See more : Zoomability Int AB (ZOOM.ST) Income Statement Analysis – Financial Results

Complete financial analysis of ImmunityBio, Inc. (IBRX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of ImmunityBio, Inc., a leading company in the Biotechnology industry within the Healthcare sector.

- The Bankers Investment Trust PLC (BIT.NZ) Income Statement Analysis – Financial Results

- Global Offshore Services Limited (GLOBOFFS.NS) Income Statement Analysis – Financial Results

- Dong Ah Tire & Rubber Co.,Ltd (282690.KS) Income Statement Analysis – Financial Results

- GoHealth, Inc. (GOCO) Income Statement Analysis – Financial Results

- Waste Connections, Inc. (WCN.TO) Income Statement Analysis – Financial Results

ImmunityBio, Inc. (IBRX)

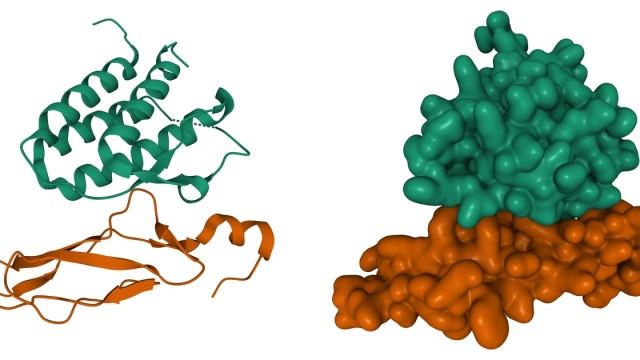

About ImmunityBio, Inc.

ImmunityBio, Inc., a clinical-stage biotechnology company, develops therapies and vaccines to treat cancers and infectious diseases. It offers immunotherapy and cell therapy platforms, including antibody cytokine fusion proteins, synthetic immunomodulators, vaccine technologies, natural killer cells, and adaptive (T cell) immune systems. The company also develops therapeutic agents, which are in Phase II or III clinical trial for the treatment of liquid and solid tumors, including bladder, pancreatic, and lung cancers, as well as pathogens as SARS-CoV-2 and HIV. It has collaboration agreements with National Cancer Institute, National Institute of Deafness and Communication Disorders, and Amyris, Inc.; and license agreements with CytRx Corporation, EnGeneIC Pty Limited, GlobeImmune, Inc., and Infectious Disease Research Institute, Sanford Health, Shenzhen Beike Biotechnology Co. Ltd., Sorrento Therapeutics, Inc., and Viracta Therapeutics, Inc. The company was founded in 2014 and is based in San Diego, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 622.00K | 240.00K | 934.00K | 605.00K | 2.20M | 47.00K | 45.00K | 44.00K | 236.00K | 641.00K | 600.00K |

| Cost of Revenue | 0.00 | 24.19M | 0.00 | 9.15M | 9.01M | -3.11M | 0.00 | 0.00 | 0.00 | 0.00 | 253.00K |

| Gross Profit | 622.00K | -23.95M | 934.00K | -8.54M | -6.81M | 3.16M | 45.00K | 44.00K | 236.00K | 641.00K | 347.00K |

| Gross Profit Ratio | 100.00% | -9,980.00% | 100.00% | -1,411.90% | -309.26% | 6,717.02% | 100.00% | 100.00% | 100.00% | 100.00% | 57.83% |

| Research & Development | 232.37M | 248.15M | 195.96M | 139.51M | 112.00M | 53.42M | 39.78M | 26.55M | 11.43M | 1.60M | 446.00K |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 28.39M | 57.12M | 95.39M | 227.68M | 4.33M | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 7.07M | -3.30M | -1.00M | -1.47M | 0.00 | 0.00 |

| SG&A | 129.62M | 102.71M | 135.26M | 71.32M | 46.46M | 35.46M | 53.82M | 94.39M | 226.21M | 4.33M | 2.42M |

| Other Expenses | 886.00K | -736.00K | 193.00K | 1.49M | -534.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 362.87M | 350.86M | 331.21M | 210.83M | 158.45M | 88.88M | 93.60M | 120.94M | 237.64M | 5.92M | 2.87M |

| Cost & Expenses | 362.87M | 350.86M | 331.21M | 210.83M | 158.45M | 98.44M | 99.17M | 124.54M | 239.11M | 6.24M | 2.87M |

| Interest Income | 863.00K | 2.71M | 836.00K | 1.73M | 2.76M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.00K |

| Interest Expense | 129.20M | 63.52M | 14.85M | 9.07M | 5.92M | 433.00K | 618.00K | 66.00K | 0.00 | 0.00 | 463.00K |

| Depreciation & Amortization | 18.51M | 24.19M | 19.12M | 9.15M | 9.01M | 9.56M | 5.57M | 3.61M | 1.47M | 128.00K | 4.00K |

| EBITDA | -436.18M | -335.51M | -315.38M | -187.93M | -142.27M | -86.74M | -90.73M | -117.71M | -235.71M | -5.68M | -1.58M |

| EBITDA Ratio | -70,125.72% | -143,324.17% | -33,865.52% | -32,252.56% | -6,356.77% | -189,008.51% | -207,897.78% | -274,756.82% | -100,594.92% | -949.14% | -263.17% |

| Operating Income | -362.25M | -351.30M | -330.28M | -220.88M | -156.25M | -98.39M | -99.12M | -124.50M | -238.88M | -6.21M | -2.27M |

| Operating Income Ratio | -58,239.55% | -146,374.17% | -35,361.88% | -36,509.09% | -7,095.87% | -209,338.30% | -220,266.67% | -282,954.55% | -101,218.64% | -969.11% | -378.17% |

| Total Other Income/Expenses | -221.64M | -65.99M | -19.56M | -25.36M | -3.95M | 1.66M | 2.20M | 3.12M | 1.70M | -609.00K | 223.00K |

| Income Before Tax | -583.89M | -417.29M | -349.84M | -226.03M | -160.26M | -96.73M | -96.92M | -121.38M | -237.18M | -6.21M | -2.05M |

| Income Before Tax Ratio | -93,873.31% | -173,869.17% | -37,456.00% | -37,360.83% | -7,278.07% | -205,806.38% | -215,368.89% | -275,865.91% | -100,498.73% | -969.11% | -341.00% |

| Income Tax Expense | -40.00K | 34.00K | 9.00K | -1.85M | -105.00K | -503.00K | -493.00K | -572.00K | -301.00K | 1.00K | 1.00K |

| Net Income | -583.20M | -417.32M | -349.85M | -224.19M | -160.16M | -96.23M | -96.42M | -120.81M | -236.88M | -6.21M | -2.05M |

| Net Income Ratio | -93,761.41% | -173,883.33% | -37,456.96% | -37,055.70% | -7,273.30% | -204,736.17% | -214,273.33% | -274,565.91% | -100,371.19% | -969.27% | -341.17% |

| EPS | -1.15 | -1.04 | -0.90 | -0.59 | -0.42 | -1.22 | -1.20 | -1.47 | -3.31 | -0.02 | -2.57 |

| EPS Diluted | -1.15 | -1.04 | -0.90 | -0.59 | -0.42 | -1.22 | -1.20 | -1.47 | -3.31 | -0.02 | -2.57 |

| Weighted Avg Shares Out | 508.64M | 399.90M | 389.23M | 383.18M | 383.18M | 79.13M | 80.58M | 81.98M | 71.52M | 315.73M | 797.11K |

| Weighted Avg Shares Out (Dil) | 508.64M | 399.90M | 389.23M | 383.18M | 383.18M | 79.13M | 80.58M | 81.98M | 71.52M | 315.73M | 797.11K |

3 Short-Squeeze Stocks Outwitting the Pessimistic Predictions

These 5 stocks are potential short-squeeze candidates

ImmunityBio Announces 2024 Annual Meeting of Stockholders with Company Update

ImmunityBio: Anktiva's Launch Demands A Reassessment

Connecting the Dots of ANKTIVA's Triangle Offense: A Deep Dive with Dr. Patrick Soon-Shiong and Dr. Ashish Kamat in a Three-Part UroToday Podcast

The 3 Best Bargain Stocks to Buy in May 2024

ImmunityBio Completes GMP Drug Substance Manufacturing Sufficient for 170,000 Doses of ANKTIVA®

Even Worse than Gamestop? 3 Meme Stocks That Are Screaming Sells

ImmunityBio Executive Chairman Dr. Patrick Soon-Shiong to Discuss ANKTIVA® Approval in Fireside Chat at the Annual Conference of the American Urological Association

What's going on with the ImmunityBio (IBRX) stock price?

Source: https://incomestatements.info

Category: Stock Reports