See more : SilverSun Technologies, Inc. (SSNT) Income Statement Analysis – Financial Results

Complete financial analysis of Huntsman Corporation (HUN) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Huntsman Corporation, a leading company in the Chemicals industry within the Basic Materials sector.

- PT Utama Radar Cahaya Tbk (RCCC.JK) Income Statement Analysis – Financial Results

- PT Citra Marga Nusaphala Persada Tbk (CMNP.JK) Income Statement Analysis – Financial Results

- HNR Acquisition Corp (HNRA) Income Statement Analysis – Financial Results

- HireQuest, Inc. (HQI) Income Statement Analysis – Financial Results

- RiverNorth/DoubleLine Strategic Opportunity Fund, Inc. (OPP) Income Statement Analysis – Financial Results

Huntsman Corporation (HUN)

About Huntsman Corporation

Huntsman Corporation manufactures and sells differentiated organic chemical products worldwide. The company operates through four segments: Polyurethanes, Performance Products, Advanced Materials, and Textile Effects. The Polyurethanes segment offers polyurethane chemicals, including methyl diphenyl diisocyanate, polyols, thermoplastic polyurethane, propylene oxide, and methyl tertiary-butyl ether products. The Performance Products segment manufactures amines and maleic anhydrides, including ethylene oxide, propylene oxide, glycols, ethylene dichloride, caustic soda, ammonia, hydrogen, methylamines, and acrylonitrile. The Advanced Materials segment offers epoxy, acrylic, polyurethane, and acrylonitrile-butadiene-based polymer formulations; high performance thermoset resins, curing agents and toughening agents, and carbon nanotubes additives; and base liquid and solid resins. The Textile Effects segment provides textile chemicals and dyes. The company's products are used in a range of applications, including adhesives, aerospace, automotive, construction products, durable and non-durable consumer products, electronics, insulation, medical, packaging, coatings and construction, power generation, refining, synthetic fiber, textile chemicals, and dye industries. Huntsman Corporation was founded in 1970 and is headquartered in The Woodlands, Texas.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 6.11B | 8.02B | 8.45B | 6.02B | 6.80B | 9.38B | 8.36B | 9.66B | 10.30B | 11.58B | 11.08B | 11.19B | 11.22B | 9.25B | 7.76B | 10.22B | 9.65B | 10.62B | 12.96B | 11.49B | 7.08B | 2.66B | 2.76B | 3.33B |

| Cost of Revenue | 5.21B | 6.48B | 6.68B | 4.92B | 5.42B | 7.35B | 6.55B | 7.98B | 8.45B | 9.66B | 9.33B | 9.15B | 9.38B | 7.79B | 6.70B | 8.95B | 8.11B | 9.08B | 11.21B | 10.09B | 6.37B | 2.42B | 0.00 | 3.40B |

| Gross Profit | 906.00M | 1.55B | 1.78B | 1.10B | 1.38B | 2.03B | 1.81B | 1.68B | 1.85B | 1.92B | 1.75B | 2.03B | 1.84B | 1.46B | 1.07B | 1.26B | 1.54B | 1.54B | 1.75B | 1.40B | 707.80M | 240.00M | 2.76B | -78.70M |

| Gross Profit Ratio | 14.83% | 19.27% | 21.00% | 18.28% | 20.33% | 21.59% | 21.68% | 17.38% | 17.94% | 16.57% | 15.82% | 18.18% | 16.40% | 15.79% | 13.76% | 12.37% | 15.95% | 14.49% | 13.52% | 12.16% | 10.00% | 9.02% | 100.00% | -2.37% |

| Research & Development | 115.00M | 125.00M | 150.00M | 135.00M | 137.00M | 152.00M | 138.00M | 152.00M | 160.00M | 158.00M | 140.00M | 152.00M | 166.00M | 151.00M | 145.00M | 154.00M | 144.70M | 115.40M | 95.50M | 83.00M | 65.60M | 23.80M | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 830.00M | 798.00M | 920.00M | 982.00M | 974.00M | 942.00M | 951.00M | 921.00M | 861.00M | 860.00M | 882.00M | 871.30M | 795.30M | 676.90M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 689.00M | 711.00M | 851.00M | 775.00M | 786.00M | 830.00M | 798.00M | 920.00M | 982.00M | 974.00M | 942.00M | 951.00M | 921.00M | 861.00M | 860.00M | 882.00M | 871.30M | 795.30M | 676.90M | 694.80M | 482.80M | 151.90M | 0.00 | 0.00 |

| Other Expenses | 18.00M | -48.00M | -61.00M | -292.00M | 31.00M | 29.00M | 2.00M | 1.00M | 1.00M | -2.00M | 2.00M | 1.00M | -20.00M | 10.00M | -18.00M | 27.00M | -194.40M | -127.70M | 42.20M | 613.90M | 465.70M | 149.90M | 3.47B | 0.00 |

| Operating Expenses | 822.00M | 788.00M | 940.00M | 618.00M | 954.00M | 990.00M | 913.00M | 932.00M | 1.14B | 1.13B | 1.09B | 1.10B | 1.07B | 1.02B | 987.00M | 1.06B | 821.60M | 783.00M | 814.60M | 696.90M | 531.30M | 173.70M | 3.47B | 0.00 |

| Cost & Expenses | 6.03B | 7.27B | 7.62B | 5.54B | 6.37B | 8.34B | 7.46B | 8.91B | 9.59B | 10.79B | 10.42B | 10.25B | 10.45B | 8.81B | 7.68B | 10.01B | 8.93B | 9.87B | 12.02B | 10.79B | 6.90B | 2.59B | 3.47B | 3.40B |

| Interest Income | 0.00 | 62.00M | 67.00M | 86.00M | 111.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | -400.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 65.00M | 62.00M | 67.00M | 86.00M | 111.00M | 115.00M | 165.00M | 202.00M | 205.00M | 205.00M | 190.00M | 226.00M | 249.00M | 229.00M | 238.00M | 263.00M | 285.60M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 278.00M | 336.00M | 335.00M | 346.00M | 325.00M | 255.00M | 319.00M | 318.00M | 399.00M | 445.00M | 448.00M | 432.00M | 439.00M | 405.00M | 442.00M | 398.00M | 412.90M | 465.70M | 500.80M | 536.80M | 353.40M | 152.70M | 197.50M | 200.30M |

| EBITDA | 442.00M | 1.10B | 1.65B | 560.00M | 827.00M | 1.10B | 1.13B | 995.00M | 781.00M | 1.06B | 915.00M | 1.21B | 1.06B | 654.00M | 1.17B | 1.33B | 728.70M | 1.08B | 892.40M | 907.60M | 529.90M | 219.00M | -511.90M | 121.60M |

| EBITDA Ratio | 7.23% | 14.22% | 11.95% | 9.31% | 7.39% | 15.59% | 14.75% | 11.20% | 10.81% | 10.71% | 10.10% | 12.31% | 10.87% | 11.44% | -1.49% | -1.16% | 14.01% | 10.89% | 14.95% | 13.03% | 7.48% | 8.52% | -18.56% | 3.66% |

| Operating Income | 84.00M | 672.00M | 795.00M | 277.00M | 232.00M | 1.04B | 851.00M | 647.00M | 405.00M | 633.00M | 510.00M | 845.00M | 606.00M | 410.00M | -71.00M | 165.00M | 536.20M | 736.50M | 813.90M | 400.40M | 176.50M | 66.30M | -709.40M | -78.70M |

| Operating Income Ratio | 1.37% | 8.38% | 9.40% | 4.60% | 3.41% | 11.07% | 10.18% | 6.70% | 3.93% | 5.47% | 4.60% | 7.55% | 5.40% | 4.43% | -0.91% | 1.62% | 5.56% | 6.93% | 6.28% | 3.49% | 2.49% | 2.49% | -25.73% | -2.37% |

| Total Other Income/Expenses | 15.00M | 25.00M | 515.00M | 60.00M | -78.00M | -93.00M | -82.00M | -189.00M | -229.00M | -229.00M | -231.00M | -411.00M | -393.00M | -390.00M | 472.00M | 504.00M | -506.00M | -385.30M | -612.40M | -657.20M | -467.00M | -220.90M | 0.00 | 0.00 |

| Income Before Tax | 99.00M | 697.00M | 1.31B | 337.00M | 391.00M | 942.00M | 647.00M | 448.00M | 176.00M | 404.00M | 279.00M | 547.00M | 360.00M | 20.00M | 485.00M | 669.00M | 30.20M | 347.50M | 62.20M | -249.60M | -290.50M | -154.60M | 0.00 | 0.00 |

| Income Before Tax Ratio | 1.62% | 8.69% | 15.53% | 5.60% | 5.75% | 10.04% | 7.74% | 4.64% | 1.71% | 3.49% | 2.52% | 4.89% | 3.21% | 0.22% | 6.25% | 6.55% | 0.31% | 3.27% | 0.48% | -2.17% | -4.10% | -5.81% | 0.00% | 0.00% |

| Income Tax Expense | 64.00M | 186.00M | 209.00M | 46.00M | -38.00M | 97.00M | 64.00M | 87.00M | 46.00M | 51.00M | 125.00M | 169.00M | 109.00M | 29.00M | 370.00M | 190.00M | -12.10M | -49.00M | 23.50M | -29.10M | 30.80M | 8.50M | 133.50M | 59.90M |

| Net Income | 101.00M | 460.00M | 1.05B | 291.00M | 429.00M | 337.00M | 636.00M | 326.00M | 93.00M | 323.00M | 128.00M | 363.00M | 247.00M | 27.00M | 114.00M | 609.00M | -172.10M | 229.80M | -34.60M | -227.70M | -319.80M | -22.20M | -842.90M | -138.60M |

| Net Income Ratio | 1.65% | 5.73% | 12.36% | 4.84% | 6.31% | 3.59% | 7.61% | 3.38% | 0.90% | 2.79% | 1.16% | 3.24% | 2.20% | 0.29% | 1.47% | 5.96% | -1.78% | 2.16% | -0.27% | -1.98% | -4.52% | -0.83% | -30.57% | -4.17% |

| EPS | 0.57 | 2.29 | 4.77 | 1.32 | 1.87 | 1.42 | 2.67 | 1.38 | 0.38 | 1.33 | 0.53 | 1.53 | 1.04 | 0.11 | 0.49 | 2.62 | -0.78 | 1.04 | -0.16 | -1.03 | -1.79 | -1.11 | -3.82 | -0.63 |

| EPS Diluted | 0.57 | 2.27 | 4.72 | 1.31 | 1.86 | 1.39 | 2.61 | 1.36 | 0.38 | 1.31 | 0.53 | 1.51 | 1.02 | 0.11 | 0.48 | 2.60 | -0.74 | 0.99 | -0.16 | -1.03 | -1.79 | -1.11 | -3.82 | -0.63 |

| Weighted Avg Shares Out | 177.40M | 201.00M | 219.20M | 220.60M | 228.90M | 238.10M | 238.40M | 236.00M | 243.00M | 242.10M | 239.70M | 237.60M | 237.60M | 236.00M | 233.90M | 232.00M | 220.95M | 220.60M | 220.50M | 220.50M | 178.66M | 20.00M | 220.65M | 220.00M |

| Weighted Avg Shares Out (Dil) | 177.40M | 203.00M | 221.40M | 221.90M | 230.60M | 241.60M | 243.90M | 240.00M | 245.00M | 246.00M | 242.40M | 240.60M | 241.70M | 236.00M | 238.30M | 234.30M | 232.79M | 233.10M | 220.50M | 220.65M | 178.66M | 20.00M | 220.65M | 220.00M |

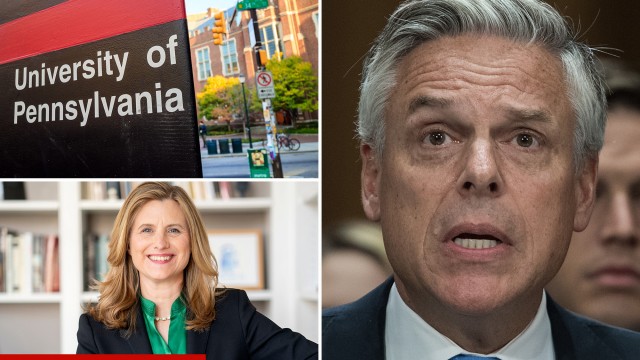

Jon Huntsman Jr. says family to stop donations to UPenn over ‘silence' on Hamas attack

UPenn in crisis over antisemitism allegations: Jon Huntsman is the latest donor to stop giving, and a board member resigns

Huntsman to Discuss Third Quarter 2023 Results on November 1, 2023; Results to be Released After Market Close on October 31, 2023

Huntsman (HUN) to Produce MIRALON Materials at New Plant

Huntsman (HUN) Unveils Technology Portal to Foster Collaboration

Construction Underway on Huntsman's 30-Ton Pilot Plant for MIRALON® Carbon Nanotube Materials

Huntsman Launches Technology Portal to Foster Innovation & Manufacturing-Driven Collaborations

Here's Why You Should Hold On to Huntsman (HUN) Stock For Now

Huntsman (HUN) Gains on Downstream Expansion, Acquisitions

Huntsman Corporation: Much Uncertainty Remains

Source: https://incomestatements.info

Category: Stock Reports