See more : Enauta Participações S.A. (ENAT3.SA) Income Statement Analysis – Financial Results

Complete financial analysis of Illinois Tool Works Inc. (ITW) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Illinois Tool Works Inc., a leading company in the Industrial – Machinery industry within the Industrials sector.

- SINOMACH HEAVY EQUIPMENT GROUP CO.,LTD (601399.SS) Income Statement Analysis – Financial Results

- HMS Bergbau AG (HMU.DE) Income Statement Analysis – Financial Results

- McCormick & Company, Incorporated (MKC) Income Statement Analysis – Financial Results

- Xebec Adsorption Inc. (XEBEQ) Income Statement Analysis – Financial Results

- KleanNara Co., Ltd. (004540.KS) Income Statement Analysis – Financial Results

Illinois Tool Works Inc. (ITW)

About Illinois Tool Works Inc.

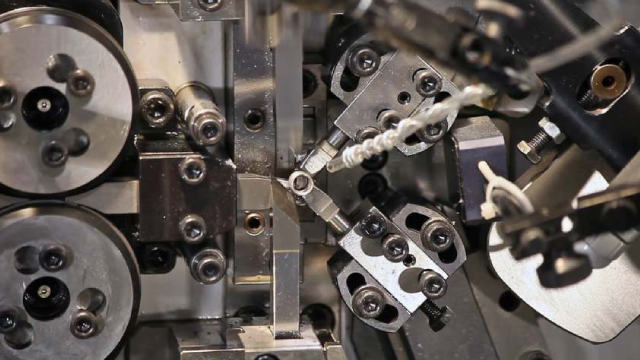

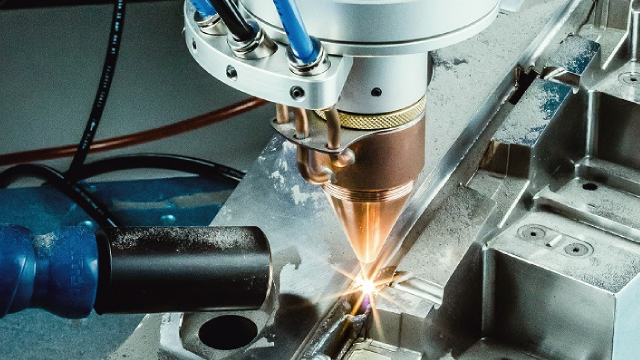

Illinois Tool Works Inc. manufactures and sells industrial products and equipment worldwide. It operates through seven segments: Automotive OEM; Food Equipment; Test & Measurement and Electronics; Welding; Polymers & Fluids; Construction Products; and Specialty Products. The Automotive OEM segment offers plastic and metal components, fasteners, and assemblies for automobiles, light trucks, and other industrial uses. The Food Equipment segment provides warewashing, refrigeration, cooking, and food processing equipment; kitchen exhaust, ventilation, and pollution control systems; and food equipment maintenance and repair services. The Test & Measurement and Electronics segment produces and sells equipment, consumables, and related software for testing and measuring of materials and structures, as well as equipment and consumables used in the production of electronic subassemblies and microelectronics. The Welding segment produces arc welding equipment; and metal arc welding consumables and related accessories. The Polymers & Fluids segment produces adhesives, sealants, lubrication and cutting fluids, and fluids and polymers for auto aftermarket maintenance and appearance. The Construction Products segment offers engineered fastening systems and solutions for the residential construction, renovation/remodel, and commercial construction markets. The Specialty Products segment offers beverage packaging equipment and consumables, product coding and marking equipment and consumables, and appliance components and fasteners. It serves the automotive OEM/tiers, commercial food equipment, construction, general industrial, and automotive aftermarket end markets. The company distributes its products directly to industrial manufacturers, as well as through independent distributors. Illinois Tool Works Inc. was founded in 1912 and is based in Glenview, Illinois.

| Metric | 2023 | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 16.11B | 15.93B | 14.46B | 12.57B | 14.11B | 14.77B | 14.31B | 13.60B | 13.41B | 14.48B | 14.14B | 17.92B | 17.79B | 15.87B | 13.88B | 15.87B | 16.17B | 14.06B | 12.92B | 11.73B | 10.04B | 9.47B | 9.29B | 9.98B | 9.33B | 5.65B | 5.22B | 5.00B | 4.15B | 3.46B | 3.16B | 2.81B | 2.64B | 2.54B | 2.17B | 1.93B | 1.70B | 961.10M | 596.10M |

| Cost of Revenue | 9.32B | 9.43B | 8.49B | 7.38B | 8.19B | 8.60B | 8.31B | 7.90B | 7.89B | 8.67B | 8.55B | 11.46B | 11.52B | 10.24B | 9.14B | 10.27B | 10.46B | 9.08B | 8.36B | 7.59B | 6.53B | 6.21B | 6.19B | 6.19B | 5.77B | 3.47B | 3.24B | 3.14B | 2.60B | 2.19B | 1.99B | 1.74B | 1.65B | 1.59B | 1.37B | 1.21B | 1.06B | 586.10M | 363.50M |

| Gross Profit | 6.79B | 6.50B | 5.97B | 5.20B | 5.92B | 6.16B | 6.01B | 5.70B | 5.52B | 5.81B | 5.58B | 6.47B | 6.27B | 5.63B | 4.73B | 5.60B | 5.72B | 4.98B | 4.56B | 4.14B | 3.51B | 3.25B | 3.10B | 3.79B | 3.56B | 2.18B | 1.98B | 1.85B | 1.56B | 1.27B | 1.17B | 1.07B | 991.20M | 957.10M | 805.70M | 716.90M | 636.60M | 375.00M | 232.60M |

| Gross Profit Ratio | 42.16% | 40.82% | 41.27% | 41.35% | 41.97% | 41.74% | 41.95% | 41.94% | 41.16% | 40.12% | 39.48% | 36.09% | 35.24% | 35.47% | 34.10% | 35.27% | 35.34% | 35.42% | 35.27% | 35.29% | 34.95% | 34.37% | 33.38% | 37.96% | 38.14% | 38.63% | 37.98% | 37.11% | 37.45% | 36.81% | 36.99% | 38.22% | 37.55% | 37.62% | 37.08% | 37.15% | 37.48% | 39.02% | 39.02% |

| Research & Development | 284.00M | 2.58B | 2.36B | 2.16B | 2.36B | 2.39B | 2.40B | 2.42B | 2.42B | 2.68B | 2.82B | 3.33B | 3.28B | 3.06B | 3.04B | 210.72M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 2.40B | 2.42B | 2.42B | 2.68B | 2.82B | 0.00 | 0.00 | 0.00 | 3.04B | 2.77B | 2.93B | 2.43B | 2.21B | 2.02B | 1.85B | 1.72B | 1.69B | 1.81B | 1.73B | 890.60M | 870.30M | 875.40M | 776.60M | 650.10M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 88.66M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 2.35B | 2.58B | 2.36B | 2.16B | 2.36B | 2.39B | 2.40B | 2.42B | 2.42B | 2.68B | 2.82B | 3.33B | 3.28B | 3.06B | 3.04B | 2.86B | 2.93B | 2.43B | 2.21B | 2.02B | 1.85B | 1.72B | 1.69B | 1.81B | 1.73B | 890.60M | 870.30M | 875.40M | 776.60M | 650.10M | 658.40M | 586.80M | 552.90M | 510.30M | 417.90M | 369.10M | 339.10M | 223.80M | 123.30M |

| Other Expenses | 113.00M | -2.45B | 133.00M | 154.00M | 159.00M | 67.00M | 36.00M | 81.00M | 78.00M | 61.00M | 72.00M | 37.00M | 255.34M | 212.88M | 203.23M | 185.45M | 161.04M | 141.34M | 83.84M | 59.12M | 24.28M | 27.93M | 104.59M | 413.37M | 343.30M | 211.80M | 185.40M | 178.20M | 151.90M | 132.10M | 131.70M | 125.30M | 115.40M | 102.10M | 84.70M | 75.10M | 57.80M | 37.20M | 27.30M |

| Operating Expenses | 2.75B | 2.71B | 2.49B | 2.32B | 2.52B | 2.58B | 2.61B | 2.64B | 2.65B | 2.92B | 3.07B | 3.62B | 3.54B | 3.27B | 3.24B | 3.26B | 3.09B | 2.57B | 2.30B | 2.08B | 1.87B | 1.75B | 1.80B | 2.23B | 2.07B | 1.10B | 1.06B | 1.05B | 928.50M | 782.20M | 790.10M | 712.10M | 668.30M | 612.40M | 502.60M | 444.20M | 396.90M | 261.00M | 150.60M |

| Cost & Expenses | 12.07B | 12.14B | 10.98B | 9.69B | 10.71B | 11.18B | 10.92B | 10.54B | 10.54B | 11.59B | 11.62B | 15.08B | 15.06B | 13.51B | 12.39B | 13.53B | 13.55B | 11.65B | 10.66B | 9.67B | 8.40B | 7.96B | 7.99B | 8.42B | 7.85B | 4.57B | 4.29B | 4.20B | 3.53B | 2.97B | 2.78B | 2.45B | 2.32B | 2.20B | 1.87B | 1.66B | 1.46B | 847.10M | 514.10M |

| Interest Income | 51.00M | 22.00M | 12.00M | 17.00M | 29.00M | 35.00M | 45.00M | 38.00M | 52.00M | 65.00M | 50.00M | 40.00M | 40.28M | 24.00M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 266.00M | 203.00M | 202.00M | 206.00M | 221.00M | 257.00M | 260.00M | 237.00M | 226.00M | 250.00M | 239.00M | 214.00M | 192.13M | 175.46M | 164.84M | 154.46M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | 395.00M | 410.00M | 410.00M | 427.00M | 426.00M | 461.00M | 462.00M | 470.00M | 231.00M | 242.00M | 250.00M | 288.00M | 255.34M | 212.88M | 674.93M | 691.91M | 524.74M | 443.91M | 383.07M | 385.80M | 306.55M | 305.75M | 386.31M | 413.37M | 343.30M | 211.80M | 185.40M | 178.20M | 151.90M | 132.10M | 131.70M | 125.30M | 115.40M | 102.10M | 84.70M | 75.10M | 57.80M | 37.20M | 27.30M |

| EBITDA | 4.48B | 4.24B | 3.91B | 3.32B | 3.85B | 4.07B | 3.86B | 3.53B | 3.42B | 3.45B | 3.11B | 4.43B | 3.37B | 2.57B | 1.95B | 3.05B | 2.97B | 2.96B | 2.63B | 2.31B | 1.94B | 1.81B | 1.69B | 1.98B | 1.83B | 1.61B | 1.36B | 978.80M | 797.90M | 623.90M | 510.20M | 487.70M | 438.30M | 446.80M | 387.80M | 347.80M | 297.50M | 151.20M | 109.30M |

| EBITDA Ratio | 27.84% | 26.23% | 25.33% | 24.37% | 26.00% | 26.00% | 25.44% | 24.77% | 23.71% | 22.05% | 20.08% | 17.71% | 16.79% | 16.20% | 15.61% | 19.24% | 19.24% | 19.70% | 20.38% | 20.72% | 19.46% | 19.17% | 18.29% | 19.93% | 20.31% | 22.96% | 20.99% | 19.64% | 18.05% | 18.45% | 16.39% | 17.69% | 16.26% | 17.78% | 17.99% | 18.74% | 17.88% | 12.18% | 20.37% |

| Operating Income | 4.04B | 3.79B | 3.48B | 2.88B | 3.40B | 3.58B | 3.49B | 3.06B | 2.87B | 2.89B | 2.51B | 2.85B | 2.73B | 2.36B | 1.39B | 2.34B | 2.62B | 2.42B | 2.26B | 2.06B | 1.63B | 1.51B | 1.31B | 1.56B | 1.49B | 1.08B | 927.10M | 800.60M | 626.50M | 491.80M | 378.50M | 362.40M | 322.90M | 344.70M | 303.10M | 272.70M | 239.70M | 114.00M | 82.00M |

| Operating Income Ratio | 25.08% | 23.79% | 24.05% | 22.92% | 24.11% | 24.27% | 24.41% | 22.53% | 21.39% | 19.94% | 17.79% | 15.88% | 15.35% | 14.85% | 9.99% | 14.73% | 16.23% | 17.22% | 17.48% | 17.53% | 16.28% | 15.90% | 14.06% | 15.66% | 15.93% | 19.11% | 17.76% | 16.02% | 15.09% | 14.21% | 11.98% | 12.89% | 12.23% | 13.55% | 13.95% | 14.13% | 14.11% | 11.86% | 13.76% |

| Total Other Income/Expenses | -217.00M | 52.00M | -151.00M | -178.00M | -114.00M | -190.00M | -215.00M | -156.00M | -148.00M | -189.00M | -167.00M | 756.00M | -138.29M | -42.01M | -172.19M | -149.75M | 132.09M | 6.53M | -92.33M | -78.92M | -57.34M | -72.21M | -75.25M | -85.26M | -133.80M | -28.30M | -4.80M | -30.30M | -2.80M | -41.50M | -42.60M | -52.60M | -35.10M | -44.80M | -34.10M | -39.90M | -39.60M | 34.10M | -12.10M |

| Income Before Tax | 3.82B | 3.84B | 3.33B | 2.70B | 3.29B | 3.39B | 3.27B | 2.91B | 2.72B | 2.70B | 2.35B | 3.60B | 2.59B | 2.21B | 1.21B | 2.19B | 2.58B | 2.45B | 2.18B | 2.00B | 1.58B | 1.43B | 1.23B | 1.48B | 1.35B | 1.06B | 924.40M | 770.30M | 623.70M | 450.30M | 335.90M | 309.80M | 287.80M | 299.90M | 269.00M | 232.80M | 200.10M | 148.10M | 69.90M |

| Income Before Tax Ratio | 23.74% | 24.11% | 23.01% | 21.50% | 23.30% | 22.98% | 22.84% | 21.38% | 20.28% | 18.63% | 16.60% | 20.10% | 14.58% | 13.94% | 8.75% | 13.81% | 15.96% | 17.40% | 16.88% | 17.04% | 15.71% | 15.14% | 13.25% | 14.81% | 14.49% | 18.76% | 17.71% | 15.42% | 15.02% | 13.01% | 10.63% | 11.02% | 10.90% | 11.79% | 12.38% | 12.06% | 11.78% | 15.41% | 11.73% |

| Income Tax Expense | 866.00M | 808.00M | 632.00M | 595.00M | 767.00M | 831.00M | 1.58B | 873.00M | 820.00M | 809.00M | 717.00M | 1.11B | 575.70M | 684.80M | 244.30M | 608.10M | 754.90M | 727.50M | 686.70M | 659.80M | 535.90M | 501.75M | 428.40M | 520.20M | 511.60M | 386.80M | 337.40M | 284.00M | 236.10M | 172.50M | 129.30M | 117.70M | 107.20M | 117.50M | 105.20M | 92.80M | 93.90M | 68.50M | 38.40M |

| Net Income | 2.96B | 3.03B | 2.69B | 2.11B | 2.52B | 2.56B | 1.69B | 2.04B | 1.90B | 2.95B | 1.68B | 2.87B | 2.07B | 1.53B | 947.01M | 1.52B | 1.87B | 1.72B | 1.49B | 1.34B | 1.02B | 712.59M | 805.66M | 957.98M | 841.10M | 672.80M | 587.00M | 486.30M | 387.60M | 277.80M | 206.60M | 192.10M | 180.60M | 182.40M | 163.80M | 140.00M | 106.20M | 79.60M | 31.50M |

| Net Income Ratio | 18.36% | 19.04% | 18.64% | 16.77% | 17.87% | 17.36% | 11.79% | 14.96% | 14.17% | 20.34% | 11.88% | 16.01% | 11.65% | 9.62% | 6.82% | 9.57% | 11.56% | 12.22% | 11.57% | 11.41% | 10.20% | 7.53% | 8.67% | 9.60% | 9.01% | 11.91% | 11.24% | 9.73% | 9.33% | 8.03% | 6.54% | 6.83% | 6.84% | 7.17% | 7.54% | 7.25% | 6.25% | 8.28% | 5.28% |

| EPS | 9.77 | 9.80 | 8.55 | 6.66 | 7.78 | 7.65 | 4.90 | 5.73 | 5.16 | 7.33 | 3.76 | 6.11 | 4.21 | 3.00 | 1.89 | 2.93 | 3.39 | 3.04 | 1.31 | 1.11 | 1.67 | 1.17 | 1.33 | 1.59 | 1.40 | 1.62 | 0.58 | 0.25 | 0.21 | 0.61 | 0.11 | 0.05 | 0.05 | 0.05 | 0.05 | 0.04 | 0.03 | 0.01 | 0.01 |

| EPS Diluted | 9.74 | 9.77 | 8.51 | 6.63 | 7.74 | 7.60 | 4.86 | 5.70 | 5.13 | 7.28 | 3.74 | 6.06 | 4.19 | 2.99 | 1.89 | 2.91 | 3.36 | 3.01 | 1.30 | 1.10 | 1.66 | 1.16 | 1.32 | 1.58 | 1.38 | 1.33 | 0.57 | 0.24 | 0.20 | 0.61 | 0.11 | 0.05 | 0.05 | 0.05 | 0.05 | 0.04 | 0.03 | 0.01 | 0.01 |

| Weighted Avg Shares Out | 302.60M | 309.60M | 315.10M | 316.90M | 323.90M | 335.00M | 344.10M | 355.00M | 367.90M | 401.70M | 446.20M | 469.80M | 491.40M | 500.80M | 500.18M | 518.61M | 551.55M | 565.05M | 574.67M | 610.44M | 614.82M | 611.67M | 608.04M | 602.50M | 600.79M | 500.26M | 499.20M | 496.08M | 473.48M | 453.55M | 453.17M | 448.62M | 445.74M | 438.44M | 429.33M | 422.78M | 414.58M | 410.03M | 403.26M |

| Weighted Avg Shares Out (Dil) | 303.60M | 310.70M | 316.40M | 318.30M | 325.60M | 337.10M | 346.80M | 357.10M | 370.10M | 404.60M | 449.30M | 473.20M | 494.60M | 503.30M | 501.92M | 518.61M | 556.03M | 570.68M | 579.02M | 615.31M | 616.67M | 616.96M | 612.67M | 608.24M | 609.49M | 608.80M | 499.20M | 496.08M | 473.48M | 453.55M | 453.17M | 448.62M | 445.74M | 438.44M | 429.33M | 422.78M | 414.58M | 410.03M | 403.26M |

Dividend Income: Lanny's July 2024 Summary

ITW Board of Directors Approves Dividend Rate Increase

Illinois Tool (ITW) Q2 Earnings Beat Estimates, Revenues Miss

Illinois Tool Works Inc. (ITW) Q2 2024 Earnings Call Transcript

Illinois Tool Works (ITW) Reports Q2 Earnings: What Key Metrics Have to Say

Illinois Tool Works (ITW) Tops Q2 Earnings Estimates

ITW Reports Second Quarter 2024 Results

6 Dividend Increases Expected In August 2024

Curious about Illinois Tool Works (ITW) Q2 Performance? Explore Wall Street Estimates for Key Metrics

Illinois Tool (ITW) to Report Q2 Earnings: What to Expect

Source: https://incomestatements.info

Category: Stock Reports