See more : Solstad Offshore ASA (SOFF.OL) Income Statement Analysis – Financial Results

Complete financial analysis of The Hartford Financial Services Group, Inc. DEB FIX/FLT 42 (HGH) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of The Hartford Financial Services Group, Inc. DEB FIX/FLT 42, a leading company in the industry within the sector.

- Dynastar Holdings, Inc. (DYNA) Income Statement Analysis – Financial Results

- Asia Cement (China) Holdings Corporation (0743.HK) Income Statement Analysis – Financial Results

- Chongqing Iron & Steel Company Limited (1053.HK) Income Statement Analysis – Financial Results

- Pembina Pipeline Corporation CUM PFD SER A 21 (PMMBF) Income Statement Analysis – Financial Results

- AnaptysBio, Inc. (ANAB) Income Statement Analysis – Financial Results

The Hartford Financial Services Group, Inc. DEB FIX/FLT 42 (HGH)

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 22.39K | 7.00K | 20.74B | 18.96B | 16.97B | 18.30B | 18.38B | 18.61B | 26.24B | 26.41B | 21.86B | 22.38B | 24.70B | 9.22B | 25.92B | 26.50B | 27.08B | 0.00 |

| Cost of Revenue | 0.00 | 0.00 | 11.47B | 11.17B | 10.17B | 11.35B | 10.78B | 10.81B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Gross Profit | 22.39K | 7.00K | 9.27B | 7.79B | 6.80B | 6.95B | 7.60B | 7.81B | 26.24B | 26.41B | 21.86B | 22.38B | 24.70B | 9.22B | 25.92B | 26.50B | 27.08B | 0.00 |

| Gross Profit Ratio | 100.00% | 100.00% | 44.69% | 41.10% | 40.06% | 37.97% | 41.37% | 41.95% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 100.00% | 0.00% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 4.78K | 228.00K | 4.58B | 4.28B | 4.38B | 3.63B | 3.77B | 4.03B | 4.28B | 5.24B | 4.40B | 4.66B | 3.75B | 3.99B | 3.89B | 3.25B | 3.23B | 1.95B |

| Operating Expenses | 4.78K | 228.00K | 4.58B | 4.28B | 4.38B | 3.63B | 3.77B | 4.03B | 4.28B | 5.24B | 4.40B | 4.66B | 3.75B | 3.99B | 3.89B | 3.25B | 3.23B | 1.95B |

| Cost & Expenses | 4.78K | 228.00K | 16.05B | 15.45B | 14.55B | 14.98B | 14.55B | 14.83B | 4.28B | 5.24B | 4.40B | 4.66B | 3.75B | 3.99B | 3.89B | 3.25B | 3.23B | 1.95B |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 234.00 | -236.00K | 259.00M | 298.00M | 316.00M | 339.00M | 357.00M | 376.00M | 397.00M | 457.00M | 0.00 | 0.00 | -476.00M | -343.00M | -263.00M | -277.00M | -252.00M | -161.00M |

| Depreciation & Amortization | 1.68M | 1.71M | 2.07B | 1.91B | 1.82B | 1.92B | 1.88B | 2.01B | -2.51B | -1.52B | 3.43B | 2.54B | 4.27B | 4.27B | 2.99B | 3.56B | 3.17B | 2.83B |

| EBITDA | 1.68M | 3.17M | 4.89B | 4.28B | -14.00M | 3.06B | 4.22B | 3.53B | -2.20B | -1.64B | 3.74B | 4.81B | 2.06B | -663.00M | 6.73B | 6.88B | 5.90B | 4.78B |

| EBITDA Ratio | 7,517.33% | 45,257.14% | 23.59% | 22.59% | -0.08% | 16.74% | 22.96% | 18.96% | -8.37% | -6.20% | 17.12% | 21.48% | 8.35% | -7.19% | 25.97% | 25.97% | 21.79% | 0.00% |

| Operating Income | 3.13K | 1.46M | 2.82B | 2.37B | -1.83B | 1.14B | 2.34B | 1.52B | 316.00M | -117.00M | 316.00M | 2.26B | -2.20B | -4.93B | 3.74B | 3.33B | 2.73B | 1.95B |

| Operating Income Ratio | 13.98% | 20,885.71% | 13.59% | 12.52% | -10.78% | 6.25% | 12.76% | 8.19% | 1.20% | -0.44% | 1.45% | 10.11% | -8.92% | -53.52% | 14.44% | 12.55% | 10.09% | 0.00% |

| Total Other Income/Expenses | -234.00 | -1.68M | -259.00M | -888.00M | 2.55B | -339.00M | -366.00M | 175.00M | -6.00M | 84.00M | 346.00M | 0.00 | 476.00M | 343.00M | 263.00M | 277.00M | 252.00M | -2.13B |

| Income Before Tax | 2.90K | -221.00K | 2.56B | 1.49B | 723.00M | 804.00M | 1.98B | 1.70B | 310.00M | -33.00M | 662.00M | 2.26B | -1.73B | -4.59B | 4.01B | 3.60B | 2.99B | -180.00M |

| Income Before Tax Ratio | 12.93% | -3,157.14% | 12.34% | 7.83% | 4.26% | 4.39% | 10.76% | 9.13% | 1.18% | -0.12% | 3.03% | 10.11% | -7.00% | -49.80% | 15.45% | 13.59% | 11.02% | 0.00% |

| Income Tax Expense | 531.00 | -39.00K | 475.00M | 268.00M | 985.00M | -92.00M | 305.00M | 350.00M | -247.00M | -494.00M | -346.00M | 584.00M | -841.00M | -1.84B | 1.06B | 857.00M | 711.00M | -161.00M |

| Net Income | 2.37K | -182.00K | 2.09B | 1.22B | -262.00M | 896.00M | 1.67B | 1.35B | 557.00M | 461.00M | 1.01B | 1.68B | -887.00M | -2.75B | 2.95B | 2.75B | 2.27B | -19.00M |

| Net Income Ratio | 10.56% | -2,600.00% | 10.05% | 6.42% | -1.54% | 4.90% | 9.10% | 7.25% | 2.12% | 1.75% | 4.61% | 7.51% | -3.59% | -29.82% | 11.38% | 10.36% | 8.40% | 0.00% |

| EPS | 0.00 | 0.00 | 5.71 | 3.34 | -0.71 | 2.31 | 4.03 | 3.05 | 1.24 | 1.05 | 2.29 | 3.81 | -2.01 | -8.98 | 9.33 | 8.91 | 7.66 | -0.07 |

| EPS Diluted | 0.00 | 0.00 | 5.71 | 3.34 | -0.71 | 2.27 | 3.93 | 2.93 | 1.15 | 1.05 | 2.15 | 3.58 | -1.89 | -8.98 | 9.33 | 8.91 | 7.66 | -0.07 |

| Weighted Avg Shares Out | 364.74M | 364.74M | 364.90M | 364.10M | 370.50M | 387.70M | 415.50M | 441.80M | 447.70M | 437.70M | 440.70M | 440.70M | 440.70M | 306.00M | 316.00M | 308.00M | 297.00M | 291.00M |

| Weighted Avg Shares Out (Dil) | 364.74M | 364.74M | 364.90M | 364.10M | 370.50M | 394.80M | 425.20M | 460.20M | 484.40M | 437.70M | 469.00M | 469.00M | 469.00M | 306.00M | 316.00M | 308.00M | 297.00M | 291.00M |

Luxury Barware Brand Riedel to Participate in HGH India

Dividend Champion And Contender Highlights: Week Of August 23

Hartford Financial Services Group, Inc. (HIG) CEO Christopher Swift on Q2 2020 Results - Earnings Call Transcript

The Hartford Financial Services Group, Inc. 2020 Q2 - Results - Earnings Call Presentation

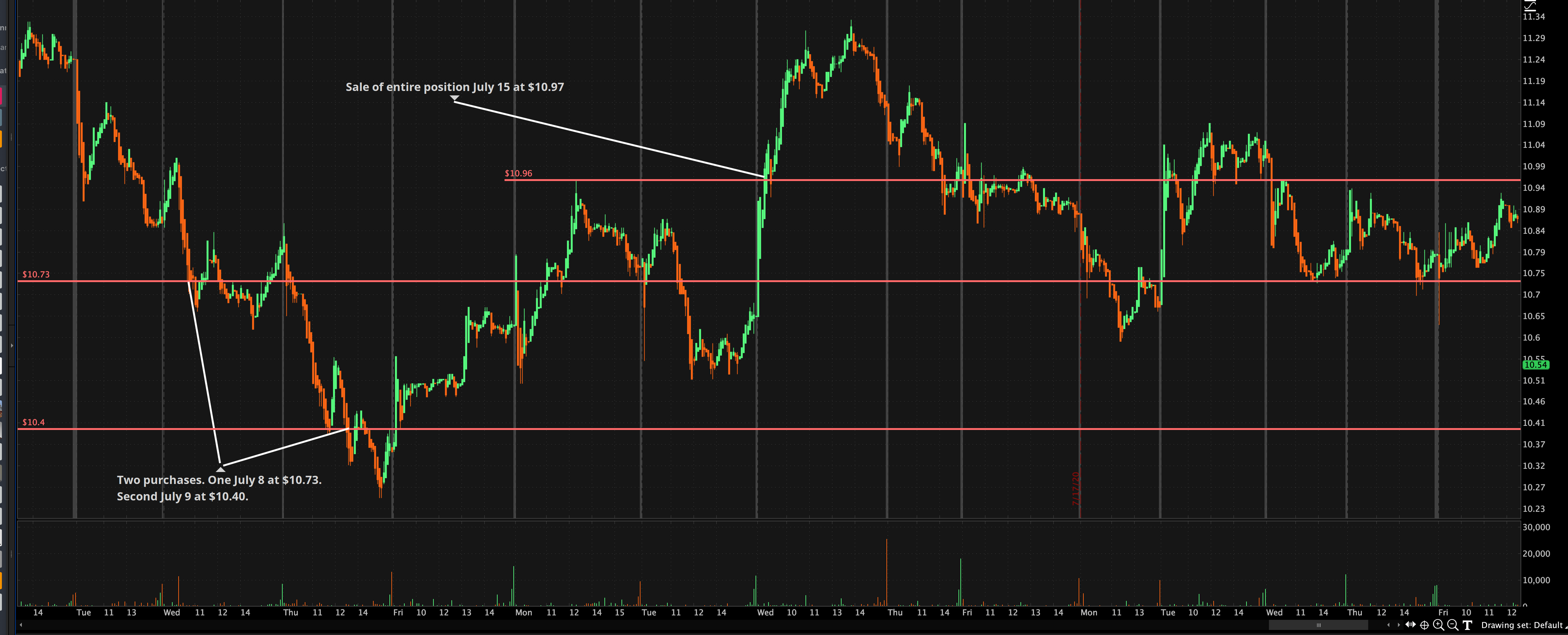

Portfolio Income: Trading Quality Stocks Vs. Longer-Term Positions In REITs And Other High-Yielding Securities

Dividend Champion And Contender Highlights: Week Of June 28

Analysts Offer Insights on Financial Companies: Brown & Brown (BRO), Crown Castle (CCI) and Intercontinental Exchange (ICE)

Hartford Financial Services Group Inc (NYSE:HIG) Shares Purchased by CX Institutional

Hartford Financial Services Group (NYSE:HIG) Trading Down 7.7% Following Analyst Downgrade

Edited Transcript of HIG earnings conference call or presentation 30-Apr-20 1:00pm GMT

Source: https://incomestatements.info

Category: Stock Reports