See more : Rithm Capital Corp. (RITM-PB) Income Statement Analysis – Financial Results

Complete financial analysis of Hill-Rom Holdings, Inc. (HRC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Hill-Rom Holdings, Inc., a leading company in the Medical – Instruments & Supplies industry within the Healthcare sector.

- SimCorp A/S (SMCYY) Income Statement Analysis – Financial Results

- Hong Kong ChaoShang Group Limited (2322.HK) Income Statement Analysis – Financial Results

- Ozon Holdings PLC (OZON.ME) Income Statement Analysis – Financial Results

- Voice Assist, Inc. (VSST) Income Statement Analysis – Financial Results

- Green International Holdings Limited (2700.HK) Income Statement Analysis – Financial Results

Hill-Rom Holdings, Inc. (HRC)

About Hill-Rom Holdings, Inc.

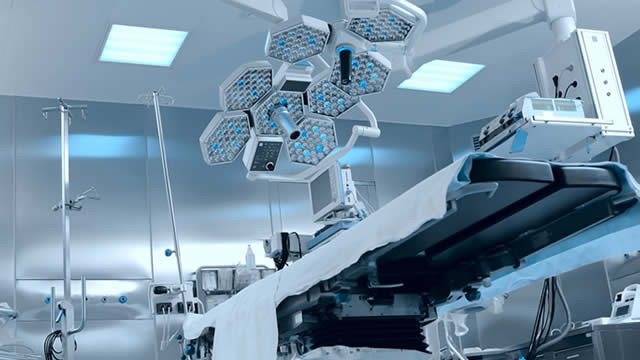

Hill-Rom Holdings, Inc. operates as a medical technology company worldwide. It operates in Patient Support Systems, Front Line Care, and Surgical Solutions segments. The company offers medical surgical beds, intensive care unit beds, and bariatric patient beds, lifts and other devices, non-invasive therapeutic products and surfaces, and information technologies and software solutions, as well as sells equipment service contracts for its capital equipment. It also provides patient monitoring and diagnostics products, such as patient exam and diagnostics, patient monitoring, diagnostic cardiology, vision screening, and diagnostics products; and respiratory health products comprising Vest System, VitalCough System, MetaNeb System, Monarch, and Life2000 systems to assist patients in the mobilization of retained blockages. In addition, the company offers surgical solutions that include surgical tables, lights, and pendants; positioning devices for use in shoulder, hip, spinal, and lithotomy surgeries, as well as platform-neutral positioning accessories for operating room tables. Further, it is involved in the sales and rental of products to acute and extended care facilities through direct sales force and distributors; sales and rental of products directly to patients in the home; and sales to primary care facilities through distributors. Additionally, the company offers continuum of clinical care, including acute care and primary care, as well as clinical research organizations. Hill-Rom Holdings, Inc. was founded in 1969 and is headquartered in Chicago, Illinois.

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 3.02B | 2.88B | 2.91B | 2.85B | 2.74B | 2.66B | 1.99B | 1.69B | 1.72B | 1.63B | 1.59B | 1.47B | 1.39B | 1.51B | 2.02B | 1.96B | 1.94B | 1.83B | 2.04B | 1.76B | 2.11B | 2.10B | 2.05B | 2.00B | 1.78B | 1.68B | 1.62B | 1.58B | 1.45B | 1.43B | 1.20B | 1.11B | 1.14B | 884.30M | 724.60M | 641.10M | 507.60M |

| Cost of Revenue | 1.43B | 1.41B | 1.48B | 1.45B | 1.42B | 1.40B | 1.11B | 906.20M | 935.90M | 879.60M | 810.40M | 753.00M | 759.00M | 838.20M | 1.14B | 1.11B | 1.05B | 921.00M | 1.14B | 1.01B | 1.25B | 1.27B | 1.27B | 1.17B | 1.03B | 908.00M | 1.01B | 939.20M | 634.80M | 646.60M | 555.60M | 508.90M | 596.90M | 410.40M | 328.50M | 286.90M | 265.80M |

| Gross Profit | 1.59B | 1.48B | 1.43B | 1.39B | 1.32B | 1.26B | 880.30M | 779.90M | 780.30M | 754.70M | 781.30M | 716.60M | 627.90M | 669.50M | 881.10M | 849.80M | 888.00M | 908.00M | 901.00M | 748.00M | 854.00M | 826.00M | 776.00M | 834.00M | 745.00M | 776.00M | 613.00M | 637.80M | 813.10M | 783.20M | 643.30M | 597.70M | 541.40M | 473.90M | 396.10M | 354.20M | 241.80M |

| Gross Profit Ratio | 52.61% | 51.20% | 49.01% | 48.95% | 48.13% | 47.34% | 44.28% | 46.25% | 45.47% | 46.18% | 49.09% | 48.76% | 45.27% | 44.41% | 43.54% | 43.29% | 45.82% | 49.64% | 44.12% | 42.57% | 40.53% | 39.41% | 37.91% | 41.68% | 41.95% | 46.08% | 37.73% | 40.44% | 56.16% | 54.78% | 53.66% | 54.01% | 47.56% | 53.59% | 54.66% | 55.25% | 47.64% |

| Research & Development | 144.90M | 136.50M | 139.50M | 135.60M | 133.70M | 133.50M | 91.80M | 71.90M | 70.20M | 66.90M | 63.80M | 58.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 941.00M | 891.50M | 876.10M | 853.30M | 664.20M | 548.30M | 549.50M | 496.40M | 502.00M | 474.60M | 0.00 | 543.90M | 604.40M | 529.10M | 604.00M | 582.00M | 573.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 441.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 0.00 | 0.00 | 941.00M | 891.50M | 876.10M | 853.30M | 664.20M | 548.30M | 549.50M | 496.40M | 502.00M | 474.60M | 0.00 | 543.90M | 604.40M | 529.10M | 604.00M | 582.00M | 573.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 441.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 995.60M | 929.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 517.30M | 22.80M | -1.40M | 3.10M | 394.00M | 6.00M | 9.00M | 780.00M | 618.00M | 582.00M | 565.00M | 606.00M | 481.00M | 99.00M | 433.50M | 481.80M | 578.80M | 593.80M | 485.40M | 460.20M | 401.00M | 338.50M | 270.30M | 240.60M | 171.20M |

| Operating Expenses | 1.14B | 1.07B | 1.08B | 1.03B | 1.01B | 986.80M | 756.00M | 620.20M | 619.70M | 563.30M | 565.80M | 532.90M | 517.30M | 566.70M | 603.00M | 532.20M | 998.00M | 588.00M | 582.00M | 780.00M | 618.00M | 582.00M | 565.00M | 606.00M | 481.00M | 540.00M | 433.50M | 481.80M | 578.80M | 593.80M | 485.40M | 460.20M | 401.00M | 338.50M | 270.30M | 240.60M | 171.20M |

| Cost & Expenses | 2.57B | 2.47B | 2.56B | 2.48B | 2.43B | 2.39B | 1.86B | 1.53B | 1.56B | 1.44B | 1.38B | 1.29B | 1.28B | 1.40B | 1.75B | 1.65B | 2.05B | 1.51B | 1.72B | 1.79B | 1.87B | 1.85B | 1.84B | 1.77B | 1.51B | 1.45B | 1.45B | 1.42B | 1.21B | 1.24B | 1.04B | 969.10M | 997.90M | 748.90M | 598.80M | 527.50M | 437.00M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 65.60M | 74.00M | 89.60M | 95.00M | 88.90M | 90.40M | 18.40M | 9.80M | 9.50M | 6.50M | 8.50M | 8.70M | 10.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 14.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 185.80M | 178.80M | 194.80M | 196.50M | 210.80M | 209.00M | 118.20M | 106.40M | 116.80M | 111.70M | 103.90M | 99.70M | 100.20M | 112.80M | 107.30M | 108.80M | 114.00M | 108.00M | 75.00M | 71.00M | 100.00M | 89.00M | 98.00M | 149.00M | 102.00M | 99.00M | 127.60M | 97.50M | 112.70M | 115.30M | 95.00M | 94.00M | 81.00M | 68.80M | 54.40M | 49.30M | 28.30M |

| EBITDA | 554.20M | 524.00M | 493.00M | 488.70M | 484.00M | 439.00M | 202.60M | 231.40M | 270.30M | 281.70M | 271.90M | 290.60M | -268.20M | 253.80M | 398.80M | 447.50M | 6.00M | 338.00M | 313.00M | 50.00M | 323.00M | 329.00M | 293.00M | 442.00M | 361.00M | 332.00M | 297.40M | 242.30M | 347.70M | 297.30M | 240.70M | 220.40M | 208.30M | 189.20M | 164.80M | 149.20M | 90.00M |

| EBITDA Ratio | 18.36% | 18.19% | 16.96% | 17.16% | 17.64% | 16.53% | 10.19% | 13.72% | 15.75% | 17.24% | 17.08% | 19.77% | -19.34% | 16.83% | 19.71% | 22.80% | 0.31% | 18.48% | 15.33% | 2.85% | 15.33% | 15.70% | 14.31% | 22.09% | 20.33% | 19.71% | 18.30% | 15.36% | 24.01% | 20.79% | 20.08% | 19.92% | 18.30% | 21.40% | 22.74% | 23.27% | 17.73% |

| Operating Income | 447.60M | 409.20M | 344.50M | 367.10M | 310.80M | 270.20M | 124.30M | 159.70M | 160.60M | 191.40M | 215.50M | 183.70M | 110.60M | 102.80M | 278.10M | 317.60M | -110.00M | 320.00M | 319.00M | -32.00M | 236.00M | 244.00M | 211.00M | 228.00M | 264.00M | 236.00M | 179.50M | 156.10M | 234.30M | 189.40M | 157.90M | 137.50M | 140.40M | 135.40M | 125.80M | 113.60M | 70.60M |

| Operating Income Ratio | 14.83% | 14.20% | 11.85% | 12.89% | 11.33% | 10.18% | 6.25% | 9.47% | 9.36% | 11.71% | 13.54% | 12.50% | 7.97% | 6.82% | 13.74% | 16.18% | -5.68% | 17.50% | 15.62% | -1.82% | 11.20% | 11.64% | 10.31% | 11.39% | 14.86% | 14.01% | 11.05% | 9.90% | 16.18% | 13.25% | 13.17% | 12.43% | 12.33% | 15.31% | 17.36% | 17.72% | 13.91% |

| Total Other Income/Expenses | -144.80M | -138.00M | -135.90M | -169.90M | -127.80M | -131.90M | -59.20M | -44.50M | -16.60M | -27.90M | -55.80M | -800.00K | -489.40M | -10.50M | 13.40M | 21.40M | -6.00M | -12.00M | -37.00M | -3.00M | -13.00M | -4.00M | -16.00M | 65.00M | -5.00M | -3.00M | -9.70M | -11.30M | -12.70M | -18.10M | -12.20M | -11.10M | -13.10M | -15.00M | -15.40M | -13.70M | -8.90M |

| Income Before Tax | 302.80M | 271.20M | 208.60M | 197.20M | 183.00M | 138.30M | 65.10M | 115.20M | 144.00M | 163.50M | 159.70M | 182.90M | -378.80M | 92.30M | 291.50M | 339.00M | -116.00M | 308.00M | 282.00M | -35.00M | 223.00M | 240.00M | 195.00M | 293.00M | 259.00M | 233.00M | 169.80M | 144.80M | 221.60M | 171.30M | 145.70M | 126.40M | 127.30M | 120.40M | 110.40M | 99.90M | 61.70M |

| Income Before Tax Ratio | 10.03% | 9.41% | 7.18% | 6.92% | 6.67% | 5.21% | 3.27% | 6.83% | 8.39% | 10.00% | 10.03% | 12.45% | -27.31% | 6.12% | 14.40% | 17.27% | -5.99% | 16.84% | 13.81% | -1.99% | 10.58% | 11.45% | 9.53% | 14.64% | 14.58% | 13.84% | 10.45% | 9.18% | 15.30% | 11.98% | 12.15% | 11.42% | 11.18% | 13.62% | 15.24% | 15.58% | 12.16% |

| Income Tax Expense | 54.30M | 48.20M | 56.40M | -55.20M | 50.70M | 15.50M | 18.30M | 54.60M | 39.00M | 42.70M | 26.20M | 56.90M | 26.20M | 25.20M | 100.90M | 117.50M | -20.00M | 120.00M | 100.00M | -25.00M | 53.00M | 86.00M | 71.00M | 109.00M | 102.00M | 93.00M | 79.90M | 55.30M | 89.10M | 65.80M | 56.50M | 50.70M | 52.30M | 50.70M | 53.00M | 49.40M | 28.90M |

| Net Income | 248.50M | 223.00M | 152.20M | 252.40M | 133.60M | 124.10M | 47.70M | 60.60M | 105.00M | 120.80M | 133.30M | 125.30M | -405.00M | 115.80M | 190.60M | 221.20M | -94.00M | 110.00M | 138.00M | -10.00M | 170.00M | 154.00M | 124.00M | 184.00M | 157.00M | 140.00M | 89.90M | 89.50M | 145.90M | 116.20M | 89.20M | 75.70M | 75.00M | 69.70M | 57.40M | 50.50M | 32.80M |

| Net Income Ratio | 8.23% | 7.74% | 5.24% | 8.86% | 4.87% | 4.67% | 2.40% | 3.59% | 6.12% | 7.39% | 8.37% | 8.53% | -29.20% | 7.68% | 9.42% | 11.27% | -4.85% | 6.01% | 6.76% | -0.57% | 8.07% | 7.35% | 6.06% | 9.20% | 8.84% | 8.31% | 5.53% | 5.68% | 10.08% | 8.13% | 7.44% | 6.84% | 6.59% | 7.88% | 7.92% | 7.88% | 6.46% |

| EPS | 3.72 | 3.32 | 2.25 | 3.73 | 2.03 | 1.89 | 0.73 | 1.06 | 1.79 | 1.99 | 2.16 | 2.00 | -6.47 | 1.85 | 3.08 | 3.60 | -1.52 | 1.77 | 2.22 | -0.16 | 2.71 | 2.45 | 1.87 | 2.72 | 2.28 | 2.02 | 1.27 | 1.26 | 2.04 | 1.62 | 1.23 | 1.03 | 1.01 | 0.93 | 0.76 | 0.66 | 0.42 |

| EPS Diluted | 3.72 | 3.32 | 2.25 | 3.73 | 1.99 | 1.86 | 0.73 | 1.04 | 1.74 | 1.94 | 2.09 | 1.97 | -6.47 | 1.85 | 3.07 | 3.59 | -1.52 | 1.75 | 2.22 | -0.16 | 2.71 | 2.45 | 1.87 | 2.72 | 2.28 | 2.01 | 1.27 | 1.26 | 2.04 | 1.62 | 1.23 | 1.03 | 1.01 | 0.93 | 0.76 | 0.66 | 0.42 |

| Weighted Avg Shares Out | 66.85M | 67.21M | 67.66M | 67.61M | 65.81M | 65.71M | 65.17M | 57.44M | 58.52M | 60.80M | 61.69M | 62.79M | 62.57M | 62.43M | 61.82M | 61.45M | 61.77M | 62.24M | 62.03M | 62.70M | 62.80M | 62.90M | 66.30M | 67.60M | 68.80M | 69.47M | 70.80M | 71.30M | 71.52M | 71.73M | 72.66M | 73.22M | 74.23M | 74.59M | 75.54M | 77.10M | 77.75M |

| Weighted Avg Shares Out (Dil) | 66.85M | 67.21M | 67.66M | 67.61M | 67.23M | 66.60M | 65.17M | 58.52M | 60.25M | 62.36M | 63.90M | 63.74M | 62.58M | 62.62M | 62.12M | 61.58M | 61.77M | 62.73M | 62.18M | 62.70M | 62.80M | 62.90M | 66.30M | 67.60M | 68.80M | 69.66M | 70.80M | 71.30M | 71.52M | 71.73M | 72.66M | 73.22M | 74.23M | 74.59M | 75.54M | 77.10M | 77.75M |

HRC vs. BLFS: Which Stock Is the Better Value Option?

Why Is Hill-Rom (HRC) Up 6.6% Since Last Earnings Report?

Top Stocks To Buy Today As The Reopening Rotation Continues

Hillrom Provides Update on Planned Acquisition of Bardy Diagnostics, Inc.

HRC vs. BLFS: Which Stock Should Value Investors Buy Now?

Moving Average Crossover Alert: Hill-Rom Holdings (HRC)

Hill-Rom Holdings, Inc. (HRC) CEO John Groetelaars on Q1 2021 Results - Earnings Call Transcript

Hill-Rom (HRC) Beats Q1 Earnings and Revenue Estimates

Recap: Hill-Rom Q1 Earnings

Hillrom Comments On Novitas Reimbursement Decision

Source: https://incomestatements.info

Category: Stock Reports