See more : Morningstar, Inc. (MORN) Income Statement Analysis – Financial Results

Complete financial analysis of HOOKIPA Pharma Inc. (HOOK) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of HOOKIPA Pharma Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- NFT Technologies Inc. (NFT.NE) Income Statement Analysis – Financial Results

- Steelcase Inc. (SCS) Income Statement Analysis – Financial Results

- Broadmark Realty Capital Inc. (BRMKW) Income Statement Analysis – Financial Results

- Vipul Limited (VIPUL.BO) Income Statement Analysis – Financial Results

- Colowide Co.,Ltd. (7616.T) Income Statement Analysis – Financial Results

HOOKIPA Pharma Inc. (HOOK)

About HOOKIPA Pharma Inc.

HOOKIPA Pharma Inc., a clinical stage biopharmaceutical company, develops immunotherapeutics targeting infectious diseases and cancers based on its proprietary arenavirus platform. The company's lead infectious disease product candidate is HB-101, which is in a randomized double-blinded Phase II clinical trial in patients awaiting kidney transplantation from cytomegalovirus-positive donors. Its lead oncology product candidates are HB-201 and HB-202 that are in Phase I/II clinical trial for the treatment of human papillomavirus 16-positive cancers. The company's preclinical stage products include HB-300 program for prostate cancer; and HB-700 for targeting mutated KRAS in pancreatic, colorectal, and lung cancer. HOOKIPA Pharma Inc. has a collaboration with Gilead Sciences, Inc. to collaborate on preclinical research programs to evaluate potential vaccine products using or incorporating its replicating and non-replicating technology platforms for the treatment, cure, diagnosis, or prevention of Hepatitis B Virus. The company was incorporated in 2011 and is headquartered in New York, New York.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 |

|---|---|---|---|---|---|---|---|

| Revenue | 20.13M | 14.25M | 18.45M | 19.58M | 11.94M | 7.63M | 0.00 |

| Cost of Revenue | 3.55M | 3.60M | 4.64M | 53.13M | 46.31M | 21.97M | 398.00K |

| Gross Profit | 16.58M | 10.65M | 13.81M | -33.55M | -34.37M | -14.34M | -398.00K |

| Gross Profit Ratio | 82.35% | 74.72% | 74.85% | -171.31% | -287.81% | -187.91% | 0.00% |

| Research & Development | 86.42M | 68.65M | 82.85M | 54.79M | 46.31M | 21.97M | 9.77M |

| General & Administrative | 18.63M | 18.76M | 17.27M | 18.08M | 16.72M | 6.84M | 4.39M |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 18.63M | 18.76M | 17.27M | 18.08M | 16.72M | 6.84M | 4.39M |

| Other Expenses | 0.00 | -392.00K | -2.84M | 3.07M | 601.00K | 133.00K | -25.00K |

| Operating Expenses | 117.82M | 87.40M | 100.12M | 72.87M | 63.03M | 23.20M | 12.09M |

| Cost & Expenses | 117.82M | 87.40M | 100.12M | 72.87M | 63.03M | 23.20M | 12.09M |

| Interest Income | 5.29M | 8.24M | 27.00K | 9.20M | 1.59M | 0.00 | 0.00 |

| Interest Expense | 317.00K | 687.00K | 898.00K | 786.00K | 877.00K | 778.00K | 606.00K |

| Depreciation & Amortization | 3.55M | 3.60M | 4.64M | 4.15M | 3.07M | 640.00K | 398.00K |

| EBITDA | -77.34M | -60.40M | -70.13M | -39.15M | -39.09M | -14.80M | -13.76M |

| EBITDA Ratio | -384.24% | -513.40% | -442.73% | -272.08% | -427.78% | -193.93% | 0.00% |

| Operating Income | -97.69M | -73.16M | -81.67M | -53.29M | -51.09M | -21.18M | -14.16M |

| Operating Income Ratio | -485.34% | -513.40% | -442.73% | -272.08% | -427.78% | -277.62% | 0.00% |

| Total Other Income/Expenses | 16.48M | 8.47M | 6.01M | 9.20M | 8.05M | 4.97M | 1.44M |

| Income Before Tax | -81.21M | -64.92M | -75.67M | -44.08M | -43.04M | -16.21M | -12.72M |

| Income Before Tax Ratio | -403.46% | -455.58% | -410.15% | -225.09% | -360.38% | -212.52% | 0.00% |

| Income Tax Expense | 368.00K | 230.00K | 1.00K | -10.28M | -8.89M | 24.00K | 4.00K |

| Net Income | -81.58M | -64.92M | -75.67M | -44.08M | -43.04M | -16.24M | -12.72M |

| Net Income Ratio | -405.29% | -455.58% | -410.15% | -225.09% | -360.38% | -212.83% | 0.00% |

| EPS | -8.63 | -9.90 | -23.00 | -16.90 | -2.41 | -0.99 | -0.78 |

| EPS Diluted | -8.63 | -9.90 | -23.00 | -16.90 | -2.41 | -0.99 | -0.78 |

| Weighted Avg Shares Out | 9.45M | 6.56M | 3.29M | 2.61M | 17.86M | 16.32M | 16.32M |

| Weighted Avg Shares Out (Dil) | 9.45M | 6.56M | 3.29M | 2.61M | 17.86M | 16.32M | 16.32M |

HOOKIPA Announces Grant of Inducement Awards Under Nasdaq Listing Rule 5635(c)(4)

7 Biotech Stocks to Sell in September Before They Crash & Burn

HOOKIPA Pharma to participate in upcoming investor conferences in September

HOOKIPA Pharma Inc. (HOOK) Reports Q2 Loss, Lags Revenue Estimates

HOOKIPA Pharma Reports Second Quarter 2023 Financial Results and Recent Business Highlights

HOOKIPA Pharma to Report Second Quarter 2023 Financial Results and Recent Business Highlights on August 10, 2023

Stock Market Today: New Penny Stocks Trends & 3 To Watch This Week

Schneider continues to make progress on environmental and social priorities

Gamida Cell Appoints Terry Coelho as CFO

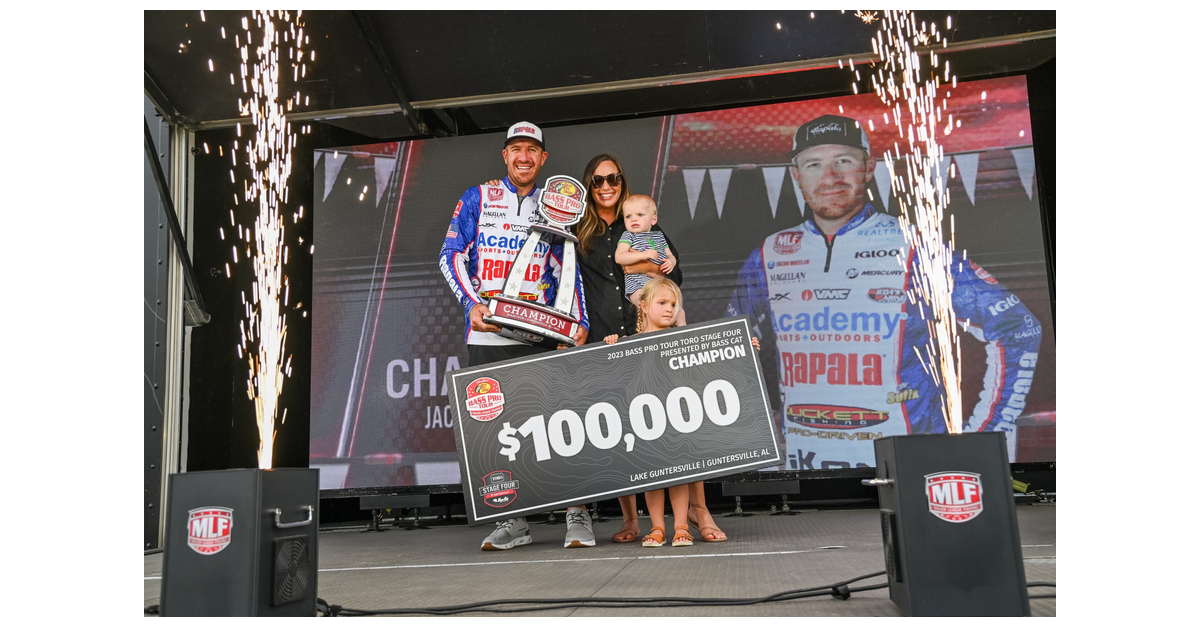

Wheeler Earns Win at MLF Bass Pro Tour Toro Stage Four on Lake Guntersville Presented by Bass Cat Boats

Source: https://incomestatements.info

Category: Stock Reports