See more : NGL Fine-Chem Limited (NGLFINE.NS) Income Statement Analysis – Financial Results

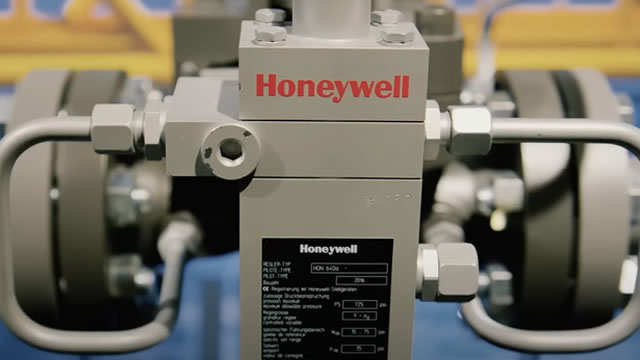

Complete financial analysis of Honeywell International Inc. (HON) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Honeywell International Inc., a leading company in the Conglomerates industry within the Industrials sector.

- Shufersal Ltd (SAE.TA) Income Statement Analysis – Financial Results

- Everest Industries Limited (EVERESTIND.NS) Income Statement Analysis – Financial Results

- Lobe Sciences Ltd. (LOBEF) Income Statement Analysis – Financial Results

- GS Engineering & Construction Corporation (006360.KS) Income Statement Analysis – Financial Results

- Houston Natural Resources Corp. (HNRC) Income Statement Analysis – Financial Results

Honeywell International Inc. (HON)

About Honeywell International Inc.

Honeywell International Inc. operates as a diversified technology and manufacturing company worldwide. Its Aerospace segment offers auxiliary power units, propulsion engines, integrated avionics, environmental control and electric power systems, engine controls, flight safety, communications, navigation hardware, data and software applications, radar and surveillance systems, aircraft lighting, advanced systems and instruments, satellite and space components, and aircraft wheels and brakes; spare parts; repair, overhaul, and maintenance services; thermal systems, as well as wireless connectivity and management services. The company's Honeywell Building Technologies segment offers software applications for building control and optimization; sensors, switches, control systems, and instruments for energy management; access control; video surveillance; fire products; and installation, maintenance, and upgrades of systems. Its Performance Materials and Technologies segment offers automation control, instrumentation, and software and related services; catalysts and adsorbents, equipment, and consulting; and materials to manufacture end products, such as bullet-resistant armor, nylon, computer chips, and pharmaceutical packaging, as well as provides reduced and low global-warming-potential materials based on hydrofluoro-olefin technology. The company's Safety and Productivity Solutions segment provides personal protection equipment, apparel, gear, and footwear; gas detection technology; cloud-based notification and emergency messaging; mobile devices and software; supply chain and warehouse automation equipment, and software solutions; custom-engineered sensors, switches, and controls; and data and asset management productivity software solutions. The company was founded in 1906 and is headquartered in Charlotte, North Carolina.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 36.66B | 35.47B | 34.39B | 32.64B | 36.71B | 41.80B | 40.53B | 39.30B | 38.58B | 40.31B | 39.06B | 37.67B | 36.53B | 33.37B | 30.91B | 36.56B | 34.59B | 31.37B | 27.65B | 25.60B | 23.10B | 22.27B | 23.65B | 25.02B | 23.74B | 15.13B | 14.47B | 13.97B | 14.35B | 12.82B | 11.83B | 12.04B | 11.83B | 12.34B | 11.94B | 11.91B | 11.12B | 11.79B | 9.12B |

| Cost of Revenue | 23.00B | 23.83B | 23.39B | 22.17B | 24.34B | 29.05B | 27.58B | 27.15B | 26.75B | 28.96B | 28.36B | 28.29B | 28.56B | 25.52B | 23.19B | 27.99B | 26.30B | 24.10B | 21.47B | 20.59B | 18.24B | 17.62B | 20.43B | 19.09B | 18.50B | 11.48B | 11.48B | 11.61B | 11.54B | 10.30B | 9.00B | 9.39B | 9.41B | 9.77B | 9.24B | 9.19B | 8.56B | 8.74B | 6.72B |

| Gross Profit | 13.67B | 11.64B | 11.00B | 10.47B | 12.37B | 12.76B | 12.96B | 12.15B | 11.83B | 11.35B | 10.69B | 9.37B | 7.97B | 7.85B | 7.72B | 8.56B | 8.29B | 7.27B | 6.19B | 5.02B | 4.87B | 4.66B | 3.22B | 5.93B | 5.24B | 3.65B | 2.99B | 2.37B | 2.81B | 2.52B | 2.82B | 2.65B | 2.42B | 2.58B | 2.70B | 2.72B | 2.55B | 3.05B | 2.40B |

| Gross Profit Ratio | 37.28% | 32.82% | 31.98% | 32.07% | 33.70% | 30.52% | 31.97% | 30.92% | 30.67% | 28.16% | 27.37% | 24.89% | 21.83% | 23.53% | 24.99% | 23.42% | 23.96% | 23.18% | 22.38% | 19.59% | 21.07% | 20.92% | 13.63% | 23.71% | 22.08% | 24.14% | 20.67% | 16.93% | 19.57% | 19.65% | 23.87% | 21.99% | 20.48% | 20.88% | 22.63% | 22.83% | 22.98% | 25.87% | 26.30% |

| Research & Development | 1.46B | 1.48B | 1.33B | 1.33B | 1.56B | 1.81B | 1.84B | 2.14B | 2.85B | 2.93B | 2.77B | 2.68B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 4.66B | 4.57B | 3.53B | 3.81B | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 643.00M | 1.27B | 958.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 4.66B | 5.21B | 4.80B | 4.77B | 5.52B | 6.05B | 5.81B | 5.47B | 5.01B | 5.52B | 5.19B | 5.22B | 5.40B | 4.72B | 4.34B | 5.03B | 4.57B | 4.21B | 3.71B | 3.32B | 2.95B | 2.76B | 3.06B | 3.13B | 3.22B | 1.69B | 1.58B | 1.51B | 1.50B | 1.37B | 1.34B | 1.70B | 2.21B | 1.39B | 1.33B | 1.60B | 1.46B | 1.63B | 1.14B |

| Other Expenses | 0.00 | 366.00M | 1.38B | 675.00M | 1.07B | 1.15B | 67.00M | 102.00M | 68.00M | 305.00M | 238.00M | 70.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -226.00M | -655.00M | 44.00M | 0.00 | 547.00M | 529.00M | 504.00M | 460.00M | 424.00M | 416.00M | 347.00M | 368.00M | 362.00M |

| Operating Expenses | 6.58B | 5.21B | 4.80B | 4.77B | 5.52B | 6.05B | 5.81B | 5.47B | 5.01B | 5.52B | 5.19B | 5.22B | 5.40B | 5.01B | 4.34B | 5.03B | 4.57B | 4.21B | 3.71B | 3.32B | 2.95B | 2.76B | 3.06B | 3.13B | 3.22B | 1.69B | 1.36B | 856.00M | 1.55B | 1.37B | 1.89B | 2.23B | 2.71B | 1.85B | 1.76B | 2.02B | 1.80B | 2.00B | 1.50B |

| Cost & Expenses | 29.58B | 29.04B | 28.19B | 26.94B | 29.86B | 35.10B | 33.38B | 32.62B | 31.75B | 34.48B | 33.55B | 33.51B | 33.96B | 30.53B | 27.53B | 33.03B | 30.87B | 28.31B | 25.17B | 23.90B | 21.19B | 20.37B | 23.49B | 22.22B | 21.71B | 13.17B | 12.84B | 12.46B | 13.09B | 11.67B | 10.89B | 11.63B | 12.12B | 11.61B | 11.00B | 11.21B | 10.37B | 10.74B | 8.22B |

| Interest Income | 321.00M | 138.00M | 102.00M | 107.00M | 255.00M | 217.00M | 151.00M | 106.00M | 104.00M | 102.00M | 69.00M | 58.00M | 58.00M | 39.00M | 33.00M | 102.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 765.00M | 414.00M | 343.00M | 359.00M | 357.00M | 367.00M | 316.00M | 338.00M | 310.00M | 318.00M | 327.00M | 351.00M | 376.00M | 386.00M | 459.00M | 456.00M | 456.00M | 374.00M | 356.00M | 331.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 1.18B | 1.20B | 1.22B | 1.00B | 1.09B | 1.12B | 1.12B | 1.03B | 883.00M | 924.00M | 989.00M | 926.00M | 957.00M | 987.00M | 957.00M | 903.00M | 837.00M | 794.00M | 697.00M | 650.00M | 595.00M | 671.00M | 926.00M | 995.00M | 881.00M | 609.00M | 609.00M | 602.00M | 612.00M | 560.00M | 547.00M | 529.00M | 504.00M | 460.00M | 424.00M | 416.00M | 347.00M | 368.00M | 362.00M |

| EBITDA | 8.73B | 8.00B | 8.80B | 7.37B | 8.59B | 9.02B | 8.31B | 7.72B | 7.71B | 6.76B | 6.49B | 5.16B | 3.73B | 4.12B | 3.46B | 5.16B | 4.56B | 3.86B | 3.08B | 2.67B | 2.58B | 2.57B | 1.09B | 3.79B | 2.91B | 3.76B | 3.00B | 2.11B | 1.87B | 1.71B | 1.50B | 944.00M | 213.00M | 1.19B | 1.37B | 1.12B | 1.10B | 1.42B | 1.26B |

| EBITDA Ratio | 23.81% | 22.55% | 25.59% | 22.59% | 24.53% | 21.46% | 20.56% | 19.88% | 20.16% | 17.52% | 17.23% | 13.68% | 9.67% | 12.35% | 14.04% | 10.58% | 13.30% | 12.28% | 11.26% | 8.75% | 11.24% | 23.25% | 4.63% | 14.67% | 10.63% | 17.11% | 13.76% | 10.34% | 13.50% | 13.56% | 11.47% | 3.63% | 0.46% | 8.43% | 10.31% | 7.26% | 7.43% | 10.98% | 19.17% |

| Operating Income | 7.08B | 6.79B | 7.58B | 6.37B | 7.92B | 6.71B | 7.15B | 6.68B | 6.83B | 5.83B | 5.50B | 4.16B | 2.57B | 3.13B | 3.38B | 3.53B | 3.72B | 3.06B | 2.48B | 1.70B | 1.92B | 1.90B | 159.00M | 2.80B | 2.02B | 1.96B | 1.64B | 1.51B | 1.26B | 1.15B | 938.00M | 415.00M | -291.00M | 730.00M | 946.00M | 703.00M | 750.00M | 1.05B | 895.00M |

| Operating Income Ratio | 19.32% | 19.15% | 22.03% | 19.52% | 21.56% | 16.04% | 17.64% | 17.00% | 17.70% | 14.47% | 14.09% | 11.03% | 7.05% | 9.39% | 10.94% | 9.65% | 10.77% | 9.76% | 8.97% | 6.64% | 8.30% | 8.54% | 0.67% | 11.19% | 8.53% | 12.97% | 11.30% | 10.80% | 8.78% | 8.99% | 7.93% | 3.45% | -2.46% | 5.91% | 7.92% | 5.90% | 6.75% | 8.92% | 9.82% |

| Total Other Income/Expenses | 75.00M | -691.00M | -238.00M | 316.00M | 708.00M | 782.00M | -201.00M | -241.00M | -242.00M | -13.00M | -89.00M | -281.00M | -292.00M | -168.00M | 525.00M | 272.00M | -403.00M | -263.00M | -126.00M | -77.00M | -278.00M | -2.85B | -581.00M | -401.00M | 224.00M | -86.00M | 783.00M | 44.00M | 1.00M | -41.00M | -44.00M | 287.00M | -99.00M | -128.00M | -177.00M | -64.00M | 7.00M | -145.00M | -672.00M |

| Income Before Tax | 7.16B | 6.38B | 7.24B | 6.01B | 7.56B | 7.49B | 6.90B | 6.45B | 6.59B | 5.82B | 5.41B | 3.88B | 2.28B | 2.84B | 2.98B | 3.80B | 3.32B | 2.80B | 2.32B | 1.68B | 1.64B | -945.00M | -422.00M | 2.40B | 2.25B | 1.94B | 1.72B | 1.55B | 1.26B | 1.11B | 910.00M | 702.00M | -390.00M | 602.00M | 769.00M | 639.00M | 757.00M | 907.00M | 223.00M |

| Income Before Tax Ratio | 19.53% | 17.99% | 21.04% | 18.42% | 20.59% | 17.91% | 17.03% | 16.40% | 17.07% | 14.43% | 13.86% | 10.29% | 6.25% | 8.52% | 9.64% | 10.40% | 9.60% | 8.92% | 8.40% | 6.56% | 7.10% | -4.24% | -1.78% | 9.58% | 9.47% | 12.84% | 11.86% | 11.12% | 8.79% | 8.67% | 7.69% | 5.83% | -3.30% | 4.88% | 6.44% | 5.37% | 6.81% | 7.69% | 2.45% |

| Income Tax Expense | 1.49B | 1.41B | 1.63B | 1.15B | 1.33B | 659.00M | 5.20B | 1.60B | 1.74B | 1.49B | 1.45B | 944.00M | 417.00M | 808.00M | 789.00M | 1.01B | 877.00M | 720.00M | 742.00M | 399.00M | 296.00M | -725.00M | -323.00M | 739.00M | 707.00M | 612.00M | 546.00M | 533.00M | 386.00M | 352.00M | 254.00M | 167.00M | -117.00M | 140.00M | 241.00M | 176.00M | 242.00M | 302.00M | 502.00M |

| Net Income | 5.66B | 4.97B | 5.54B | 4.78B | 6.14B | 6.77B | 1.66B | 4.81B | 4.77B | 4.24B | 3.92B | 2.93B | 2.07B | 2.02B | 2.15B | 2.79B | 2.44B | 2.08B | 1.66B | 1.28B | 1.32B | -220.00M | -99.00M | 1.66B | 1.54B | 1.33B | 1.17B | 1.02B | 875.00M | 759.00M | 411.00M | -712.00M | -273.00M | 462.00M | 528.00M | 463.00M | 518.00M | 605.00M | -279.00M |

| Net Income Ratio | 15.43% | 14.00% | 16.11% | 14.64% | 16.73% | 16.18% | 4.08% | 12.24% | 12.36% | 10.52% | 10.05% | 7.77% | 5.66% | 6.06% | 6.97% | 7.64% | 7.07% | 6.64% | 5.98% | 5.00% | 5.73% | -0.99% | -0.42% | 6.63% | 6.49% | 8.80% | 8.08% | 7.30% | 6.10% | 5.92% | 3.48% | -5.91% | -2.31% | 3.74% | 4.42% | 3.89% | 4.66% | 5.13% | -3.06% |

| EPS | 8.53 | 7.33 | 8.01 | 6.79 | 8.52 | 9.10 | 2.03 | 6.30 | 6.11 | 5.40 | 4.99 | 3.74 | 2.65 | 2.61 | 2.06 | 3.79 | 3.20 | 2.54 | 1.93 | 1.45 | 1.52 | -0.27 | -0.12 | 2.07 | 1.95 | 2.38 | 2.04 | 1.77 | 1.55 | 1.34 | 0.73 | -1.26 | -0.50 | 0.84 | 0.89 | 0.78 | 0.78 | 0.82 | -0.40 |

| EPS Diluted | 8.47 | 7.27 | 7.91 | 6.72 | 8.41 | 8.98 | 2.00 | 6.21 | 6.04 | 5.33 | 4.92 | 3.69 | 2.61 | 2.59 | 2.05 | 3.76 | 3.16 | 2.52 | 1.92 | 1.45 | 1.52 | -0.27 | -0.12 | 2.05 | 1.90 | 2.34 | 2.00 | 1.73 | 1.55 | 1.34 | 0.73 | -1.26 | -0.50 | 0.84 | 0.89 | 0.78 | 0.78 | 0.82 | -0.40 |

| Weighted Avg Shares Out | 663.00M | 677.10M | 692.30M | 704.10M | 721.00M | 743.00M | 762.10M | 764.30M | 779.80M | 784.40M | 786.40M | 782.40M | 780.80M | 773.50M | 752.60M | 736.76M | 763.75M | 820.08M | 848.70M | 859.31M | 871.05M | 820.39M | 825.00M | 801.45M | 790.26M | 562.50M | 565.60M | 576.27M | 566.34M | 566.42M | 563.01M | 565.08M | 546.00M | 550.00M | 593.26M | 593.59M | 662.82M | 698.78M | 700.78M |

| Weighted Avg Shares Out (Dil) | 668.20M | 683.10M | 700.40M | 711.20M | 730.30M | 753.00M | 772.10M | 775.30M | 789.30M | 795.20M | 797.30M | 791.90M | 791.60M | 780.90M | 755.12M | 743.53M | 773.42M | 826.59M | 853.13M | 859.31M | 871.05M | 820.39M | 825.00M | 809.27M | 811.05M | 575.70M | 581.40M | 589.60M | 567.21M | 567.15M | 566.28M | 565.08M | 546.00M | 550.00M | 593.26M | 593.59M | 662.82M | 698.78M | 700.78M |

Honeywell International Inc. (HON) Tops Q3 Earnings Estimates

Honeywell's stock falls as sales miss and lowered guidance offsets profit beat

HONEYWELL REPORTS THIRD QUARTER RESULTS; UPDATES 2024 GUIDANCE

Honeywell Beats Earnings Estimates. Sales Are Another Story.

Red-Hot Dow Stock Hoping for Post-Earnings Pop

3 Industrial Dividend Growth Stocks to Buy With $600 and Hold Forever

Honeywell, Google Join Forces to Build AI-Driven Industrial Operations

The long-term prospects for Honeywell are fantastic, says Capital Wealth's Kevin Simpson

Honeywell Gears up to Report Q3 Earnings: What to Expect?

Source: https://incomestatements.info

Category: Stock Reports