28.97M | 29.65M | 30.88M | 30.65M | 30.52M | 30.44M | 30.27M | 29.92M | 27.09M | 25.78M | 8.01M | 5.60M | 5.60M |

| Weighted Avg Shares Out (Dil) | 42.42M | 41.41M | 40.34M | 38.64M | 37.81M | 36.45M | 34.75M | 34.21M | 33.59M | 33.24M | 31.91M | 29.79M | 29.82M | 29.41M | 29.95M | 31.35M | 31.41M | 31.15M | 30.78M | 31.10M | 30.71M | 27.60M | 25.78M | 8.01M | 5.60M | 5.60M |

The 10 best global universities of 2021, according to U.S. News

Lagarde Schedules Her Priorities For The ECB's New Monetary Policy Framework

Anti-lockdown advocate appears on radio show that has featured Holocaust deniers

If you find yourself doomscrolling your way through social media, help is at hand | Rhiannon Lucy Cosslett

Ivy League Basketball Season In Jeopardy Amid Covid-19 Pandemic, With Harvard Not Expected To Play

Totalitarianism on Campus | National Review

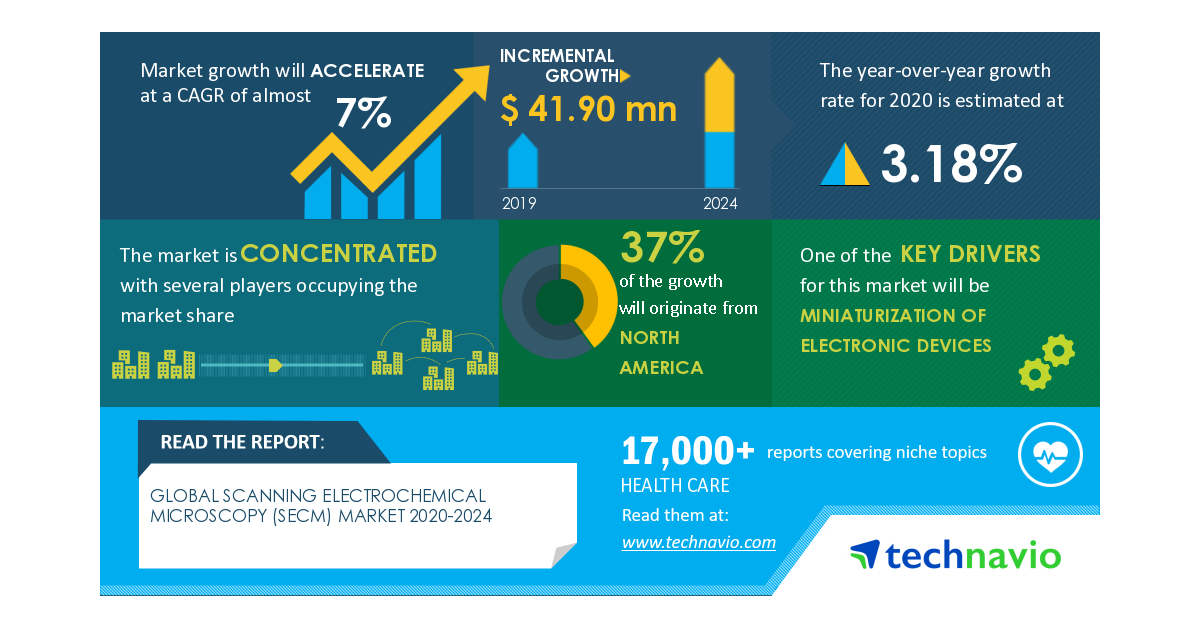

Scanning Electrochemical Microscopy Market | Growth to Accelerate at a CAGR of Almost 7% Through 2024 | Technavio

Source: https://incomestatements.info

Category: Stock Reports