See more : Green World Fintech Service Co., Ltd. (6763.TWO) Income Statement Analysis – Financial Results

Complete financial analysis of Harsco Corporation (HSC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Harsco Corporation, a leading company in the Waste Management industry within the Industrials sector.

- Catcha Investment Corp (CHAA-UN) Income Statement Analysis – Financial Results

- Razer Inc. (1337.HK) Income Statement Analysis – Financial Results

- Kim Forest Enterprise Co., Ltd. (6645.TW) Income Statement Analysis – Financial Results

- Gansu Jiu Steel Group Hongxing Iron & Steel Co.,Ltd. (600307.SS) Income Statement Analysis – Financial Results

- Fukuda Corporation (1899.T) Income Statement Analysis – Financial Results

Harsco Corporation (HSC)

About Harsco Corporation

Harsco Corporation provides environmental solutions for industrial and specialty waste streams worldwide. It operates through two segments, Harsco Environmental and Harsco Clean Earth. The Harsco Environmental segment offers on-site services for material logistics, product quality improvement, and resource recovery for iron, steel, and metals manufacturing; manufactures and sells industrial abrasives, roofing granules, aluminum dross, and scrap processing systems; and produces value-added downstream products from industrial waste-stream. The Harsco Clean Earth segment provides waste management services, including transportation, specialty waste processing, and recycling and beneficial reuse solutions for hazardous wastes, and soil and dredged materials. The company was founded in 1853 and is headquartered in Camp Hill, Pennsylvania.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 2.07B | 1.89B | 1.85B | 1.86B | 1.50B | 1.72B | 1.61B | 1.45B | 1.72B | 2.07B | 2.90B | 3.05B | 3.30B | 3.04B | 2.99B | 3.97B | 3.69B | 3.42B | 2.77B | 2.50B | 2.12B | 1.98B | 2.11B | 2.00B | 1.72B | 1.74B | 1.63B | 1.56B | 1.50B | 1.36B | 1.42B | 1.62B | 1.94B | 1.76B | 1.35B | 1.28B | 1.17B | 1.13B | 1.26B |

| Cost of Revenue | 1.63B | 1.55B | 1.49B | 1.50B | 1.14B | 1.29B | 1.22B | 1.17B | 1.36B | 1.65B | 2.23B | 2.35B | 2.57B | 2.34B | 2.25B | 2.93B | 2.69B | 2.55B | 2.10B | 1.92B | 1.60B | 1.48B | 1.59B | 1.37B | 1.20B | 1.20B | 1.11B | 1.07B | 1.04B | 961.10M | 1.03B | 1.24B | 1.59B | 1.41B | 1.10B | 1.00B | 854.50M | 825.50M | 931.10M |

| Gross Profit | 435.56M | 335.73M | 357.84M | 363.05M | 359.45M | 433.64M | 386.34M | 280.76M | 366.73M | 418.95M | 662.31M | 696.50M | 732.11M | 701.80M | 738.44M | 1.04B | 1.00B | 875.71M | 666.81M | 585.68M | 514.14M | 494.97M | 514.02M | 634.95M | 521.10M | 539.40M | 514.70M | 490.00M | 452.90M | 396.60M | 390.00M | 384.90M | 355.20M | 352.00M | 246.80M | 277.10M | 314.70M | 304.80M | 330.10M |

| Gross Profit Ratio | 21.05% | 17.77% | 19.36% | 19.48% | 23.90% | 25.18% | 24.04% | 19.35% | 21.28% | 20.28% | 22.87% | 22.87% | 22.17% | 23.10% | 24.69% | 26.25% | 27.19% | 25.58% | 24.11% | 23.41% | 24.27% | 25.04% | 24.38% | 31.67% | 30.28% | 31.08% | 31.63% | 31.46% | 30.28% | 29.21% | 27.42% | 23.69% | 18.28% | 20.01% | 18.27% | 21.67% | 26.92% | 26.97% | 26.17% |

| Research & Development | 1.29M | 690.00K | 956.00K | 3.25M | 4.82M | 5.55M | 4.23M | 4.28M | 4.51M | 6.35M | 9.57M | 9.14M | 6.04M | 4.27M | 3.15M | 5.30M | 3.18M | 3.03M | 2.68M | 2.58M | 3.31M | 2.82M | 3.98M | 5.71M | 7.80M | 7.00M | 6.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 238.69M | 234.67M | 200.39M | 242.11M | 285.25M | 481.05M | 503.34M | 647.92M | 532.62M | 520.00M | 602.17M | 538.23M | 507.37M | 393.19M | 368.39M | 329.98M | 312.70M | 322.93M | 274.08M | 207.80M | 213.40M | 211.20M | 212.60M | 203.60M | 222.40M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 312.38M | 268.07M | 272.23M | 327.93M | 252.97M | 238.69M | 234.67M | 200.39M | 242.11M | 285.25M | 481.05M | 503.34M | 647.92M | 532.62M | 520.00M | 602.17M | 538.23M | 507.37M | 393.19M | 368.39M | 329.98M | 312.70M | 322.93M | 274.08M | 207.80M | 213.40M | 211.20M | 212.60M | 203.60M | 222.40M | 188.00M | 180.10M | 174.40M | 173.60M | 161.50M | 166.20M | 153.40M | 171.30M | 157.40M |

| Other Expenses | 10.88M | 1.25M | 19.36M | -3.57M | -2.87M | 0.00 | 4.64M | 12.62M | 31.57M | 63.88M | 306.48M | 358.81M | -3.34M | 94.92M | -4.86M | 21.95M | -4.01M | 2.41M | 2.00M | 4.86M | 6.96M | 3.47M | 23.49M | 159.10M | 135.90M | 131.40M | 116.50M | 109.40M | 104.90M | 99.60M | 74.90M | 57.10M | 57.70M | 56.60M | 56.20M | 53.80M | 56.10M | 51.90M | 49.80M |

| Operating Expenses | 324.55M | 268.76M | 273.19M | 331.18M | 257.79M | 244.24M | 238.90M | 204.67M | 246.62M | 291.60M | 490.62M | 512.48M | 650.63M | 631.81M | 518.29M | 629.41M | 537.40M | 512.80M | 397.86M | 375.83M | 340.25M | 319.00M | 350.41M | 438.89M | 351.50M | 351.80M | 333.80M | 322.00M | 308.50M | 322.00M | 262.90M | 237.20M | 232.10M | 230.20M | 217.70M | 220.00M | 209.50M | 223.20M | 207.20M |

| Cost & Expenses | 1.96B | 1.82B | 1.76B | 1.83B | 1.40B | 1.53B | 1.46B | 1.38B | 1.60B | 1.94B | 2.72B | 2.86B | 3.22B | 2.97B | 2.77B | 3.56B | 3.22B | 3.06B | 2.50B | 2.29B | 1.94B | 1.80B | 1.94B | 1.81B | 1.55B | 1.55B | 1.45B | 1.39B | 1.35B | 1.28B | 1.30B | 1.48B | 1.82B | 1.64B | 1.32B | 1.22B | 1.06B | 1.05B | 1.14B |

| Interest Income | 6.67M | 3.56M | 2.23M | 2.17M | 1.98M | 2.16M | 2.47M | 2.48M | 1.57M | 1.70M | 2.09M | 3.68M | 2.75M | 2.67M | 2.93M | 3.61M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | -103.87M | 75.16M | 63.24M | 61.61M | 44.29M | 38.15M | 47.55M | 51.58M | 46.80M | 47.11M | 49.65M | 47.38M | 48.74M | 60.62M | 62.75M | 73.16M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 138.96M | 163.85M | 179.04M | 159.70M | 134.88M | 132.79M | 129.94M | 141.49M | 156.48M | 176.33M | 237.04M | 272.12M | 310.44M | 315.24M | 311.53M | 337.95M | 306.41M | 252.98M | 198.07M | 184.37M | 168.94M | 155.66M | 176.53M | 159.10M | 135.90M | 131.40M | 116.50M | 109.40M | 104.90M | 99.60M | 74.90M | 57.10M | 57.70M | 56.60M | 56.20M | 53.80M | 56.10M | 51.90M | 49.80M |

| EBITDA | 111.01M | 235.63M | 267.41M | 190.19M | 239.16M | 320.89M | 269.11M | 114.04M | 237.15M | 225.82M | 93.67M | 100.14M | 397.51M | 386.89M | 511.56M | 743.87M | 723.50M | 546.90M | 419.49M | 354.62M | 302.86M | 288.01M | 285.24M | 302.71M | 278.20M | 306.30M | 460.50M | 304.70M | 266.20M | 245.70M | 218.80M | 190.50M | 177.30M | 172.20M | 78.40M | 108.20M | 163.90M | 137.30M | 157.80M |

| EBITDA Ratio | 5.37% | 12.47% | 14.47% | 10.20% | 15.90% | 18.63% | 16.75% | 7.86% | 13.76% | 10.93% | 3.23% | 3.29% | 12.04% | 12.73% | 17.11% | 18.75% | 19.62% | 15.98% | 15.16% | 14.17% | 14.30% | 14.57% | 13.53% | 15.10% | 16.17% | 17.65% | 28.29% | 19.56% | 17.80% | 18.10% | 15.38% | 11.72% | 9.12% | 9.79% | 5.80% | 8.46% | 14.02% | 12.15% | 12.51% |

| Operating Income | 111.01M | 71.78M | 88.38M | 30.48M | 104.28M | 190.93M | 142.80M | 63.47M | 88.54M | 63.47M | -134.80M | -174.79M | 87.65M | 78.43M | 218.66M | 411.99M | 457.81M | 358.47M | 268.95M | 209.85M | 173.89M | 175.97M | 163.62M | 196.06M | 169.60M | 187.60M | 178.30M | 164.70M | 121.60M | 74.60M | 127.10M | 147.70M | 123.10M | 121.80M | 29.10M | 57.10M | 105.20M | 81.60M | 122.90M |

| Operating Income Ratio | 5.37% | 3.80% | 4.78% | 1.64% | 6.93% | 11.09% | 8.89% | 4.37% | 5.14% | 3.07% | -4.65% | -5.74% | 2.65% | 2.58% | 7.31% | 10.38% | 12.41% | 10.47% | 9.72% | 8.39% | 8.21% | 8.90% | 7.76% | 9.78% | 9.86% | 10.81% | 10.96% | 10.57% | 8.13% | 5.49% | 8.94% | 9.09% | 6.34% | 6.92% | 2.15% | 4.46% | 9.00% | 7.22% | 9.74% |

| Total Other Income/Expenses | -129.56M | -194.74M | -50.87M | -52.21M | -47.81M | -33.67M | -47.35M | -142.94M | -53.72M | -55.15M | -48.53M | -43.71M | -45.98M | -57.96M | -59.31M | -68.65M | 64.18M | -56.58M | -38.68M | -38.61M | -37.99M | -39.27M | -49.82M | -52.45M | -27.30M | -12.70M | -12.70M | 30.60M | 39.70M | 71.50M | 10.00M | -7.10M | -3.50M | -6.20M | -6.90M | -2.70M | 2.60M | 3.80M | -14.90M |

| Income Before Tax | -18.55M | -122.96M | 37.51M | -31.13M | 56.47M | 157.25M | 95.45M | -79.47M | 34.82M | 8.32M | -183.33M | -218.50M | 41.67M | 20.48M | 159.34M | 343.34M | 382.44M | 301.89M | 230.27M | 171.24M | 135.90M | 136.70M | 113.80M | 143.61M | 142.30M | 174.90M | 165.60M | 195.30M | 161.30M | 146.10M | 137.10M | 140.60M | 119.60M | 115.60M | 22.20M | 54.40M | 107.80M | 85.40M | 108.00M |

| Income Before Tax Ratio | -0.90% | -6.51% | 2.03% | -1.67% | 3.76% | 9.13% | 5.94% | -5.48% | 2.02% | 0.40% | -6.33% | -7.17% | 1.26% | 0.67% | 5.33% | 8.65% | 10.37% | 8.82% | 8.32% | 6.84% | 6.41% | 6.92% | 5.40% | 7.16% | 8.27% | 10.08% | 10.18% | 12.54% | 10.79% | 10.76% | 9.64% | 8.65% | 6.16% | 6.57% | 1.64% | 4.25% | 9.22% | 7.56% | 8.56% |

| Income Tax Expense | -28.19M | 10.38M | 9.09M | -2.78M | 20.21M | 12.90M | 83.80M | 6.64M | 27.68M | 27.17M | 34.91M | 35.25M | 49.85M | 4.28M | 18.51M | 91.82M | 117.60M | 97.52M | 64.77M | 49.03M | 41.71M | 42.24M | 36.98M | 46.81M | 51.60M | 67.40M | 65.20M | 76.30M | 63.90M | 59.50M | 56.30M | 49.10M | 43.10M | 43.10M | 10.80M | 23.30M | 44.50M | 35.80M | 47.50M |

| Net Income | -86.12M | -133.34M | 28.42M | -28.35M | 36.26M | 137.06M | 7.82M | -85.67M | 6.19M | -24.79M | -227.94M | -254.61M | -11.51M | 6.75M | 118.78M | 240.95M | 299.49M | 196.40M | 156.66M | 121.21M | 92.22M | 90.11M | 71.73M | 96.80M | 90.70M | 107.50M | 278.80M | 119.00M | 97.40M | 86.60M | 87.60M | 84.30M | 76.50M | 72.50M | 11.40M | 31.10M | 63.30M | 49.60M | 60.50M |

| Net Income Ratio | -4.16% | -7.06% | 1.54% | -1.52% | 2.41% | 7.96% | 0.49% | -5.90% | 0.36% | -1.20% | -7.87% | -8.36% | -0.35% | 0.22% | 3.97% | 6.07% | 8.12% | 5.74% | 5.66% | 4.84% | 4.35% | 4.56% | 3.40% | 4.83% | 5.27% | 6.19% | 17.13% | 7.64% | 6.51% | 6.38% | 6.16% | 5.19% | 3.94% | 4.12% | 0.84% | 2.43% | 5.41% | 4.39% | 4.80% |

| EPS | -1.08 | -1.68 | 0.36 | -0.36 | 0.46 | 1.64 | 0.10 | -1.07 | 0.08 | -0.31 | -2.82 | -3.16 | -0.14 | 0.08 | 1.48 | 2.88 | 3.56 | 2.34 | 1.88 | 1.47 | 1.13 | 1.12 | 0.90 | 1.21 | 1.11 | 1.18 | 2.86 | 0.60 | 0.96 | 0.86 | 0.88 | 0.83 | 0.73 | 0.69 | 0.11 | 0.29 | 0.58 | 0.42 | 0.51 |

| EPS Diluted | -1.08 | -1.68 | 0.35 | -0.36 | 0.45 | 1.64 | 0.09 | -1.07 | 0.08 | -0.31 | -2.82 | -3.16 | -0.14 | 0.08 | 1.47 | 2.87 | 3.53 | 2.33 | 1.86 | 1.46 | 1.13 | 1.11 | 0.90 | 1.21 | 1.11 | 1.17 | 2.83 | 0.60 | 0.96 | 0.86 | 0.88 | 0.83 | 0.73 | 0.69 | 0.11 | 0.29 | 0.58 | 0.42 | 0.51 |

| Weighted Avg Shares Out | 79.80M | 79.49M | 79.23M | 78.94M | 79.63M | 83.60M | 80.55M | 80.33M | 80.23M | 80.88M | 80.76M | 80.63M | 80.74M | 80.57M | 80.30M | 83.60M | 84.17M | 83.91M | 83.28M | 82.26M | 81.38M | 80.72M | 79.75M | 79.93M | 81.76M | 91.14M | 97.51M | 199.53M | 100.98M | 100.46M | 99.11M | 101.52M | 104.94M | 104.89M | 104.84M | 105.74M | 108.66M | 117.40M | 119.39M |

| Weighted Avg Shares Out (Dil) | 79.80M | 79.49M | 80.29M | 78.94M | 81.38M | 83.60M | 82.84M | 80.33M | 80.37M | 80.88M | 80.76M | 80.63M | 80.99M | 80.76M | 80.59M | 84.03M | 84.72M | 84.43M | 84.16M | 83.20M | 81.95M | 81.36M | 80.13M | 80.04M | 82.03M | 91.88M | 98.34M | 199.53M | 100.98M | 100.46M | 99.11M | 101.52M | 104.94M | 104.89M | 104.84M | 105.74M | 108.66M | 117.40M | 119.39M |

Charles Schwab Investment Management Inc. Boosts Stake in Harsco Co. (NYSE:HSC)

Great West Life Assurance Co. Can Has $1.29 Million Stock Position in Harsco Co. (NYSE:HSC)

Here are 35 stocks in the market’s two hottest sectors that Wall Street loves

Harsco Co. (NYSE:HSC) Shares Purchased by Bank of New York Mellon Corp

California Public Employees Retirement System Decreases Stock Holdings in Harsco Co. (NYSE:HSC)

Principal Financial Group Inc. Sells 17,543 Shares of Harsco Co. (NYSE:HSC)

Harsco Hammered By Weak Volumes, But This Transformation Is Worth Watching

Harsco Releases 2019-2020 Environmental, Social & Governance Report

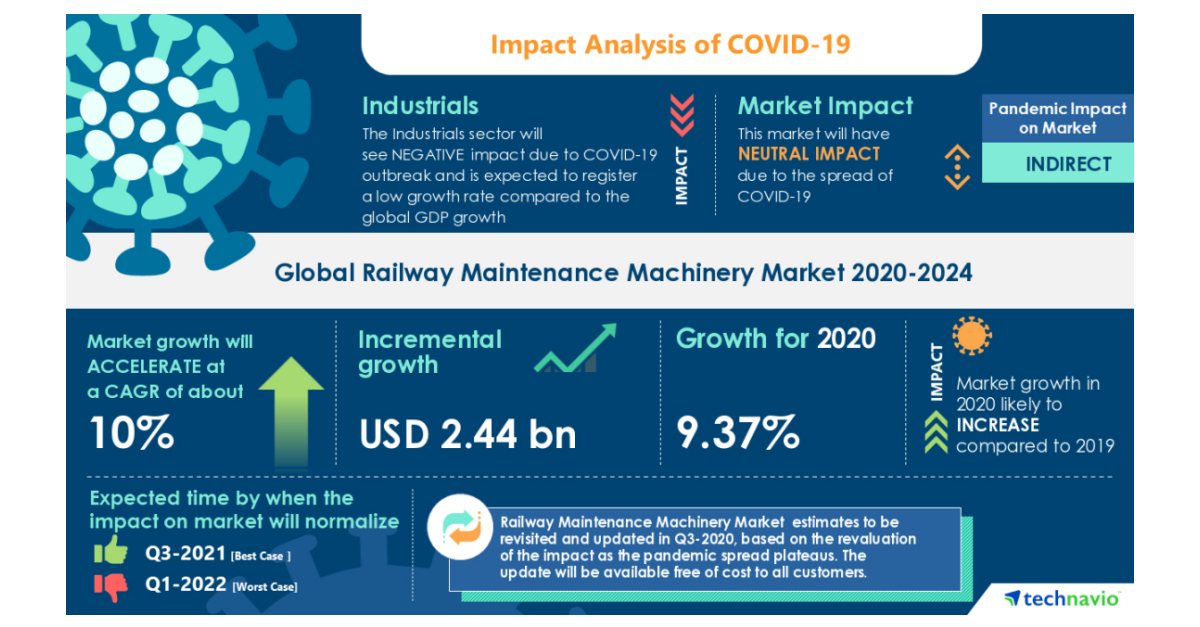

Railway Maintenance Machinery Market 2020-2024 | Increasing Number of Railway Electrification Projects to Boost Growth | Technavio

Harsco Completes Amendment To Its Credit Facility

Source: https://incomestatements.info

Category: Stock Reports