See more : Hoshino Resorts REIT, Inc. (3287.T) Income Statement Analysis – Financial Results

Complete financial analysis of Iteris, Inc. (ITI) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Iteris, Inc., a leading company in the Communication Equipment industry within the Technology sector.

- Taiwan Bio Therapeutics Co., Ltd (6892.TWO) Income Statement Analysis – Financial Results

- Abitare In S.p.A. (ABT.MI) Income Statement Analysis – Financial Results

- Marvel Gold Limited (GRXMF) Income Statement Analysis – Financial Results

- Hawkeye Systems, Inc. (HWKE) Income Statement Analysis – Financial Results

- Highcroft Investments Plc (HCFT.L) Income Statement Analysis – Financial Results

Iteris, Inc. (ITI)

About Iteris, Inc.

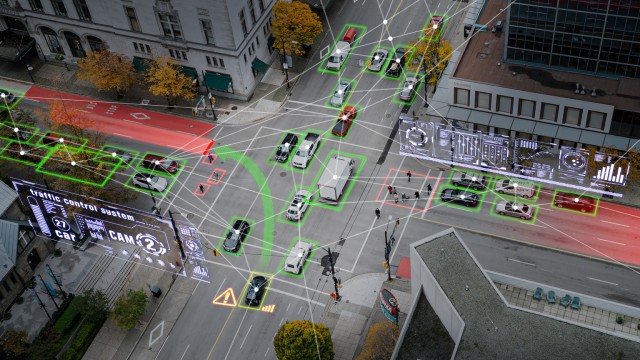

Iteris, Inc. provides intelligent transportation systems technology solutions in North America, Europe, South America, and Asia. The company offers smart mobility infrastructure solutions include traveler information systems, transportation performance measurement software, traffic analytics software, transportation operations software, transportation-related data sets, advanced sensing devices, managed services, traffic engineering services, and mobility consulting services. Its products include ClearGuide, ClearRoute, Commercial Vehicle Operations, BlueArgus, TrafficCarma, Vantage Apex, Vantage Fusion, Vantage Next, VantagePegasus, VantageRadius, Vantage Vector, Velocity, SmartCycle, SmartCycle Bike Indicator, SmartSpan, VersiCam, PedTrax, and P-Series products. The company also sells original equipment manufacturer products for the traffic intersection markets, such as traffic signal controllers and traffic signal equipment cabinets. In addition, it offers traffic management centers design, staffing, and operations services; traffic engineering and mobility consulting services include planning, design, development, and implementation of software and hardware-based ITS systems that integrate sensors, video surveillance, computers, and advanced communications equipment; distributes real-time information about traffic conditions; and surface transportation infrastructure systems implementation, and operation and management. Further, the company provides travel demand forecasting and systems engineering, and identify mitigation measures to reduce traffic congestion; ClearMobility platform; and ClearMobility Cloud that enables mobility data management engine, application programming interface framework, and microservices ecosystem. It serves public transportation agencies, municipalities, commercial entities, government agencies, and other transportation infrastructure providers. The company was founded in 1969 and is headquartered in Austin, Texas.

| Metric | 2024 | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 171.99M | 156.05M | 133.57M | 117.14M | 114.12M | 99.12M | 103.73M | 95.98M | 77.75M | 72.25M | 68.23M | 61.69M | 58.41M | 59.44M | 58.06M | 69.36M | 65.16M | 58.30M | 50.49M | 46.40M | 45.28M | 47.63M | 59.49M | 77.07M | 80.71M | 83.40M | 89.80M | 140.80M | 104.60M | 87.70M | 84.10M | 69.30M | 70.30M | 72.40M | 55.30M | 54.80M | 49.70M | 39.70M | 33.10M |

| Cost of Revenue | 107.40M | 114.03M | 86.18M | 70.28M | 66.36M | 60.52M | 63.90M | 58.58M | 47.08M | 44.07M | 42.25M | 38.43M | 35.34M | 33.50M | 33.90M | 41.44M | 36.87M | 34.29M | 28.86M | 27.04M | 27.47M | 27.46M | 35.38M | 55.06M | 57.13M | 53.60M | 58.80M | 85.40M | 65.10M | 55.30M | 52.80M | 44.80M | 44.80M | 44.60M | 34.40M | 33.90M | 29.50M | 23.70M | 19.80M |

| Gross Profit | 64.59M | 42.02M | 47.39M | 46.86M | 47.76M | 38.61M | 39.83M | 37.40M | 30.67M | 28.18M | 25.97M | 23.26M | 23.07M | 25.94M | 24.16M | 27.92M | 28.30M | 24.01M | 21.63M | 19.35M | 17.81M | 20.17M | 24.11M | 22.01M | 23.58M | 29.80M | 31.00M | 55.40M | 39.50M | 32.40M | 31.30M | 24.50M | 25.50M | 27.80M | 20.90M | 20.90M | 20.20M | 16.00M | 13.30M |

| Gross Profit Ratio | 37.55% | 26.93% | 35.48% | 40.00% | 41.85% | 38.95% | 38.40% | 38.97% | 39.45% | 39.01% | 38.07% | 37.70% | 39.50% | 43.64% | 41.61% | 40.25% | 43.42% | 41.18% | 42.84% | 41.71% | 39.34% | 42.35% | 40.53% | 28.56% | 29.21% | 35.73% | 34.52% | 39.35% | 37.76% | 36.94% | 37.22% | 35.35% | 36.27% | 38.40% | 37.79% | 38.14% | 40.64% | 40.30% | 40.18% |

| Research & Development | 9.96M | 8.32M | 7.35M | 5.13M | 8.60M | 7.82M | 7.95M | 6.88M | 6.93M | 5.40M | 4.03M | 3.07M | 3.18M | 3.76M | 3.68M | 4.03M | 3.57M | 4.03M | 5.09M | 4.19M | 3.92M | 4.22M | 8.12M | 18.81M | 16.89M | 11.20M | 11.40M | 13.40M | 7.00M | 9.30M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 23.87M | 22.08M | 25.13M | 24.21M | 24.05M | 38.47M | 37.40M | 33.31M | 26.85M | 24.43M | 19.27M | 18.09M | 17.99M | 18.65M | 17.00M | 18.04M | 17.29M | 16.09M | 15.77M | 25.26M | 12.84M | 16.16M | 24.57M | 41.78M | 38.17M | 31.70M | 26.00M | 30.30M | 23.70M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 25.33M | 22.80M | 18.93M | 14.96M | 16.62M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 49.20M | 44.89M | 44.06M | 39.16M | 44.38M | 38.47M | 37.40M | 33.31M | 26.85M | 24.43M | 19.27M | 18.09M | 17.99M | 18.65M | 17.00M | 18.04M | 17.29M | 16.09M | 15.77M | 25.26M | 12.84M | 16.16M | 24.57M | 41.78M | 38.17M | 31.70M | 26.00M | 30.30M | 23.70M | 20.90M | 24.40M | 19.40M | 20.20M | 20.80M | 15.10M | 16.20M | 15.60M | 12.50M | 10.20M |

| Other Expenses | 2.60M | 2.62M | 2.67M | 1.50M | 757.00K | 50.00K | -16.00K | -7.00K | 2.00K | -20.00K | 627.00K | 2.00K | -115.00K | 277.00K | 159.00K | 147.00K | 147.00K | 56.00K | 147.00K | 536.00K | 11.83M | 0.00 | 2.19M | 11.25M | 7.19M | 5.20M | 2.90M | 3.60M | 2.70M | 2.40M | 2.60M | 2.80M | 2.80M | 3.10M | 2.30M | 1.80M | 1.60M | 1.50M | 1.20M |

| Operating Expenses | 61.77M | 55.83M | 54.09M | 45.80M | 53.74M | 46.57M | 45.43M | 40.47M | 34.14M | 30.25M | 23.93M | 21.81M | 21.05M | 22.69M | 20.84M | 22.21M | 21.00M | 20.18M | 21.01M | 29.99M | 16.77M | 20.37M | 34.87M | 71.84M | 62.25M | 48.10M | 40.30M | 47.30M | 33.40M | 32.60M | 27.00M | 22.20M | 23.00M | 23.90M | 17.40M | 18.00M | 17.20M | 14.00M | 11.40M |

| Cost & Expenses | 169.17M | 169.86M | 140.27M | 116.08M | 120.09M | 107.08M | 109.33M | 99.05M | 81.22M | 74.32M | 66.18M | 60.23M | 56.39M | 56.20M | 54.75M | 63.65M | 57.87M | 54.47M | 49.87M | 57.03M | 44.24M | 47.83M | 70.25M | 126.90M | 119.38M | 101.70M | 99.10M | 132.70M | 98.50M | 87.90M | 79.80M | 67.00M | 67.80M | 68.50M | 51.80M | 51.90M | 46.70M | 37.70M | 31.20M |

| Interest Income | 0.00 | 329.00K | 14.00K | 113.00K | 229.00K | 129.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 5.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 0.00 | 1.62M | 14.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 6.00K | 72.00K | 152.00K | 264.00K | 651.00K | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 3.84M | 5.91M | 6.58M | 4.21M | 3.22M | 1.98M | 1.55M | 1.35M | 1.18M | 431.00K | 627.00K | 644.00K | 1.41M | 1.25M | 159.00K | 1.17M | 1.07M | 766.00K | 892.00K | 597.00K | 2.00K | -603.00K | 5.01M | 4.97M | 7.19M | 5.20M | 2.90M | 3.60M | 2.70M | 2.40M | 2.60M | 2.80M | 2.80M | 3.10M | 2.30M | 1.80M | 1.60M | 1.50M | 1.20M |

| EBITDA | 6.66M | -10.01M | -2.63M | 4.81M | -99.00K | -1.55M | -4.06M | -1.72M | -2.30M | -1.63M | 3.55M | 3.00M | 3.43M | -3.47M | 4.51M | 6.99M | 8.45M | 3.83M | 1.49M | -10.04M | 180.00K | -1.09M | 2.23M | -10.97M | -31.48M | -13.10M | -6.40M | 3.00M | 8.80M | 2.20M | 6.90M | 5.10M | 5.30M | 7.00M | 5.80M | 4.70M | 4.60M | 3.50M | 3.10M |

| EBITDA Ratio | 3.87% | -6.72% | -3.01% | 2.72% | -4.57% | -7.75% | -5.32% | -0.65% | -4.00% | -2.26% | 3.96% | 3.11% | 5.87% | 7.57% | 5.99% | 9.92% | 12.46% | 8.84% | 2.92% | -22.69% | 0.10% | -1.24% | -10.81% | -74.78% | -86.63% | -15.71% | -5.23% | 8.31% | 8.41% | 7.98% | 8.20% | 7.36% | 7.54% | 9.67% | 10.49% | 8.58% | 9.26% | 8.82% | 9.37% |

| Operating Income | 2.82M | -13.81M | -6.69M | 1.68M | -5.98M | -7.96M | -5.60M | -5.24M | -3.47M | -2.08M | 2.02M | 1.63M | 2.02M | -4.72M | 3.32M | 5.71M | 7.30M | 3.83M | 619.00K | -10.77M | 1.05M | -203.00K | -10.76M | -49.83M | -38.67M | -18.30M | -9.30M | 8.10M | 6.10M | -200.00K | 4.30M | 2.30M | 2.50M | 3.90M | 3.50M | 2.90M | 3.00M | 2.00M | 1.90M |

| Operating Income Ratio | 1.64% | -8.85% | -5.01% | 1.43% | -5.24% | -8.03% | -5.40% | -5.46% | -4.46% | -2.88% | 2.97% | 2.65% | 3.45% | -7.94% | 5.71% | 8.23% | 11.20% | 6.57% | 1.23% | -23.22% | 2.31% | -0.43% | -18.09% | -64.66% | -47.91% | -21.94% | -10.36% | 5.75% | 5.83% | -0.23% | 5.11% | 3.32% | 3.56% | 5.39% | 6.33% | 5.29% | 6.04% | 5.04% | 5.74% |

| Total Other Income/Expenses | 644.00K | -205.00K | -32.00K | 167.00K | 526.00K | -4.85M | 16.00K | 6.00K | 14.00K | -14.00K | 0.00 | -4.00K | -68.00K | -154.00K | -220.00K | -530.00K | -1.03M | -2.25M | -1.42M | -124.00K | 880.00K | 518.00K | -1.27M | 17.40M | 38.44M | 0.00 | -2.30M | -300.00K | -2.10M | -6.80M | -1.80M | -2.10M | 0.00 | -2.40M | -2.20M | -1.80M | -1.50M | -1.80M | -1.90M |

| Income Before Tax | 3.46M | -14.72M | -6.73M | 606.00K | -5.45M | -7.78M | -5.59M | -5.23M | -3.46M | -2.09M | 2.02M | 1.63M | 1.95M | -4.86M | 3.10M | 5.18M | 6.26M | 1.58M | -805.00K | -10.90M | 1.93M | -576.00K | -12.09M | -37.06M | -231.00K | 0.00 | -11.60M | 6.10M | 4.00M | -7.00M | 2.50M | 200.00K | 0.00 | 1.50M | 1.30M | 1.10M | 1.50M | 200.00K | 0.00 |

| Income Before Tax Ratio | 2.01% | -9.43% | -5.04% | 0.52% | -4.78% | -7.85% | -5.39% | -5.45% | -4.45% | -2.90% | 2.97% | 2.64% | 3.34% | -8.17% | 5.34% | 7.46% | 9.61% | 2.70% | -1.59% | -23.48% | 4.25% | -1.21% | -20.32% | -48.09% | -0.29% | 0.00% | -12.92% | 4.33% | 3.82% | -7.98% | 2.97% | 0.29% | 0.00% | 2.07% | 2.35% | 2.01% | 3.02% | 0.50% | 0.00% |

| Income Tax Expense | 332.00K | 135.00K | 174.00K | 115.00K | 160.00K | 36.00K | -1.82M | -44.00K | 9.08M | -816.00K | 704.00K | 716.00K | 643.00K | 353.00K | 895.00K | -5.30M | -5.90M | -1.34M | -885.00K | -94.00K | 100.00K | 12.57M | -785.00K | -17.29M | -36.39M | 1.80M | -2.90M | 2.40M | 1.50M | -2.30M | 700.00K | 100.00K | 2.40M | 500.00K | 100.00K | 400.00K | 600.00K | 100.00K | 0.00 |

| Net Income | 3.13M | -14.86M | -6.90M | 491.00K | -5.61M | -7.82M | -3.53M | -4.83M | -12.32M | -1.07M | 1.41M | 2.38M | 2.51M | -5.21M | 2.20M | 10.47M | 12.16M | 2.92M | 80.00K | -11.33M | 7.00K | -13.15M | -26.59M | -32.54M | -2.28M | -20.10M | -6.60M | 3.70M | 2.50M | -4.70M | 1.80M | 100.00K | 100.00K | 1.00M | 1.20M | 700.00K | 900.00K | 100.00K | 0.00 |

| Net Income Ratio | 1.82% | -9.52% | -5.17% | 0.42% | -4.92% | -7.89% | -3.40% | -5.03% | -15.85% | -1.48% | 2.07% | 3.86% | 4.30% | -8.76% | 3.79% | 15.10% | 18.67% | 5.01% | 0.16% | -24.42% | 0.02% | -27.61% | -44.69% | -42.22% | -2.82% | -24.10% | -7.35% | 2.63% | 2.39% | -5.36% | 2.14% | 0.14% | 0.14% | 1.38% | 2.17% | 1.28% | 1.81% | 0.25% | 0.00% |

| EPS | 0.07 | -0.35 | -0.16 | 0.01 | -0.14 | -0.23 | -0.11 | -0.15 | -0.38 | -0.03 | 0.04 | 0.07 | 0.07 | -0.15 | 0.06 | 0.31 | 0.37 | 0.10 | 0.00 | -0.45 | 0.00 | -0.92 | -2.36 | -3.26 | -0.25 | -2.57 | -0.95 | 0.59 | 0.40 | -0.80 | 0.31 | 0.03 | 0.02 | 0.24 | 0.28 | 0.16 | 0.29 | 0.02 | 0.00 |

| EPS Diluted | 0.07 | -0.35 | -0.16 | 0.01 | -0.14 | -0.23 | -0.11 | -0.15 | -0.38 | -0.03 | 0.04 | 0.07 | 0.07 | -0.15 | 0.06 | 0.30 | 0.35 | 0.09 | 0.00 | -0.45 | 0.00 | -0.92 | -2.36 | -3.19 | -0.24 | -2.57 | -0.95 | 0.59 | 0.40 | -0.80 | 0.31 | 0.03 | 0.02 | 0.24 | 0.28 | 0.16 | 0.29 | 0.02 | 0.00 |

| Weighted Avg Shares Out | 42.87M | 42.37M | 42.22M | 41.18M | 39.01M | 33.27M | 31.40M | 32.17M | 32.05M | 31.93M | 32.67M | 33.49M | 34.26M | 34.34M | 34.25M | 33.96M | 32.72M | 29.70M | 28.18M | 25.28M | 19.45M | 14.28M | 11.27M | 9.98M | 9.09M | 7.82M | 6.95M | 6.27M | 6.18M | 5.87M | 5.78M | 3.33M | 5.00M | 4.17M | 4.29M | 4.38M | 3.08M | 5.26M | 3.08M |

| Weighted Avg Shares Out (Dil) | 43.90M | 42.37M | 42.22M | 41.60M | 39.01M | 33.27M | 32.78M | 32.17M | 32.05M | 32.60M | 32.85M | 33.61M | 34.38M | 34.34M | 34.44M | 34.64M | 34.71M | 33.35M | 32.74M | 25.28M | 19.45M | 14.28M | 11.27M | 10.21M | 9.44M | 7.82M | 6.95M | 6.27M | 6.18M | 5.87M | 5.78M | 3.33M | 5.00M | 4.17M | 4.29M | 4.38M | 3.08M | 5.26M | 3.08M |

Iteris Appoints Gary Hall and Kimberly Valentine-Poska to its Board of Directors

Iteris: Average Financial Performance And Unattractive Valuation

Iteris to Join the Russell 2000® Index

Iteris, Inc. (ITI) Q4 2023 Earnings Call Transcript

Iteris (ITI) Reports Q4 Loss, Tops Revenue Estimates

Iteris Reports Record Fiscal 2023 Fourth Quarter Revenue Up 24% Year Over Year and Record Full Year Revenue Up 17% Year Over Year

Iteris Announces Date Change for 2023 Fiscal Fourth Quarter and Full Year Conference Call

Iteris Sets Fiscal Fourth Quarter and Full Year 2023 Conference Call for Thursday, June 1, 2023 at 4:30 p.m. ET

Iteris to Attend B. Riley Securities 23rd Annual Institutional Investor Conference on May 24, 2023

Iteris to Attend B. Riley Securities 23rd Annual Institutional Investor Conference on May 24, 2023

Source: https://incomestatements.info

Category: Stock Reports