See more : World Known MFG (Cayman) Limited (4581.TW) Income Statement Analysis – Financial Results

Complete financial analysis of IMAC Holdings, Inc. (IMAC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of IMAC Holdings, Inc., a leading company in the Medical – Care Facilities industry within the Healthcare sector.

- Galata Acquisition Corp. (GLTA) Income Statement Analysis – Financial Results

- Kaiser Aluminum Corporation (KALU) Income Statement Analysis – Financial Results

- G5 Entertainment AB (publ) (0QUS.L) Income Statement Analysis – Financial Results

- Rainbow Children’s Medicare Limited (RAINBOW.BO) Income Statement Analysis – Financial Results

- Southern Home Medical, Inc. (SHOM) Income Statement Analysis – Financial Results

IMAC Holdings, Inc. (IMAC)

About IMAC Holdings, Inc.

IMAC Holdings, Inc. owns, manages, and subleases a chain of innovative medical advancements and care regeneration centers in the United States. The company's outpatient medical clinics provide regenerative, orthopedic, and minimally invasive procedures and therapies to patients with sports injuries, ligament and tendon damage, and other related soft tissue conditions, as well as back, knee, and joint pains. It also provides physical therapy and spinal decompression, and chiropractic manipulation. The company owns or manages 15 outpatient medical clinics in Kentucky, Missouri, Tennessee, Illinois, Louisiana, and Florida. IMAC Holdings, Inc. was founded in 2000 and is headquartered in Brentwood, Tennessee.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 |

|---|---|---|---|---|---|---|---|---|

| Revenue | 5.20M | 16.19M | 14.39M | 12.84M | 15.13M | 6.70M | 786.03K | 15.00K |

| Cost of Revenue | 1.35M | 1.51M | 1.63M | 1.62M | 2.54M | 933.91K | 63.22K | 4.27K |

| Gross Profit | 3.85M | 14.68M | 12.76M | 11.21M | 12.59M | 5.77M | 722.81K | 10.73K |

| Gross Profit Ratio | 74.05% | 90.68% | 88.68% | 87.35% | 83.21% | 86.06% | 91.96% | 71.56% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | -6.26K | 21.80M | 19.73M | 15.44M | 15.98M | 7.81M | 1.45M | 204.78K |

| Selling & Marketing | 7.73K | 1.10M | 1.32M | 933.34K | 1.24M | 859.19K | 119.87K | 25.00K |

| SG&A | 1.47K | 22.90M | 21.06M | 16.38M | 17.22M | 8.67M | 1.57M | 229.78K |

| Other Expenses | 0.00 | 1.63M | 1.65M | 1.31M | 1.55M | 18.36K | 65.90K | 0.00 |

| Operating Expenses | 5.03M | 24.53M | 22.71M | 17.68M | 18.77M | 9.32M | 1.64M | 229.78K |

| Cost & Expenses | 6.38M | 26.03M | 24.33M | 19.31M | 21.31M | 10.25M | 1.70M | 234.05K |

| Interest Income | 0.00 | 10.58K | 2.89K | 6.07K | 7.79K | 7.54K | 14.82K | 4.00 |

| Interest Expense | 0.00 | 14.19K | 504.10K | 563.07K | 897.69K | 153.82K | 27.15K | 4.00 |

| Depreciation & Amortization | 403.59K | 1.63M | 1.65M | 1.72M | 1.55M | 651.07K | 65.90K | 219.05K |

| EBITDA | -5.95M | -10.20M | -8.39M | -3.26M | -4.50M | -2.98M | -823.48K | -397.44K |

| EBITDA Ratio | -114.43% | -50.91% | -57.28% | -36.96% | -30.68% | -44.47% | -104.42% | -2,649.60% |

| Operating Income | -6.38M | -9.85M | -9.95M | -6.47M | -6.19M | -3.55M | -915.07K | -219.05K |

| Operating Income Ratio | -122.68% | -60.85% | -69.16% | -50.43% | -40.89% | -53.00% | -116.42% | -1,460.31% |

| Total Other Income/Expenses | -99.85K | 6.11K | -443.89K | 993.86K | -765.96K | -233.48K | -1.47K | -178.39K |

| Income Before Tax | -6.48M | -18.31M | -10.54M | -5.54M | -6.95M | -3.78M | -916.53K | -397.44K |

| Income Before Tax Ratio | -124.60% | -113.14% | -73.28% | -43.18% | -45.96% | -56.48% | -116.60% | -2,649.60% |

| Income Tax Expense | 0.00 | 8.43M | 561.43K | 24.37K | 427.20K | -79.65K | -818.59K | -16.65K |

| Net Income | -9.42M | -26.74M | -11.10M | -5.57M | -7.38M | -3.05M | -57.18K | -380.80K |

| Net Income Ratio | -181.23% | -165.24% | -77.18% | -43.37% | -48.78% | -45.57% | -7.27% | -2,538.65% |

| EPS | -5.06 | -28.38 | -14.77 | -15.11 | -28.55 | -12.65 | -0.38 | -2.56 |

| EPS Diluted | -7.36 | -28.38 | -14.77 | -15.11 | -28.55 | -12.65 | -0.38 | -2.56 |

| Weighted Avg Shares Out | 1.62M | 942.46K | 751.72K | 368.34K | 258.45K | 241.43K | 150.40K | 149.02K |

| Weighted Avg Shares Out (Dil) | 1.11M | 942.46K | 751.72K | 368.34K | 258.45K | 241.43K | 150.40K | 149.02K |

At least 11 people have died during protests since Floyd's death

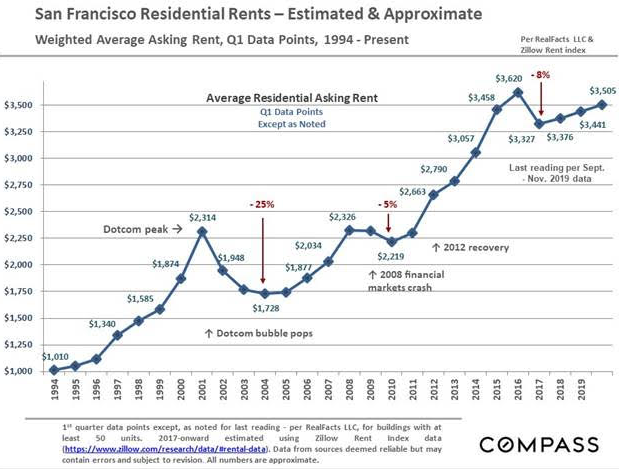

Rents in the Most Expensive Cities Drop. Oil Patch Gets Hit Too. But Massive Gains in Other Cities

It's tough out there. But some small businesses have prospered

The Sporting Green's readers tell us their favorite sports memories

The antidote: your favourite reads beyond coronavirus

Grandmother and son wrongly accused of TV theft sue police over beating

How would a lost baseball season affect Giants and A's?

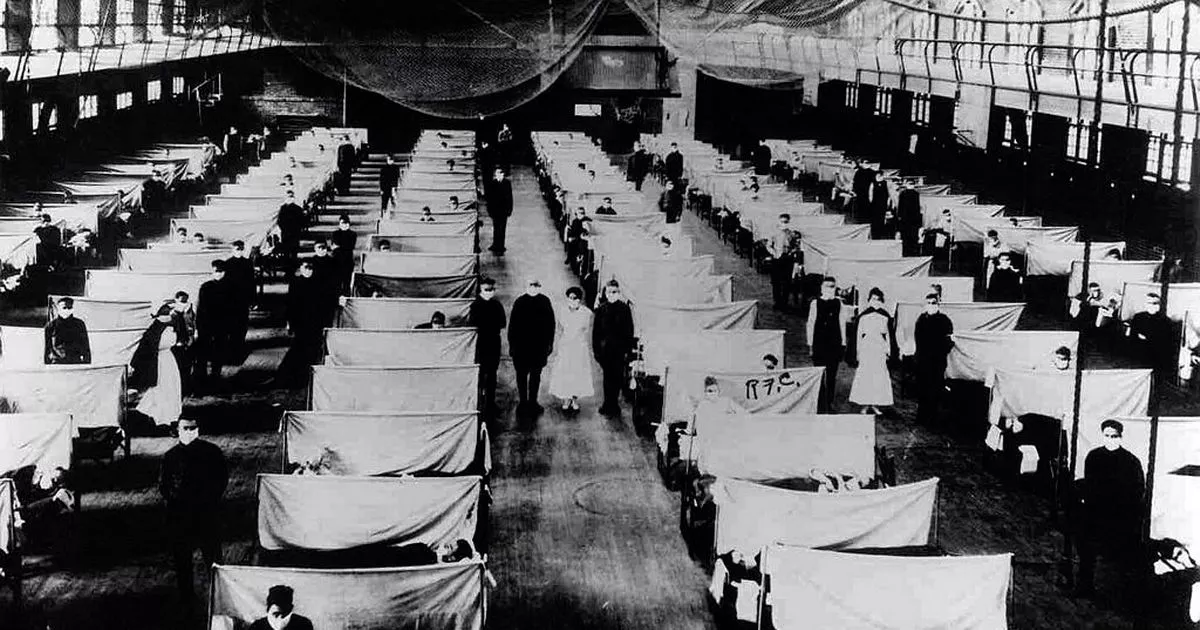

Weird cures for Spanish Flu pandemic 100 years on from deadly outbreak

Asian Stocks Mixed Over Recovery Fears

Source: https://incomestatements.info

Category: Stock Reports