See more : Enfusion, Inc. (ENFN) Income Statement Analysis – Financial Results

Complete financial analysis of Robinhood Markets, Inc. (HOOD) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Robinhood Markets, Inc., a leading company in the Software – Infrastructure industry within the Technology sector.

- Surrozen, Inc. (SRZNW) Income Statement Analysis – Financial Results

- Aerospace CH UAV Co.,Ltd (002389.SZ) Income Statement Analysis – Financial Results

- Pettenati S.A. Industria Têxtil (PTNT4.SA) Income Statement Analysis – Financial Results

- TSG Star Travel Corp. (2719.TWO) Income Statement Analysis – Financial Results

- Datang Environment Industry Group Co., Ltd. (1272.HK) Income Statement Analysis – Financial Results

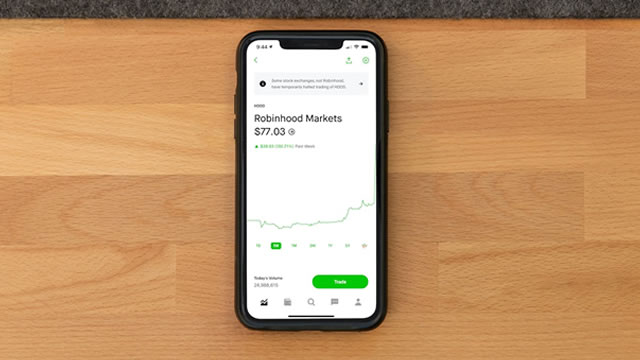

Robinhood Markets, Inc. (HOOD)

About Robinhood Markets, Inc.

Robinhood Markets, Inc. operates financial services platform in the United States. Its platform allows users to invest in stocks, exchange-traded funds (ETFs), options, gold, and cryptocurrencies. The company also offers various learning and education solutions comprise Snacks, a digest of business news stories; Learn, which is a collection of approximately articles, including guides, feature tutorials, and financial dictionary; Newsfeeds that offer access to free premium news from various sites, such as Barron's, Reuters, and The Wall Street Journal; lists and alerts, which allow users to create custom watchlists and alerts to monitor securities, ETFs, and cryptocurrencies, as well as cash management services; and offers First trade recommendations to all new customers who have yet to place a trade. Robinhood Markets, Inc. was incorporated in 2013 and is headquartered in Menlo Park, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 |

|---|---|---|---|---|---|

| Revenue | 1.89B | 1.38B | 1.84B | 958.83M | 277.53M |

| Cost of Revenue | 179.00M | 215.00M | 489.77M | 474.56M | 179.70M |

| Gross Profit | 1.71B | 1.17B | 1.35B | 484.28M | 97.83M |

| Gross Profit Ratio | 59.25% | 84.17% | 73.02% | 50.46% | 35.25% |

| Research & Development | 805.00M | 878.00M | 1.23B | 215.00M | 94.93M |

| General & Administrative | 1.17B | 9.24B | 1.37B | 487.00M | 154.42M |

| Selling & Marketing | 122.00M | 103.00M | 327.37M | 185.00M | 124.61M |

| SG&A | 1.29B | 1.03B | 1.70B | 696.00M | 305.14M |

| Other Expenses | 126.00M | 204.00M | 2.08B | -440.50M | -195.31M |

| Operating Expenses | 2.22B | 2.11B | 5.01B | 470.50M | 204.76M |

| Cost & Expenses | 2.40B | 2.32B | 5.50B | 945.05M | 384.46M |

| Interest Income | 0.00 | 0.00 | 0.00 | 182.32M | 71.63M |

| Interest Expense | 23.00M | 24.00M | 20.22M | 4.88M | 991.00K |

| Depreciation & Amortization | 71.00M | 61.00M | 25.50M | 9.94M | 5.44M |

| EBITDA | -442.00M | -881.00M | -3.64B | 23.72M | -101.49M |

| EBITDA Ratio | -23.70% | -64.87% | -200.60% | 2.48% | -36.57% |

| Operating Income | -513.00M | -942.00M | -3.67B | 13.78M | -106.93M |

| Operating Income Ratio | -55.55% | -69.37% | -202.01% | 1.44% | -38.53% |

| Total Other Income/Expenses | -20.00M | -85.00M | -17.97M | 50.00K | -657.00K |

| Income Before Tax | -533.00M | -1.03B | -3.68B | 13.83M | -107.59M |

| Income Before Tax Ratio | -28.58% | -75.63% | -203.03% | 1.36% | -38.77% |

| Income Tax Expense | 8.00M | 1.00M | 2.00M | 6.38M | -1.02M |

| Net Income | -541.00M | -1.03B | -3.69B | 2.85M | -106.57M |

| Net Income Ratio | -29.01% | -75.70% | -203.14% | 0.31% | -38.40% |

| EPS | -0.61 | -1.17 | -4.27 | 0.00 | -0.13 |

| EPS Diluted | -0.61 | -1.17 | -4.27 | 0.00 | -0.13 |

| Weighted Avg Shares Out | 890.86M | 878.63M | 863.91M | 850.18M | 850.18M |

| Weighted Avg Shares Out (Dil) | 890.86M | 878.63M | 863.91M | 850.18M | 850.18M |

Robinhood attorney, Republican regulators being considered for Trump financial agency short list

Robinhood Markets, Inc. to Present at the Wolfe Research Wealth Symposium on November 13, 2024

Why Wall Street Got Robinhood's Earnings All Wrong

Robinhood Markets, Inc. (HOOD) Is a Trending Stock: Facts to Know Before Betting on It

Options Traders Bet Big on These 3 Tech Stocks

Crypto firms including Robinhood, Kraken launch global stablecoin network

Introducing Global Dollar Network - An open network to accelerate and reward global stablecoin adoption driven by Anchorage Digital, Bullish, Galaxy Digital, Kraken, Nuvei, Paxos and Robinhood

Robinhood Price Levels to Watch as Stock Drops After Promotion Causes Revenue Miss

Robinhood tumbles as customer incentives eat into results

Robinhood shares down as promotions eat into profits

Source: https://incomestatements.info

Category: Stock Reports