See more : Salazar Resources Limited (SRL.V) Income Statement Analysis – Financial Results

Complete financial analysis of Harbor PanAgora Dynamic Large Cap Core ETF (INFO) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Harbor PanAgora Dynamic Large Cap Core ETF , a leading company in the Asset Management industry within the Financial Services sector.

- Golden Ocean Group Limited (GOGL) Income Statement Analysis – Financial Results

- GreenMobility A/S (GREENM.CO) Income Statement Analysis – Financial Results

- Public Joint Stock Oil Company Bashneft (BANEP.ME) Income Statement Analysis – Financial Results

- AngloGold Ashanti Limited (AGG.AX) Income Statement Analysis – Financial Results

- InterCure Ltd. (INCR) Income Statement Analysis – Financial Results

Harbor PanAgora Dynamic Large Cap Core ETF (INFO)

Industry: Asset Management

Sector: Financial Services

About Harbor PanAgora Dynamic Large Cap Core ETF

INFO aims to generate alpha consistently within the large-cap US market. Portfolio construction utilizes a bottom-up investment strategy integrating fundamental analysis with quantitative techniques and risk management tools. The subadvisor employs a proprietary alpha modeling framework to identify companies with strong financial and operational health, aiming for above-market returns relative to the S&P 500 Index. The strategy incorporates uncorrelated alpha factors, such as value, momentum, and quality. Additionally, ESG attributes are also evaluated to enhance the overall alpha scores. Security weighting is determined using a proprietary optimization technique, balancing alpha generation with risk metrics like tracking err, market risk, and concentration risk.

| Metric | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 4.66B | 4.29B | 4.41B | 4.01B | 3.60B | 2.73B | 2.18B | 2.23B | 1.84B | 1.53B | 1.33B | 1.08B | 967.30M | 844.03M | 688.39M | 550.77M | 476.12M | 394.55M | 345.84M | 338.91M | 431.64M | 482.30M |

| Cost of Revenue | 1.71B | 1.59B | 1.66B | 1.50B | 1.35B | 1.04B | 819.17M | 879.05M | 748.18M | 624.51M | 558.49M | 457.88M | 410.02M | 372.73M | 302.56M | 252.42M | 228.17M | 186.84M | 160.95M | 165.17M | 256.28M | 291.67M |

| Gross Profit | 2.95B | 2.70B | 2.76B | 2.51B | 2.25B | 1.70B | 1.37B | 1.35B | 1.09B | 905.36M | 767.15M | 617.58M | 557.28M | 471.30M | 385.83M | 298.35M | 247.95M | 207.71M | 184.89M | 173.74M | 175.37M | 190.63M |

| Gross Profit Ratio | 63.33% | 62.92% | 62.47% | 62.69% | 62.54% | 62.06% | 62.50% | 60.59% | 59.35% | 59.18% | 57.87% | 57.42% | 57.61% | 55.84% | 56.05% | 54.17% | 52.08% | 52.64% | 53.46% | 51.27% | 40.63% | 39.52% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 1.18B | 1.13B | 1.20B | 1.19B | 1.10B | 907.10M | 799.83M | 834.93M | 692.61M | 558.96M | 498.48M | 358.01M | 332.52M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 1.18B | 1.13B | 1.20B | 1.19B | 1.10B | 907.10M | 799.83M | 834.93M | 692.61M | 558.96M | 498.48M | 358.01M | 332.52M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Other Expenses | 50.20M | 212.90M | 468.60M | 537.30M | 518.10M | 345.60M | 216.66M | 202.05M | 164.75M | 118.13M | 86.96M | 63.81M | 45.69M | 325.70M | 269.39M | 215.06M | 172.39M | 158.01M | 118.60M | -116.63M | 177.78M | 184.22M |

| Operating Expenses | 1.23B | 1.34B | 1.67B | 1.73B | 1.61B | 1.25B | 1.02B | 1.04B | 857.36M | 677.09M | 585.44M | 421.82M | 378.20M | 325.70M | 269.39M | 215.06M | 172.39M | 158.01M | 118.60M | -116.63M | 177.78M | 184.22M |

| Cost & Expenses | 2.94B | 2.93B | 3.41B | 3.37B | 3.07B | 2.47B | 1.84B | 1.92B | 1.61B | 1.30B | 1.14B | 879.70M | 788.22M | 698.43M | 571.94M | 467.48M | 400.56M | 344.86M | 279.55M | 165.17M | 434.06M | 475.89M |

| Interest Income | 300.00K | 1.00M | 1.90M | 3.10M | 2.20M | 1.30M | 933.00K | 988.00K | 1.27M | 999.00K | 862.00K | 655.00K | 1.09M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 220.20M | 236.60M | 259.70M | 225.70M | 154.30M | 119.40M | 70.99M | 55.38M | 44.58M | 20.57M | 11.35M | 2.04M | 2.22M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 586.50M | 591.60M | 573.10M | 541.20M | 492.50M | 335.70M | 235.50M | 202.15M | 158.74M | 118.24M | 88.04M | 59.47M | 49.15M | 39.41M | 25.48M | 15.71M | 11.66M | 9.88M | 8.94M | -10.42M | 30.67M | 28.12M |

| EBITDA | 2.15B | 1.71B | 1.58B | 1.19B | 1.01B | 602.80M | 595.53M | 506.73M | 358.11M | 326.55M | 261.50M | 246.82M | 227.91M | 176.92M | 148.08M | 98.94M | 73.83M | 86.59M | 75.44M | 46.70M | 28.62M | 25.30M |

| EBITDA Ratio | 46.13% | 39.93% | 35.75% | 29.78% | 28.16% | 22.04% | 27.26% | 22.72% | 19.46% | 21.34% | 19.73% | 22.95% | 23.56% | 20.96% | 21.51% | 17.96% | 15.51% | 21.95% | 21.81% | 13.78% | 6.63% | 5.25% |

| Operating Income | 1.56B | 1.15B | 1.00B | 646.90M | 524.20M | 260.40M | 307.84M | 303.59M | 198.20M | 207.29M | 172.47M | 186.74M | 179.82M | 133.51M | 116.60M | 80.19M | 61.85M | 49.69M | 66.29M | 57.12M | -2.42M | 6.41M |

| Operating Income Ratio | 33.54% | 26.83% | 22.73% | 16.14% | 14.56% | 9.52% | 14.09% | 13.61% | 10.77% | 13.55% | 13.01% | 17.36% | 18.59% | 15.82% | 16.94% | 14.56% | 12.99% | 12.59% | 19.17% | 16.85% | -0.56% | 1.33% |

| Total Other Income/Expenses | -220.80M | -267.20M | -260.60M | -222.60M | -152.10M | -118.10M | -70.05M | -54.40M | -43.31M | -19.57M | -10.48M | -1.38M | -1.13M | 680.00K | 6.06M | 5.13M | 2.72M | 27.29M | 255.00K | -10.39M | -9.58M | -12.51M |

| Income Before Tax | 1.34B | 883.30M | 742.90M | 424.30M | 372.10M | 142.30M | 237.79M | 249.20M | 154.89M | 187.71M | 161.98M | 185.36M | 178.69M | 134.19M | 122.67M | 85.31M | 64.57M | 76.98M | 66.54M | 46.73M | -12.00M | -6.10M |

| Income Before Tax Ratio | 28.80% | 20.60% | 16.83% | 10.58% | 10.34% | 5.20% | 10.89% | 11.17% | 8.42% | 12.27% | 12.22% | 17.24% | 18.47% | 15.90% | 17.82% | 15.49% | 13.56% | 19.51% | 19.24% | 13.79% | -2.78% | -1.26% |

| Income Tax Expense | 135.30M | 13.30M | 242.60M | -115.40M | -49.90M | -5.10M | 48.85M | 54.65M | 23.06M | 29.56M | 26.70M | 43.99M | 41.58M | 38.51M | 38.83M | 26.88M | 20.38M | 15.40M | 23.94M | 16.78M | -4.56M | 7.56M |

| Net Income | 1.21B | 870.70M | 502.70M | 542.30M | 416.90M | 152.80M | 240.19M | 194.55M | 131.73M | 158.17M | 135.42M | 141.32M | 134.96M | 98.99M | 83.78M | 56.35M | 41.80M | 61.31M | 42.56M | 29.93M | 2.51M | -10.38M |

| Net Income Ratio | 25.89% | 20.31% | 11.39% | 13.53% | 11.58% | 5.59% | 11.00% | 8.72% | 7.16% | 10.34% | 10.22% | 13.14% | 13.95% | 11.73% | 12.17% | 10.23% | 8.78% | 15.54% | 12.31% | 8.83% | 0.58% | -2.15% |

| EPS | 3.01 | 2.17 | 1.23 | 1.33 | 1.04 | 0.49 | 0.99 | 0.80 | 0.56 | 0.68 | 0.59 | 0.62 | 0.60 | 0.45 | 0.40 | 0.28 | 0.21 | 0.31 | 0.22 | 0.15 | 0.01 | -0.05 |

| EPS Diluted | 3.01 | 2.17 | 1.23 | 1.33 | 1.00 | 0.48 | 0.97 | 0.79 | 0.55 | 0.67 | 0.58 | 0.61 | 0.59 | 0.44 | 0.32 | 0.23 | 0.17 | 0.25 | 0.22 | 0.15 | 0.01 | -0.05 |

| Weighted Avg Shares Out | 401.30M | 401.50M | 409.20M | 406.90M | 400.30M | 309.20M | 243.45M | 242.43M | 236.28M | 234.17M | 230.96M | 227.49M | 224.26M | 220.73M | 211.49M | 201.16M | 195.95M | 195.61M | 195.61M | 195.61M | 178.68M | 194.23M |

| Weighted Avg Shares Out (Dil) | 401.30M | 401.50M | 409.20M | 406.90M | 416.20M | 316.30M | 246.43M | 245.83M | 239.86M | 237.35M | 233.73M | 230.18M | 227.41M | 223.91M | 263.81M | 246.85M | 247.70M | 244.52M | 195.61M | 195.61M | 178.68M | 194.23M |

IHS Markit, Stockperks Partner To Deliver Retail Investor Engagement Solutions

Stockperks and IHS Markit Partner to Deliver Year-Round Retail Investor Engagement Solutions

Stockperks and IHS Markit Partner to Deliver Year-Round Retail Investor Engagement Solutions

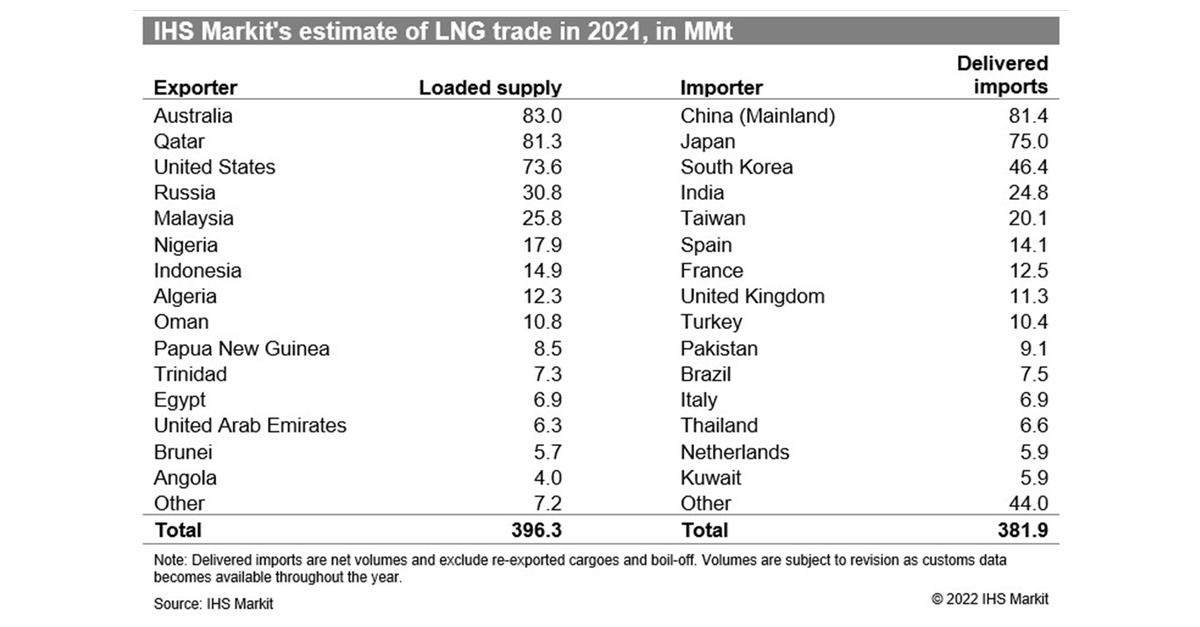

United States Poised to be World’s Largest LNG Exporter in 2022 as China Becomes Top LNG Importer

United States Poised to be World's Largest LNG Exporter in 2022 as China Becomes Top LNG Importer

IHS Markit (INFO) Earnings Expected to Grow: What to Know Ahead of Q4 Release

S&P Global and IHS Markit to sell off two subsidiaries to assuage regulators' concerns ahead of merger

S&P, IHS to offload units ahead of merger to meet antitrust conditions

News Corp to Acquire Base Chemicals

S&P Global and IHS Markit Announce Agreements to Sell Base Chemicals and CUSIP Businesses

Source: https://incomestatements.info

Category: Stock Reports