See more : Ablerex Electronics Co., Ltd. (3628.TWO) Income Statement Analysis – Financial Results

Complete financial analysis of Heska Corporation (HSKA) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Heska Corporation, a leading company in the Medical – Devices industry within the Healthcare sector.

- Churchill Capital Corp IX Ordinary Shares (CCIX) Income Statement Analysis – Financial Results

- Saregama India Limited (SAREGAMA.NS) Income Statement Analysis – Financial Results

- Farmmi, Inc. (FAMI) Income Statement Analysis – Financial Results

- Finbar Group Limited (FRI.AX) Income Statement Analysis – Financial Results

- AngloGold Ashanti Limited (AU) Income Statement Analysis – Financial Results

Heska Corporation (HSKA)

About Heska Corporation

Heska Corporation sells veterinary and animal health diagnostic and specialty products for canine and feline healthcare markets in the United States, Canada, Mexico, Australia, France, Germany, Italy, Malaysia, Spain, and Switzerland. The company offers Element DC, Element DCX, Element DC5x veterinary chemistry analyzers for blood chemistry and electrolyte analysis; Element RC, Element RCX, and Element RC3X chemistry systems for blood chemistry and electrolyte analysis; Element HT5 and scil Vet abc Plus veterinary hematology analyzers to measure blood cell and platelet count, and hemoglobin levels; Element POC blood gas and electrolyte analyzers; Element i immunodiagnostic analyzers; and Element COAG and Element AIM veterinary analyzers. It also provides HeskaView Telecytology that provides in-clinic automated microscopic slide scanning and computing equipment; IV infusion pumps; digital radiography hardware and mobile digital radiography products; ultrasound systems; Cloudbank, a Web-based image storage solution; point-of-care products to detect antigens and antibodies associated with infectious and parasitic diseases of animals; Tri-Heart Plus chewable tablets for the treatment of canine heartworm infection, and ascarid and hookworm infections; and allergy products and services, including ALLERCEPT definitive allergen panels, and therapy shots or drops. In addition, the company provides a line of bovine vaccines; biological and pharmaceutical products to other animal health companies; and turnkey services comprising research, licensing, production, labeling, and packaging; and validation support and distribution services. It sells its products to veterinarians through a telephone sales force, and third-party distributors; and trade shows, print advertising, and other distribution relationships. The company was formerly known as Paravax, Inc. and changed its name to Heska Corporation in 1995. The company was founded in 1988 and is based in Loveland, Colorado.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 257.31M | 253.74M | 197.32M | 122.66M | 127.45M | 129.34M | 130.08M | 104.60M | 89.84M | 78.34M | 72.81M | 70.07M | 65.45M | 75.68M | 81.65M | 82.34M | 75.06M | 69.44M | 67.69M | 65.33M | 51.33M | 48.28M | 52.68M | 51.20M | 39.80M | 20.90M | 10.00M |

| Cost of Revenue | 146.14M | 147.95M | 116.03M | 68.21M | 70.81M | 71.08M | 76.19M | 60.38M | 54.12M | 47.71M | 41.70M | 40.88M | 40.66M | 47.22M | 52.81M | 49.15M | 44.41M | 43.61M | 42.25M | 38.40M | 30.20M | 28.66M | 29.23M | 32.50M | 25.50M | 12.00M | 5.40M |

| Gross Profit | 111.17M | 105.79M | 81.29M | 54.45M | 56.64M | 58.26M | 53.89M | 44.21M | 35.72M | 30.63M | 31.10M | 29.19M | 24.79M | 28.46M | 28.84M | 33.19M | 30.65M | 25.83M | 25.44M | 26.93M | 21.13M | 19.63M | 23.44M | 18.70M | 14.30M | 8.90M | 4.60M |

| Gross Profit Ratio | 43.20% | 41.69% | 41.20% | 44.39% | 44.44% | 45.04% | 41.43% | 42.27% | 39.76% | 39.10% | 42.72% | 41.66% | 37.88% | 37.61% | 35.33% | 40.31% | 40.83% | 37.19% | 37.58% | 41.22% | 41.16% | 40.65% | 44.50% | 36.52% | 35.93% | 42.58% | 46.00% |

| Research & Development | 19.75M | 6.98M | 8.77M | 8.24M | 3.33M | 2.00M | 2.15M | 1.66M | 1.41M | 1.50M | 958.00K | 1.65M | 1.60M | 1.72M | 1.95M | 2.68M | 3.48M | 3.75M | 6.62M | 6.77M | 8.57M | 13.57M | 14.93M | 17.00M | 25.10M | 22.40M | 14.00M |

| General & Administrative | 64.05M | 54.52M | 42.24M | 18.20M | 24.85M | 14.81M | 13.12M | 12.66M | 12.23M | 11.13M | 9.65M | 9.12M | 8.11M | 8.17M | 8.92M | 8.93M | 9.89M | 7.19M | 7.44M | 7.08M | 6.69M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 47.66M | 45.28M | 38.47M | 27.68M | 24.66M | 23.23M | 22.09M | 21.34M | 19.16M | 19.43M | 18.34M | 15.17M | 14.73M | 14.52M | 17.64M | 16.11M | 14.36M | 14.02M | 15.62M | 15.75M | 13.13M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 111.71M | 99.81M | 80.71M | 45.88M | 49.51M | 38.04M | 35.21M | 34.00M | 31.39M | 30.56M | 27.99M | 24.29M | 22.84M | 22.70M | 26.56M | 25.03M | 24.24M | 21.21M | 23.06M | 22.83M | 19.82M | 21.86M | 24.25M | 26.30M | 25.10M | 19.60M | 7.00M |

| Other Expenses | -923.00K | -44.00K | 166.00K | -482.00K | 62.00K | 228.00K | 7.00K | -102.00K | 55.00K | -16.00K | -113.00K | 1.02M | 0.00 | 0.00 | 1.65M | 1.10M | 83.00K | 1.86M | 4.49M | 5.91M | 8.41M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 131.47M | 106.79M | 89.48M | 54.12M | 52.84M | 40.04M | 37.36M | 35.66M | 32.80M | 32.06M | 28.94M | 25.94M | 24.43M | 24.42M | 28.74M | 27.67M | 27.57M | 24.96M | 29.68M | 29.61M | 28.45M | 35.73M | 44.14M | 49.40M | 56.50M | 46.70M | 23.30M |

| Cost & Expenses | 277.61M | 254.73M | 205.52M | 122.33M | 123.65M | 111.12M | 113.55M | 96.04M | 86.93M | 79.77M | 70.65M | 66.82M | 65.09M | 71.63M | 81.55M | 76.81M | 71.99M | 68.57M | 71.93M | 68.00M | 58.65M | 64.38M | 73.38M | 81.90M | 82.00M | 58.70M | 28.70M |

| Interest Income | 3.58M | 1.80M | 607.00K | 661.00K | 261.00K | 167.00K | 124.00K | 172.00K | 190.00K | 127.00K | 95.00K | 268.00K | 58.00K | 64.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.54M | 4.20M | 6.37M | 3.09M | 310.00K | 245.00K | 160.00K | 200.00K | 206.00K | 74.00K | 117.00K | 124.00K | 189.00K | 407.00K | 640.00K | 588.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 13.97M | 13.56M | 11.39M | 4.92M | 4.60M | 4.75M | 4.65M | 4.19M | 3.71M | 2.50M | 1.70M | 2.05M | 2.30M | 2.57M | 3.27M | 2.18M | 2.01M | 2.01M | 1.73M | 1.89M | 2.64M | 3.72M | 4.97M | 6.10M | 6.30M | 4.70M | 2.30M |

| EBITDA | -20.30M | -993.00K | -8.19M | 327.00K | 3.79M | 18.22M | 16.53M | 8.56M | 2.91M | -1.43M | 2.16M | 5.57M | 2.71M | 6.67M | 4.47M | 5.52M | 4.79M | 2.63M | -4.24M | -444.00K | -8.34M | -10.05M | -14.73M | -19.80M | -35.90M | -34.80M | -17.60M |

| EBITDA Ratio | -7.89% | -0.39% | -4.15% | 0.27% | 2.98% | 14.09% | 12.71% | 8.18% | 3.24% | -1.83% | 2.96% | 7.95% | 4.15% | 8.82% | 5.47% | 9.24% | 6.38% | 3.79% | -3.84% | -0.68% | -7.17% | -20.81% | -27.97% | -38.67% | -90.20% | -166.51% | -176.00% |

| Operating Income | -20.30M | -993.00K | -8.19M | -4.59M | 3.75M | 18.22M | 16.53M | 8.56M | 2.91M | -1.43M | 2.16M | 3.25M | 358.00K | 4.04M | -681.00K | 5.52M | 3.08M | 871.00K | -4.24M | -3.19M | -8.34M | -18.12M | -20.70M | -30.70M | -42.20M | -37.80M | -18.70M |

| Operating Income Ratio | -7.89% | -0.39% | -4.15% | -3.74% | 2.94% | 14.09% | 12.71% | 8.18% | 3.24% | -1.83% | 2.96% | 4.64% | 0.55% | 5.34% | -0.83% | 6.71% | 4.10% | 1.25% | -6.26% | -4.89% | -16.24% | -37.53% | -39.30% | -59.96% | -106.03% | -180.86% | -187.00% |

| Total Other Income/Expenses | -1.54M | -2.45M | -5.60M | -2.91M | 13.00K | 150.00K | -29.00K | -130.00K | 39.00K | 37.00K | -135.00K | 117.00K | -289.00K | -306.00K | -640.00K | -588.00K | -1.04M | -774.00K | -575.00K | -214.00K | -334.00K | -2.33M | -1.00M | -4.80M | 0.00 | 1.70M | 1.20M |

| Income Before Tax | -21.83M | -3.44M | -13.79M | -2.58M | 3.81M | 18.37M | 16.50M | 8.43M | 2.95M | -1.39M | 2.02M | 3.37M | 69.00K | 3.74M | -1.32M | 4.93M | 2.03M | 97.00K | -4.82M | -3.41M | -9.34M | -20.45M | -21.70M | -35.50M | 0.00 | -36.10M | -17.50M |

| Income Before Tax Ratio | -8.49% | -1.36% | -6.99% | -2.11% | 2.99% | 14.20% | 12.69% | 8.06% | 3.28% | -1.78% | 2.78% | 4.80% | 0.11% | 4.94% | -1.62% | 5.99% | 2.71% | 0.14% | -7.11% | -5.22% | -18.20% | -42.36% | -41.20% | -69.34% | 0.00% | -172.73% | -175.00% |

| Income Tax Expense | -3.41M | -3.57M | 239.00K | -1.45M | -2.12M | 8.91M | 4.34M | 2.91M | 1.35M | -454.00K | 820.00K | 1.22M | 51.00K | 1.50M | -471.00K | -29.88M | 206.00K | -185.00K | 575.00K | 51.00K | 1.34M | 2.59M | 1.17M | 5.10M | 2.10M | -500.00K | -700.00K |

| Net Income | -18.42M | 132.00K | -14.03M | -1.14M | 5.85M | 9.95M | 10.51M | 5.24M | 2.60M | -1.20M | 1.20M | 2.15M | 18.00K | 2.24M | -850.00K | 34.81M | 1.83M | 282.00K | -4.82M | -3.46M | -8.67M | -18.69M | -21.87M | -35.80M | -44.30M | -37.30M | -18.00M |

| Net Income Ratio | -7.16% | 0.05% | -7.11% | -0.93% | 4.59% | 7.70% | 8.08% | 5.01% | 2.90% | -1.53% | 1.65% | 3.06% | 0.03% | 2.96% | -1.04% | 42.28% | 2.44% | 0.41% | -7.11% | -5.30% | -16.89% | -38.71% | -41.52% | -69.92% | -111.31% | -178.47% | -180.00% |

| EPS | -1.78 | 0.01 | -1.62 | -0.15 | 0.74 | 1.42 | 1.55 | 0.80 | 0.44 | -0.21 | 0.23 | 0.41 | 0.00 | 0.43 | -0.16 | 6.80 | 0.40 | 0.10 | -0.98 | -0.72 | -1.82 | -4.80 | -6.47 | -13.12 | -17.94 | -23.20 | -14.34 |

| EPS Diluted | -1.78 | 0.01 | -1.62 | -0.15 | 0.74 | 1.30 | 1.43 | 0.74 | 0.41 | -0.21 | 0.22 | 0.40 | 0.00 | 0.43 | -0.16 | 6.30 | 0.30 | 0.10 | -0.98 | -0.72 | -1.82 | -4.80 | -6.47 | -13.12 | -17.94 | -23.20 | -14.34 |

| Weighted Avg Shares Out | 10.34M | 10.02M | 8.65M | 7.45M | 7.86M | 7.03M | 6.78M | 6.51M | 5.95M | 5.76M | 5.33M | 5.24M | 5.22M | 5.21M | 5.17M | 5.11M | 5.03M | 4.97M | 4.90M | 4.81M | 4.77M | 3.89M | 3.38M | 2.73M | 2.47M | 1.61M | 1.25M |

| Weighted Avg Shares Out (Dil) | 10.34M | 10.02M | 8.65M | 7.45M | 7.86M | 7.64M | 7.36M | 7.07M | 6.41M | 5.76M | 5.49M | 5.34M | 5.25M | 5.21M | 5.17M | 5.55M | 5.29M | 5.04M | 4.90M | 4.81M | 4.77M | 3.89M | 3.38M | 2.73M | 2.47M | 1.61M | 1.25M |

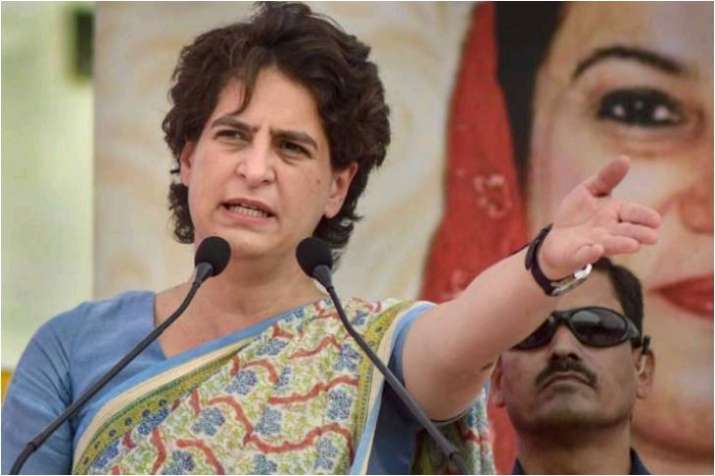

Priyanka Gandhi asked to vacate government bungalow within one month

कांग्रेस नेता प्रियंका गांधी को सरकारी बंगला खाली करने का आदेश, 1 महीने का मिला समय

JPMorgan Chase & Co. Analysts Give Bayer (FRA:BAYN) a €77.00 Price Target

Bayer (FRA:BAYN) Given a €90.00 Price Target at Sanford C. Bernstein

Voloridge Investment Management LLC Boosts Holdings in Phibro Animal Health Corp (NASDAQ:PAHC)

BOScoin (BOS) Price Down 10.9% This Week

BOScoin Tops One Day Trading Volume of $186,933.00 (BOS)

Bayer (FRA:BAYN) PT Set at €105.00 by Baader Bank

Netflix dominasi kemenangan Critics Choice Real TV Awards 2020

Source: https://incomestatements.info

Category: Stock Reports