See more : Tanvi Foods (India) Limited (TANVI.BO) Income Statement Analysis – Financial Results

Complete financial analysis of Ichor Holdings, Ltd. (ICHR) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Ichor Holdings, Ltd., a leading company in the Semiconductors industry within the Technology sector.

- Bata India Limited (BATAINDIA.BO) Income Statement Analysis – Financial Results

- Fansfrenzy Corporation (FFZY) Income Statement Analysis – Financial Results

- New Age Metals Inc. (NAM.V) Income Statement Analysis – Financial Results

- Chimera Investment Corporation (CIM-PD) Income Statement Analysis – Financial Results

- Atd New Holdings Inc (AHLD) Income Statement Analysis – Financial Results

Ichor Holdings, Ltd. (ICHR)

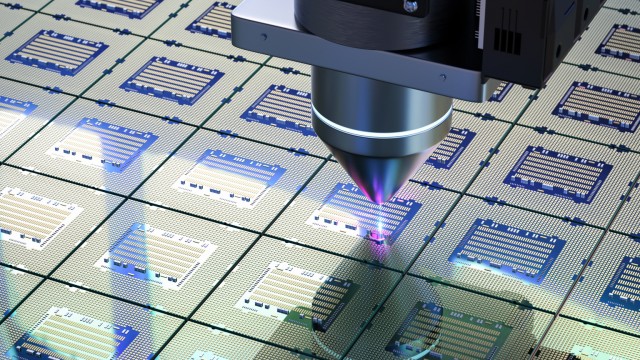

About Ichor Holdings, Ltd.

Ichor Holdings, Ltd. engages in the design, engineering, and manufacture of fluid delivery subsystems and components for semiconductor capital equipment. It primarily offers gas and chemical delivery systems and subsystems that are used in the manufacturing of semiconductor devices. The company's gas delivery subsystems deliver, monitor, and control gases used in semiconductor manufacturing processes, such as etch and deposition; and chemical delivery subsystems blend and dispense the reactive liquid chemistries used in semiconductor manufacturing processes comprising chemical-mechanical planarization, electroplating, and cleaning. It also manufactures precision machined components, weldments, electron beam, laser-welded components, precision vacuum and hydrogen brazing, surface treatment technologies, and other proprietary products for use in fluid delivery systems. The company primarily markets its products directly and through resellers to equipment OEMs in the semiconductor equipment market in the United States, the United Kingdom, Singapore, Malaysia, Korea, Mexico, and internationally. Ichor Holdings, Ltd. was incorporated in 1999 and is headquartered in Fremont, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 811.12M | 1.28B | 1.10B | 914.24M | 620.84M | 823.61M | 655.89M | 405.75M | 290.64M | 249.09M | 277.64M |

| Cost of Revenue | 707.72M | 1.07B | 919.44M | 789.34M | 534.47M | 687.47M | 553.50M | 340.35M | 242.09M | 212.75M | 239.65M |

| Gross Profit | 103.40M | 211.86M | 177.48M | 124.89M | 86.36M | 136.14M | 102.40M | 65.40M | 48.55M | 36.34M | 37.99M |

| Gross Profit Ratio | 12.75% | 16.55% | 16.18% | 13.66% | 13.91% | 16.53% | 15.61% | 16.12% | 16.71% | 14.59% | 13.68% |

| Research & Development | 20.22M | 19.56M | 15.69M | 13.36M | 11.10M | 9.36M | 7.90M | 6.38M | 4.81M | 3.92M | 4.21M |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 47.45M | 37.80M | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 79.33M | 88.57M | 65.86M | 56.61M | 47.27M | 47.45M | 37.80M | 28.13M | 24.73M | 22.47M | 22.35M |

| Other Expenses | 14.73M | 17.91M | 14.92M | 13.37M | 13.02M | 241.00K | 126.00K | 629.00K | 46.00K | -253.00K | 0.00 |

| Operating Expenses | 114.29M | 126.04M | 96.47M | 83.34M | 71.39M | 72.17M | 54.24M | 41.52M | 35.95M | 32.79M | 34.43M |

| Cost & Expenses | 822.02M | 1.19B | 1.02B | 872.68M | 605.86M | 759.65M | 607.73M | 381.88M | 278.04M | 245.54M | 274.08M |

| Interest Income | 0.00 | 11.06M | 6.45M | 8.73M | 10.65M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 3.35M |

| Interest Expense | 19.38M | 11.06M | 6.45M | 8.73M | 10.65M | 9.99M | 3.28M | 4.37M | 3.83M | 3.12M | 0.00 |

| Depreciation & Amortization | 34.58M | 35.10M | 25.99M | 24.27M | 21.92M | 23.06M | 12.48M | 9.50M | 9.94M | 9.63M | 9.21M |

| EBITDA | 22.88M | 121.49M | 106.20M | 65.28M | 36.84M | 87.27M | 58.79M | 34.00M | 22.58M | 13.05M | 12.77M |

| EBITDA Ratio | 2.82% | 9.49% | 9.68% | 7.14% | 5.93% | 10.60% | 9.22% | 8.38% | 7.77% | 5.19% | 4.95% |

| Operating Income | -10.90M | 85.82M | 81.01M | 41.55M | 14.98M | 63.97M | 48.16M | 23.87M | 12.60M | 3.55M | 4.54M |

| Operating Income Ratio | -1.34% | 6.70% | 7.39% | 4.54% | 2.41% | 7.77% | 7.34% | 5.88% | 4.34% | 1.42% | 1.64% |

| Total Other Income/Expenses | -20.18M | -10.49M | -7.26M | -9.26M | -10.70M | -9.75M | -3.15M | -3.74M | -3.79M | -3.37M | -4.33M |

| Income Before Tax | -31.08M | 75.33M | 73.76M | 32.29M | 4.28M | 54.22M | 45.01M | 20.13M | 8.82M | 178.00K | 209.00K |

| Income Before Tax Ratio | -3.83% | 5.88% | 6.72% | 3.53% | 0.69% | 6.58% | 6.86% | 4.96% | 3.03% | 0.07% | 0.08% |

| Income Tax Expense | 11.91M | 2.53M | 2.86M | -988.00K | -6.45M | -3.66M | -7.11M | -649.00K | -3.99M | -5.60M | 2.55M |

| Net Income | -42.99M | 72.80M | 70.90M | 33.28M | 10.73M | 57.88M | 51.39M | 16.66M | 12.81M | 6.17M | 2.76M |

| Net Income Ratio | -5.30% | 5.69% | 6.46% | 3.64% | 1.73% | 7.03% | 7.83% | 4.11% | 4.41% | 2.48% | 0.99% |

| EPS | -1.47 | 2.54 | 2.51 | 1.44 | 0.48 | 2.34 | 2.05 | -3.11 | -0.74 | 0.00 | 0.12 |

| EPS Diluted | -1.47 | 2.51 | 2.45 | 1.42 | 0.47 | 2.30 | 1.96 | -3.11 | -0.74 | 0.00 | 0.12 |

| Weighted Avg Shares Out | 29.20M | 28.71M | 28.26M | 23.17M | 22.42M | 24.71M | 25.12M | 1.21M | 22.39M | 22.39M | 22.39M |

| Weighted Avg Shares Out (Dil) | 29.20M | 28.96M | 28.98M | 23.46M | 22.77M | 25.13M | 26.22M | 1.21M | 22.58M | 22.58M | 22.58M |

Ichor Holdings (ICHR) Surges 9.0%: Is This an Indication of Further Gains?

Ichor to Announce Fourth Quarter 2023 Financial Results on February 6th

Ichor Announces Participation in 26th Annual Needham Growth Conference

Ichor Announces Participation in 12th Annual NYC Summit

Ichor Holdings, Ltd. (ICHR) Q3 2023 Earnings Call Transcript

Ichor Holdings, Ltd. Announces Third Quarter 2023 Financial Results

Ichor to Announce Third Quarter 2023 Financial Results on November 6th

The 3 Most Undervalued Small-Cap Stocks to Buy Now: August 2023

Ichor Announces Participation in Upcoming Investor Events

Ichor Holdings: Expensive With Difficult Quarters Ahead

Source: https://incomestatements.info

Category: Stock Reports