See more : Palmer Square Capital BDC Inc. (PSBD) Income Statement Analysis – Financial Results

Complete financial analysis of Invacare Corporation (IVC) income statement, including revenue, profit margins, EPS and key performance metrics. Get detailed insights into the financial performance of Invacare Corporation, a leading company in the Medical – Instruments & Supplies industry within the Healthcare sector.

- Medtronic plc (2M6.DE) Income Statement Analysis – Financial Results

- Godfrey Phillips India Limited (GODFRYPHLP.BO) Income Statement Analysis – Financial Results

- USI Corporation (1304.TW) Income Statement Analysis – Financial Results

- Nissan Motor Co., Ltd. (NSANF) Income Statement Analysis – Financial Results

- Aditya Birla Sun Life AMC Limited (ABSLAMC.NS) Income Statement Analysis – Financial Results

Invacare Corporation (IVC)

About Invacare Corporation

Invacare Corporation, together with its subsidiaries, designs, manufactures, distributes, and exports medical equipment for use in home health care, retail, and extended care markets worldwide. The company offers mobility and seating products, such as power wheelchairs under the Invacare TDX brand; custom manual wheelchairs under the Invacare, Invacare Top End, and Küschall brand names; and seating and positioning products under the Invacare brand, as well as custom molded seat modules under the PinDot brand. It also provides lifestyle products, including pressure relieving overlays and mattress systems under the Invacare Softform and microAIR brands; safe patient handling products under the Birdie, Evo, and ISA brands; residential and institutional care beds and bed accessories, and manual wheelchairs under the Invacare brand name; and personal care products. In addition, the company offers respiratory therapy products comprising stationary oxygen concentrators under the Platinum and Perfecto2 brands; portable oxygen concentrators under the Platinum brand; and Invacare HomeFill oxygen systems. Further, it provides repair, equipment rentals, and external contracting services, as well as distributes heart rate monitors, thermometers, and nebulizers; and portable ramps. The company sells its products primarily to home medical equipment providers through retail and e-commerce channels, as well as to residential care operators, dealers, and government health service customers through its sales force, independent manufacturers' representatives, and distributors. Invacare Corporation was founded in 1885 and is headquartered in Elyria, Ohio.

| Metric | 2022 | 2021 | 2020 | 2019 | 2018 | 2017 | 2016 | 2015 | 2014 | 2013 | 2012 | 2011 | 2010 | 2009 | 2008 | 2007 | 2006 | 2005 | 2004 | 2003 | 2002 | 2001 | 2000 | 1999 | 1998 | 1997 | 1996 | 1995 | 1994 | 1993 | 1992 | 1991 | 1990 | 1989 | 1988 | 1987 | 1986 | 1985 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Revenue | 741.73M | 872.46M | 850.69M | 927.96M | 972.35M | 966.50M | 1.05B | 1.14B | 1.27B | 1.35B | 1.46B | 1.80B | 1.72B | 1.69B | 1.76B | 1.60B | 1.50B | 1.53B | 1.40B | 1.25B | 1.09B | 1.05B | 1.01B | 878.30M | 797.50M | 653.40M | 619.50M | 504.00M | 411.10M | 365.50M | 305.20M | 263.20M | 229.80M | 186.10M | 160.80M | 130.80M | 111.50M | 94.30M |

| Cost of Revenue | 566.34M | 633.35M | 605.44M | 665.90M | 704.67M | 697.25M | 763.85M | 829.51M | 922.78M | 974.89M | 1.01B | 1.28B | 1.21B | 1.20B | 1.27B | 1.16B | 1.08B | 1.08B | 984.74M | 872.52M | 761.76M | 735.29M | 673.32M | 581.10M | 535.20M | 436.70M | 400.10M | 323.60M | 265.30M | 238.80M | 197.80M | 170.50M | 153.10M | 129.20M | 108.70M | 88.40M | 74.90M | 66.30M |

| Gross Profit | 175.39M | 239.11M | 245.25M | 262.07M | 267.68M | 269.25M | 283.63M | 312.82M | 347.39M | 377.47M | 444.90M | 518.48M | 509.64M | 493.19M | 488.89M | 446.30M | 417.07M | 448.51M | 418.59M | 374.66M | 327.40M | 318.35M | 339.84M | 297.20M | 262.30M | 216.70M | 219.40M | 180.40M | 145.80M | 126.70M | 107.40M | 92.70M | 76.70M | 56.90M | 52.10M | 42.40M | 36.60M | 28.00M |

| Gross Profit Ratio | 23.65% | 27.41% | 28.83% | 28.24% | 27.53% | 27.86% | 27.08% | 27.38% | 27.35% | 27.91% | 30.57% | 28.79% | 29.59% | 29.13% | 27.85% | 27.86% | 27.84% | 29.32% | 29.83% | 30.04% | 30.06% | 30.21% | 33.54% | 33.84% | 32.89% | 33.16% | 35.42% | 35.79% | 35.47% | 34.66% | 35.19% | 35.22% | 33.38% | 30.57% | 32.40% | 32.42% | 32.83% | 29.69% |

| Research & Development | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| General & Administrative | 0.00 | 0.00 | 0.00 | 260.06M | 281.91M | 296.82M | 303.78M | 319.85M | 383.91M | 401.82M | 414.50M | 422.10M | 411.51M | 0.00 | 398.25M | 366.85M | 373.85M | 341.78M | 297.12M | 262.02M | 220.30M | 195.57M | 201.54M | 177.60M | 157.60M | 160.10M | 136.10M | 112.20M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Selling & Marketing | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| SG&A | 226.78M | 232.24M | 236.36M | 260.06M | 281.91M | 296.82M | 303.78M | 319.85M | 383.91M | 401.82M | 414.50M | 422.10M | 411.51M | 398.65M | 398.25M | 366.85M | 373.85M | 341.78M | 297.12M | 262.02M | 220.30M | 195.57M | 201.54M | 177.60M | 157.60M | 160.10M | 136.10M | 112.20M | 89.30M | 77.50M | 69.80M | 60.90M | 53.30M | 43.10M | 38.10M | 33.30M | 29.20M | 26.30M |

| Other Expenses | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 24.20M | 40.16M | 2.88M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 8.97M | 31.47M | 26.00M | 23.80M | 18.30M | 17.90M | 14.20M | 12.70M | 12.30M | 10.00M | 8.10M | 6.60M | 5.00M | 3.20M | 2.70M | 2.20M | -55.60M |

| Operating Expenses | 226.78M | 232.24M | 236.36M | 260.06M | 281.91M | 296.82M | 303.78M | 319.85M | 383.91M | 401.82M | 414.50M | 446.30M | 451.68M | 401.52M | 398.25M | 366.85M | 373.85M | 341.78M | 297.12M | 262.02M | 220.30M | 204.55M | 233.01M | 203.60M | 181.40M | 178.40M | 154.00M | 126.40M | 102.00M | 89.80M | 79.80M | 69.00M | 59.90M | 48.10M | 41.30M | 36.00M | 31.40M | -29.30M |

| Cost & Expenses | 793.12M | 865.59M | 841.79M | 925.96M | 986.58M | 994.06M | 1.07B | 1.15B | 1.31B | 1.38B | 1.43B | 1.73B | 1.66B | 1.60B | 1.67B | 1.52B | 1.45B | 1.42B | 1.28B | 1.13B | 982.06M | 939.84M | 906.33M | 784.70M | 716.60M | 615.10M | 554.10M | 450.00M | 367.30M | 328.60M | 277.60M | 239.50M | 213.00M | 177.30M | 150.00M | 124.40M | 106.30M | 94.30M |

| Interest Income | -56.00K | -1.00K | 93.00K | 429.00K | 534.00K | 473.00K | 265.00K | 165.00K | 507.00K | 384.00K | 685.00K | 1.44M | 724.00K | 1.67M | 0.00 | 0.00 | -2.78M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Interest Expense | 28.52M | 24.31M | 28.50M | 29.08M | 28.34M | 22.91M | 15.88M | 2.91M | 3.04M | 3.51M | 9.12M | 7.96M | 20.65M | 33.15M | 39.23M | 44.31M | 3.75M | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 | 0.00 |

| Depreciation & Amortization | -10.99M | 16.82M | 21.27M | 24.49M | 15.56M | 14.63M | 14.64M | 19.43M | 32.79M | 36.79M | 38.59M | 38.88M | 36.80M | 40.56M | 43.74M | 43.72M | 37.71M | 40.52M | 32.32M | 27.24M | 26.64M | 33.45M | 31.47M | 26.00M | 23.80M | 18.30M | 17.90M | 14.20M | 12.70M | 12.30M | 10.00M | 8.10M | 6.60M | 5.00M | 3.20M | 2.70M | 2.20M | 1.70M |

| EBITDA | -80.47M | 2.01M | 25.33M | 2.01M | -14.23M | -28.71M | -42.86M | 10.86M | -14.69M | 86.01M | 67.78M | 52.43M | 95.49M | 120.99M | 95.25M | 79.46M | 43.22M | 111.83M | 142.69M | 133.64M | 123.17M | 99.84M | 129.69M | 94.00M | 98.90M | 23.60M | 81.70M | 66.10M | 54.60M | 45.80M | 37.50M | 31.00M | 20.50M | 10.00M | 11.60M | 7.50M | 7.50M | 400.00K |

| EBITDA Ratio | -10.85% | 0.23% | 2.98% | 1.03% | 1.01% | -2.97% | 0.09% | 0.95% | -1.16% | 6.36% | 4.66% | 2.91% | 5.55% | 7.15% | 5.42% | 3.63% | -18.14% | 7.31% | 10.17% | 10.72% | 11.31% | 9.48% | 12.80% | 10.70% | 12.40% | 3.61% | 13.19% | 13.12% | 13.28% | 12.53% | 12.29% | 11.78% | 8.92% | 5.37% | 7.21% | 5.73% | 6.73% | 0.42% |

| Operating Income | -69.48M | -14.81M | 11.33M | -10.41M | -18.29M | -40.16M | -15.22M | -7.02M | -36.53M | -24.36M | 30.40M | 12.11M | 57.96M | 78.76M | 90.64M | 79.46M | 43.22M | 99.43M | 121.47M | 112.65M | 107.10M | 113.80M | 106.83M | 93.60M | 80.90M | 38.30M | 65.40M | 54.00M | 43.80M | 36.90M | 27.60M | 23.70M | 16.80M | 8.80M | 10.80M | 6.40M | 5.20M | -1.30M |

| Operating Income Ratio | -9.37% | -1.70% | 1.33% | -1.12% | -1.88% | -4.16% | -1.45% | -0.61% | -2.88% | -1.80% | 2.09% | 0.67% | 3.37% | 4.65% | 5.16% | 4.96% | 2.89% | 6.50% | 8.66% | 9.03% | 9.83% | 10.80% | 10.54% | 10.66% | 10.14% | 5.86% | 10.56% | 10.71% | 10.65% | 10.10% | 9.04% | 9.00% | 7.31% | 4.73% | 6.72% | 4.89% | 4.66% | -1.38% |

| Total Other Income/Expenses | -17.54M | -14.88M | -35.77M | -46.03M | -19.87M | 10.29M | 13.30M | -4.72M | -26.69M | -13.98M | -20.43M | -90.79M | -19.92M | -47.27M | -39.14M | -64.97M | -352.75M | -28.13M | -11.10M | -6.24M | -10.57M | -47.41M | -8.62M | -25.60M | -5.80M | -33.00M | -1.60M | -2.10M | -1.90M | -3.40M | -100.00K | -800.00K | -2.90M | -3.80M | -2.40M | -1.60M | 100.00K | 0.00 |

| Income Before Tax | -98.00M | -39.12M | -24.44M | -44.03M | -34.10M | -66.25M | -29.56M | -11.74M | -63.21M | -38.34M | 9.97M | 5.59M | 38.04M | 47.28M | 51.50M | 14.49M | -309.52M | 71.30M | 110.37M | 106.41M | 96.53M | 66.39M | 98.22M | 68.00M | 75.10M | 5.30M | 63.80M | 51.90M | 41.90M | 33.50M | 27.50M | 22.90M | 13.90M | 5.00M | 8.40M | 4.80M | 5.30M | -1.30M |

| Income Before Tax Ratio | -13.21% | -4.48% | -2.87% | -4.74% | -3.51% | -6.85% | -2.82% | -1.03% | -4.98% | -2.84% | 0.69% | 0.31% | 2.21% | 2.79% | 2.93% | 0.90% | -20.66% | 4.66% | 7.87% | 8.53% | 8.86% | 6.30% | 9.69% | 7.74% | 9.42% | 0.81% | 10.30% | 10.30% | 10.19% | 9.17% | 9.01% | 8.70% | 6.05% | 2.69% | 5.22% | 3.67% | 4.75% | -1.38% |

| Income Tax Expense | 3.07M | 6.45M | 3.84M | 9.30M | 9.82M | 10.29M | 13.30M | 14.71M | 5.55M | 12.66M | 18.24M | 9.70M | 12.70M | 6.10M | 12.95M | 13.30M | 8.25M | 22.45M | 35.18M | 35.00M | 31.76M | 31.20M | 38.31M | 26.50M | 29.30M | 3.70M | 24.90M | 19.70M | 15.50M | 11.40M | 9.80M | 8.80M | 6.30M | 2.40M | 3.30M | 2.40M | 1.90M | -200.00K |

| Net Income | -101.07M | -45.56M | -28.28M | -53.33M | -43.92M | -76.54M | -42.86M | -26.19M | -56.07M | 33.05M | 1.83M | -4.11M | 25.34M | 41.18M | 38.55M | 1.19M | -317.77M | 48.85M | 75.20M | 71.41M | 64.77M | 35.19M | 59.91M | 41.50M | 45.80M | 1.60M | 38.90M | 32.20M | 26.40M | 22.10M | 17.70M | 14.10M | 7.60M | 2.60M | 5.10M | 2.40M | 3.40M | -1.10M |

| Net Income Ratio | -13.63% | -5.22% | -3.32% | -5.75% | -4.52% | -7.92% | -4.09% | -2.29% | -4.41% | 2.44% | 0.13% | -0.23% | 1.47% | 2.43% | 2.20% | 0.07% | -21.21% | 3.19% | 5.36% | 5.73% | 5.95% | 3.34% | 5.91% | 4.73% | 5.74% | 0.24% | 6.28% | 6.39% | 6.42% | 6.05% | 5.80% | 5.36% | 3.31% | 1.40% | 3.17% | 1.83% | 3.05% | -1.17% |

| EPS | -2.77 | -1.29 | -0.82 | -1.59 | -1.31 | -2.34 | -1.32 | -0.81 | -1.75 | 1.04 | 0.06 | -0.13 | 0.78 | 1.29 | 1.21 | 0.04 | -10.00 | 1.55 | 2.41 | 2.31 | 2.10 | 1.15 | 1.99 | 1.38 | 1.53 | 0.05 | 1.28 | 1.07 | 0.89 | 0.77 | 0.62 | 0.52 | 0.33 | 0.12 | 0.23 | 0.11 | 0.15 | -0.05 |

| EPS Diluted | -2.77 | -1.29 | -0.82 | -1.59 | -1.31 | -2.30 | -1.32 | -0.80 | -1.74 | 1.03 | 0.06 | -0.13 | 0.78 | 1.29 | 1.21 | 0.04 | -10.00 | 1.51 | 2.32 | 2.25 | 2.05 | 1.11 | 1.95 | 1.36 | 1.50 | 0.05 | 1.28 | 1.07 | 0.89 | 0.77 | 0.62 | 0.52 | 0.33 | 0.12 | 0.23 | 0.11 | 0.15 | -0.05 |

| Weighted Avg Shares Out | 36.52M | 35.27M | 34.38M | 33.64M | 33.54M | 32.75M | 32.47M | 32.17M | 32.01M | 31.92M | 31.64M | 31.96M | 32.39M | 31.97M | 31.90M | 31.84M | 31.79M | 31.56M | 31.15M | 30.86M | 30.87M | 30.62M | 30.13M | 30.14M | 29.93M | 29.57M | 30.39M | 30.08M | 29.66M | 28.81M | 28.71M | 27.33M | 23.11M | 22.55M | 22.28M | 22.28M | 22.28M | 22.22M |

| Weighted Avg Shares Out (Dil) | 36.52M | 35.27M | 34.38M | 33.64M | 33.54M | 33.22M | 32.59M | 32.68M | 32.20M | 32.04M | 31.87M | 31.96M | 32.69M | 32.00M | 31.95M | 31.93M | 31.79M | 32.45M | 32.35M | 31.73M | 31.66M | 31.68M | 30.76M | 30.62M | 30.58M | 30.37M | 30.39M | 30.08M | 29.66M | 28.81M | 28.71M | 27.33M | 23.11M | 22.55M | 22.28M | 22.28M | 22.28M | 22.22M |

Electric Wheelchair Market Report 2024-2031: Drive Medical Design & Manufacturing, Numotion, Invacare, and Sunrise Medical Dominate with 55-60% Share

Electric Wheelchair Market Report and Company Analysis 2024-2032, Featuring Invacare, Sunrise Medical, Karman Healthcare, Pride Mobility Products Corp., Permobil, Sermax Mobility & Carex Health Brand

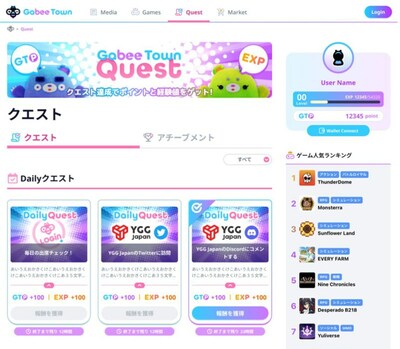

YGGJ, KryptoGO, and IVC Launch Joint Venture, StickeyGO: Revolutionizing the GameFi Wallet Landscape

NYSE to Suspend Trading Immediately in Invacare Corporation (IVC) and Commence Delisting Proceedings

Invacare files for bankruptcy, but expects to keep making and delivering home-care products

Invacare Corporation Takes Action to Strengthen Its Financial Position and Drive Long-Term Growth Through Voluntary Prearranged Chapter 11 Cases That Do Not Include Its International Operations

Invacare Corporation Announces Additional Draw of Term Loans

Azurite Trims Invacare Stake after Inadvertently Passing 10% Ownership Trigger

Invacare Appoints Geoff Purtill President and Chief Executive Officer

Invacare Corporation (IVC) Q3 2022 Earnings Call Transcript

Source: https://incomestatements.info

Category: Stock Reports