See more : Truworths International Limited (TRU.JO) Income Statement Analysis – Financial Results

Complete financial analysis of Houston Wire & Cable Company (HWCC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Houston Wire & Cable Company, a leading company in the Industrial – Distribution industry within the Industrials sector.

- Development Advance Solution Co.,Ltd. (058730.KS) Income Statement Analysis – Financial Results

- Sydinvest – USA Ligevægt & Value (SYIULVADKK.CO) Income Statement Analysis – Financial Results

- Zhejiang Meida Industrial Co., Ltd. (002677.SZ) Income Statement Analysis – Financial Results

- SS Innovations International, Inc. (SSII) Income Statement Analysis – Financial Results

- Digitree Group S.A. (DTR.WA) Income Statement Analysis – Financial Results

Houston Wire & Cable Company (HWCC)

About Houston Wire & Cable Company

Houston Wire & Cable Company, through its subsidiaries, sells electrical and mechanical wire and cable, industrial fasteners, hardware, and related services in the United States. The company offers wire and cable products, including continuous and interlocked armor cables; control and power cables; electronic wires and cables; flexible and portable cords; instrumentation and thermocouple cables; lead and high temperature cables; medium voltage cables; and premise and category wires and cables, primary and secondary aluminum distribution cables, and steel wire ropes and wire rope slings, as well as synthetic fiber rope slings, chains, shackles, and other related hardware and corrosion resistant products. It also provides private branded products comprising its proprietary brand LifeGuard, a low-smoke zero-halogen cable. The company's products are used in maintenance, repair, and operations activities, and related projects; larger-scale projects in the utility, industrial, and infrastructure markets; and a range of industrial applications, such as communications, energy, engineering and construction, general manufacturing, marine construction and marine transportation, mining, infrastructure, oilfield services, petrochemical, transportation, utility, wastewater treatment, and food and beverage. Houston Wire & Cable Company was founded in 1975 and is headquartered in Houston, Texas.

| Metric | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 286.02M | 338.29M | 356.86M | 317.70M | 261.64M | 308.13M | 390.01M | 383.29M | 393.04M | 396.41M | 308.52M | 254.82M | 360.94M | 359.12M | 323.47M | 213.96M | 172.72M | 149.08M | 158.23M | 189.69M |

| Cost of Revenue | 222.97M | 258.36M | 271.65M | 245.04M | 208.69M | 242.22M | 304.07M | 298.63M | 306.02M | 307.52M | 245.93M | 201.87M | 275.22M | 266.28M | 231.13M | 158.24M | 131.42M | 0.00 | 120.84M | 146.43M |

| Gross Profit | 63.05M | 79.92M | 85.21M | 72.66M | 52.95M | 65.91M | 85.94M | 84.66M | 87.02M | 88.90M | 62.59M | 52.95M | 85.72M | 92.84M | 92.34M | 55.72M | 41.30M | 149.08M | 37.39M | 43.26M |

| Gross Profit Ratio | 22.04% | 23.63% | 23.88% | 22.87% | 20.24% | 21.39% | 22.03% | 22.09% | 22.14% | 22.43% | 20.29% | 20.78% | 23.75% | 25.85% | 28.55% | 26.04% | 23.91% | 100.00% | 23.63% | 22.80% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 33.01M | 37.18M | 38.11M | 36.57M | 29.37M | 28.54M | 31.20M | 30.95M | 30.01M | 28.05M | 25.28M | 20.60M | 44.81M | 42.67M | 38.89M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 33.01M | 37.18M | 38.11M | 36.57M | 29.37M | 28.54M | 31.20M | 30.95M | 30.01M | 28.05M | 25.28M | 20.60M | 44.81M | 42.67M | 38.89M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 32.27M | 35.74M | 33.14M | 31.49M | 27.73M | 27.94M | 29.32M | 29.05M | 28.08M | 27.47M | 22.30M | 18.59M | 523.00K | 459.00K | 376.00K | 32.95M | 30.43M | 0.00 | 30.28M | 34.11M |

| Operating Expenses | 65.28M | 72.92M | 71.25M | 68.06M | 57.10M | 56.48M | 60.52M | 59.99M | 58.09M | 55.52M | 47.58M | 39.18M | 45.33M | 43.13M | 39.27M | 32.95M | 30.43M | 0.00 | 30.28M | 34.11M |

| Cost & Expenses | 288.25M | 331.28M | 342.90M | 313.09M | 265.80M | 298.70M | 364.59M | 358.63M | 364.11M | 363.03M | 293.52M | 241.05M | 320.56M | 309.41M | 270.39M | 191.19M | 161.85M | 0.00 | 151.12M | 180.54M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 1.89M | 3.06M | 2.91M | 2.07M | 845.00K | 901.00K | 1.17M | 992.00K | 1.25M | 1.42M | 844.00K | 520.00K | 1.83M | 1.19M | 3.08M | 2.96M | 3.54M | 0.00 | 4.36M | 5.97M |

| Depreciation & Amortization | 3.38M | 2.50M | 2.18M | 2.77M | 3.02M | 2.92M | 2.92M | 2.98M | 2.94M | 2.95M | 1.74M | 563.00K | 2.74M | 2.35M | 1.03M | 522.00K | 1.00M | -148.87M | 1.69M | -130.00K |

| EBITDA | -7.95M | 9.38M | 16.08M | 7.38M | -3.52M | 8.93M | 28.34M | 20.08M | 31.87M | 36.33M | 16.74M | 14.34M | 43.12M | 52.06M | 54.11M | 23.29M | 12.52M | 216.00K | 27.84M | 9.02M |

| EBITDA Ratio | -2.78% | 2.77% | 4.50% | 2.32% | -1.34% | 2.90% | 7.27% | 5.24% | 8.11% | 9.16% | 5.43% | 5.63% | 11.95% | 14.50% | 16.73% | 10.89% | 7.25% | 0.14% | 17.59% | 4.76% |

| Operating Income | -2.23M | 7.00M | 13.96M | 4.60M | -4.15M | 9.44M | 25.42M | 24.67M | 28.93M | 33.38M | 15.01M | 13.77M | 40.38M | 49.71M | 53.07M | 22.77M | 10.87M | 149.08M | 7.11M | 9.15M |

| Operating Income Ratio | -0.78% | 2.07% | 3.91% | 1.45% | -1.59% | 3.06% | 6.52% | 6.44% | 7.36% | 8.42% | 4.86% | 5.40% | 11.19% | 13.84% | 16.41% | 10.64% | 6.29% | 100.00% | 4.50% | 4.82% |

| Total Other Income/Expenses | -10.99M | -3.18M | -2.97M | -2.07M | -3.23M | -4.32M | -1.17M | -8.55M | -1.25M | -1.42M | -844.00K | -520.00K | -1.83M | -1.19M | -3.08M | -2.96M | -2.89M | 0.00 | -4.36M | -5.97M |

| Income Before Tax | -13.22M | 3.83M | 10.99M | 2.53M | -7.38M | 5.12M | 24.26M | 16.11M | 27.67M | 31.95M | 14.16M | 13.25M | 38.56M | 48.52M | 50.00M | 19.81M | 7.98M | 0.00 | 2.75M | 3.19M |

| Income Before Tax Ratio | -4.62% | 1.13% | 3.08% | 0.80% | -2.82% | 1.66% | 6.22% | 4.20% | 7.04% | 8.06% | 4.59% | 5.20% | 10.68% | 13.51% | 15.46% | 9.26% | 4.62% | 0.00% | 1.74% | 1.68% |

| Income Tax Expense | -636.00K | 1.28M | 2.36M | 2.75M | -1.37M | 3.07M | 9.28M | 8.21M | 10.64M | 12.28M | 5.54M | 5.22M | 14.82M | 18.30M | 19.33M | 7.30M | 3.17M | 148.87M | 19.33M | 130.00K |

| Net Income | -12.58M | 2.55M | 8.64M | -222.00K | -6.01M | 2.04M | 14.97M | 7.90M | 17.04M | 19.68M | 8.62M | 8.03M | 23.74M | 30.23M | 30.67M | 12.51M | 4.81M | 216.00K | 2.46M | 3.06M |

| Net Income Ratio | -4.40% | 0.75% | 2.42% | -0.07% | -2.30% | 0.66% | 3.84% | 2.06% | 4.34% | 4.96% | 2.79% | 3.15% | 6.58% | 8.42% | 9.48% | 5.85% | 2.78% | 0.14% | 1.56% | 1.61% |

| EPS | -0.77 | 0.15 | 0.52 | -0.01 | -0.37 | 0.12 | 0.85 | 0.44 | 0.96 | 1.11 | 0.49 | 0.46 | 1.33 | 1.49 | 1.63 | 0.75 | 0.29 | 0.01 | 0.15 | 0.19 |

| EPS Diluted | -0.77 | 0.15 | 0.52 | -0.01 | -0.37 | 0.12 | 0.85 | 0.44 | 0.96 | 1.11 | 0.49 | 0.45 | 1.33 | 1.48 | 1.62 | 0.75 | 0.29 | 0.01 | 0.15 | 0.19 |

| Weighted Avg Shares Out | 16.43M | 16.55M | 16.52M | 16.27M | 16.35M | 17.01M | 17.61M | 17.81M | 17.72M | 17.68M | 17.66M | 17.65M | 17.79M | 20.33M | 18.88M | 16.61M | 16.35M | 16.33M | 16.33M | 16.11M |

| Weighted Avg Shares Out (Dil) | 16.43M | 16.55M | 16.52M | 16.27M | 16.35M | 17.07M | 17.68M | 17.90M | 17.82M | 17.80M | 17.71M | 17.67M | 17.84M | 20.41M | 18.98M | 16.76M | 16.52M | 16.50M | 16.50M | 16.11M |

Houston Wire & Cable Company to Sell Southern Wire Division

Houston Wire & Cable Company Announces Results for the Quarter Ended September 30, 2020, Update on Continuing Cost and Debt Reduction

Houston Wire & Cable Company Announces Third Quarter 2020 Earnings Release Date

Searching For Wonderful Businesses: Encore Wire (NASDAQ:WIRE)

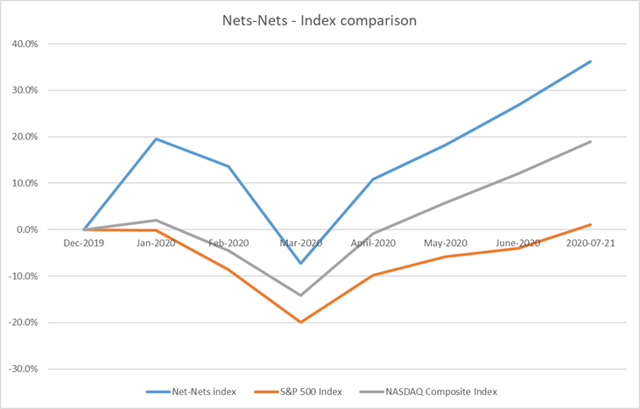

Deep Value Index Posts Strong Outperformance Vs. Nasdaq During COVID-19 Pandemic

Houston Wire & Cable Company: Low Potential In The Short Term

Power Cables Market to Reach 272.88 Billion by 2027; Increasing Product Applications Across Diverse Industries Will Aid Growth, says Fortune Business Insights™

Source: https://incomestatements.info

Category: Stock Reports