See more : Oceanteam ASA (OTS.OL) Income Statement Analysis – Financial Results

Complete financial analysis of IRIDEX Corporation (IRIX) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of IRIDEX Corporation, a leading company in the Medical – Devices industry within the Healthcare sector.

- Cornish Metals Inc. (CUSN.V) Income Statement Analysis – Financial Results

- B-RIGHT REALESTATE LIMITED (BRRL.BO) Income Statement Analysis – Financial Results

- Soho Development S.A. (SHD.WA) Income Statement Analysis – Financial Results

- Zardoya Otis, S.A. (ZOT.MC) Income Statement Analysis – Financial Results

- HC Group Inc. (2280.HK) Income Statement Analysis – Financial Results

IRIDEX Corporation (IRIX)

About IRIDEX Corporation

IRIDEX Corporation, an ophthalmic medical technology company, provides therapeutic based laser systems, delivery devices, and consumable instrumentation to treat sight-threatening eye diseases in ophthalmology. It offers laser consoles, such as Cyclo G6 laser system for use in the treatment of glaucoma; IQ 532 and IQ 577 laser photocoagulation systems, which are used for the treatment of diabetic macular edema and other retinal diseases; and OcuLight TX, OcuLight SL, OcuLight SLx, OcuLight GL, and OcuLight GLx laser photocoagulation systems that are used to treat proliferative diabetic retinopathy, macular holes, retinal tears, and detachments. The company also provides delivery devices, including TxCell scanning laser delivery system that allows the physician to perform multi-spot pattern scanning; slit lamp adapter, which allows the physician to utilize a standard slit lamp in diagnosis and treatment procedures; and laser indirect ophthalmoscope for use in procedures to treat peripheral retinal disorders. It offers MicroPulse P3 Probe, which is used with its Cylco G6 laser system to perform MicroPulse transscleral laser therapy; G-Probe, which is used in procedures to treat uncontrolled glaucoma; G-Probe and G-Probe Illuminate, which are used in procedures to treat refractory glaucoma; and EndoProbe family of products for use in vitrectomy procedures. The company serves ophthalmologists, research and teaching hospitals, government installations, surgical centers, hospitals, veterinary practices, and office clinics. It markets its products through direct and independent sales force in the United States, as well as through independent distributors internationally. The company was formerly known as IRIS Medical Instruments, Inc. and changed its name to IRIDEX Corporation in November 1995. IRIDEX Corporation was incorporated in 1989 and is headquartered in Mountain View, California.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 51.87M | 56.97M | 53.90M | 36.35M | 43.45M | 42.60M | 41.59M | 46.16M | 41.76M | 42.81M | 38.27M | 33.86M | 33.16M | 43.69M | 43.21M | 48.53M | 55.53M | 35.90M | 37.03M | 32.81M | 31.70M | 30.63M | 27.28M | 33.44M | 26.76M | 23.60M | 18.10M | 12.40M | 8.80M |

| Cost of Revenue | 30.06M | 31.60M | 31.07M | 20.79M | 25.51M | 25.13M | 26.09M | 25.32M | 21.80M | 21.41M | 19.69M | 17.51M | 16.87M | 22.79M | 22.94M | 28.85M | 31.25M | 17.10M | 18.85M | 17.92M | 17.63M | 17.05M | 14.21M | 13.75M | 10.97M | 9.60M | 7.20M | 4.70M | 2.70M |

| Gross Profit | 21.81M | 25.37M | 22.83M | 15.56M | 17.94M | 17.47M | 15.50M | 20.84M | 19.95M | 21.41M | 18.59M | 16.35M | 16.29M | 20.90M | 20.27M | 19.68M | 24.28M | 18.81M | 18.18M | 14.89M | 14.07M | 13.59M | 13.07M | 19.69M | 15.79M | 14.00M | 10.90M | 7.70M | 6.10M |

| Gross Profit Ratio | 42.04% | 44.53% | 42.36% | 42.80% | 41.29% | 41.01% | 37.27% | 45.15% | 47.78% | 50.00% | 48.56% | 48.28% | 49.13% | 47.84% | 46.92% | 40.55% | 43.73% | 52.38% | 49.08% | 45.38% | 44.39% | 44.36% | 47.92% | 58.89% | 59.01% | 59.32% | 60.22% | 62.10% | 69.32% |

| Research & Development | 6.83M | 7.18M | 6.87M | 3.28M | 3.68M | 4.01M | 5.73M | 5.37M | 5.21M | 4.63M | 3.68M | 4.39M | 3.91M | 3.81M | 3.61M | 4.01M | 5.78M | 5.51M | 4.20M | 4.51M | 4.03M | 4.32M | 4.81M | 5.27M | 3.93M | 3.10M | 1.70M | 1.30M | 0.00 |

| General & Administrative | 8.75M | 7.56M | 8.86M | 6.62M | 8.38M | 9.55M | 8.26M | 7.64M | 5.55M | 6.03M | 5.02M | 4.93M | 4.26M | 4.49M | 4.87M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 16.24M | 18.18M | 14.64M | 12.24M | 14.85M | 16.78M | 14.54M | 10.28M | 8.90M | 8.16M | 7.72M | 7.90M | 7.46M | 9.80M | 9.27M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 24.99M | 25.74M | 23.50M | 18.86M | 23.23M | 26.33M | 22.80M | 17.92M | 14.45M | 14.19M | 12.74M | 12.82M | 11.72M | 14.29M | 14.15M | 17.84M | 27.93M | 18.06M | 12.17M | 11.46M | 10.09M | 9.45M | 10.25M | 10.75M | 9.22M | 8.40M | 6.10M | 5.20M | 4.60M |

| Other Expenses | 0.00 | 60.00K | 2.35M | 280.00K | 209.00K | 92.00K | -107.00K | -91.00K | 3.00K | -1.26M | -371.00K | -210.00K | 0.00 | 0.00 | 0.00 | 5.36M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Operating Expenses | 31.81M | 32.91M | 30.36M | 22.14M | 26.91M | 30.34M | 28.53M | 23.28M | 19.67M | 18.82M | 15.95M | 17.21M | 14.36M | 18.11M | 17.76M | 21.85M | 48.40M | 23.57M | 16.37M | 15.96M | 14.12M | 13.77M | 15.06M | 16.91M | 13.97M | 12.20M | 8.20M | 6.70M | 4.70M |

| Cost & Expenses | 61.88M | 64.51M | 61.44M | 42.93M | 52.42M | 55.47M | 54.62M | 48.60M | 41.47M | 40.23M | 35.64M | 34.72M | 31.23M | 40.90M | 40.69M | 50.70M | 79.65M | 40.67M | 35.22M | 33.89M | 31.75M | 30.82M | 29.26M | 30.65M | 24.94M | 21.80M | 15.40M | 11.40M | 7.40M |

| Interest Income | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 733.00K | 528.00K | 249.00K | 159.00K | 151.00K | 378.00K | 552.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 1.26M | 371.00K | 210.00K | 296.00K | 78.00K | 237.00K | 507.00K | 644.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 2.03M | 1.38M | 803.00K | 504.00K | 688.00K | 809.00K | 858.00K | 648.00K | 522.00K | 420.00K | 490.00K | 427.00K | 410.00K | 515.00K | 899.00K | 3.22M | 3.82M | 542.00K | 435.00K | 384.00K | 703.00K | 869.00K | 859.00K | 893.00K | 817.00K | 700.00K | 400.00K | 200.00K | 100.00K |

| EBITDA | -7.98M | -6.10M | -6.73M | -6.08M | -8.29M | -12.06M | -12.17M | -1.80M | 810.00K | 3.01M | 2.65M | 267.00K | 2.85M | 4.11M | 4.22M | -3.52M | -17.80M | -3.49M | 2.24M | -373.00K | 655.00K | 688.00K | -1.13M | 3.21M | 2.29M | 2.47M | 3.03M | 1.20M | 1.50M |

| EBITDA Ratio | -15.38% | -13.24% | -13.98% | -18.11% | -20.66% | -30.21% | -31.66% | -5.04% | 0.69% | 6.04% | 6.88% | -4.90% | 7.07% | 7.58% | 5.83% | 2.16% | -14.60% | -11.76% | 6.06% | -2.32% | 1.90% | 2.34% | -4.32% | 10.95% | 9.55% | 8.47% | 13.81% | 4.03% | 15.91% |

| Operating Income | -10.01M | -7.54M | -7.53M | -6.58M | -8.97M | -12.87M | -12.89M | -2.57M | 288.00K | 2.59M | 2.63M | -860.00K | 1.93M | 2.80M | 2.52M | -7.54M | -24.12M | -4.77M | 1.81M | -1.08M | -48.00K | -181.00K | -1.99M | 2.79M | 1.83M | 1.80M | 2.70M | 1.00M | 1.40M |

| Operating Income Ratio | -19.29% | -13.24% | -13.98% | -18.11% | -20.66% | -30.21% | -30.99% | -5.56% | 0.69% | 6.04% | 6.88% | -2.54% | 5.83% | 6.40% | 5.83% | -15.53% | -43.43% | -13.27% | 4.89% | -3.28% | -0.15% | -0.59% | -7.29% | 8.34% | 6.82% | 7.63% | 14.92% | 8.06% | 15.91% |

| Total Other Income/Expenses | 527.00K | 60.00K | 2.35M | 280.00K | 209.00K | 92.00K | -107.00K | -91.00K | 3.00K | -1.26M | -371.00K | -110.00K | 504.00K | 722.00K | 563.00K | 293.00K | 1.86M | 733.00K | 528.00K | 319.00K | 212.00K | 122.00K | 426.00K | 569.00K | 556.00K | 500.00K | 600.00K | 700.00K | 100.00K |

| Income Before Tax | -9.48M | -7.48M | -5.19M | -6.30M | -8.77M | -12.78M | -13.00M | -2.66M | 291.00K | 1.33M | 2.26M | -270.00K | 2.44M | 3.52M | 3.08M | -7.24M | -22.26M | -4.03M | 2.34M | -757.00K | 164.00K | -59.00K | -1.56M | 3.36M | 2.38M | 2.30M | 3.30M | 1.70M | 1.50M |

| Income Before Tax Ratio | -18.28% | -13.13% | -9.62% | -17.34% | -20.17% | -29.99% | -31.24% | -5.75% | 0.70% | 3.11% | 5.91% | -0.80% | 7.35% | 8.05% | 7.13% | -14.93% | -40.08% | -11.23% | 6.31% | -2.31% | 0.52% | -0.19% | -5.73% | 10.04% | 8.90% | 9.75% | 18.23% | 13.71% | 17.05% |

| Income Tax Expense | 90.00K | 65.00K | 40.00K | 26.00K | 48.00K | 37.00K | -128.00K | 9.06M | -183.00K | -8.71M | 31.00K | -100.00K | 297.00K | 473.00K | 496.00K | 127.00K | 13.00K | 1.72M | 666.00K | -355.00K | -207.00K | -209.00K | -962.00K | 940.00K | 763.00K | 600.00K | 1.20M | 700.00K | 500.00K |

| Net Income | -9.57M | -7.55M | -5.23M | -6.33M | -8.81M | -12.81M | -12.87M | -11.71M | 474.00K | 10.04M | 2.23M | 1.44M | 2.61M | 3.05M | 2.59M | -7.37M | -22.27M | -5.75M | 1.67M | -402.00K | 371.00K | 150.00K | -1.27M | 2.42M | 1.62M | 1.70M | 2.10M | 1.00M | 1.00M |

| Net Income Ratio | -18.45% | -13.25% | -9.69% | -17.41% | -20.28% | -30.08% | -30.94% | -25.38% | 1.14% | 23.45% | 5.83% | 4.25% | 7.87% | 6.97% | 5.98% | -15.19% | -40.11% | -16.02% | 4.51% | -1.23% | 1.17% | 0.49% | -4.67% | 7.23% | 6.05% | 7.20% | 11.60% | 8.06% | 11.36% |

| EPS | -0.59 | -0.47 | -0.34 | -0.46 | -0.64 | -1.05 | -1.11 | -1.15 | 0.05 | 1.01 | 0.24 | 0.16 | 0.29 | 0.34 | 0.29 | -0.84 | -2.69 | -0.75 | 0.23 | -0.06 | 0.05 | 0.02 | -0.19 | 0.36 | 0.25 | 0.27 | 0.33 | 0.16 | 0.78 |

| EPS Diluted | -0.59 | -0.47 | -0.34 | -0.46 | -0.64 | -1.05 | -1.11 | -1.15 | 0.05 | 0.97 | 0.22 | 0.16 | 0.26 | 0.30 | 0.29 | -0.84 | -2.69 | -0.75 | 0.21 | -0.06 | 0.05 | 0.02 | -0.19 | 0.33 | 0.24 | 0.26 | 0.31 | 0.16 | 0.23 |

| Weighted Avg Shares Out | 16.13M | 15.94M | 15.42M | 13.84M | 13.71M | 12.20M | 11.56M | 10.17M | 9.96M | 9.89M | 9.25M | 8.50M | 8.96M | 8.94M | 8.84M | 8.82M | 8.29M | 7.71M | 7.41M | 7.20M | 7.42M | 6.87M | 6.76M | 6.64M | 6.50M | 6.48M | 6.41M | 6.25M | 4.29M |

| Weighted Avg Shares Out (Dil) | 16.13M | 15.94M | 15.42M | 13.84M | 13.71M | 12.20M | 11.56M | 10.17M | 10.13M | 10.36M | 10.10M | 8.94M | 10.23M | 10.13M | 8.94M | 8.82M | 8.29M | 7.71M | 7.88M | 7.20M | 7.42M | 6.93M | 6.76M | 7.29M | 6.85M | 6.77M | 6.76M | 6.25M | 4.29M |

Worsening eye sight doesn't stop for Covid, neither did we

IRIDEX Co. (NASDAQ:IRIX) Expected to Post Earnings of -$0.23 Per Share

IRIDEX (NASDAQ:IRIX) Upgraded at Zacks Investment Research

IRIDEX (NASDAQ:IRIX) Share Price Crosses Above Two Hundred Day Moving Average of $2.27

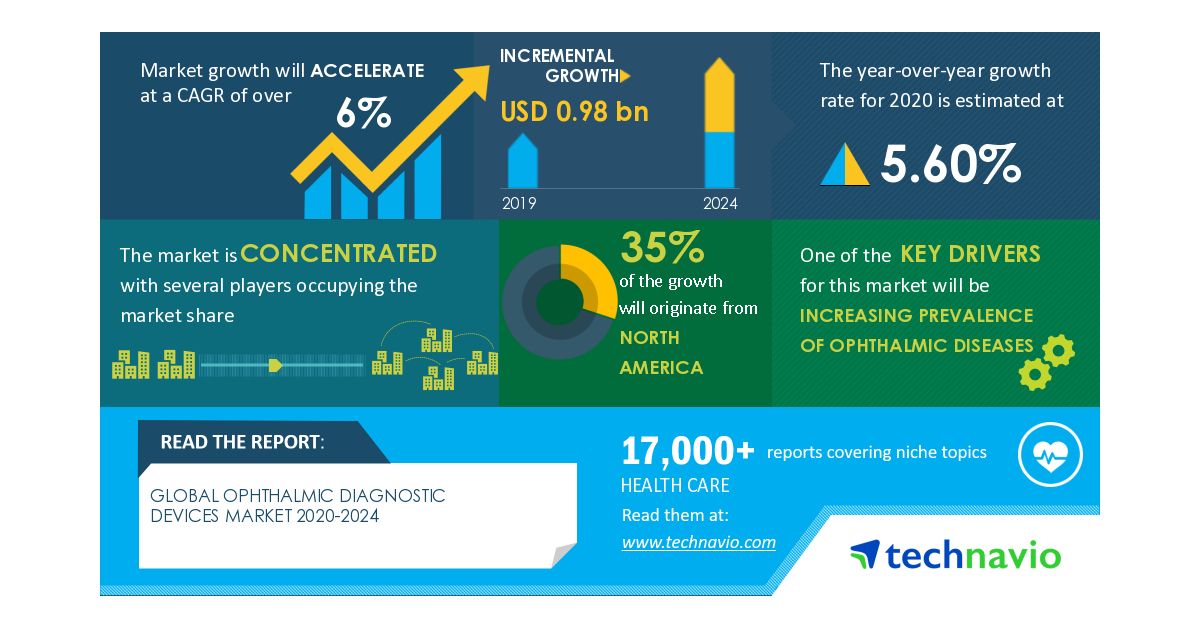

COVID-19 Impact and Recovery Analysis- Ophthalmic Diagnostic Devices Market 2020-2024 | Increasing Prevalence of Ophthalmic Diseases to Boost Growth | Technavio

Cosmetic Surgery Product Market is Envisioned to Behold a CAGR of 5.9% to reach USD 28 Billion During 2015-2021 (Impact Analysis of COVID-19)

Indirect Ophthalmoscope Market 2020 Global Industry Current Trends, Top Companies, Application, Growth Factors, Development and Forecast to 2026 Research Report

Glaucoma Surgery Market 2020 Global Market Size, Analysis, Share, Research, Business Growth and Forecast to 2026 Research Reports World

Source: https://incomestatements.info

Category: Stock Reports